- Carbon Finance

- Posts

- 💡 5 Investment Ideas (November 2025)

💡 5 Investment Ideas (November 2025)

5 Investment Ideas - November 2025

Welcome to the November edition of Investment Ideas.

Each month, I spotlight a select mix of businesses I am following closely.

As a reminder, this report is concise by design.

It does not capture every risk in full but highlights the key dynamics shaping each business and why they merit close attention.

Let’s dive in.

Note: This report is for informational purposes only and is not investment advice. Please see the full disclaimer at the end.

5/ Porsche AG

Ticker: $DRPRY

Market Cap: $46B

Porsche AG, founded in 1931 and headquartered in Germany, is a global manufacturer of high-performance vehicles.

The company operates across automotive manufacturing and financial services, including vehicle production, engineering development, parts and accessories, financing and leasing solutions, and certified pre-owned sales through its global dealer network.

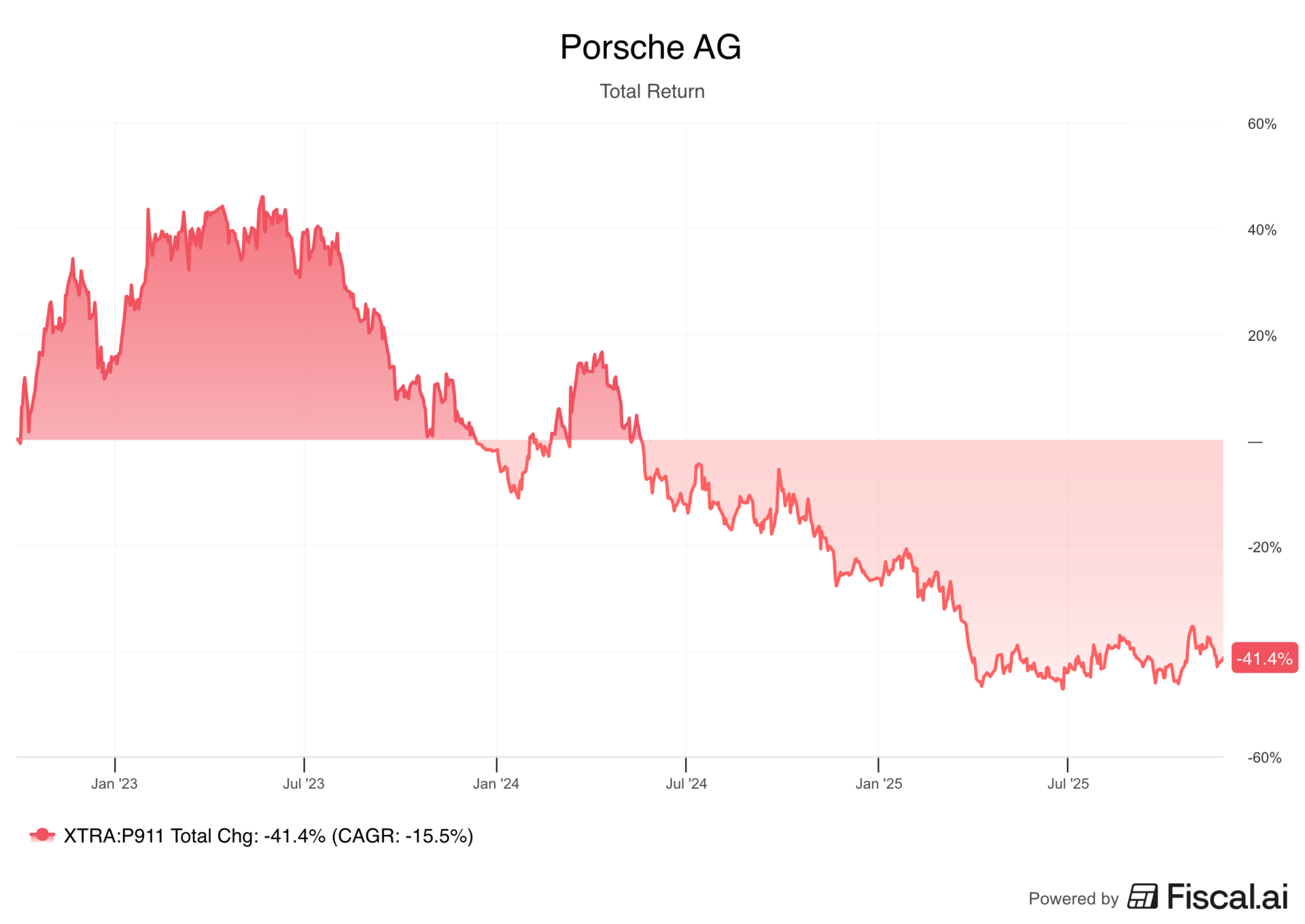

The stock is down 14% in 2025 and has fallen over 50% since its IPO in late 2022.

Key Metrics:

5Y Revenue CAGR: 7%

5Y Diluted EPS CAGR: -34%

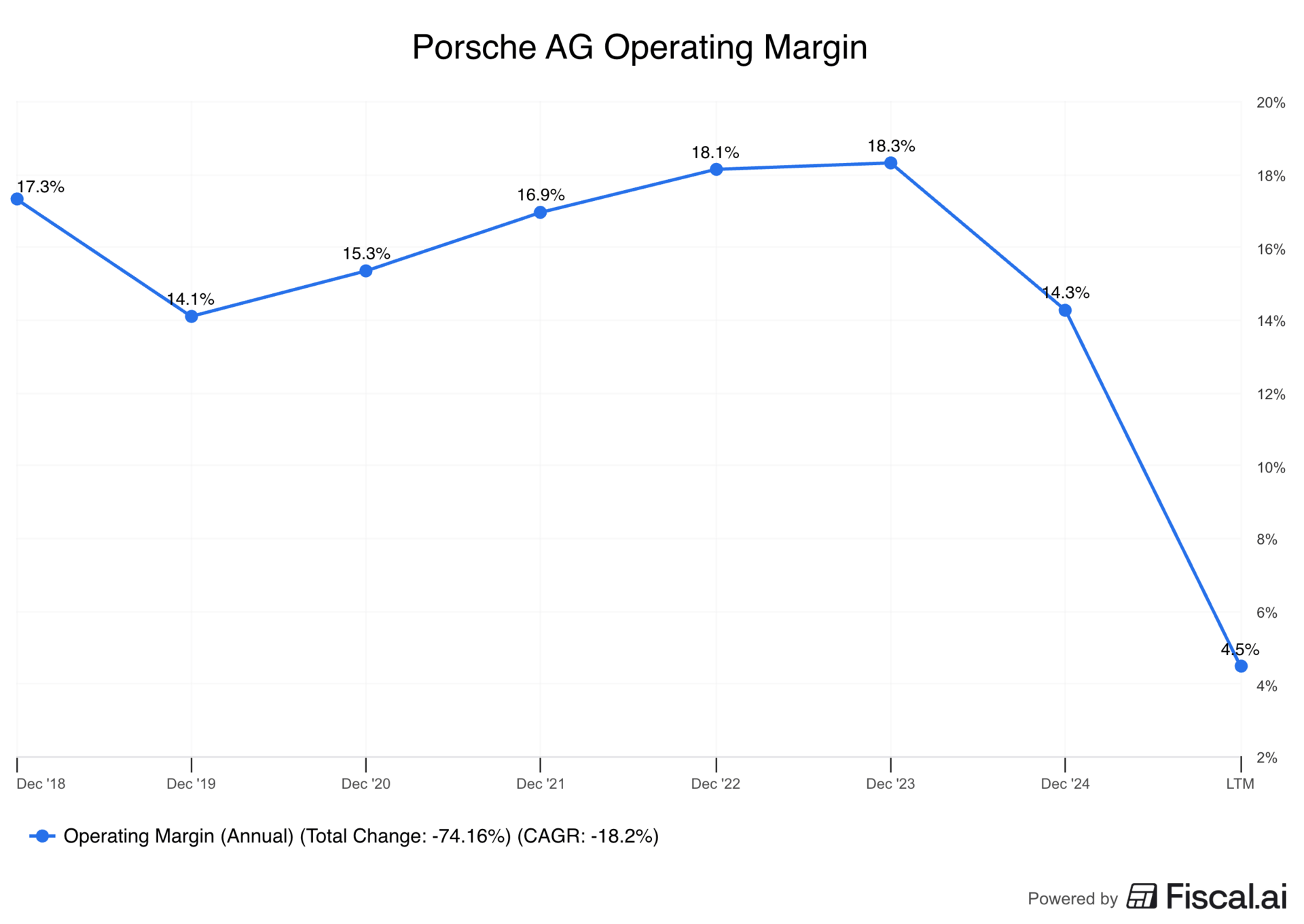

Operating Margin: 5%

5Y ROIC: N/A

Total Cash & Short Term Investments: $9B

Net Debt: $5B

Outlook (Estimates):

