- Carbon Finance

- Posts

- 📊 2026 IPO Watchlist

📊 2026 IPO Watchlist

1) Best S&P 500 Stocks In 2025 2) 98 Years Of The S&P 500 3) Nvidia & Google Carried The S&P 500 and more!

Happy Sunday!

I hope you all had an incredible Christmas and New Year surrounded by friends and family.

And a warm welcome to the hundreds of new subscribers who recently joined us.

We are now 44,300+ investors and growing.

Going forward, the structure of the newsletter will be straightforward.

Each Sunday, you’ll receive a flagship edition like this one, covering the most important infographics and market insights.

Every 2 weeks or so, I’ll also share a deep dive on a specific company, offering a clear viewpoint and a hard take on the story.

Looking forward to navigating another year in the markets together in 2026.

Key Data Bites From This Week:

Bloomberg compiled 2026 outlooks from more than 60 institutions.

Bank of America said 6 stocks will lead the $1T chip surge in 2026.

Nvidia plans to buy Israel-based AI startup AI21 Labs for up to $3B.

Meta will acquire AI startup Manus for more than $2B.

Meta’s Reels has achieved an annual run rate exceeding $50B.

OpenAI has average stock-based compensation of $1.5M per employee.

Sam Altman is offering a $555K salary for the most daunting role in AI.

Tesla reported a 16% decline in fourth quarter deliveries.

World’s richest people added record $2.2T to their collective wealth.

Global dealmaking crossed $4T for the third time ever in 2025.

Five things to know about Nvidia’s $20B Groq licensing deal.

SoftBank has completed its $40B investment in OpenAI.

SoftBank will buy AI infrastructure investor DigitalBridge in $4B deal.

In today’s newsletter:

📈 Best S&P 500 Stocks In 2025

📉 Worst S&P 500 Stocks In 2025

🕰️ 98 Years Of The S&P 500

🏋️♀️ Nvidia & Google Carried The S&P 500

🔎 2026 IPO Watchlist

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Together With Axios HQ

Attention is scarce. Learn how to earn it.

Every leader faces the same challenge: getting people to actually absorb what you're saying - in a world of overflowing inboxes, half-read Slacks, and meetings about meetings.

Smart Brevity is the methodology Axios HQ built to solve this. It's a system for communicating with clarity, respect, and precision — whether you're writing to your board, your team, or your entire organization.

Join our free 60-minute Open House to learn how it works and see it in action.

Runs monthly - grab a spot that works for you.

