- Carbon Finance

- Posts

- 💡 5 Investment Ideas (October 2025)

💡 5 Investment Ideas (October 2025)

5 Investment Ideas - October 2025

Welcome to the October edition of Investment Ideas.

Each month, I spotlight a select mix of businesses I am following closely.

This edition highlights companies navigating turnarounds or near-term challenges, alongside durable operators that appear fairly valued but underappreciated.

As a reminder, this report is concise by design.

It does not capture every risk in full but highlights the key dynamics shaping each business and why they merit close attention.

Let’s dive in.

Note: This report is for informational purposes only and is not investment advice. Please see the full disclaimer at the end. As of the date of publication, I hold a position in $KVUE and $PZZA.

5/ Papa John’s International

Ticker: $PZZA

Market Cap: $1.7B

Papa John’s, founded in 1984 and based in Kentucky, operates and franchises pizza delivery and carryout restaurants across more than 50 countries.

The company manages a mix of company-owned and franchised stores under its core brand, supported by regional commissaries that supply dough and ingredients to franchisees.

Key Metrics:

5Y Revenue CAGR: 4.3%

5Y Diluted EPS CAGR: 42.9%

Operating Margin: 8.2%

5Y ROIC: 18.8%

Total Cash & Short Term Investments: $33.5M

Net Debt: $933.9M

Outlook (Estimates):

Forward 2Y Revenue CAGR: 1.7%

Forward 2Y EPS CAGR: -2.8%

Long Term EPS Growth: 6.6%

Recent Developments & Key Headwinds:

1/ Acquisition Rumors — Reuters reported that Apollo Global Management submitted a new bid to take Papa John’s private at $64 per share just a few weeks ago, up from a prior joint offer with Qatari-backed Irth Capital Management at $60 per share in June. Multiple activist investors have also reportedly shown interest in the company, which could lead to strategic changes or additional takeover interest.