Forward 2Y Revenue CAGR: -3%

Forward 2Y EPS CAGR: -21%

Long Term EPS Growth: -11%

Recent Developments:

1/ Profitability Under Pressure — Porsche posted its first quarterly loss in Q3, with operating income falling €966M due to a pullback in its EV strategy, elevated tariffs, and weakening demand in China. For the full year, the EV pullback created a €3.1B profit hit, while U.S. tariffs were projected to cost another €700M. EV penetration reached 23% this year, well below the company’s prior 50% target, highlighting weaker demand and slower execution than planned.

2/ Sharp Decline in China — China, one of Porsche’s most important markets, saw demand fall sharply. Deliveries dropped from nearly 96,000 vehicles in 2021 to just under 46,000 over the last twelve months, representing a 52% decline. Competition from BYD, Geely, Chery, Xiaomi, and other value-focused brands have intensified.

3/ Divided Leadership Focus — Volkswagen, the majority owner of Porsche, had its CEO Oliver Blume overseeing both Volkswagen and Porsche simultaneously, which likely divided focus and limited leadership capacity.

Why This Might Be An Opportunity:

1/ EV Strategy Pivot — Porsche recognized that EV demand was weaker than expected and made a costly pivot that allows it to focus on selling what customers actually want. The company is expanding its lineup of combustion engine and plug-in hybrid models while continuing to invest in electrification, aiming for a more balanced drivetrain mix.

2/ China Strategy Reset — Porsche is restructuring its China strategy by reducing its planned dealer network from 150 locations to about 80 by 2027. This reflects a more disciplined, profitability-focused approach in a market that has become highly competitive.

3/ Margin Recovery Efforts — To offset tariff pressure, Porsche is introducing price increases in the U.S. market. Tariffs fell from 27.5% to 15% after a new U.S.–EU trade agreement, and management expects restructuring efforts, operational adjustments, and cost controls to support a return to high single digit profit margins next year. R&D spending is expected to peak this year and next, followed by a decline, and the company is shifting toward partnerships and licensing to improve flexibility and reduce capital intensity.

4/ New Leadership — Volkswagen’s CEO Oliver Blume is stepping down from his role at Porsche, and the company will now have a dedicated CEO in Michael Leiters, the former McLaren Automotive CEO and former Ferrari CTO. This brings more focused leadership during a critical turnaround period.

5/ Strong Brand Equity — Porsche remains one of the most desirable automotive brands globally, with strong loyalty and broad cultural recognition. Nearly 60% of owners repurchase another Porsche, the brand has over 30M social media followers, and it consistently ranks highly in JD Power awards for quality and sales satisfaction.

TLDR: Porsche has faced significant challenges from a costly EV reset, weaker China demand, tariff pressure, and diluted leadership focus, all of which drove its first quarterly loss. The company is now repositioning its model mix, restructuring China operations, and working to restore margins under a new dedicated CEO. Its brand strength and product strategy shift provide a solid foundation for recovery, though execution risk and competitive pressure will likely make the turnaround story volatile.

My Take: Porsche is working through several short-term headwinds, many of which were self-imposed. The opportunity is clear if management can execute as operating margins could meaningfully recover toward historical levels. I have not taken a position yet, as I want to further evaluate competitive pressures in China, which remains an important market and has shifted dramatically over the past few years. However, I’ll be following the company closely as the turnaround unfolds.

4/ Celsius

Ticker: $CELH

Market Cap: $11B

Celsius, founded in 2004 and based in Florida, develops and markets functional energy drinks and liquid supplements globally.

The company sells a range of carbonated and non-carbonated performance drinks, on-the-go powders, and recovery blends through retailers, convenience channels, gyms, health clubs, and major e-commerce platforms.

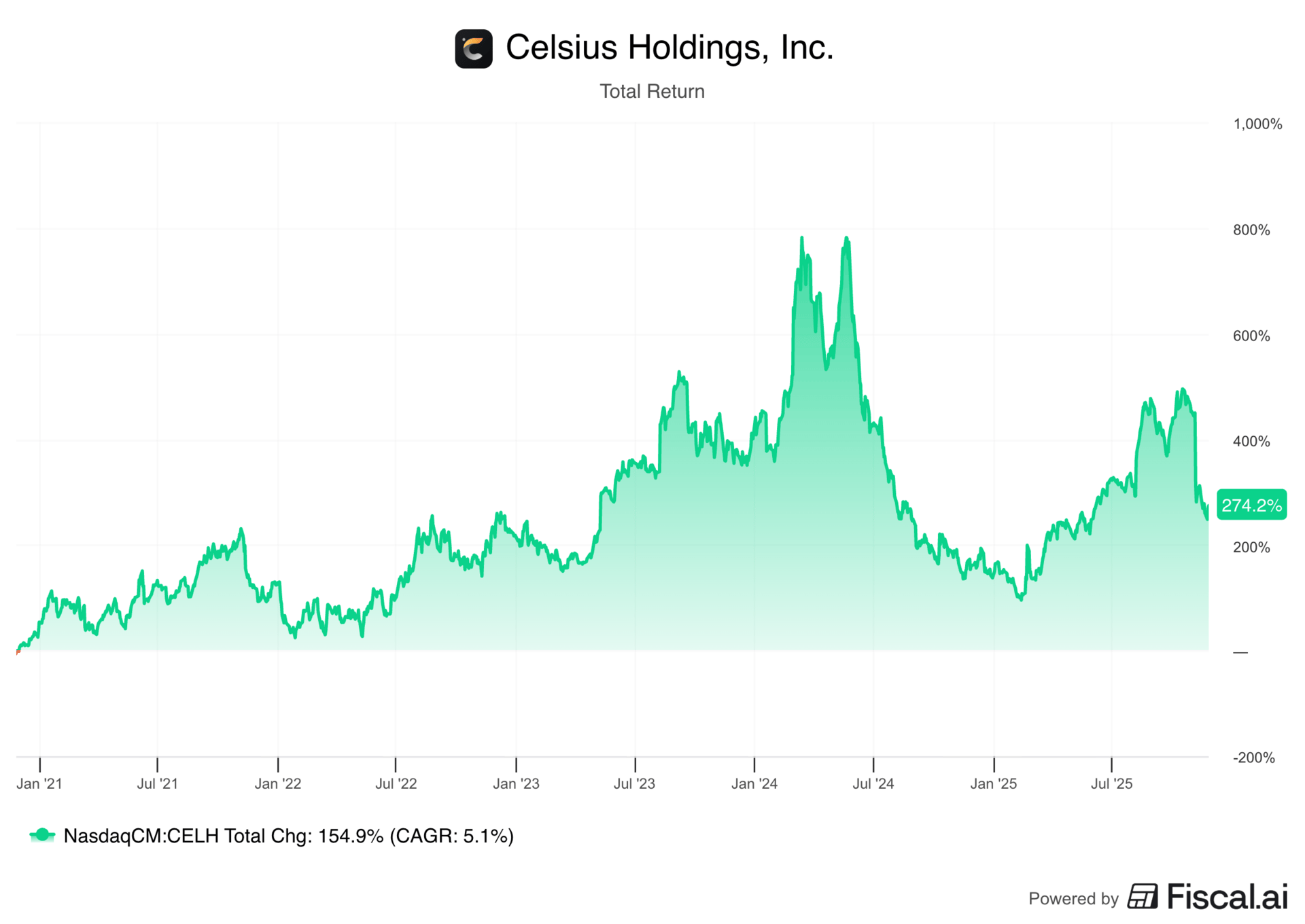

Over the past month, the stock is down roughly 35%, but is still up 50% on the year.