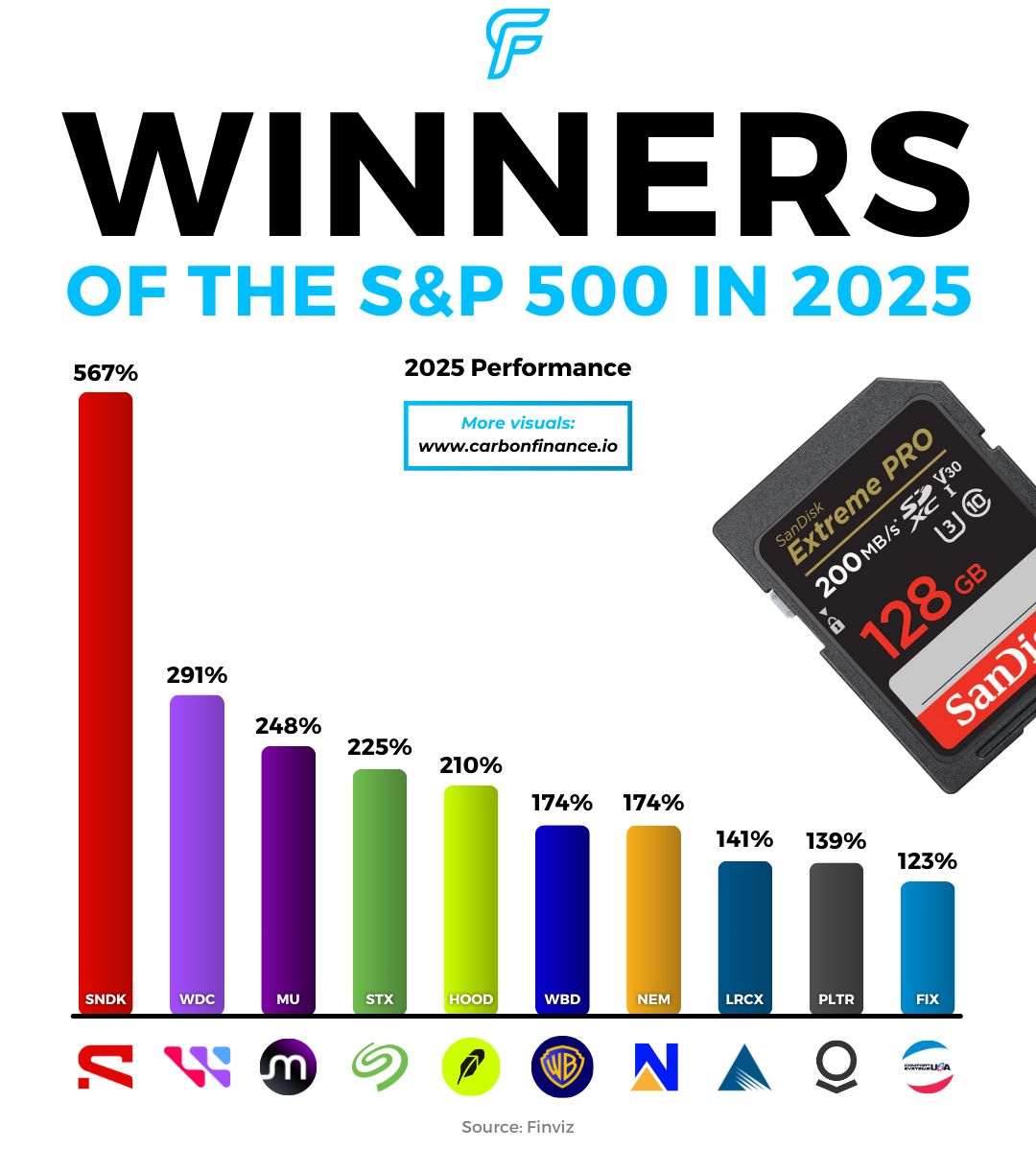

Memory is in a full-blown supercycle.

Some of the best-performing stocks in the S&P 500 this year share a common thread.

They sit at the center of AI data storage and memory, where high-capacity hardware has become a critical bottleneck for model training and data centers.

SanDisk led the group with nearly 600% returns, driven by surging demand for NAND flash after its spinoff from Western Digital.

Western Digital followed close behind, while Seagate also ranked among the top performers.

Micron posted another standout year as high-bandwidth memory became essential for powering advanced GPUs.

Outside of the memory players, Palantir made the list yet again, marking its third consecutive year of triple-digit returns.