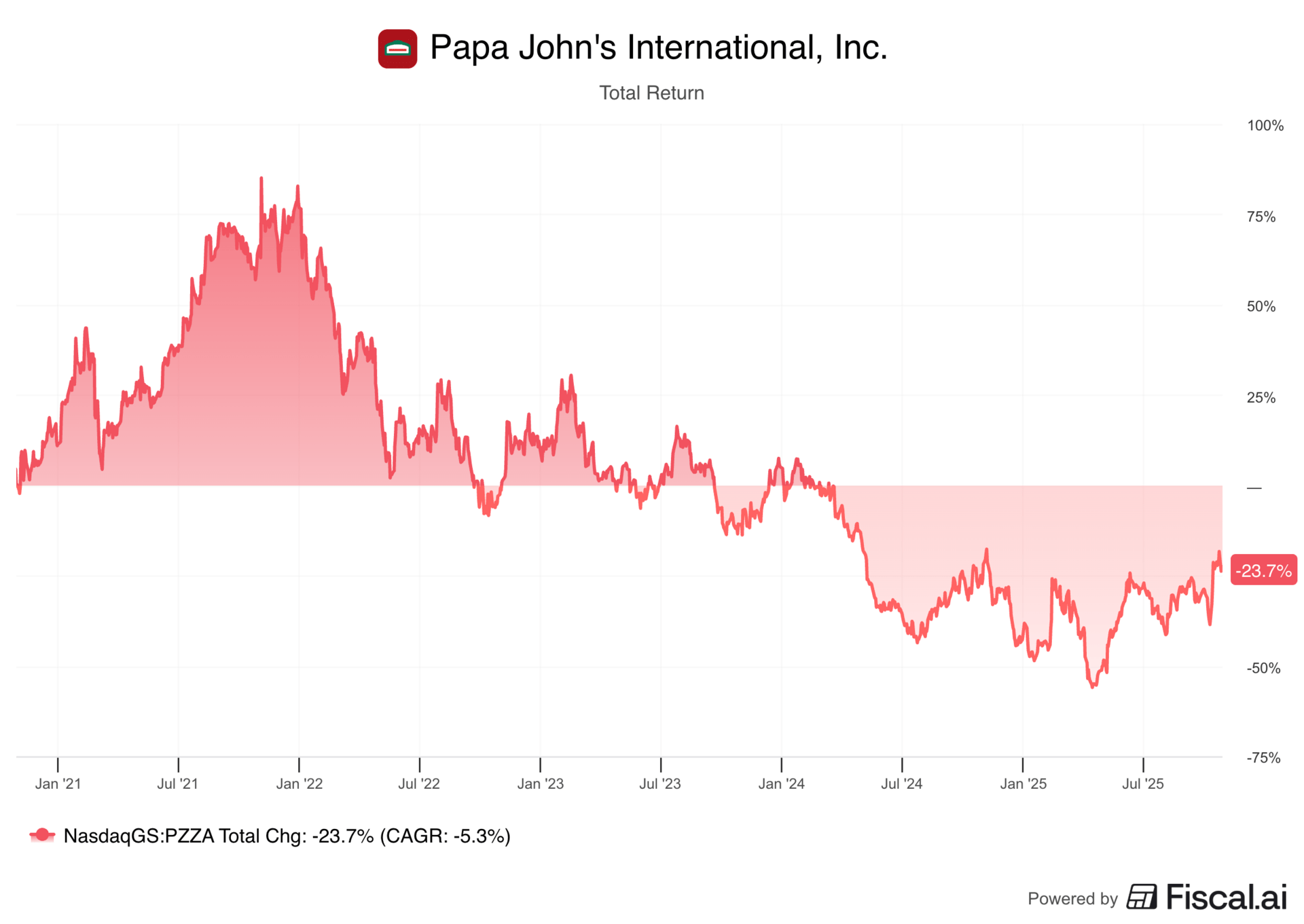

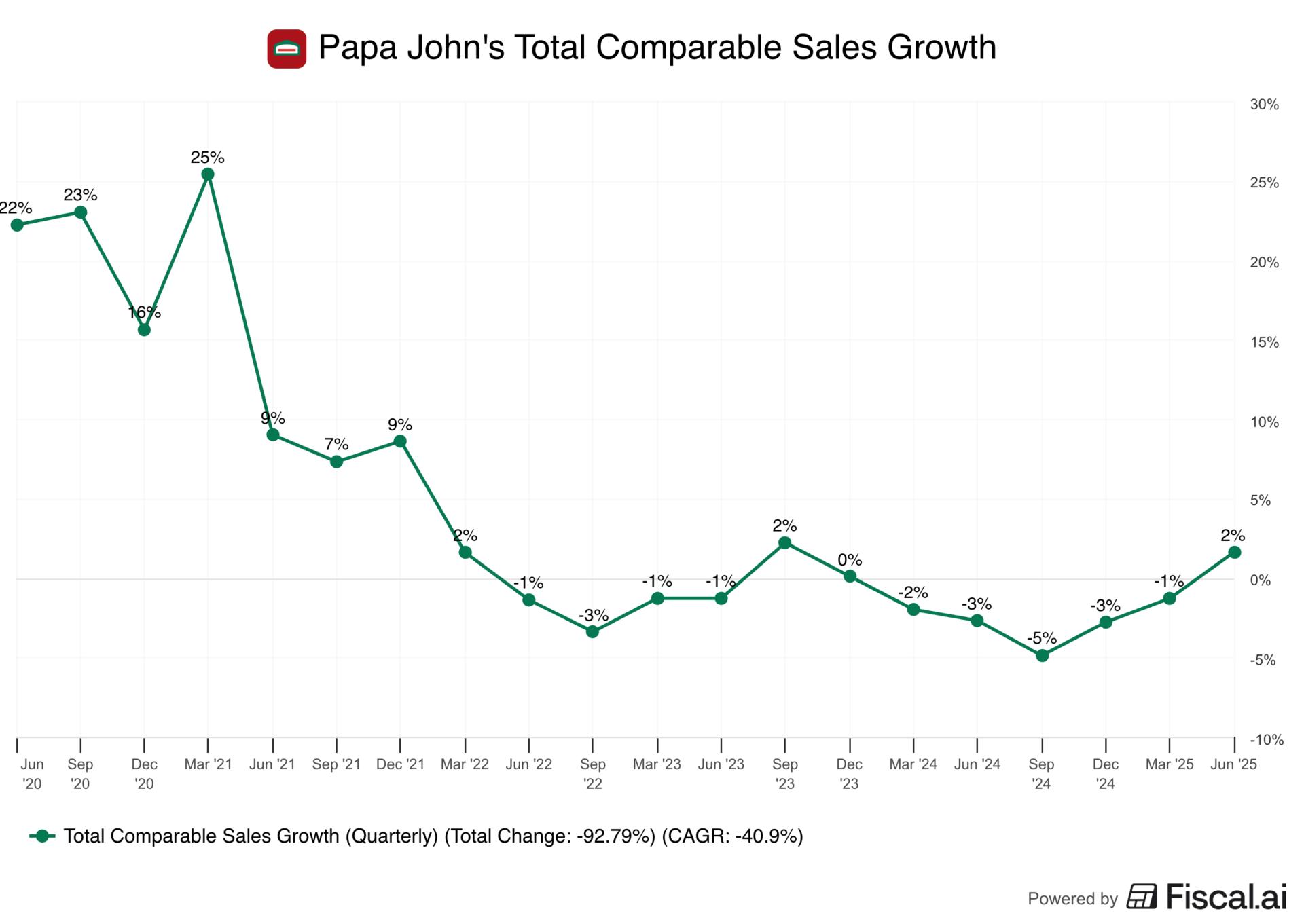

2/ Prolonged Sales Weakness — After strong growth during the pandemic, comparable-store sales have since declined in nine of the last twelve quarters, with one flat and only two showing growth. The company’s complex menu, inconsistent pricing, and lack of value positioning have hurt demand amid inflationary pressures, while competitors like Domino’s continue to maintain steady sales growth due to greater scale and operational efficiency.

3/ Leadership Turnover and Brand Legacy Issues — Founder John Schnatter’s 2018 controversy, which included racially insensitive remarks and public disputes with the board, damaged brand perception. The incident initiated a series of executive turnovers, with Todd Penegor taking over as CEO in August 2024 to lead stabilization efforts.

Why This Might Be An Opportunity:

1/ Buyout Upside — An Apollo-led buyout would represent roughly a 25% upside from the current stock price if completed. A higher bid could deliver even greater returns, while the entrance of a major activist could still drive operational changes and accelerate a turnaround if no deal materializes.

2/ Private Equity Appetite — Private equity firms have been active in acquiring and restructuring restaurant chains. These include Subway, Tropical Smoothie Cafe, Dave’s Hot Chicken, and Jersey Mike’s. Even large brands like Burger King were taken private in 2010 before later merging under RBI. Papa John’s could fit this pattern, with strong brand recognition and room for margin enhancement under private ownership.

3/ Operational Turnaround In Motion — Management has launched a five-priority plan focused on product quality, pricing balance, marketing, technology, and supply chain efficiency. In the most recent quarter, North America returned to 1% positive comparable sales and international markets rose 4%. Additionally, since late 2014, 2.7M new members have joined the loyalty program. Planned supply chain optimizations are expected to lift margins by at least 1 percentage point by 2028, laying groundwork for improved profitability.

TLDR: Papa John’s remains a turnaround story with ongoing sales and operational challenges. While longer-term fundamentals could improve over time, renewed private equity interest and activist pressure have created a near-term, event-driven setup for investors seeking buyout-style opportunities.

4/ Watches of Switzerland Group

Ticker: $WOSGF

Market Cap: $1.2B

Watches of Switzerland, founded in 1924 and based in the United Kingdom, is a leading luxury watch and jewelry retailer operating across the U.K. and the U.S.

The company runs nearly 200 showrooms in the U.K. and U.S., and is known for its close partnerships with Rolex, Patek Philippe, and Audemars Piguet.

This idea was brought to my attention by my friend Compounding Quality. I definitely recommend you check out his work!

Key Metrics:

5Y Revenue CAGR: 15.3%

5Y Diluted EPS CAGR: 157.6%

Operating Margin: 10.3%

5Y ROIC: 14.0%

Total Cash & Short Term Investments: $133M

Net Debt: $737M

Outlook (Estimates):

Forward 2Y Revenue CAGR: 5.1%

Forward 2Y EPS CAGR: 2.8%

Long Term EPS Growth: 4.2%

Recent Developments & Key Headwinds:

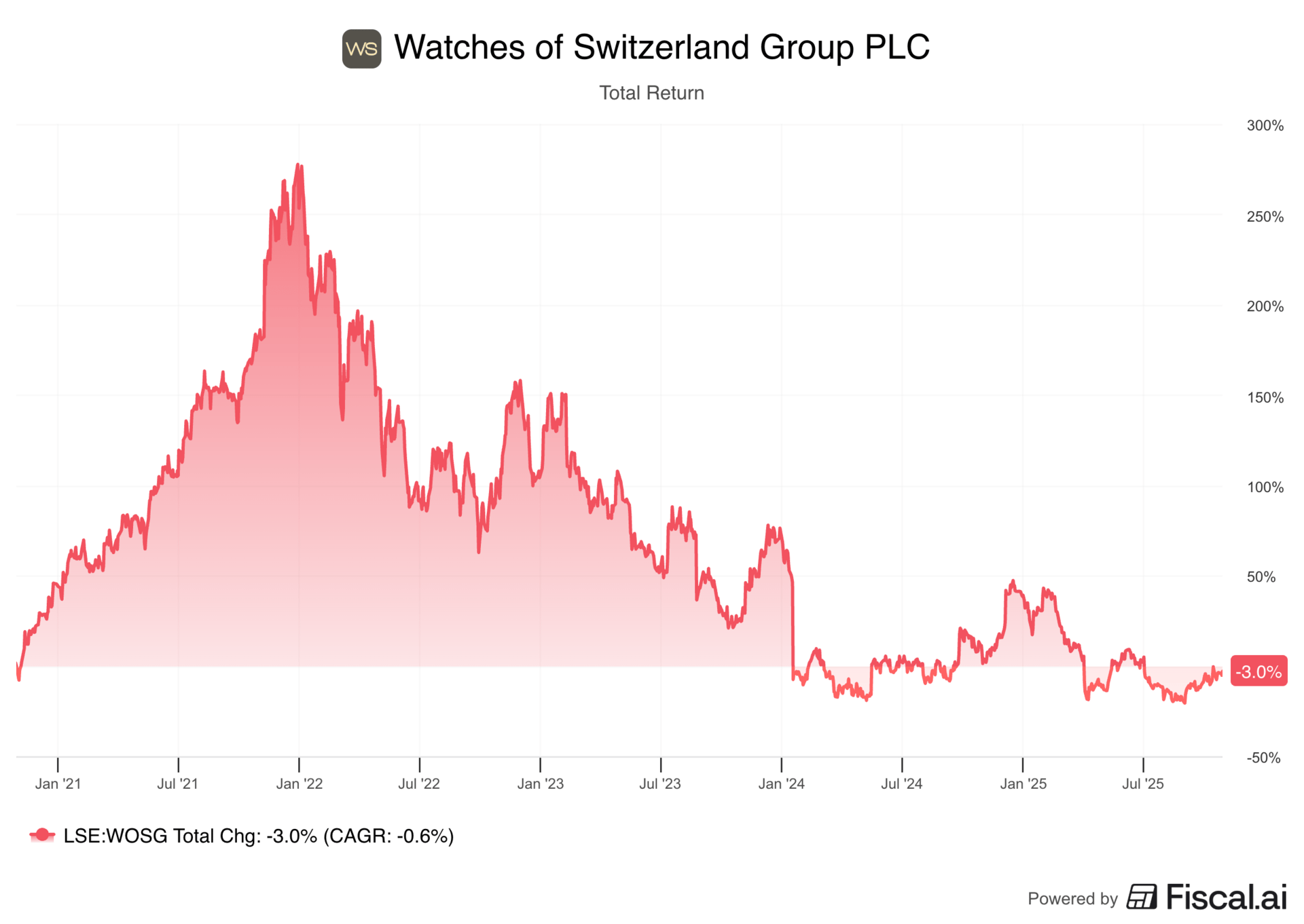

1/ Post Pandemic Slowdown — The luxury market surged during the pandemic but cooled sharply as inflation rose and interest rates reached decade highs in the U.S. and U.K. Consumer spending has since tightened, pressuring discretionary categories such as watches and jewelry. The U.S. market has held up better, while the U.K. continues to experience softer demand.

2/ Rolex’s Acquisition of Bucherer — Rolex’s 2023 acquisition of retailer Bucherer raised concerns that the watchmaker could move toward vertical integration, potentially squeezing out partners like Watches of Switzerland and putting them in direct competition. Investors also worry Rolex may grant Bucherer preferential access to high-demand models, which could weaken Watches of Switzerland’s product allocation, overall appeal to collectors, and distribution exclusivity.

3/ Macroeconomic Pressure — The U.S. imposed a 10% baseline tariff on imported Swiss goods in April 2025 and raised it to 39% in August. Watches of Switzerland had guided assuming a 10% rate would persist, meaning the higher tariff introduces additional margin pressure and potential guidance risk if extended. The company currently expects its fiscal 2026 EBIT margin to decline by up to 100 basis points from 9.1% in fiscal 2025, reflecting the near-term impact. Tariffs are a continuing headwind for the broader Swiss watch industry and could impact the company if further hikes ensue or last longer than expected.

Why This Might Be An Opportunity:

1/ Sector Wide Reset — The luxury market’s weakness has been broad, with names like LVMH and Kering also seeing slower demand. However, in a September trading update, Watches of Switzerland recently noted that the U.K. market has stabilized near pre-COVID growth trends, while U.S. performance remains resilient.

2/ Exposure To The Highest-End Consumer — Luxury watch buyers tend to be more insulated from macro headwinds, with average purchase prices often exceeding $10,000. This positions Watches of Switzerland within a more resilient segment of the luxury market. The group continues to invest and expand flagship locations, including a Rolex boutique on Old Bond Street, London, a Patek Philippe salon in Greenwich, Connecticut, and an Audemars Piguet House in Manchester, reinforcing brand positioning and customer experience.

3/ Guidance Maintained — Despite the tariff escalation, Watches of Switzerland recently reiterated its fiscal 2026 guidance for 6%–10% constant-currency revenue growth, signaling confidence in near-term performance. The company doesn’t expect a material impact from tariffs in the first half of fiscal 2026, supported by inventory front-loading and strong brand relationships. Moreover, tariff discussions and recent trade frameworks offer potential for policy relief, leaving room for a more constructive medium-term outlook.

4/ Partnership Stability With Rolex — Watches of Switzerland has maintained a century-long partnership with Rolex, dating back to 1919. Following the Bucherer acquisition, Rolex emphasized that Bucherer would operate independently and that its broader retail partnerships remain unchanged. The decision was reportedly driven by succession planning rather than competitive strategy, suggesting continuity rather than disruption in Rolex’s retail relationships.