Key Metrics:

5Y Revenue CAGR: 78%

5Y Diluted EPS CAGR: 37%

Operating Margin: 20%

5Y ROIC: 6%

Total Cash & Short Term Investments: $806M

Net Debt: $89M

Outlook (Estimates):

Forward 2Y Revenue CAGR: 54%

Forward 2Y EPS CAGR: 81%

Long Term EPS Growth: 34%

Recent Developments:

1/ Lower Core Brand Demand — In the most recent quarter, Celsius reported 44% revenue growth in its core brand, but retail sales grew only 13%, which is a more accurate gauge of real consumer demand. PepsiCo serves as the exclusive U.S. distributor for Celsius, and is the preferred global distribution partner. The gap reflects PepsiCo increasing its orders this year after cutting them sharply in 2024 to correct an earlier overstocking issue in its warehouses.

2/ Integration Noise & Margin Pressure — Celsius recorded a $247M one-time charge tied to transitioning Alani Nu (which it acquired in April 2025) into PepsiCo’s distribution network, which pushed Q3 to an 11% operating loss. Management expects the next few quarters to remain “noisy” as integration work continues, marketing spend stays elevated, and freight costs remain pressured. Profitability will likely stay constrained until these moving pieces stabilize.

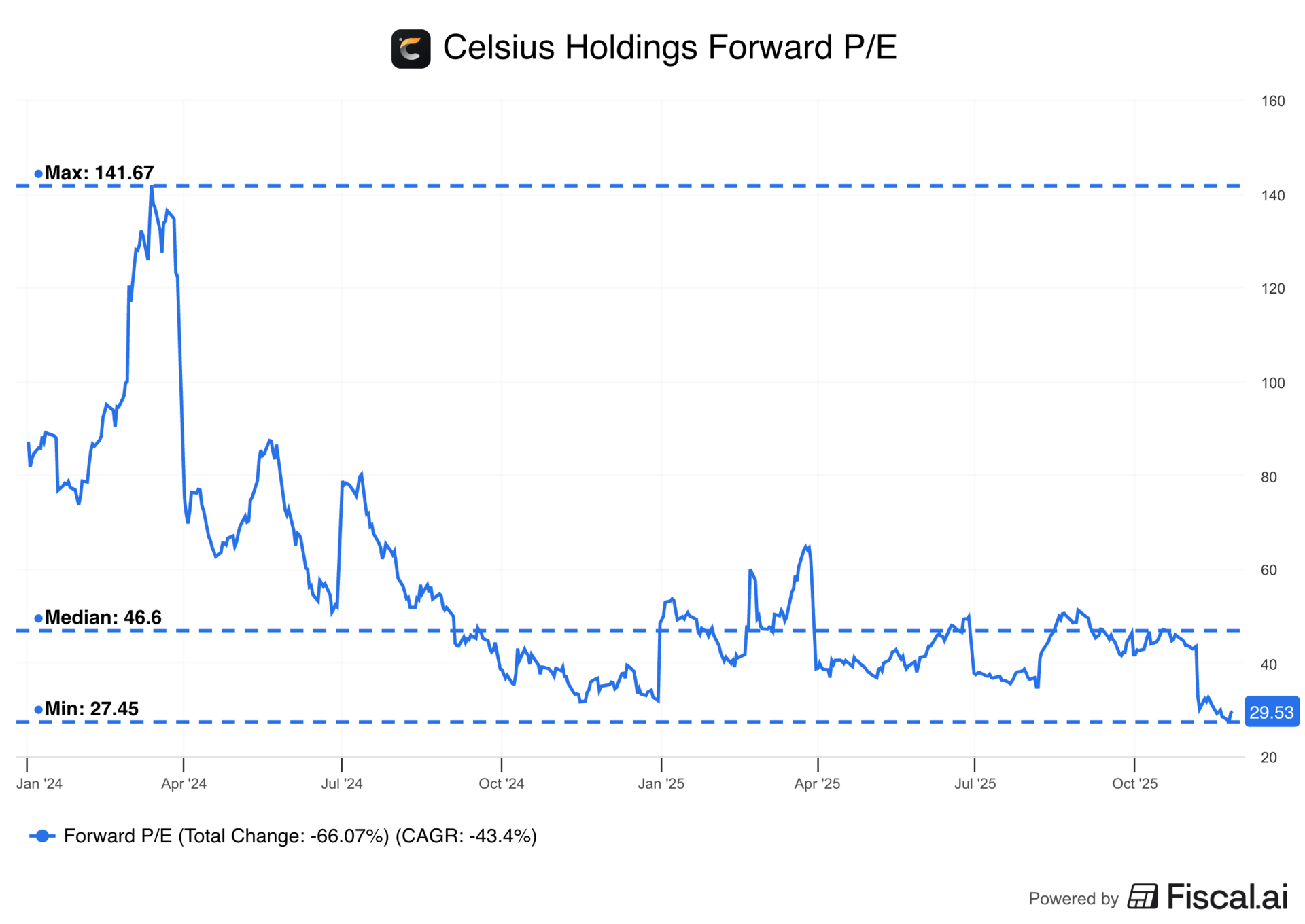

3/ Elevated Valuation Resetting — Before the recent pullback, Celsius stock had surged more than 120% this year and traded at roughly 50x forward earnings and 5x forward sales, which left little room for any blemishes.

Why This Might Be An Opportunity:

1/ One-Time Costs Covered — The $247M distribution termination charge is fully funded by PepsiCo and does not impact Celsius’ cash position. Adjusted earnings beat expectations in Q3, and many of the current gross margin pressures are temporary. Management expects benefits to begin as early as next year and is evaluating pricing actions to offset cost headwinds.

2/ Rapid Market Share Gains — Celsius has grown its U.S. energy-drink market share from 5% three years ago to 21% today, driven by strong core brand momentum and the additions of Alani Nu (acq. April 2025) and Rockstar Energy (acq. August 2025). In the most recent quarter, the full portfolio grew 31% at U.S. retailers. This positions Celsius as a strong competitor to Monster and Red Bull in a $25B U.S. energy drinks market projected to grow 7.2% annually through 2030.

3/ More Synergistic Partnership — Celsius acquired the rights to Rockstar Energy in the U.S. and Canada, creating a more streamlined partnership with PepsiCo. Pepsi previously owned Rockstar, which competed directly with Celsius. Consolidating the brands under Celsius allows Pepsi to focus on distribution while Celsius manages and grows the full energy drink portfolio. Rockstar is currently seeing sales decline, but Celsius has room to reposition the brand. Meanwhile, Alani Nu delivered triple-digit growth in Q3, and is joining the PepsiCo distribution system on December 1st, 2025, enabling broader distribution.

4/ Affordability & Health Tailwind — A Celsius can generally costs under $3, far below the $5 to $10 price tag for specialty drinks at major coffee chains. Combined with its “clean” and functional perception, Celsius is well positioned to benefit as consumers seek more affordable and healthier alternatives.

5/ Management Signals Confidence — Celsius authorized a $300M share repurchase program on November 10th, signaling confidence in long-term value. Days later, COO Eric Hanson and director Hal Kravitz made the first insider purchases in more than five years, buying a combined 14,558 shares worth $652K.

TLDR: Celsius is dealing with short-term noise and one-time charges, but the core business is still growing rapidly and gaining share. The pullback appears more sentiment-driven than fundamental, and the current valuation offers a solid risk/reward. A stronger PepsiCo partnership supports long-term upside if execution remains solid.

