- Carbon Finance

- Posts

- 💡 5 Investment Ideas (August 2025)

💡 5 Investment Ideas (August 2025)

5 Investment Ideas - August 2025

This is the first edition of our monthly Investment Ideas series.

Each month, I’ll highlight a select group of quality businesses worth watching.

These are companies facing temporary challenges, external pressures, systemic headwinds, or potentially overstated disruption narratives that could offer upside if the long-term outlook remains intact.

Many are trading at valuations that could present compelling opportunities for long-term investors.

They could also get cheaper if conditions worsen, the turnaround takes longer than expected, or broader market weakness drags prices lower.

In some cases, the risk of further business erosion or poor execution means the investment could ultimately disappoint.

But when a fundamentally strong business faces temporary trouble, it can create a rare opening for patient investors.

As Warren Buffett put it, “The best thing that happens to us is when a great company gets into temporary trouble…we want to buy them when they’re on the operating table.”

These ideas are worth reviewing, researching further, and following closely over time.

Let’s dive in.

Note: This report is for informational purposes only and is not investment advice. Please see the full disclaimer at the end. As of the date of publication, the only position held among the companies discussed is $NVO.

1/ Novo Nordisk

Ticker: $NVO

Market Cap: $214B

Novo Nordisk, founded in 1923 and based in Denmark, is a global healthcare company focused on treatments for diabetes, obesity, and rare diseases.

Most of its revenue comes from the Diabetes & Obesity Care segment, driven by GLP-1 drugs like Ozempic and Wegovy and a range of insulin products.

The Rare Disease segment contributes a smaller share from therapies for haemophilia, endocrine, and growth disorders.