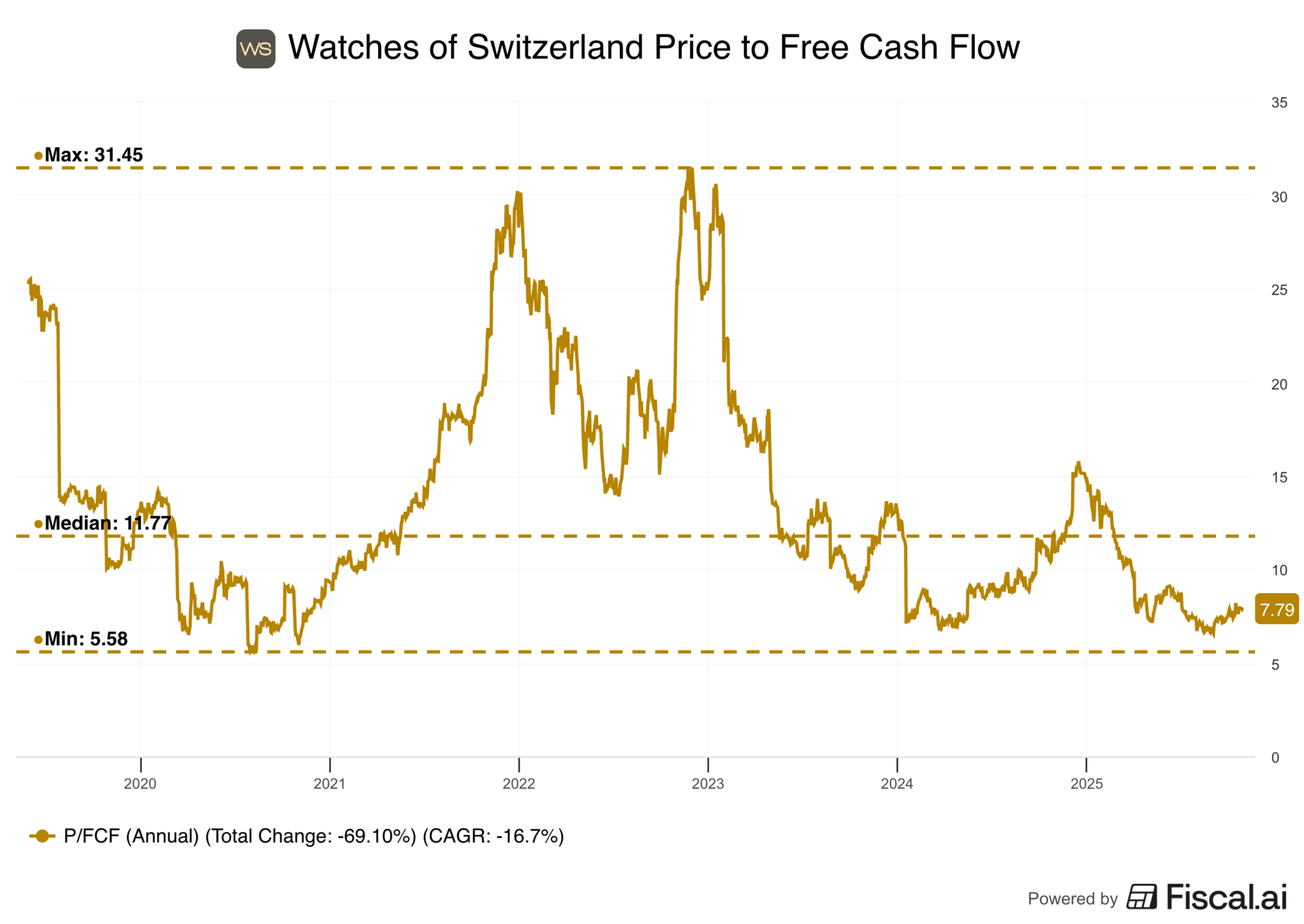

TLDR: Watches of Switzerland serves as a pure-play proxy for Rolex and the broader luxury watch market. Despite tariff pressures and softer demand, the company reaffirmed guidance and continues to expand its flagship network. With shares down sharply and trading at just 8x TTM free cash flow, valuation looks undemanding for investors seeking exposure to a resilient, brand-backed segment of the luxury space.

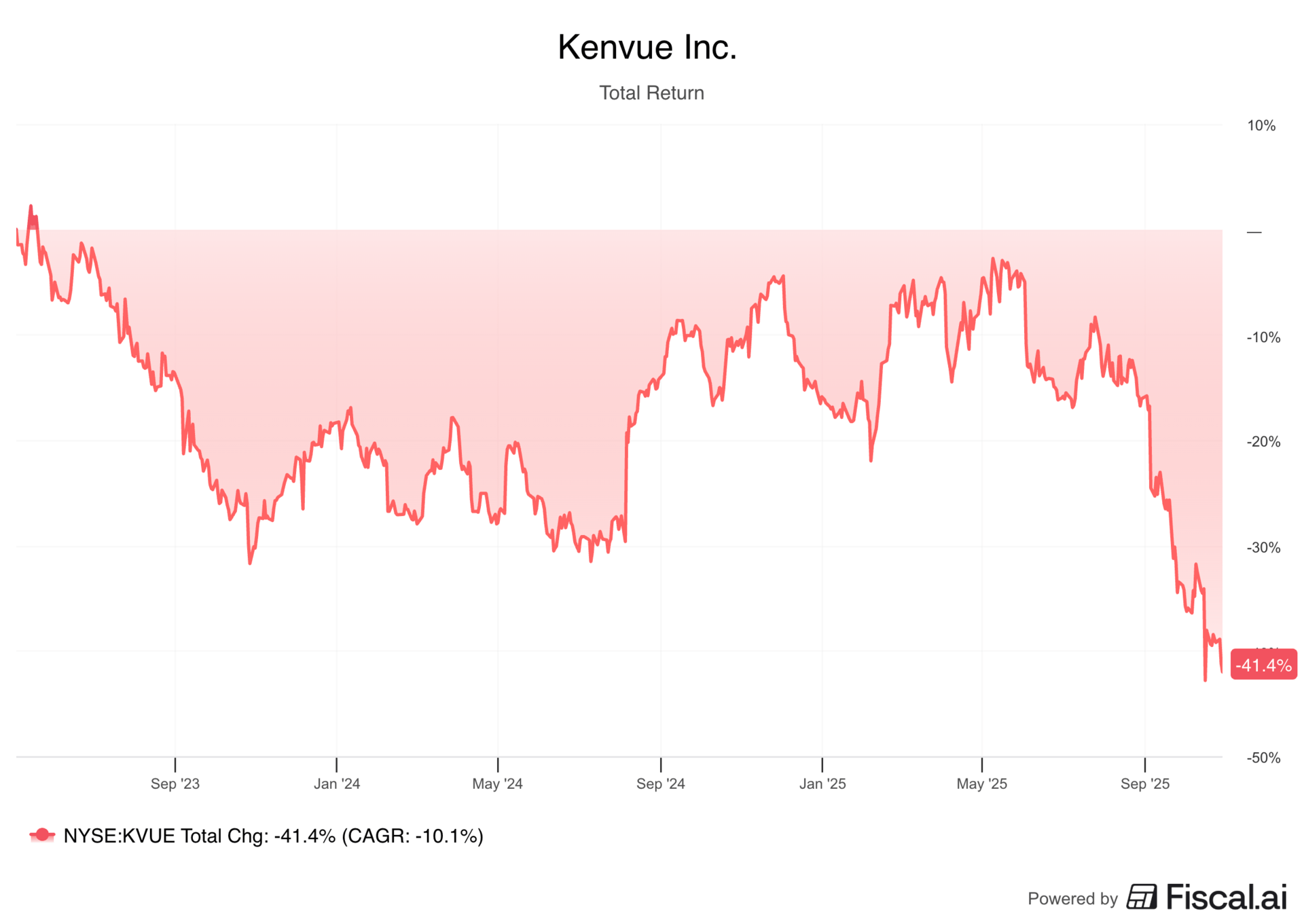

3/ Kenvue

Ticker: $KVUE

Market Cap: $27B

Kenvue, founded in 2022 and based in New Jersey, is a global consumer health company built around some of the world’s most recognizable brands.

Its portfolio spans Tylenol, Zyrtec, Nicorette, Listerine, Neutrogena, Aveeno, Band-Aid, and Johnson’s Baby. These products dominate shelves across self-care, skin health, and essential health categories.

The company was spun off from Johnson & Johnson in 2023 to give each business greater strategic focus and to isolate potential legal liabilities tied to J&J’s consumer health products.

Key Metrics:

3Y Revenue CAGR: 0.9%

3Y Diluted EPS CAGR: -23.7%

Operating Margin: 19.4%

3Y ROIC: N/A

Total Cash & Short Term Investments: $1.07B

Net Debt: $7.67B

Outlook (Estimates):

Forward 2Y Revenue CAGR: 0.4%

Forward 2Y EPS CAGR: -1.3%

Long Term EPS Growth: 13.7%

Recent Developments & Key Headwinds:

1/ Tylenol-Autism Controversy — Statements from the Trump administration linked acetaminophen (Tylenol’s active ingredient) use during pregnancy to potential autism risk. The FDA is initiating the process to add warning labels, which could weigh on sales and brand perception. Any further regulatory changes or negative headlines could further pressure the stock due to reputational risk.

2/ Baby Powder Litigation — Kenvue allegedly faces over 3,000 claimants seeking $1.3B in damages in the U.K. alleging Johnson’s Baby Powder contained asbestos and caused cancer. Even if the claims prove unfounded, the headlines create additional public scrutiny and investor uncertainty around legacy J&J risks.