My Take: I have initiated a small (<5%) exploratory position, given that this is not a wide-moat compounder. That said, I do see a credible long-term thesis with strong growth prospects, and this could evolve into a larger position over time if execution remains strong and its moat continues to widen. I am also a fan of the energy drink.

3/ Duolingo

Ticker: $DUOL

Market Cap: $9B

Duolingo, founded in 2011 and based in Pennsylvania, operates one of the world’s most popular digital language-learning platforms.

The company offers courses in more than 40 languages through its website and mobile app, and also provides a digital English proficiency exam used by academic institutions and employers globally.

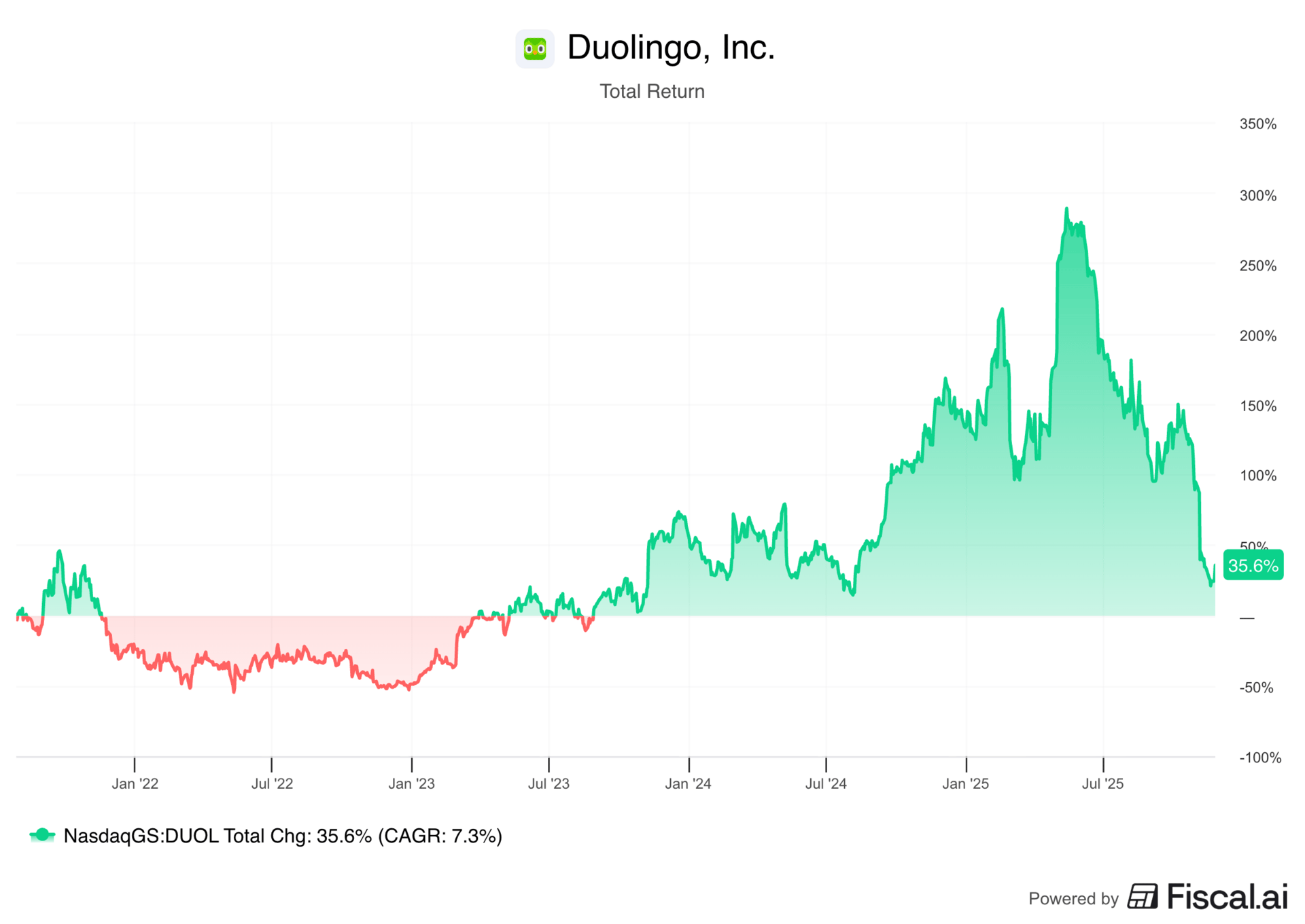

Since its peak in the beginning of the year, shares have plunged nearly 70%.

Key Metrics:

5Y Revenue CAGR: 60%

5Y Diluted EPS CAGR: N/A

Operating Margin: 12%

5Y ROIC: -12%

Total Cash & Short Term Investments: $1B

Net Debt: -$1B

Outlook (Estimates):

Forward 2Y Revenue CAGR: 30%

Forward 2Y EPS CAGR: 51%

Long Term EPS Growth: -10%

Recent Developments:

1/ User Growth Over Monetization — In the most recent earnings report, management highlighted a strategic shift toward teaching effectiveness and user expansion over near-term monetization. Additionally, during the earnings call, management said it would be a few years until they get to the point where the app is in the best possible way to learn.

2/ Slowing User Growth — In Q3, Duolingo surpassed 50M daily active users, an impressive milestone, but slightly below analyst expectations of 51M DAUs. Monthly active users also came in below analyst estimates. While user growth remains strong, it has decelerated sequentially since Q4 2023, reflecting the challenge of sustaining rapid scale at this size.

3/ Light Forecast — For Q4, Duolingo guided to midpoint bookings of $332.5M (vs. $344M expected) and adjusted EBITDA of $77M (vs. $81M expected). Both reflect near-term investment in growth initiatives. Revenue is projected to rise 31% YoY, though only 1% QoQ.

4/ AI-First Backlash — In April 2025, an internal memo describing Duolingo’s plan to become an “AI-first” company sparked criticism after references to phasing out contractors. The company later clarified that AI would be used to increase efficiency and no full-time employees were laid off.

5/ AI Disruption Theme — Investors remain weary about potential AI-driven disruption. Competing products such as Apple’s real-time translation in AirPods, Google’s AI-powered “practice mode”, and OpenAI’s “study mode” are viewed as emerging substitutes for language learning.