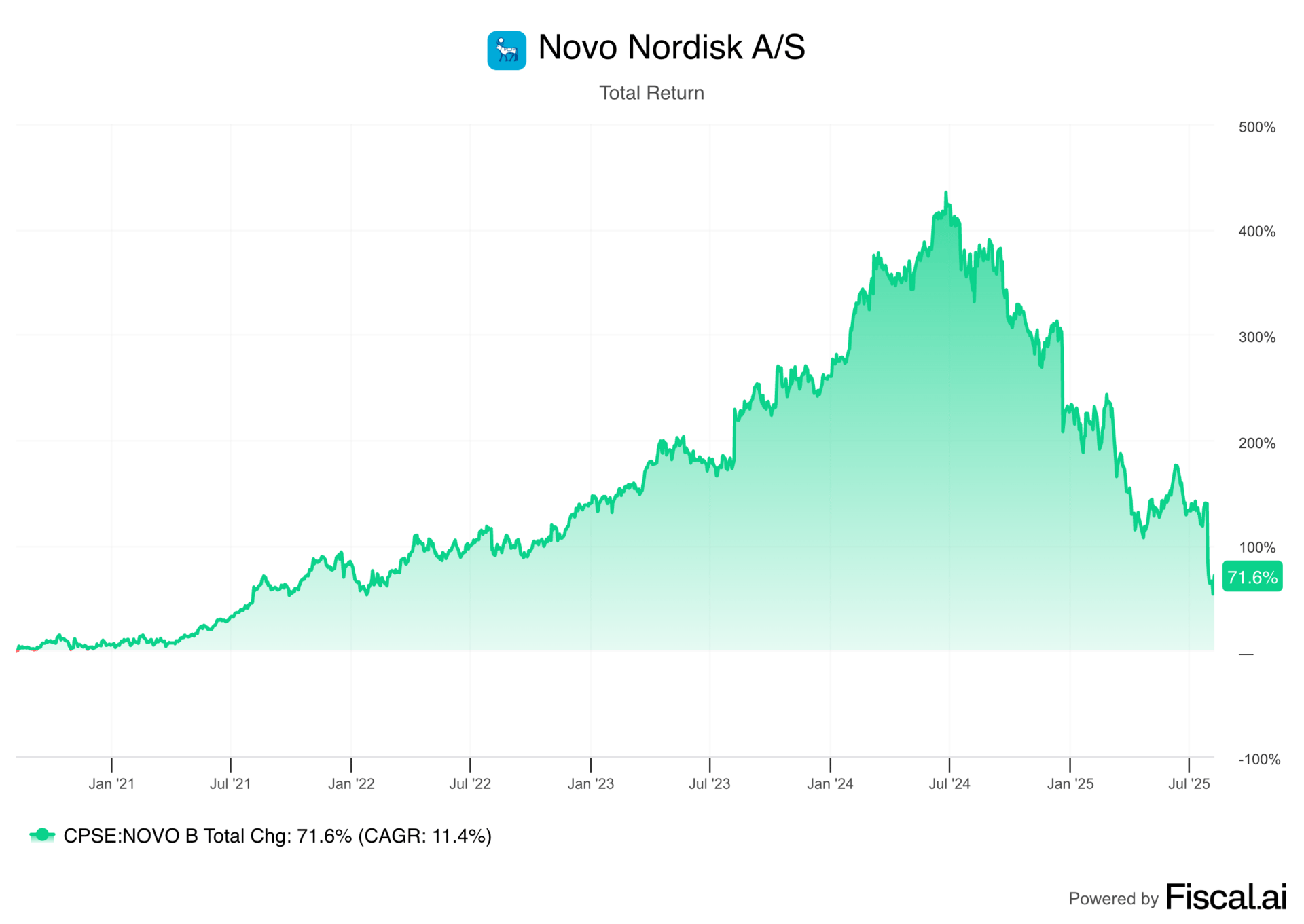

Shares are down more than 60% from their all-time high in June 2024, when optimism over obesity drug growth was at its peak.

Over the past five years, the company has delivered a 72% total return, while net income has surged 181%.

Key Metrics:

5Y Revenue CAGR: 19.8%

5Y Diluted EPS CAGR: 23.2%

Operating Margin: 47.7%

5Y ROIC: 29.0%

Total Cash & Short Term Investments: $2.95B

Net Debt: $12.53B

Outlook (Estimates):

Forward 2Y Revenue CAGR: 10.2%

Forward 2Y EPS CAGR: 11.4%

Long Term EPS Growth: 11.9%

Recent Developments & Key Headwinds:

1/ Increased Competition – Eli Lilly’s Mounjaro and Zepbound have steadily gained share, with many patients switching due to fewer reported side effects.

2/ Compounded GLP-1s – Growth in compounded versions, especially targeting Wegovy for its brand recognition, has pressured sales. Estimates suggest 80% of compounded pharmacies target Wegovy.

3/ Reduced Guidance – 2025 sales growth is now projected at 11% (midpoint) and operating profit at 13% (midpoint), down from 17% and 20% previously.

4/ Tariff & Policy Risks – The Trump administration may impose tariffs up to 250% on pharmaceuticals and pursue “most favored nation” pricing, which could disrupt pricing power.

5/ Leadership Change – New CEO Maziar Mike Doustdar, a 30-year company veteran who led global commercial units outside the U.S., lacks U.S.-market experience, a disappointment to investors hoping for an outsider to spearhead domestic growth.

Why This Might Be An Opportunity:

1/ Market Leader – Novo holds a 62% share of the GLP-1 agonist market, with the global obesity treatment market expected to grow at a 22.3% CAGR through 2030. Core drug patents last until 2032 in the U.S., with potential new patents possible for alternative delivery methods

2/ Potential Competitive Reversal – Investor expectations for Eli Lilly’s obesity pipeline may have been overextended. For example, slower-than-expected trial results for its oral GLP-1 pill led to a 13% drop in Lilly shares and a 7% jump in Novo in a single day, demonstrating how quickly sentiment and market share expectations can shift.

3/ Legal Action – Novo is pursuing lawsuits against compounding, which could help restore sales, though it carries reputational risk.

4/ Attractive Valuation – Novo trades at 12x forward earnings with 13% expected operating income growth in 2025 and a 3.7% dividend yield, which has grown at a 5Y CAGR of 22.1%.

5/ Policy Positioning – Novo plans to expand direct-to-consumer channels to lower costs and align with White House pricing priorities, benefits from a more favorable export-over-import position in the U.S. compared to peers, and could see most-favored-nation enforcement delayed due to the complexity of implementation.

TLDR: Novo Nordisk combines dominant market share, strong margins, and a favorable long-term obesity market tailwind with an attractive valuation, but execution risk, policy uncertainty, and intensifying competition could pressure the story.

2/ ASML

Ticker: $ASML

Market Cap: $284B

ASML, founded in 1984 and based in the Netherlands, is the world’s dominant supplier of advanced semiconductor manufacturing equipment.

It designs, builds, and services lithography systems, including its exclusive EUV machines, that are essential for producing the most advanced logic and memory chips.