3/ Texas Deceptive Marketing Lawsuit — The state of Texas filed a lawsuit against Kenvue, alleging they deceptively marketed Tylenol by failing to disclose a supposed link to autism. The complaint seeks civil penalties of $10,000 per violation across 11 alleged violations, and calls for warning labels about autism risk.

4/ Leadership and Operational Struggles — Kenvue’s CEO was removed in July 2025 as weak sales and underperforming brands weighed on results. Sales declined 4% in each of the two most recent quarters, as the company admitted to having too many overlapping products across markets and facing heightened competition from private-label brands. Kenvue acknowledged “self-induced complexity” and suboptimal go-to-market execution during the Q2 earnings call.

Why This Might Be An Opportunity:

1/ Tylenol Risk Overstated — Tylenol accounts for about 10% of annual sales, and estimates suggest purchases by pregnant women represent less than 0.5% of Kenvue’s sales. Recent retail data shows Tylenol holding up better than Advil and Aleve, suggesting limited short-term consumer reaction. A Numerator survey conducted in October 2025 found that 93% of acetaminophen buyers plan to continue purchasing, and 91% of expecting parents consider the medication safe when taken as directed, reinforcing stable consumer trust in the brand.

In the FDA’s official announcement, it stated that “it remains reasonable for pregnant women to use acetaminophen in certain scenarios,” found no causal relationship, and presented no new evidence. Additionally, a federal judge dismissed the largest federal lawsuit on the matter in 2023 due to a lack of reliable scientific evidence. The Texas lawsuit has limited financial exposure and likely to be dismissed in a similar fashion. If the FDA ultimately decides against a label change, shares could re-rate higher, while any market overreaction to an approval could create a more attractive entry point if consumer demand remains stable.

Most recently, U.S. Health and Human Services Secretary RFK Jr. acknowledged that current evidence remains inconclusive, describing the link as suggestive but not definitive.

2/ Strong Legal Position — Kenvue reported fewer than 2,000 active claimants (below the 3,000 figure reported by media outlets) and expects to prevail in the U.K. trial. The company cites decades of independent studies confirming its talc meets regulatory standards and does not contain asbestos. U.K. courts also tend to award lower damages than U.S. cases, reducing downside exposure.

3/ Portfolio Streamlining Underway — The board has launched a full strategic review to optimize the brand portfolio, which may include potential divestitures of underperforming brands. The company also indicated it would aim to concentrate on fewer, bigger, and better innovation initiatives. The new interim CEO Kirk Perry has decades of experience at Circana, Google, and Procter & Gamble and brings extensive CPG and transformation experience.

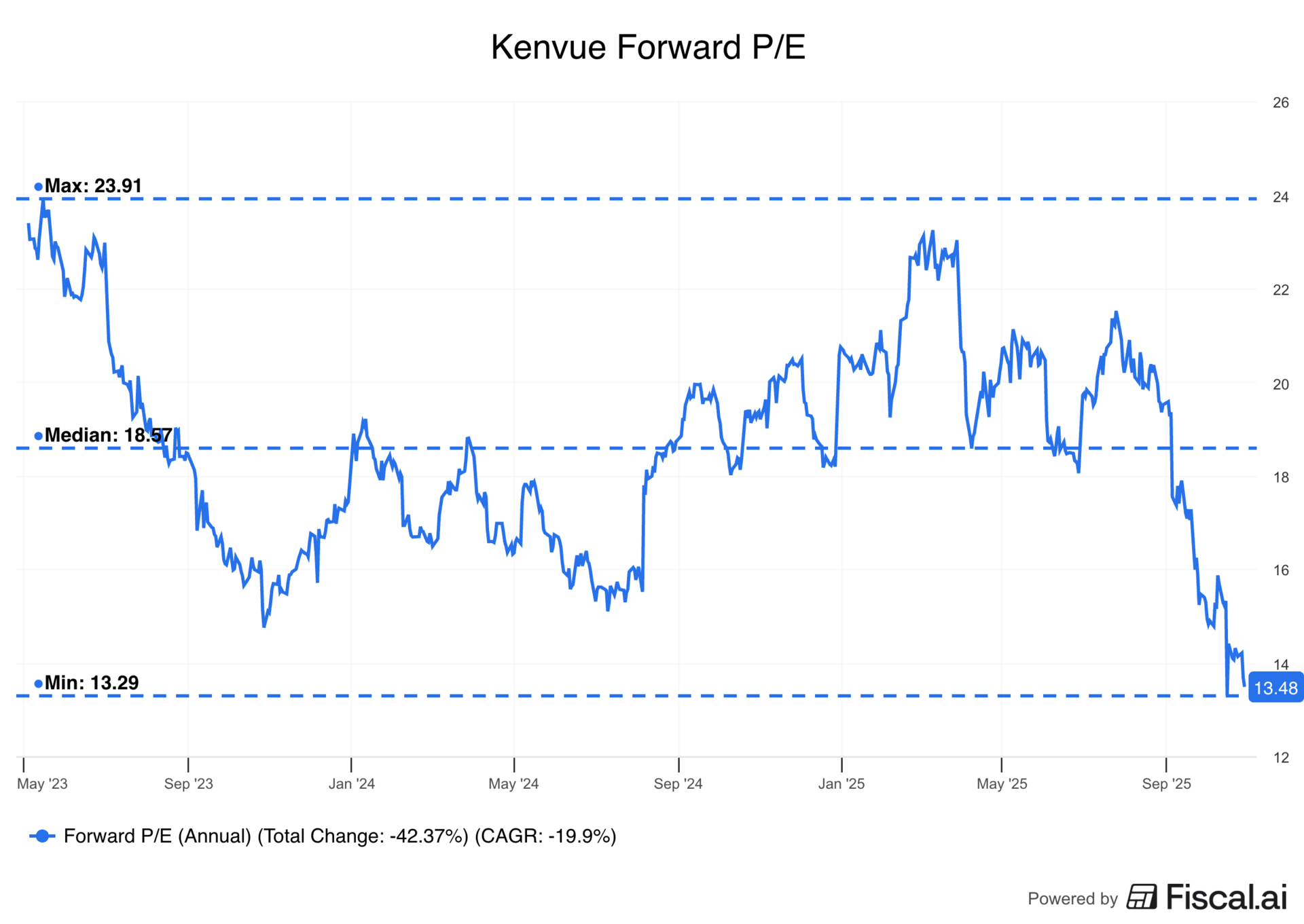

4/ Attractive Valuation & Dividend — Kenvue trades at 14x forward earnings, cheaper than peers like P&G (21x), Colgate-Palmolive (21x), Haleon (18x). It also offers a 5.80% dividend yield, recently raised, providing investors with stable income and defensive exposure.

TLDR: Kenvue offers a portfolio of trusted, recession-resistant consumer health brands that generate steady cash flow. Tylenol-related risks appear overstated given minimal exposure tied to pregnant consumers and continued scientific support. With a strong dividend, defensive profile, and multiple potential catalysts including stabilizing sales, favorable FDA outcomes, and legal resolutions, the stock could re-rate higher as sentiment improves.