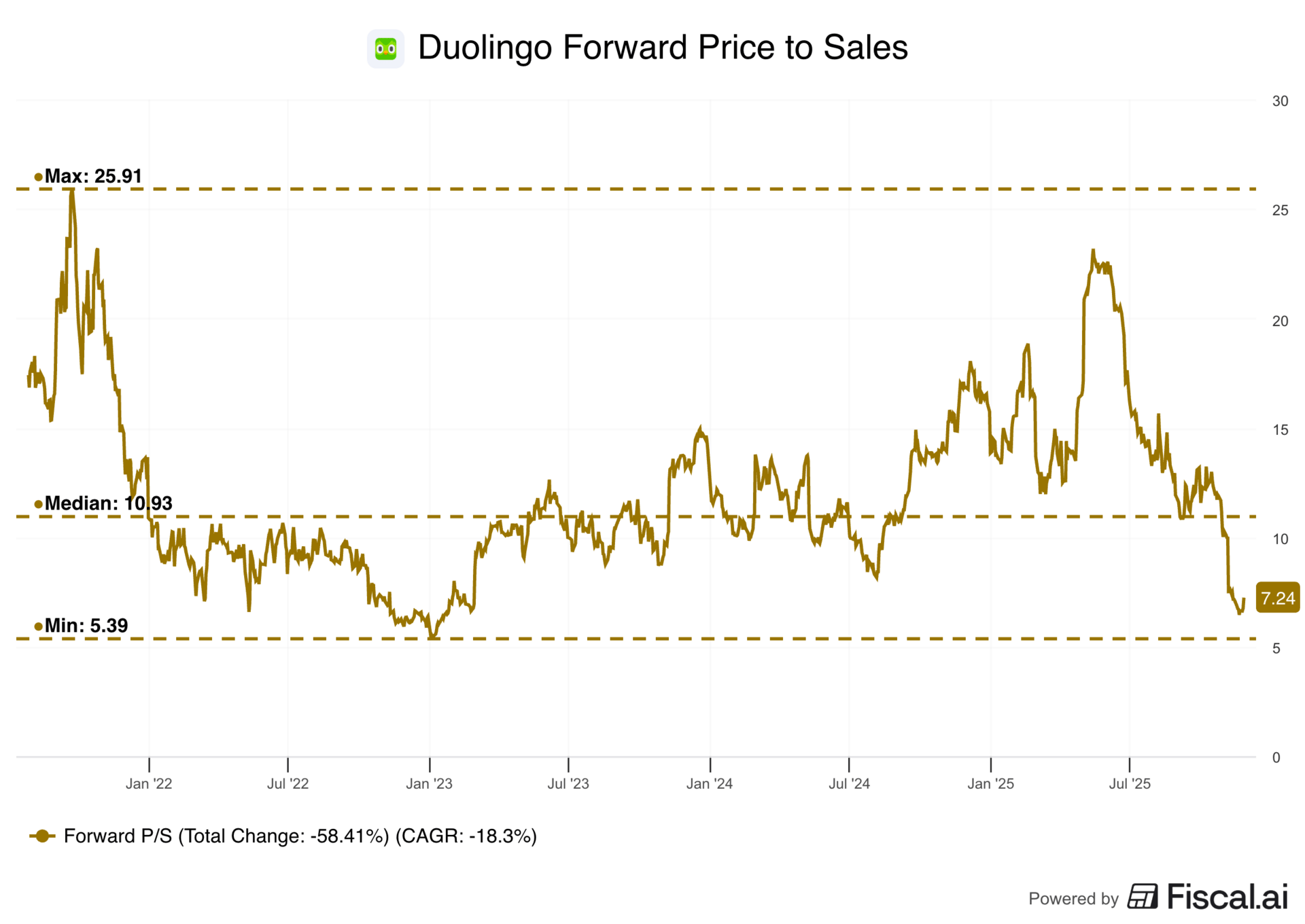

6/ Expensive Valuation — Duolingo’s rich valuation left little room for any surprises. The stock traded at roughly 23× forward sales (!) in May 2025, making it extremely sensitive to any slowdown in user, revenue, or bookings growth.

Why This Might Be An Opportunity:

1/ Long Term Focus — Management’s decision to prioritize user growth and product quality over near-term monetization reflects a disciplined long-term vision. By investing in engagement and teaching effectiveness now, Duolingo aims to maximize lifetime user value and sustain growth over the next decade rather than optimizing for short-term profits.

2/ Expanding Market Opportunity — The online language-learning market is valued at roughly $22B and is expected to grow 17% through 2030. The broader online education market is even larger, and represents a bigger TAM. Duolingo’s expansion into adjacent categories such as math, music, and games like chess could significantly widen its addressable market beyond languages.

3/ Solid Growth — Despite softer guidance, Duolingo continues to post strong fundamentals. In Q3 2025, DAUs climbed 36%, MAUs 20%, and paid subscribers 34%, with penetration rising to 9% from 8.5% a year earlier. Revenue grew 41%, bookings 33%, and the company has been GAAP profitable.

4/ Network Effects — With over 20M social media followers and one of the largest learning communities globally, Duolingo benefits from powerful network effects. Its gamified mechanics, such as streaks, family plans, and competitions, drive organic growth and retention, reducing the need for heavy marketing spend.

5/ AI Tailwind — While AI-powered tools from Apple, Google, and OpenAI may seem competitive, Duolingo’s edge lies in retention, user data, and engagement loops. The company’s massive dataset of learning interactions uniquely positions it to integrate conversational AI bots that vastly enhance instruction and personalize learning, far above the quality that it delivers today. AI is likely to enhance, not replace, Duolingo’s value proposition.

6/ Founder Led - Duolingo remains founder-led under Luis von Ahn, a proven entrepreneur who previously built and sold reCAPTCHA to Google. His long-term orientation and product-led culture provide strategic consistency and alignment with shareholders.

TLDR: Duolingo is under pressure from slowing user growth and softer guidance, yet subscribers, revenue, and bookings remain strong. One risk often cited is that new AI language apps will chip away at Duolingo’s share, but this appears overstated given the company’s brand strength, retention, and scale advantages. The more meaningful risk is that AI tools will deliver quick, on-demand competence that some users prefer over structured learning. That impact is harder to gauge. If Duolingo can use AI to enhance learning and expand into new education categories, it can help offset this risk. The setup remains high risk and high reward.

My Take: Duolingo has corrected from an excessive valuation and returned to its 2024 lows near the $160 support zone. A desirable entry window lasted only a few days before rebounding. That said, the stock still trades around 7x sales, which is expensive but reasonable given consistent revenue growth above 35%. Rather than chase, I plan to stay patient since new AI announcements from other companies could pressure the stock beyond fundamentals. If I initiate a position, it will be small, with the option to DCA. Long term, I expect Duolingo to defend its turf against other language apps, and I view the idea that AI removes the need to learn languages as exaggerated, since structured learning still matters for education and real-world use.

2/ On Holding

Ticker: $ONON

Market Cap: $14B

On Holding AG, founded in 2010 and headquartered in Switzerland, develops and distributes performance footwear, apparel, and accessories.

The company sells its products through independent retailers, distributors, e-commerce channels, and branded stores across global markets.