Growth is fueled by rising demand for smaller, more complex chips, expanding capacity at top foundries, and the surge in AI industry growth.

Despite its critical role in the chip supply chain, shares are down 15% over the past year, trailing AI leaders like Nvidia (+68%) and TSMC (+44%).

Key Metrics:

5Y Revenue CAGR: 20.3%

5Y Diluted EPS CAGR: 28.3%

Operating Margin: 34.8%

5Y ROIC: 23.7%

Total Cash & Short Term Investments: $8.45B

Net Debt: -$4.14B

Outlook (Estimates):

Forward 2Y Revenue CAGR: 9.1%

Forward 2Y EPS CAGR: 15.3%

Long Term EPS Growth: 16.7%

Recent Developments & Key Headwinds:

1/ Muted 2026 Outlook – Despite strong Q2 2025 results and robust AI-driven demand, ASML held back on confirming 2026 growth expectations, citing uncertainty from macroeconomic conditions and geopolitical developments.

2/ Export Restrictions & Tariffs – U.S.-led export controls on advanced chip equipment to China, renewed tariffs, and potential tightening of trade rules could pressure sales in a key market.

3/ Supply Chain Risks – Geopolitical tensions could trigger component delays, increase costs, and push out delivery schedules for customers.

4/ Low Volume Concentration – ASML sold just 583 net systems in 2024, and with a highly concentrated customer base, a slowdown from one or two large clients can significantly impact results.

Why This Might Be An Opportunity:

1/ Virtual Monopoly – ASML is the sole supplier of EUV technology needed for the most advanced chips, with high switching costs and increasing complexity. Additionally, they are targeting ~$61B in annual revenue by 2030 (midpoint), a projected 65% increase.

2/ Industry Growth – Global semiconductor sales are expected to surpass $1T by 2030, fueled by AI adoption.

3/ Service Revenue – Durable machines and long lifespans support recurring service revenue, which has grown at a 17% CAGR since 2012 and now makes up 24% of sales.

4/ Conservative Guidance – Management’s muted outlook may be precautionary, positioning the company to outpace expectations if headwinds ease.

5/ Fair Valuation – Trades below its median forward EV/EBIT at 22.6× despite being a critical, irreplaceable link in the semiconductor supply chain.

TLDR: ASML’s monopoly in EUV technology, recurring service revenue, and exposure to long-term semiconductor growth make its current valuation attractive given its competitive advantage, though geopolitical risks and industry cyclicality could still create opportunities to buy cheaper if conditions deteriorate.

3/ Deckers Outdoor Corp

Ticker: $DECK

Market Cap: $15B

Deckers Outdoor, founded in 1973 and based in California, designs, markets, and sells premium footwear, apparel, and accessories worldwide.

It generates revenue through its UGG and Koolaburra lifestyle brands, performance-focused Hoka running shoes, and outdoor-oriented Teva and Sanuk lines, sold via wholesale, retail stores, and e-commerce.

Growth is driven by Hoka’s rapid adoption in the performance running market, expanding direct-to-consumer sales, and strong brand equity across its portfolio.

Over the past five years, the company has delivered a 180% total return, while net income has grown 244%.

Key Metrics:

5Y Revenue CAGR: 19.1%

5Y Diluted EPS CAGR: 31.1%

Operating Margin: 23.7%

5Y ROIC: 55.5%

Total Cash & Short Term Investments: $1.72B

Net Debt: -$1.41B

Outlook (Estimates):

Forward 2Y Revenue CAGR: 8.8%

Forward 2Y EPS CAGR: 4.9%

Long Term EPS Growth: 4.2%

Recent Developments & Key Headwinds:

1/ Guidance Withdrawn – In May, Deckers pulled its Fiscal Year 2026 outlook, citing macroeconomic uncertainty and evolving trade policy.

2/ Tariff Pressures – Heavy reliance on Vietnam for manufacturing leaves Deckers exposed to a potential 20% tariff, which could add $185M to FY 2026 Cost of Goods Sold (up from $150M prior estimate).

3/ U.S. Demand Slowdown – Domestic revenue fell ~3% in the most recent quarter and was flat the prior quarter; trailing 12-month growth of 7% is the lowest in years.

4/ DTC Deceleration – Direct-to-consumer revenue growth slowed to 0.5% last quarter and -1.2% in the quarter prior, both multi-year lows.