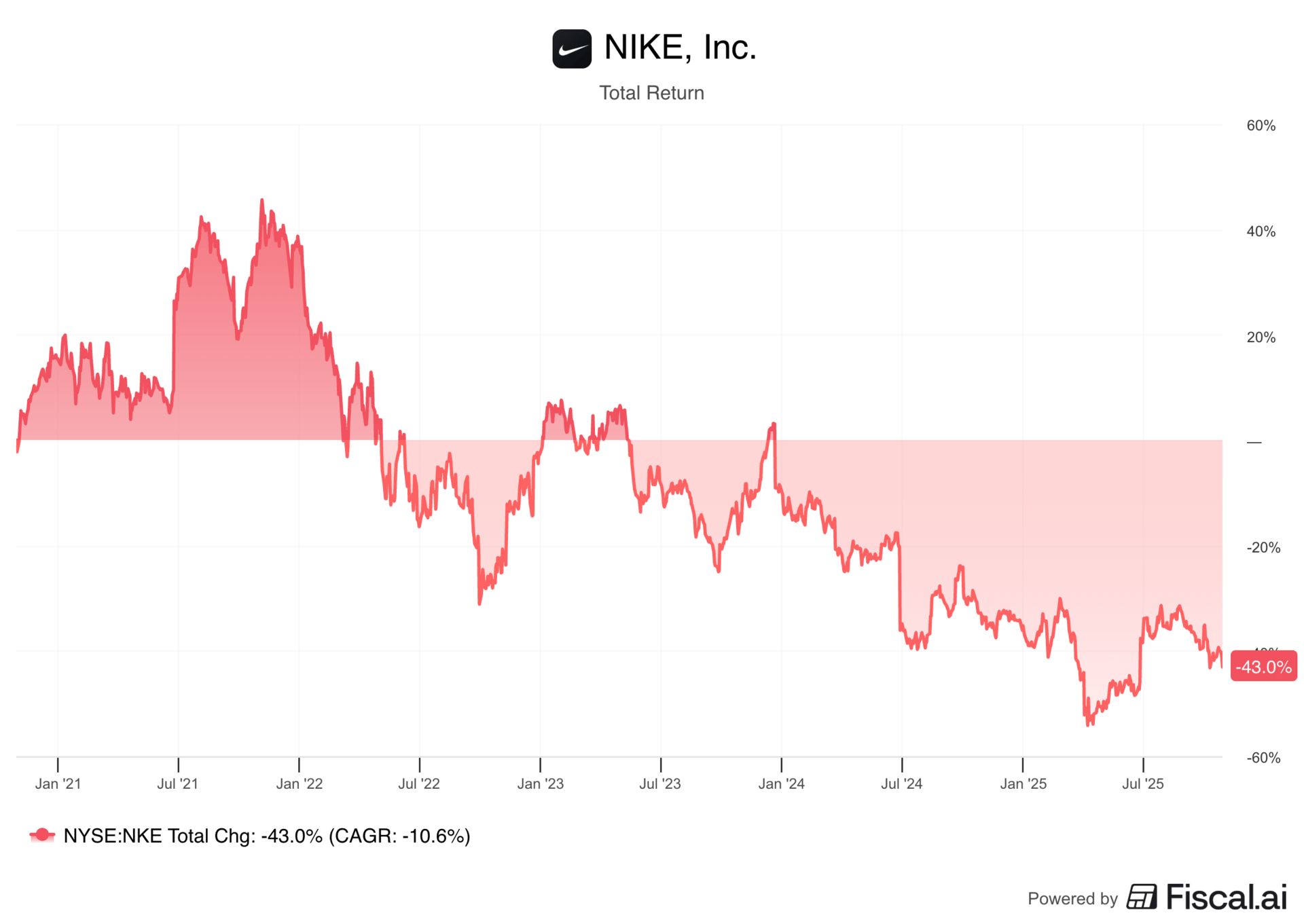

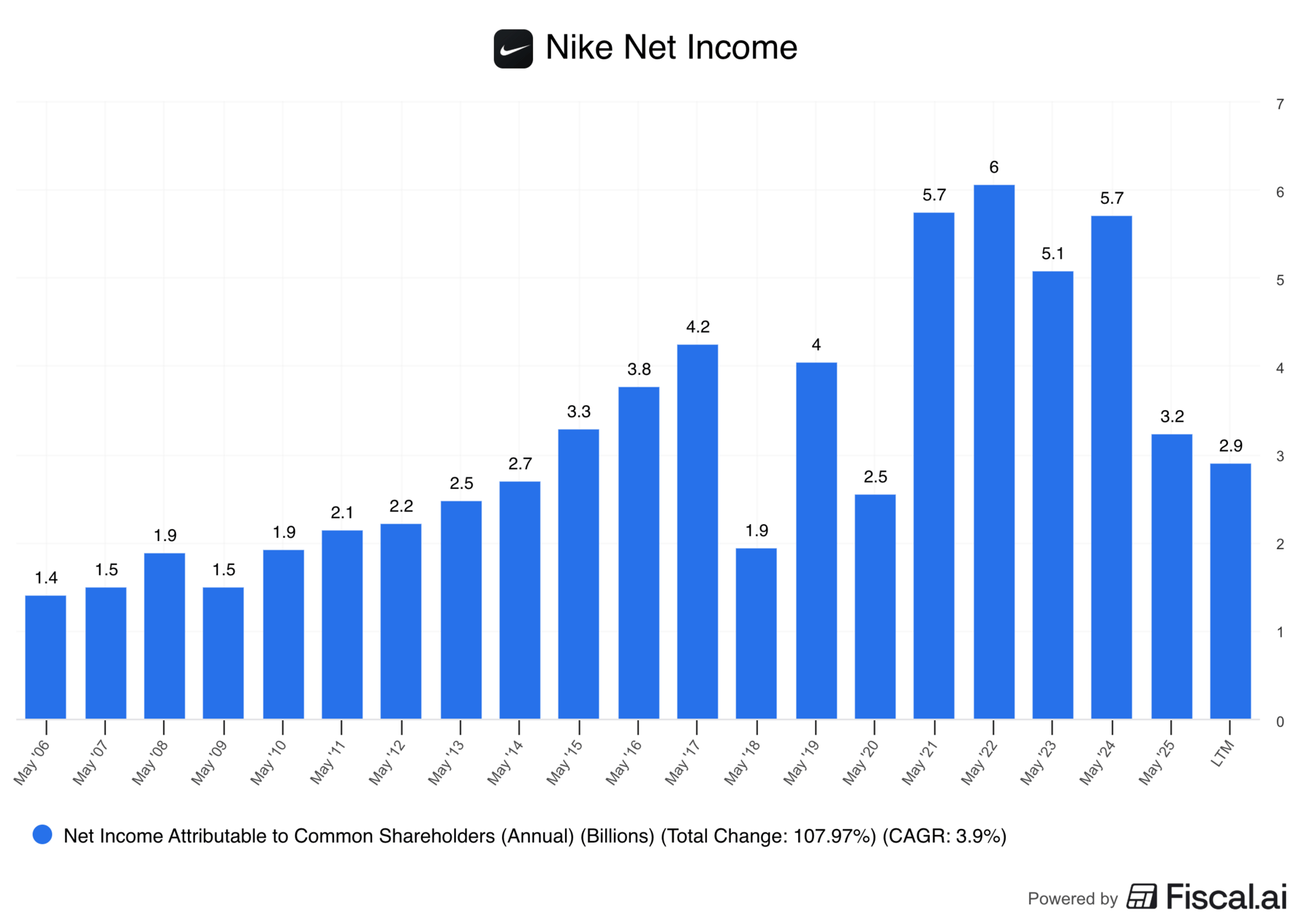

2/ Nike

Ticker: $NKE

Market Cap: $100B

Nike, founded in 1964 and based in Oregon, is the world’s largest athletic footwear and apparel company.