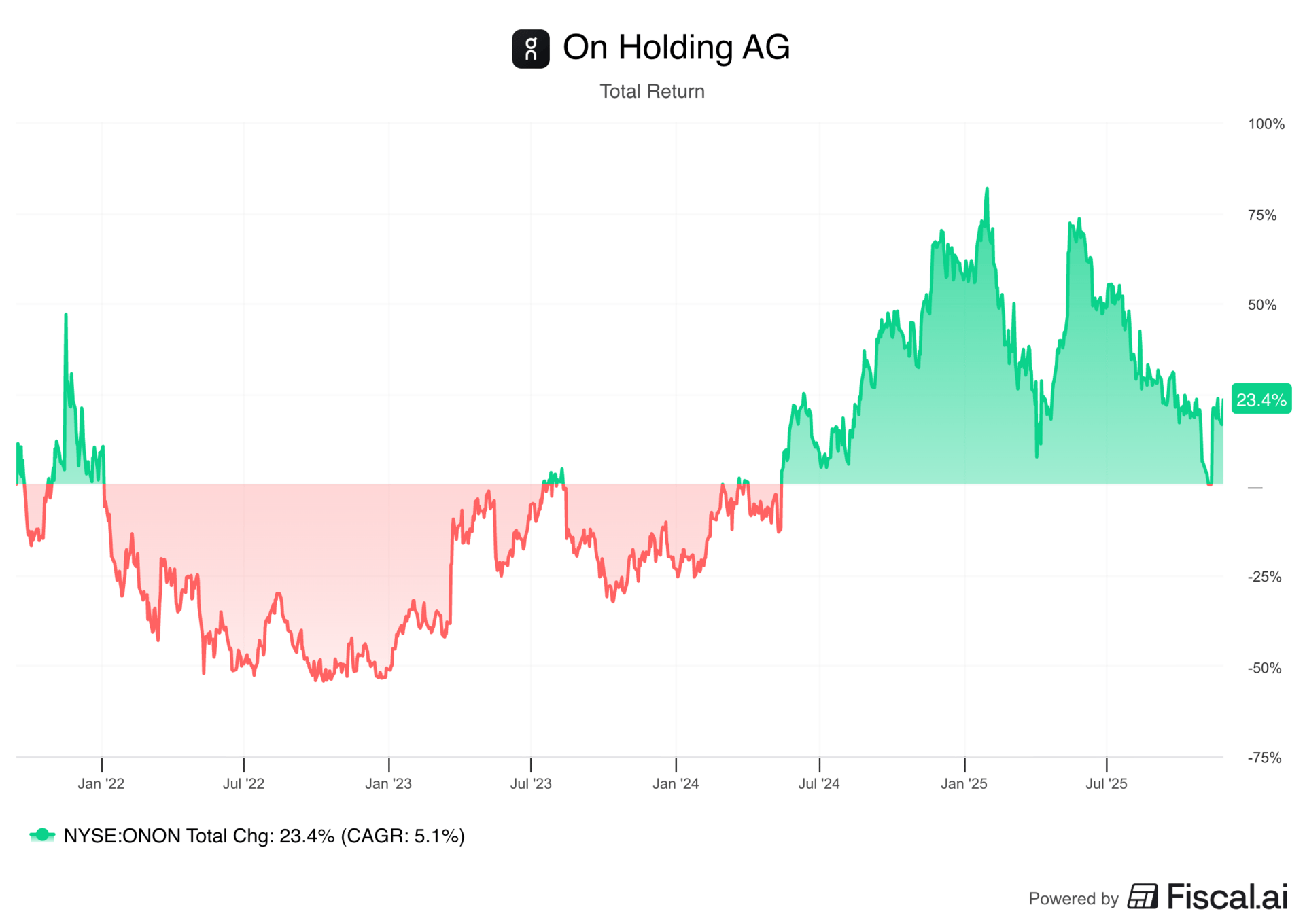

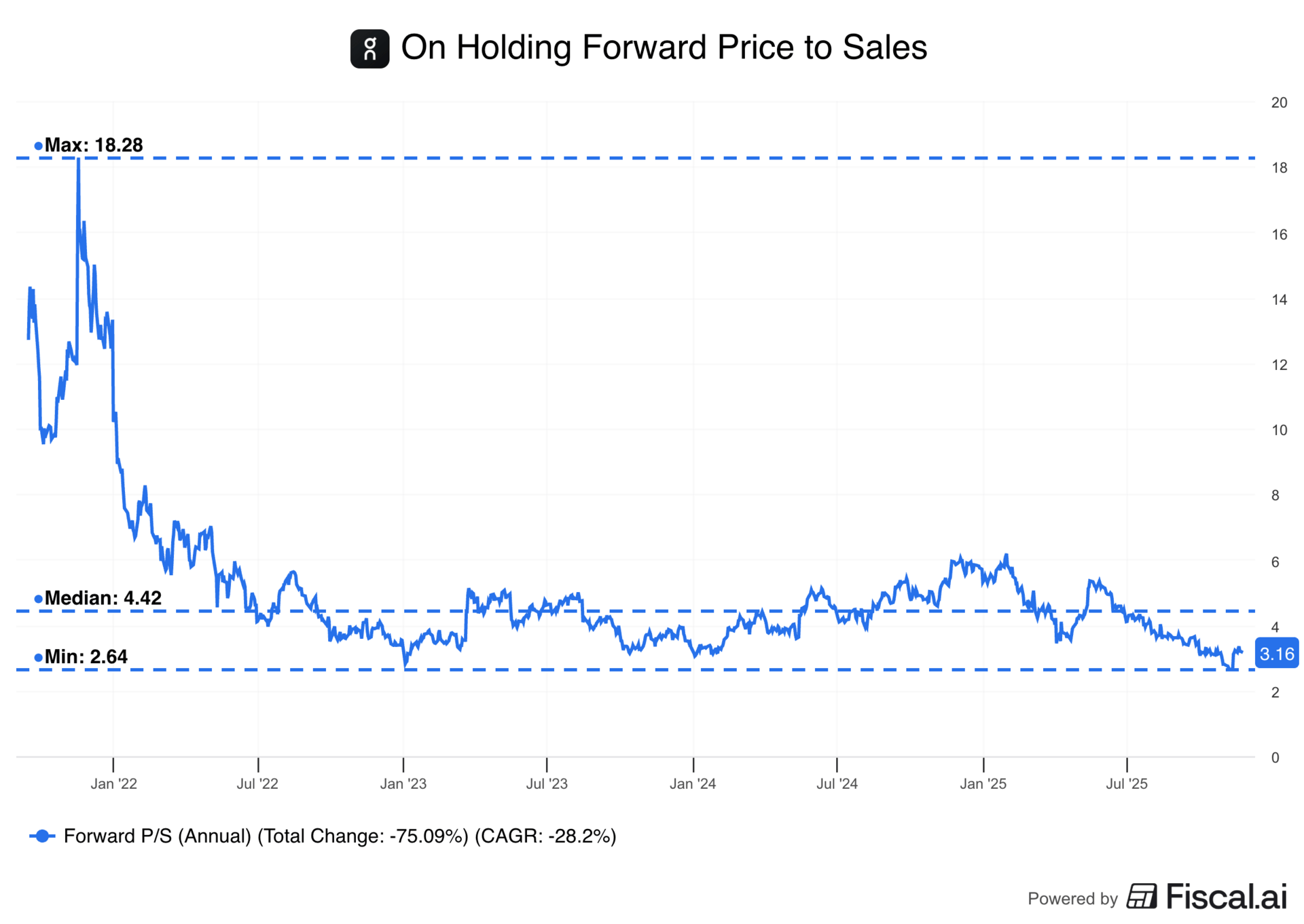

Since mid-November, shares have climbed 23%. However, shares are still down 22% YTD.

Key Metrics:

5Y Revenue CAGR: 54%

5Y Diluted EPS CAGR: 159%

Operating Margin: 12%

5Y ROIC: 8%

Total Cash & Short Term Investments: $1B

Net Debt: -$1B

Outlook (Estimates):

Forward 2Y Revenue CAGR: 26%

Forward 2Y EPS CAGR: 18%

Long Term EPS Growth: 25%

Recent Developments:

1/ Full Year Guidance Raised — On reported a strong Q3 and raised full year 2025 sales guidance to $3.72B, up from $3.67B and above analyst expectations. This marked the third consecutive quarter of raised guidance and reflected 34% YoY sales growth on a constant currency basis.

2/ Expanding Beyond Footwear — While footwear remains the core business, apparel has become a major growth driver. Apparel sales increased 100% YoY in Q3 2025 at constant currency with more than 1M units sold in the quarter. The company is also expanding into tennis, hiking, and training, which is broadening its addressable market. Additionally, accessories sales also saw rapid growth, increasing 161% at constant currency.

3/ Strong International Momentum — Asia Pacific delivered its fourth straight quarter of triple digit constant currency growth (109%) and now accounts for nearly 20% of total sales. Meanwhile, EMEA grew at 33%, and the Americas grew at 21%. These results highlight effective execution and global expansion.

4/ Scaling DTC — Direct-to-consumer (DTC) continues to be a key driver, representing 40% of sales in Q3 2025. The higher DTC mix is improving gross margins by removing intermediaries and giving the company more control over pricing and brand experience. DTC sales grew 37.5% at constant currency in the most recent quarter.

Why This Might Be An Opportunity:

1/ Premium Positioning — On has established itself as a premium performance brand with loyalty levels that allow it to hold firm on pricing even in a weak consumer environment. Its ability to grow more than 30% while competitors face demand softness suggests On has carved out a differentiated positioning that consumers are willing to pay for. This premium stance supports long-term pricing power and brand equity that can compound for years.

2/ Margin Expansion With Structural Benefits — On’s premium pricing, rising DTC mix, and disciplined inventory management are creating a structurally advantaged margin profile. Hitting 66% gross margins shows the model scales efficiently and gives On margin power that rivals luxury brands like LVMH.

3/ Building A Global Performance Brand — On’s global multi-category performance brand across tennis, hiking, training, and apparel will expand its long-term TAM and reduce reliance on any single category. Strong growth in APAC, EMEA, and the Americas signals early global scale advantages that position On as one of the few credible challengers to Nike and Adidas.

TLDR: On is delivering strong growth across categories and geographies with rising DTC penetration. Its premium positioning and scalable model support a margin structure well above typical peers. If the company maintains execution, the long-term growth story remains compelling at a reasonable price.