5/ Brand Dependence – Reliance on Hoka and UGG leaves Deckers vulnerable to shifting consumer preferences, and international adoption will require strong execution to replicate U.S. success.

Why This Might Be An Opportunity:

1/ Proactive Withdrawal – Pulling full-year guidance in the midst of rapidly changing policy allows management to adapt without committing to forecasts that could be disrupted.

2/ Tariff Mitigation – Q1 impact was minimal due to pre-tariff inventory, and phased price increases throughout FY 2026 are intended to recapture ~$75M of the potential $185M hit. Most price adjustments have been communicated, with no material changes to the order book.

3/ International Growth – Q1 international sales surged nearly 50%, offsetting U.S. weakness, with further runway for Hoka and UGG expansion abroad.

4/ Health & Wellness Tailwind – Rising focus on active lifestyles supports demand for performance footwear like Hoka, especially as the running shoes market is projected to grow at a 5.9% CAGR through 2030.

5/ Strong Financial Position – With $1.72B in cash and negative net debt, Deckers is well-covered on liabilities. A 5-year average ROIC of 55.5% highlights exceptional capital efficiency.

TLDR: Deckers’ strong balance sheet, international growth momentum, and ability to offset tariff pressures position it well for a rebound, though sustained U.S. softness and shifting consumer tastes remain key risks.

4/ Adobe

Ticker: $ADBE

Market Cap: $145B

Adobe, founded in 1982 and based in California, is a global software company best known for its creative and document solutions.

It generates most of its revenue from subscriptions to Creative Cloud and Document Cloud in the Digital Media segment, alongside its Digital Experience platform that helps businesses manage and optimize customer experiences.

Growth is fueled by expanding cloud adoption, rising demand for AI-enhanced creative and marketing tools, and deeper enterprise penetration across both creative professionals and global brands.

Over the past five years, Adobe has returned –23%, sharply underperforming the S&P 500, even as net income grew 86%, a gap largely driven by valuation multiple contraction rather than weak fundamentals.

Key Metrics:

5Y Revenue CAGR: 13.4%

5Y Diluted EPS CAGR: 15.6%

Operating Margin: 36.7%

5Y ROIC: 22.5%

Total Cash & Short Term Investments: $5.71B

Net Debt: $0.9B

Outlook (Estimates):

Forward 2Y Revenue CAGR: 9.5%

Forward 2Y EPS CAGR: 12.0%

Long Term EPS Growth: 15.2%

Recent Developments & Key Headwinds:

1/ AI-Driven Competition – Adobe faces growing pressure from free or low-cost creative tools, including Canva, Figma, Midjourney, and other AI-powered platforms that can quickly replicate or replace parts of Adobe’s core offerings.

2/ Slowing Growth From Maturity – After years of double-digit expansion fueled by its SaaS transition, revenue growth has steadied around 10%, raising concerns over how much upside remains in core markets.

3/ Monetization Uncertainty In AI – New AI-first products like Firefly and Acrobat AI Assistant have seen adoption but are only expected to generate >$250M in ending annual recurring revenue by Q4 FY25, with profitability and scale still unproven.

4/ Failed Figma Acquisition – The collapse of the $20B Figma deal, which cost Adobe a $1B breakup fee, removed a key growth avenue in collaborative design and emphasized regulatory hurdles to large-scale acquisitions.

Why This Might Be An Opportunity:

1/ High Switching Costs – Adobe’s broad product suite, entrenched workflows, and years of stored assets make switching difficult, with AI tools more likely to threaten simpler platforms like Canva than complex, professional-grade software like Photoshop.

2/ Sticky Subscription Model – Recurring revenue streams and predictable free cash flow provide stability, even in slower growth periods. Meanwhile, the stock trades at 12× forward EV/EBITDA, its lowest valuation in a decade.

3/ Limited Exposure To Tariffs & Geopolitics – Software-centric model avoids many of the macro risks impacting manufacturing-heavy companies.

4/ Market Leadership – 750M monthly active Digital Media users, 22K enterprise customers, and market dominance in PDFs (650M monthly Acrobat users opening 400B documents annually) reinforce its position as the gold standard in creative and document software.

5/ Freemium Expansion – Adobe Express, positioned to compete with Canva, has seen >4× YoY growth in generative AI monthly active users, expanding reach into a broader creator base.

TLDR: Adobe’s entrenched user base, strong brand, and high switching costs give it a durable moat, while new AI features and freemium expansion offer growth upside, though competitive pressure and regulatory risks remain.