Its portfolio includes Nike, Jordan, and Converse, covering performance gear, lifestyle sneakers, and sports accessories sold through global retail partners and direct-to-consumer channels.

Key Metrics:

5Y Revenue CAGR: 4.5%

5Y Diluted EPS CAGR: 2.9%

Operating Margin: 7.4%

5Y ROIC: 25.3%

Total Cash & Short Term Investments: $8.58B

Net Debt: $2.49B

Outlook (Estimates):

Forward 2Y Revenue CAGR: 3.1%

Forward 2Y EPS CAGR: 7.4%

Long Term EPS Growth: 18.5%

Recent Developments & Key Headwinds:

1/ Poorly Executed DTC Strategy — Under former CEO John Donahoe, Nike prioritized direct sales to improve margins and strengthen consumer relationships. The company pulled back from major retail partners, which reduced visibility and allowed competitors to capture shelf space. As physical retail rebounded post-pandemic, Nike continued to focus on DTC, which ultimately hurt wholesale relationships and contributed to slower sales growth.

2/ Rising Competition and Slower Innovation — Brands such as On and Deckers’ Hoka have gained share with performance-driven running shoes, while Lululemon, Alo, and Vuori have taken momentum in athleisure. Even long-time rival Adidas has seen renewed popularity. Nike’s slower product refresh cycle and perceived lack of innovation have contributed to softer demand and brand fatigue.

3/ Supply Chain Imbalance and Tariff Costs — Nike has faced persistent inventory challenges since the pandemic, leading to heavy discounting and weaker margins. The company remains heavily reliant on Vietnam and China for manufacturing, exposing it to tariffs estimated at roughly $1.5B annually, and a 120 basis point headwind to fiscal 2026 gross margin, as per the latest earnings call.

4/ Ongoing Weakness in Greater China — China, which accounts for about 14% of trailing twelve-month revenue, continues to underperform with sales well below 2021 levels. In the most recent quarter, sales fell 9% YoY. The brand has struggled to maintain cultural relevance and reconnect with local consumers despite recovery in other markets.

1/ Leadership Transition and Cultural Reset — Longtime Nike executive Elliot Hill returned as CEO in 2024 after previously retiring, bringing over three decades of company experience and deep brand familiarity. Apple CEO Tim Cook, Nike’s longest-tenured board member, played a key role in persuading Hill to rejoin and lead the company’s turnaround.

2/ Organizational Overhaul and New Initiatives — Nike launched its “Win Now” and “Sport Offense” initiatives, restructuring around 8,000 employees to realign teams by sport such as running, basketball, and training. The goal is to sharpen consumer insights, accelerate innovation, and deepen category focus. Early signs show promise, with Nike Running growing 20% YoY in the most recent quarter, and wholesale revenue increasing 5% following renewed partnerships with retailers like Foot Locker.

3/ Product and Brand Revitalization — The company has rolled out new innovation-driven initiatives, including the All Conditions Racing Department, and a high-profile collaboration with Skims, which debuted 58 performance silhouettes to strong early demand. These efforts aim to refresh the brand’s image, reconnect with consumers, and reinforce Nike’s dominance in performance and lifestyle categories.

4/ Operational Improvements and Supply Chain Diversification — Nike is reducing forward supply to wholesale partners, shifting discounted products to factory stores instead of online channels to protect brand value. The company is also diversifying production, targeting high-single-digit U.S. footwear imports from China by the end of May 2026, down from roughly 16% today, while implementing selective pricing adjustments to restore margin strength.

5/ Sports Research Moat — Nike’s Sports Research Lab (NSRL) provides a competitive edge few can replicate. Leveraging decades of athlete data, motion tracking, and AI-driven performance models, the NSRL enables Nike to create proprietary, data-backed designs that competitors will likely struggle to match.

6/ Endorsements and Global Brand Power — Nike remains deeply embedded in global sports, sponsoring top athletes and teams across major leagues and tournaments. Recent highlights include wins by the England women’s national team, Jannik Sinner, Scottie Scheffler, and Chelsea FC, reinforcing the brand’s visibility and cultural dominance. The 2026 World Cup could serve as a key catalyst to further boost brand engagement and sales momentum.

TLDR: Nike’s turnaround is gaining traction with early signs of progress across strategy, product, and operations, and while structural and macro challenges persist, improving execution and renewed brand momentum could set the stage for recovery.

1/ Constellation Software

Ticker: $CNSWF

Market Cap: $57B

Constellation Software, founded in 1995 and based in Canada, acquires, builds, and operates vertical market software businesses that provide mission-critical solutions to public and private sector clients across North America and Europe.

These businesses develop specialized software tailored for specific industries, such as education, healthcare, utilities, real estate, transportation, and government, where products are deeply embedded in customers’ daily operations and face little direct competition.