My Take: I’m interested in taking a mid-sized position (5–10%) in On. The company has executed exceptionally well through a tough macro environment, and the global growth opportunity is clear. Management’s premium positioning and disciplined focus continue to stand out. Shares jumped sharply after earnings, so I plan to conduct deeper research and build a position gradually at some point, with a preference to scale in during broader market pullbacks.

1/ Meta Platforms

Ticker: $META

Market Cap: $1.6T

Meta Platforms, founded in 2004 and headquartered in California, develops digital products that enable people to communicate and share across mobile devices, computers, and immersive technologies.

The company operates through its Family of Apps, including Facebook, Instagram, Messenger, and WhatsApp, and through Reality Labs, which focuses on virtual and augmented reality hardware, software, and content.

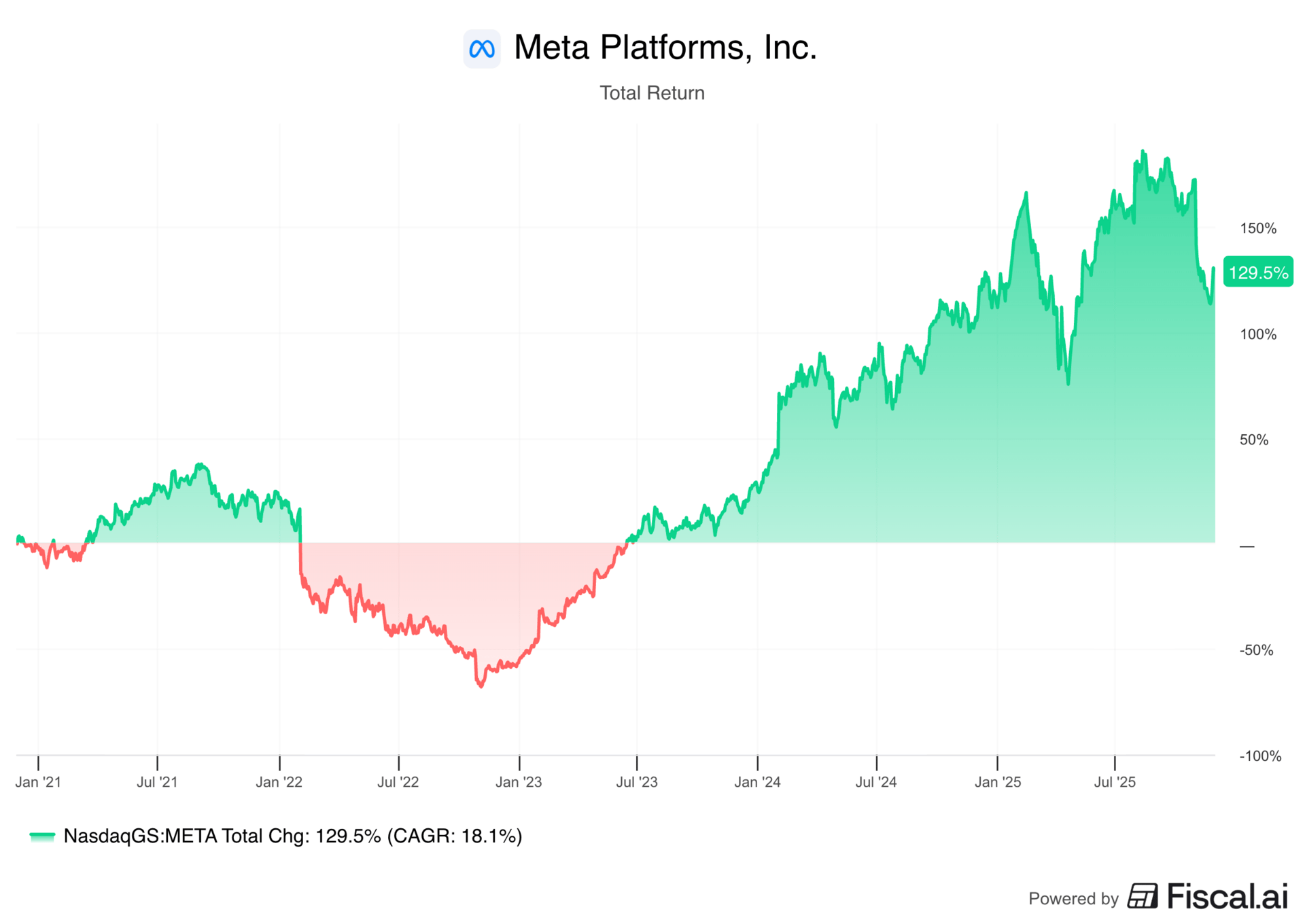

Shares are down 16% over the past month and up just 6% in 2025.

Key Metrics:

5Y Revenue CAGR: 19%

5Y Diluted EPS CAGR: 21%

Operating Margin: 43%

5Y ROIC: 29%

Total Cash & Short Term Investments: $44B

Net Debt: $7B

Outlook (Estimates):

Forward 2Y Revenue CAGR: 19%

Forward 2Y EPS CAGR: 13%

Long Term EPS Growth: 16%

Recent Developments:

1/ Earnings Plunge — Meta reported an 82% decline in diluted earnings in the most recent quarter, which alarmed some investors. The drop was not operational but driven by a one-time, non-cash income tax charge tied to President Trump’s One Big Beautiful Bill Act.

2/ Rising Spending — Meta raised its 2025 capital expenditure outlook to $71B, up from $69B, and increased total expense expectations to $117B. Mark Zuckerberg said these investments are needed to build the computing power for Meta’s AI roadmap, but investors worry the company could be overbuilding without a clear path to monetization. Unlike hyperscalers that rent out computing power through their cloud platforms and earn returns quickly, Meta cannot offset these costs in the same way. The company also signaled that 2026 CapEx will be “notably larger,” which has drawn comparisons to the earlier metaverse spending cycle.

3/ AI Talent Strategy Whiplash — Meta spent billions recruiting high-cost AI talent and also acquired a 49% stake in Scale AI for $14.3B. Yet the company later restructured its AI division, split Meta Superintelligence Labs into four groups, and froze AI hiring in August. In October 2025, Meta laid off roughly 600 employees in its AI unit, raising concerns about strategy coherence. The company’s cash and cash equivalents have declined 43% since the end of 2024, partly due to these aggressive investments.

4/ Off-Balance-Sheet Financing Exposure — Meta partnered with private credit manager Blue Owl to create an SPV that finances multiple AI infrastructure projects. A Blue Owl–run fund owns 80% of the vehicle, which keeps the associated debt off Meta’s balance sheet while still leaving Meta economically exposed to the project’s performance. Investors view this as risk that is effectively similar to on-balance-sheet debt, since Meta must cover shortfalls if its AI projects underperform.

5/ GPU Depreciation Risk — Meta extended the useful life of its GPUs to 5.5 years in 2025, reducing depreciation expense and boosting reported earnings. Analysts, like Michael Burry, estimate the company’s earnings could be overstated by nearly 21% by 2028 under this schedule. With Nvidia releasing new GPU architectures every year and high utilization accelerating economic depreciation, the assets may lose value faster than assumed, creating the risk of a sizable future write-down that would hit earnings.

6/ Persistent Reality Labs Losses — Reality Labs continues to generate multi-billion-dollar operating losses with no visible path to profitability. Since 2019, cumulative losses have reached nearly $90B, and investor patience remains limited given the lack of returns on this investment.

Why This Might Be An Opportunity:

1/ Accounting Adjustment — The earnings plunge was driven by an accounting change, not cash leaving the business. Meta clarified that the new tax law will actually reduce U.S. federal cash taxes through 2025 and beyond, making the headline decline more optical than fundamental.

2/ The Compute Bet — Mark Zuckerberg explained that building AI capacity ahead of demand is deliberate, and that Meta routinely finds internal demand outpacing even aggressive capacity assumptions. This approach positions Meta to benefit if AI performance accelerates and also allows the company to use excess compute to improve its core ads and recommendation systems. Management also said external parties have already asked to access Meta’s compute, which creates potential future optionality. However, the risk remains that if AI adoption stalls or the industry overbuilds capacity, Meta could be left with underutilized infrastructure and lower long-term returns on these massive investments.