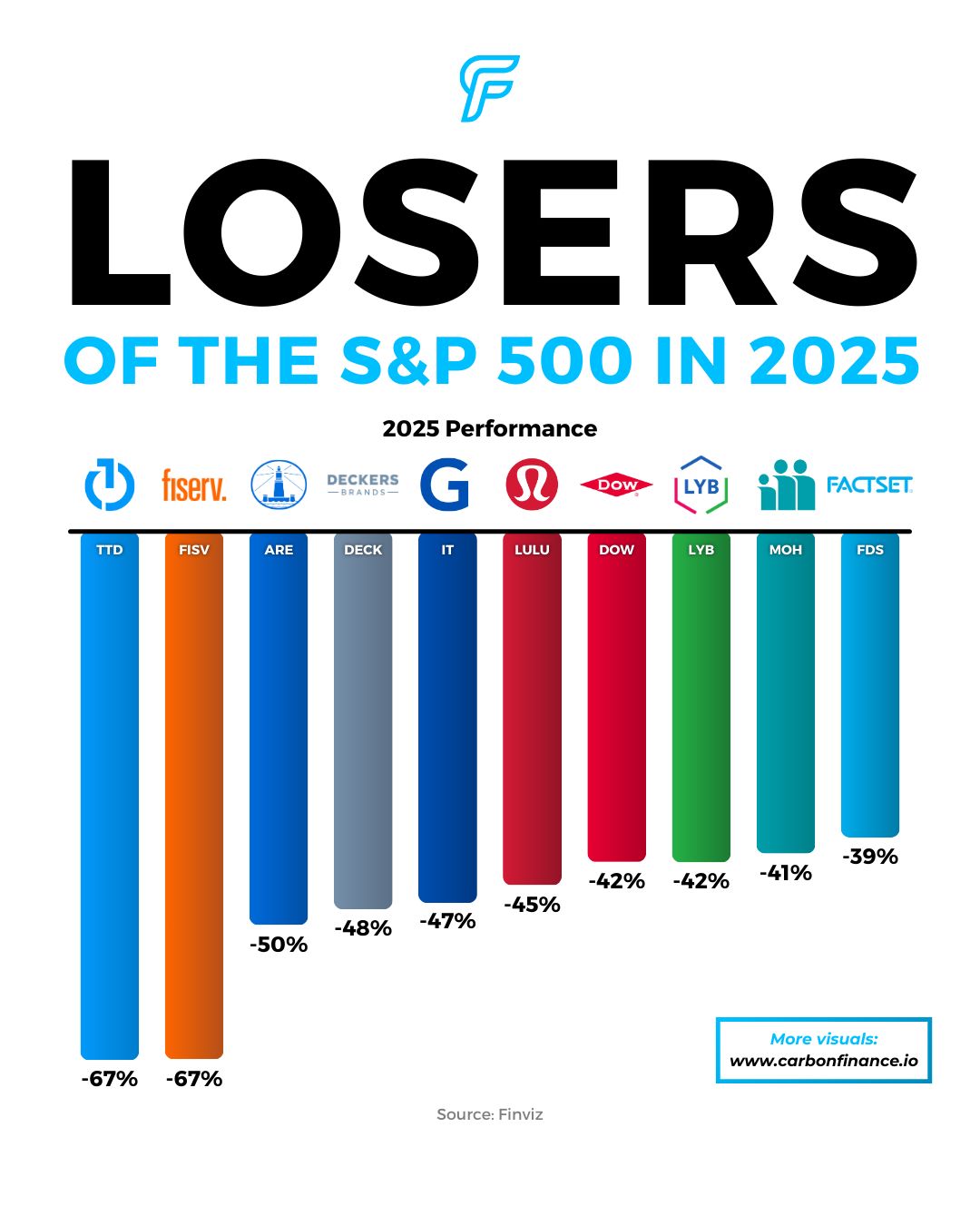

Not every stock benefited from the AI wave.

Among the worst performers in the S&P 500 were Trade Desk and Fiserv.

Trade Desk struggled after posting its first revenue miss in eight years, alongside heavier competition in digital advertising.

Fiserv sold off sharply after cutting guidance unexpectedly, triggering an ongoing lawsuit tied to alleged inflated growth claims.

Consumer names like Deckers and Lululemon also suffered as valuations reset and domestic growth slowed.

Research firms such as Gartner and FactSet were hit as well, as AI is increasingly viewed as a structural threat to premium data and research models.