5/ Salesforce

Ticker: $CRM

Market Cap: $230B

Salesforce, founded in 1999 and based in California, is the global leader in customer relationship management (CRM) software.

It generates revenue primarily through subscriptions to its Customer 360 platform, which includes Sales, Service, Marketing, Commerce, analytics tools like Tableau, integration tools like MuleSoft, and collaboration through Slack, supplemented by professional services.

Growth is driven by expanding enterprise adoption of cloud-based CRM solutions, cross-selling across its broad platform, and integrating AI capabilities to improve customer engagement and productivity.

The stock is down over 30% from its December 2024 peak, with a five-year total return of just 23%.

Much of this underperformance stems from the unwinding of an inflated valuation that surged during the post-COVID tech boom.

Key Metrics:

5Y Revenue CAGR: 16.2%

5Y Diluted EPS CAGR: 101.1%

Operating Margin: 20.5%

5Y ROIC: 3.4%

Total Cash & Short Term Investments: $17.41B

Net Debt: -$5.39B

Outlook (Estimates):

Forward 2Y Revenue CAGR: 8.9%

Forward 2Y EPS CAGR: 11.3%

Long Term EPS Growth: 17.4%

Recent Developments & Key Headwinds:

1/ Slowing Growth – Revenue growth has decelerated from 20%+ for several years to mid-to-high single digits, raising concerns that the era of high double-digit top-line growth may be over.

2/ AI Monetization Lag – The company’s AI platform, Agentforce, has yet to generate revenue at a scale that materially impacts results, with the solution raking in $100M in ARR as of the most recent quarter.

3/ Acquisition Dependence – Historical growth has relied heavily on M&A, including the recent $8B Informatica deal to bolster AI data infrastructure; past acquisitions like Slack ($27B) have drawn criticism for overpayment and carry integration risk.

4/ Rising Competition – Salesforce faces pressure from traditional rivals Oracle, SAP, and Microsoft, as well as enterprise platforms like ServiceNow and emerging AI-driven platforms like Palantir that could capture enterprise budgets in overlapping areas.

5/ Dilution Risk – Despite heavy buybacks, high stock-based compensation has offset most of the impact, with shares outstanding down only 2% over the past 3 years.

Why This Might Be An Opportunity:

1/ Expanding CRM Market – The global CRM market is expected to grow at a 14.6% CAGR through 2030, reaching $163B, laying a strong foundation for continued enterprise demand.

2/ Agentic AI Moonshot – The agentic AI market is projected to surge from $7B today to $93B by 2032, representing a 44.6% CAGR. Salesforce’s vast enterprise data and distribution advantage position it to embed AI agents into CRM workflows, potentially unlocking new revenue streams or efficiency gains, even if the agentic market underdelivers on current expectations.

3/ Market Leadership & Stickiness – Salesforce maintains a dominant footprint, serving 90%+ of Fortune 500 customers, with high switching costs given its integrated CRM suite and long-standing customer relationships.

4/ Margin Expansion Potential – Operating margins have moved from under 5% to nearly 20% with peers like Adobe (37%) and Intuit (26%) showing there’s still room for further improvement.

TLDR: Salesforce’s scale, entrenched customer base, and potential to capitalize on the fast-growing agentic AI market offer meaningful upside, though slower core growth and AI-driven competition remain watchpoints.

Disclaimer

This content is for informational and educational purposes only and should not be construed as financial, investment, tax, legal, or other professional advice. It does not constitute a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. You are solely responsible for any investment decisions you make, and you should consult with a qualified financial advisor before making any investment or financial decisions.

The author may hold, or may in the future acquire, sell, or otherwise change positions, long or short, in any of the securities, investments, or financial instruments mentioned in this content, without notice or obligation to update this information. Any such holdings or transactions should not be construed as an endorsement of any security or strategy.

The author and publisher make no representations or warranties, express or implied, as to the accuracy, completeness, or timeliness of the information provided, and assume no liability for any losses or damages of any kind arising from or related to the use of this content. Past performance is not indicative of future results. All investments carry risk, including the potential loss of principal.

This content is intended for a general audience and may not be lawful or appropriate in certain jurisdictions. Readers are responsible for ensuring compliance with all applicable laws and regulations in their country or region.

AI tools were used to refine, expand, or edit portions of this content for clarity, flow, and digestibility.

Reply