3/ Talent Reset — Meta highlighted that it has the highest talent density in the industry during the recent earnings call. The company decision to reorganize its AI division and later trim headcount may appear messy, but reflects agility and a willingness to course-correct quickly when teams become bloated.

4/ Flexible Financing — Meta’s SPV structure with private credit manager Blue Owl lowers reported CapEx and debt while giving the company long-term flexibility to scale AI infrastructure quickly through an 80/20 ownership split. If AI demand and monetization unfold as expected, the setup acts as a capital-efficient way to fund capacity. However, if returns disappoint, Meta could still face billions in off-balance-sheet obligations that resemble traditional leverage and may pressure future cash flows.

5/ Utility of Legacy GPUs — Many older GPUs can still generate strong cash flow on lower-intensity inference workloads, which make up a large portion of global AI demand. This supports Meta’s view that these chips remain productive for years and help justify a longer depreciation schedule. That said, if workloads shift toward heavier training or new architectures make older GPUs economically obsolete sooner than expected, their useful life could shrink faster than assumed.

6/ Emerging Momentum in Reality Labs — Reality Labs revenue grew 74% in Q3, its fastest pace ever, driven largely by retailers stocking up on Quest headsets ahead of the holiday season. Meanwhile, Meta’s AI glasses continue to show strong early traction, with management noting they sold out within 48 hours. Meta is increasingly prioritizing AI-powered smart glasses, which appear to have a clearer path to mainstream adoption, while keeping Quest as a core part of its ecosystem.

7/ Resilient Business — Meta operates one of the strongest businesses ever created, with more than 3.5B daily users, high margins, strong capital efficiency, and a resilient balance sheet. The core business continues to grow, with revenue up 26%, daily actives up 8%, impressions up 14%, and price per ad up 10%. AI improvements across ranking, recommendations, content discovery, and advertising have proven to further strengthen Meta’s platforms. Mark Zuckerberg has also shown the ability to pivot, restructure, and reinvest effectively, with Meta demonstrating resilience through every major headwind since its IPO.

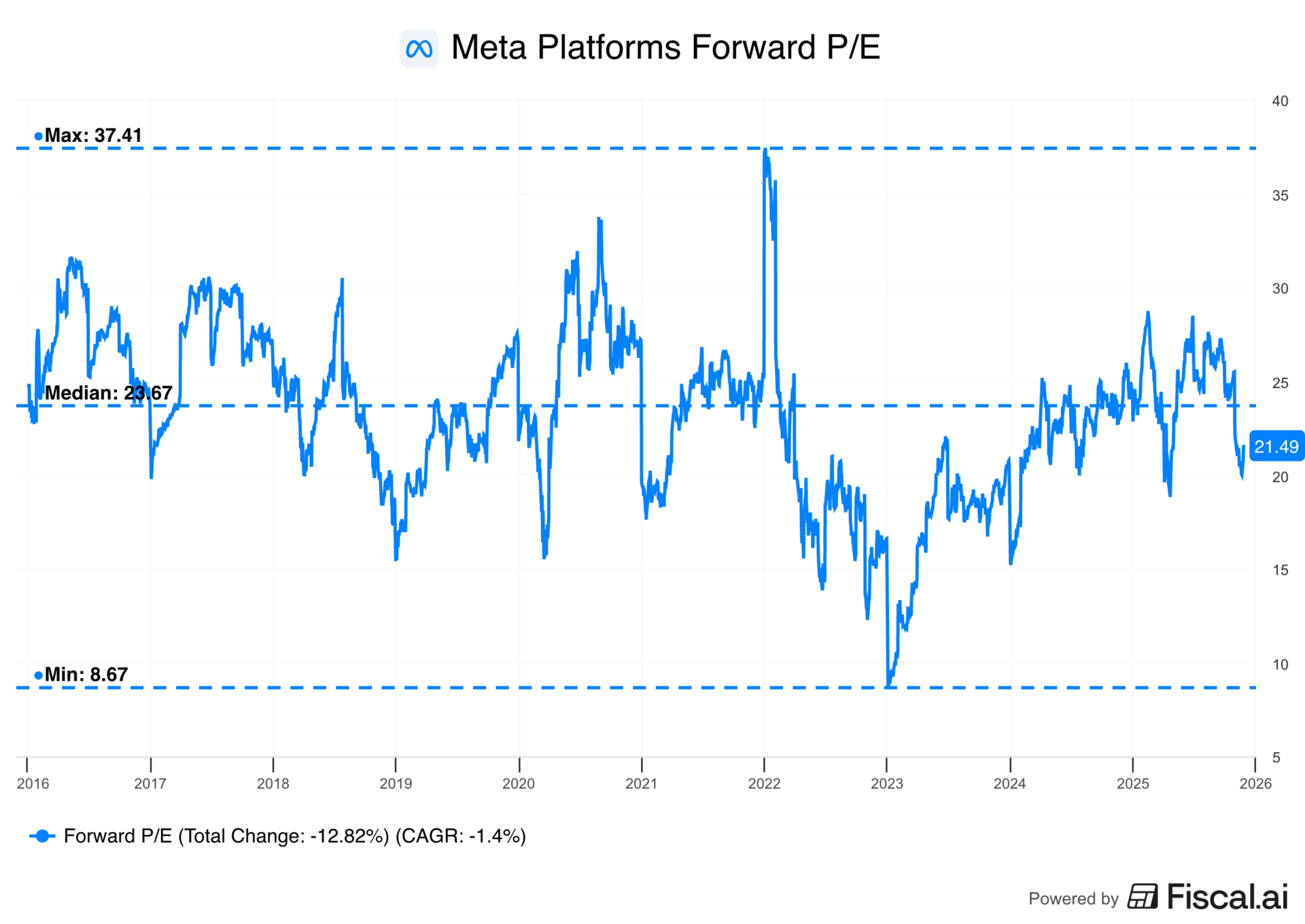

TLDR: Meta trades roughly in line with the market and its historical median, making it the least expensive name in the Mag 7. If AI demand holds up, Meta’s scale, ads engine, and infrastructure could create meaningful upside. If AI demand and performance disappoints, its heavy CapEx load and limited immediate monetization optionality relative to hyperscalers could pressure returns. The risk and reward are both elevated, and outcomes depend heavily on future AI performance and Meta’s ability to efficiently convert its spending into ROI.

My Take: Meta is attracting attention because it screens as the cheapest Mag 7 name, but I view the margin of safety as limited at today’s levels. The company has a history of deep drawdowns, and the path to monetizing its AI investment is less straightforward than peers. I would prefer to wait for a larger valuation cushion, especially since Meta has repeatedly traded at mid-teens forward earnings during periods of stress. If shares revisit those levels, I would be more interested in building a position. Until then, Meta remains one of the names I’ll track closest for a potential future entry.

Disclaimer

This content is for informational and educational purposes only and should not be construed as financial, investment, tax, legal, or other professional advice. It does not constitute a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. You are solely responsible for any investment decisions you make, and you should consult with a qualified financial advisor before making any investment or financial decisions.

The author may hold, or may in the future acquire, sell, or otherwise change positions, long or short, in any of the securities, investments, or financial instruments mentioned in this content, without notice or obligation to update this information. Any such holdings or transactions should not be construed as an endorsement of any security or strategy.

The author and publisher make no representations or warranties, express or implied, as to the accuracy, completeness, or timeliness of the information provided, and assume no liability for any losses or damages of any kind arising from or related to the use of this content. Past performance is not indicative of future results. This report contains forward-looking statements that reflect current expectations and are subject to risks and uncertainties that may cause actual results to differ. All investments carry risk, including the potential loss of principal.

This content is intended for a general audience and may not be lawful or appropriate in certain jurisdictions. Readers are responsible for ensuring compliance with all applicable laws and regulations in their country or region.

This report was optimized using AI for clarity, structure, and conciseness. AI tools also assisted in research organization, idea generation, and analytical stress testing. All analysis, conclusions, and opinions remain the author’s own.

Reply