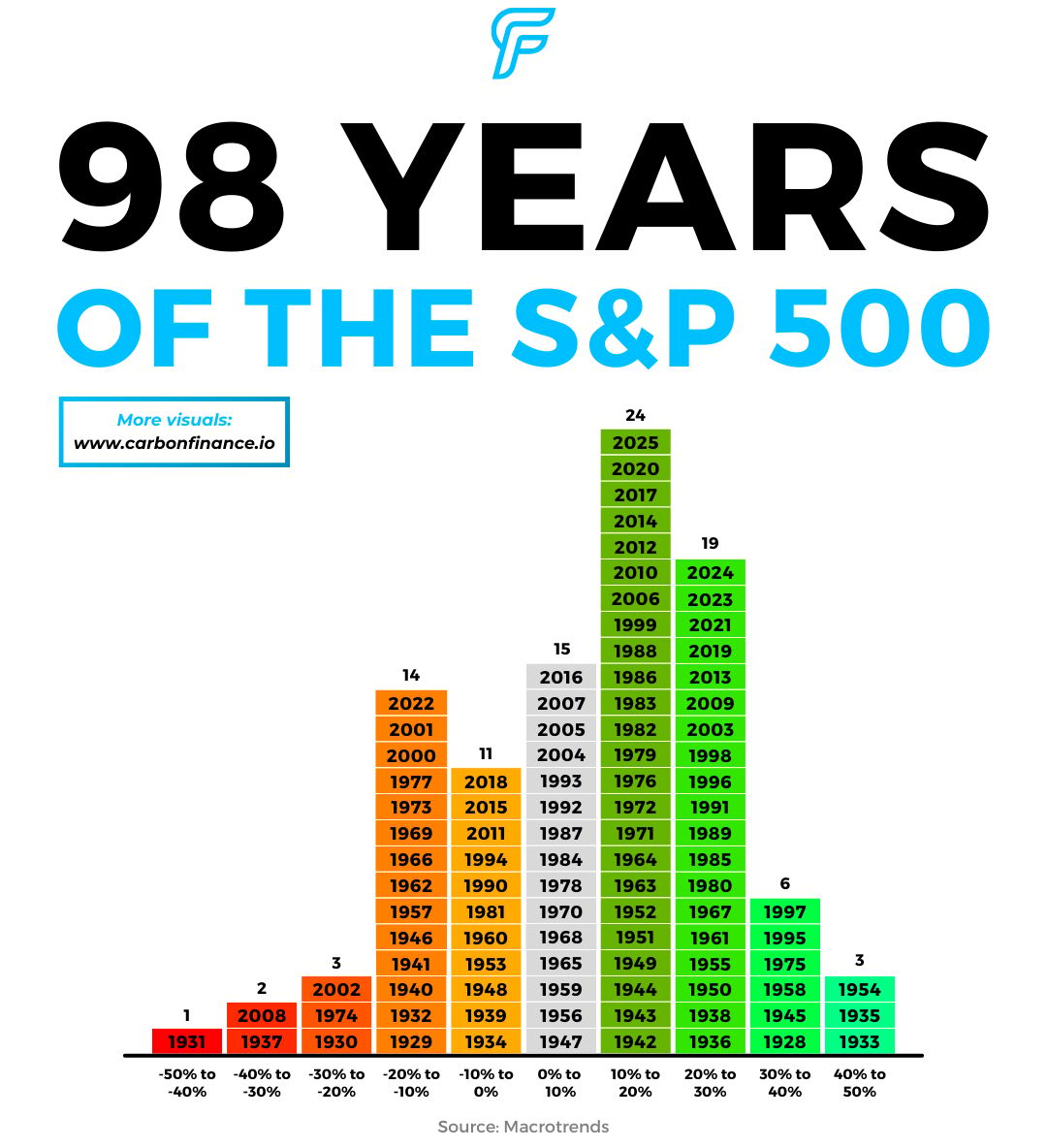

Time in the market continues to beat timing the market.

As Peter Lynch once said: far more money has been lost preparing for corrections than in corrections themselves.

The past few years have proven that lesson once again.

Despite widespread concerns about froth, sitting on the sidelines would have been costly.

The S&P 500 closed 2025 up 18%, marking its third straight year of double-digit gains.

In 2023 and 2024, the index rose 26% and 25% respectively.

Three or more consecutive years of double-digit returns have occurred only a handful of times in history.

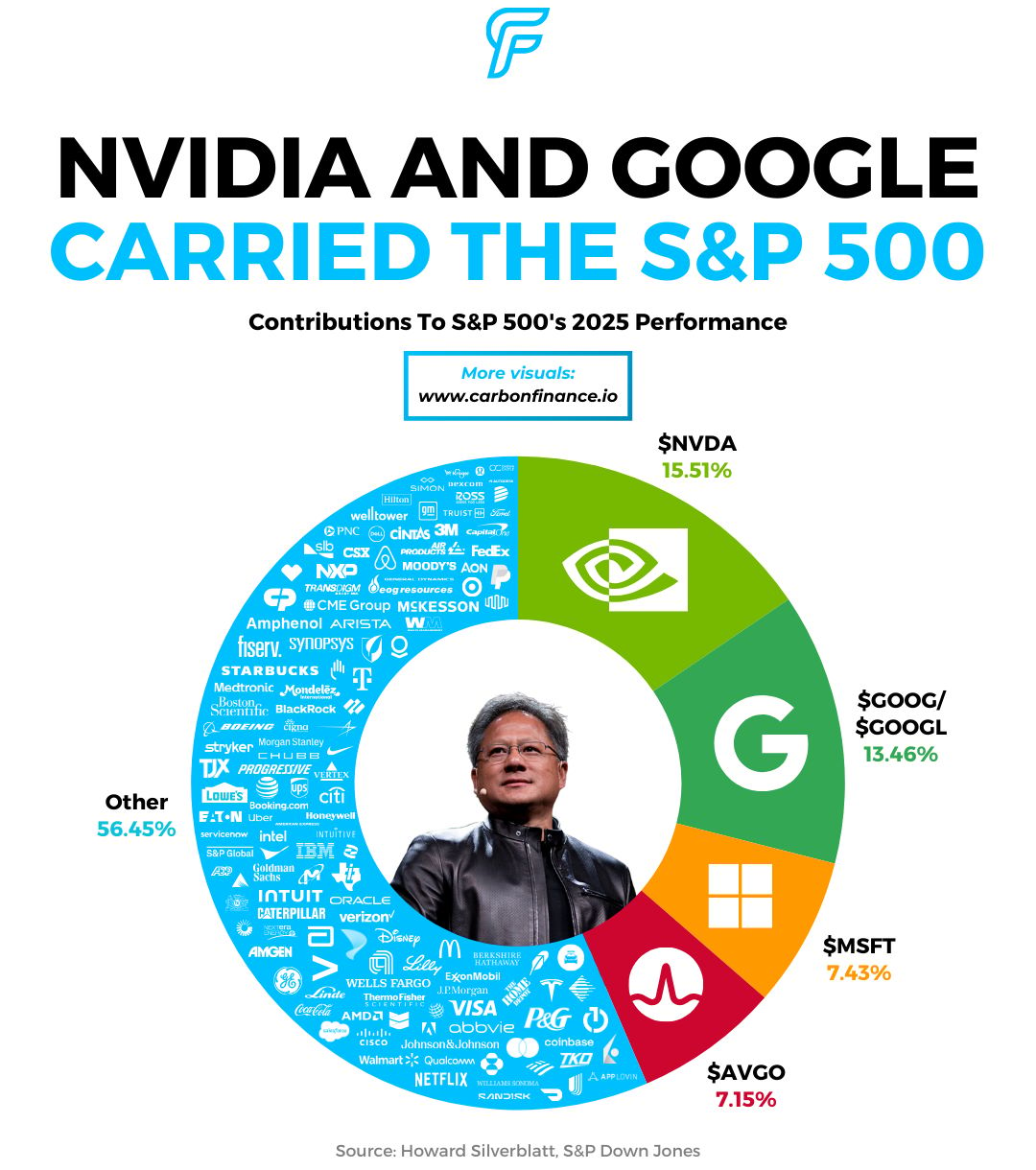

So who powered the S&P 500’s gains? A very small group.

Nvidia and Alphabet alone drove nearly 30% of the index’s 2025 return.

The top four stocks accounted for 43.55%.

Everyone else? 56.45%.

This should serve as a clear reminder of just how concentrated market leadership has become.

Massive names could enter the market in 2026.

After a year where a handful of mega-cap stocks drove index returns, the next wave may be just as big.

SpaceX is reportedly targeting an IPO later in 2026 at a valuation near $1.5T, with plans to raise more than $30B.

That would make it the largest public listing in history.

OpenAI and Anthropic are also rumored to be preparing IPOs, at valuations of roughly $1T and $350B.

If even part of this pipeline materializes, 2026 could become the biggest IPO year ever.

📣 Presented by Levanta

The Future of Shopping? AI + Actual Humans.

AI has changed how consumers shop, but people still drive decisions. Levanta’s research shows affiliate and creator content continues to influence conversions, plus it now shapes the product recommendations AI delivers. Affiliate marketing isn’t being replaced by AI, it’s being amplified.

❤️ Career Matching↗ - People are turning to dating apps to find jobs in a tough labor market.

⛏️ Founder Revolt↗ - Lululemon’s founder Chip Wilson launched a proxy fight to overhaul the company’s board of directors.

🪙 Silver Squeeze↗ - China has restricted silver exports, a key input for critical industrial processes.

🅿️ Parking Power↗ - Uber is looking to acquire parking app SpotHero.

🎛️ Risk Containment↗ - Meta allegedly drafted a playbook to slow regulator efforts to crack down on scam ads.

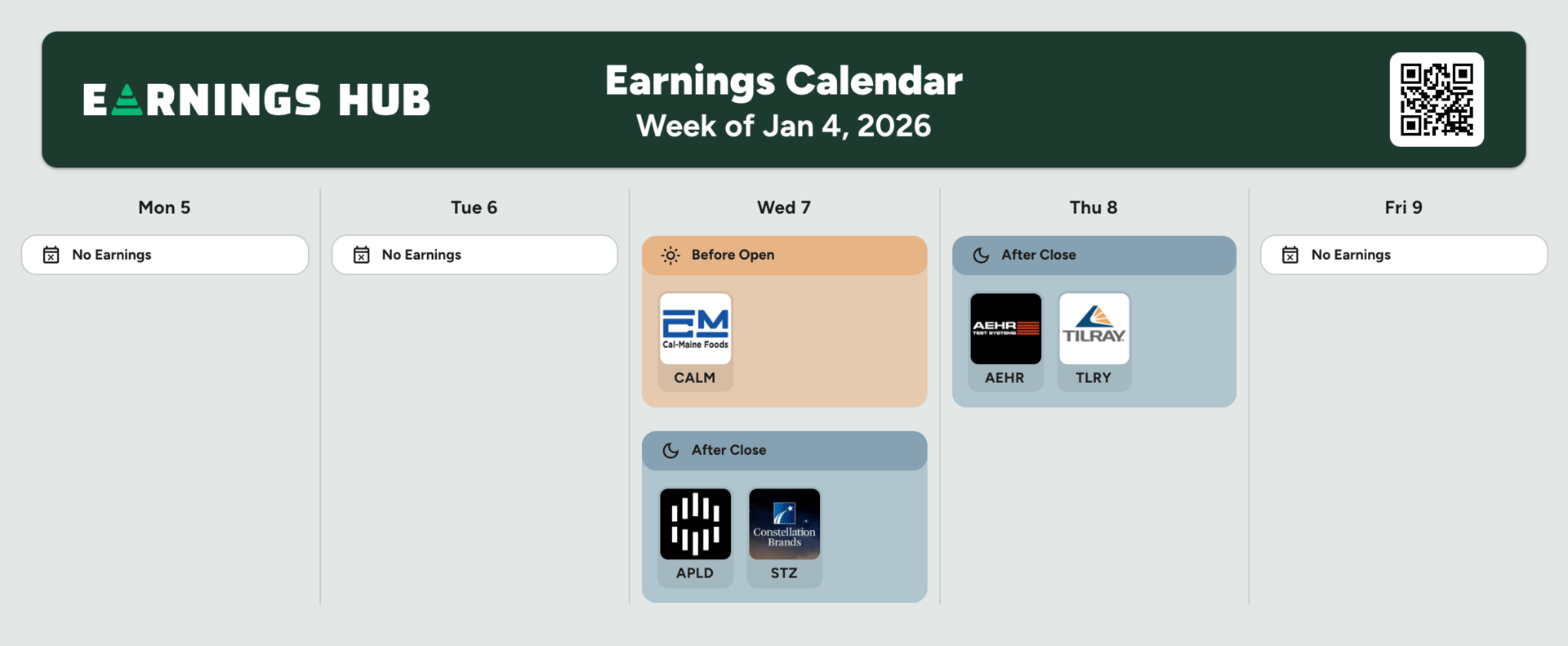

Courtesy of our affiliate partner, EarningsHub.

Notable Companies Reporting Earnings Week of January 4th, 2025:

Major Trades Published 12/29 - 1/2. Trades may be those of family members. [Source: 2iQ]

Buys

Josh Gottheimer (D)

Company: CSW Industrials ($CSW)

Amount Purchased: $1K - $5K

Sells

Josh Gottheimer (D)

Company: Fidelity National Information Services ($FIS)

Amount Sold: $15K - $50K

Major Trades Published 12/29 - 1/2

Buys

Sells

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

This newsletter is sponsored by Axios HQ and Levanta. Sponsorship does not influence our editorial content. We do not endorse the sponsor’s products, services, or views, and we are not responsible or liable for any interaction or transaction between readers and the sponsor.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Reply