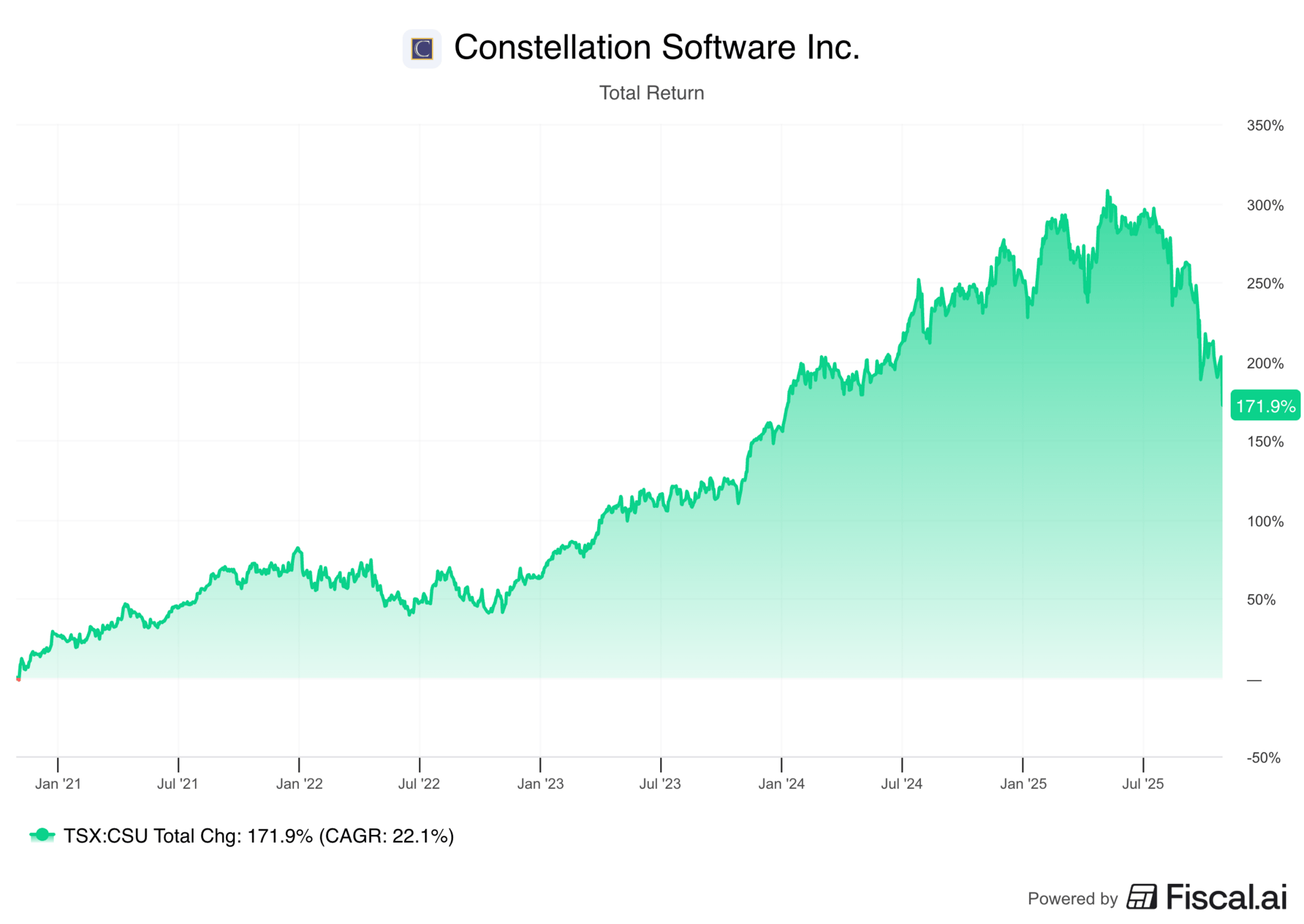

The company has delivered exceptional long-term performance, compounding at an annual rate of 33% since 2006, though shares are currently experiencing over a 30% drawdown from their highs.

Key Metrics:

5Y Revenue CAGR: 23.8%

5Y Diluted EPS CAGR: 13.6%

Operating Margin: 15.8%

5Y ROIC: 8.3%

Total Cash & Short Term Investments: $2.58B

Net Debt: $2.58B

Outlook (Estimates):

Forward 2Y Revenue CAGR: 16.9%

Forward 2Y EPS CAGR: 20.4%

Long Term EPS Growth: 18.7%

Recent Developments & Key Headwinds:

1/ Founder’s Departure — Founder and long-time CEO Mark Leonard stepped down in September 2025 due to health reasons. His exit raised concerns about the future direction of the company and whether Constellation can maintain its exceptional track record without its visionary leader.

2/ AI Disruption — The rapid rise of artificial intelligence has sparked investor fears that AI-native competitors could disrupt the vertical market software (VMS) sector and Constellation’s portfolio companies.

3/ Law of Large Numbers — As Constellation has grown into one of the largest acquirers in vertical market software, it faces the challenge of sustaining its historic pace of value creation. Finding acquisitions large enough to materially impact results will likely become more difficult, raising questions about whether future deals can deliver the same level of returns without expanding beyond its core focus.

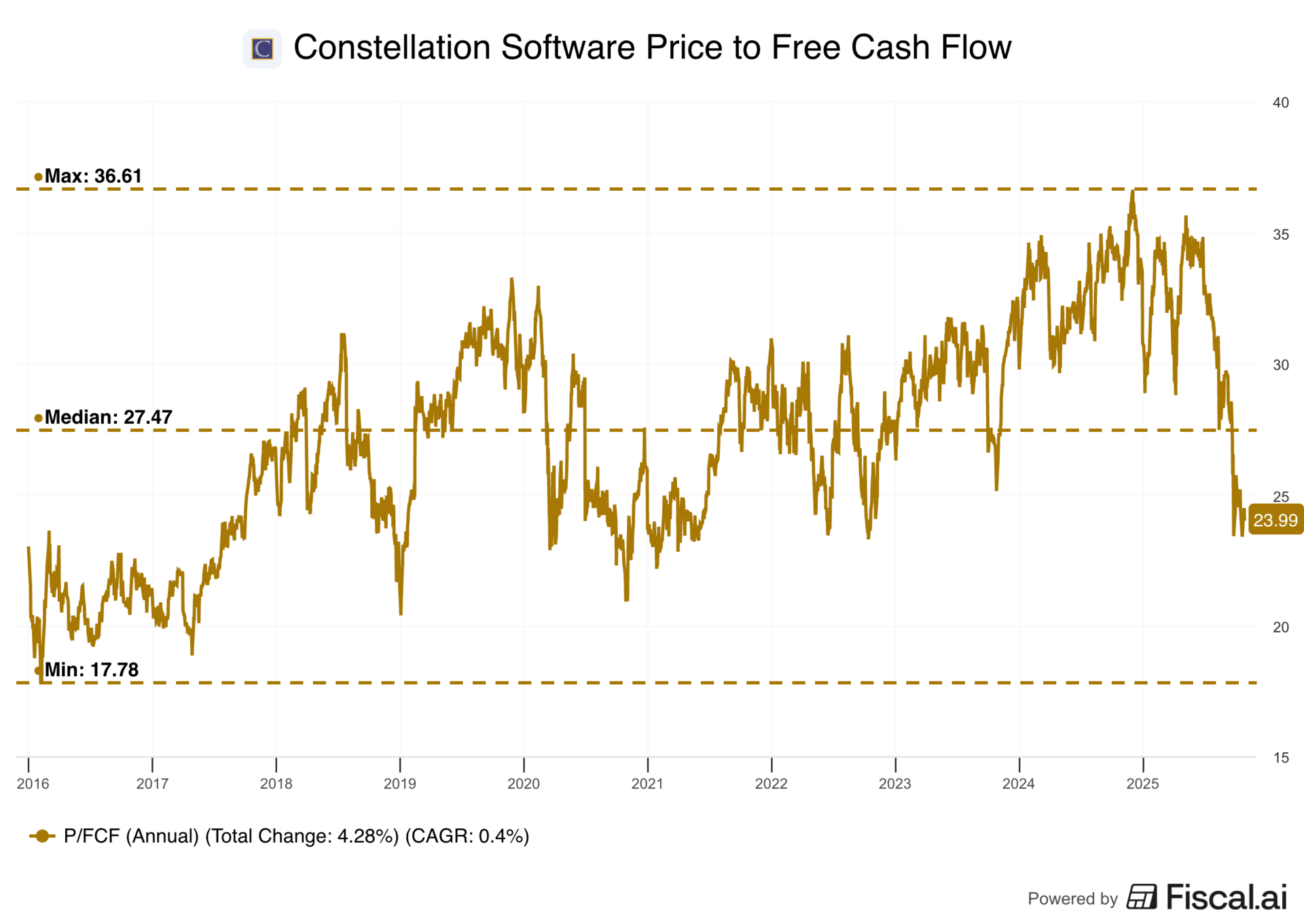

4/ Rich Valuation — The company’s long-term success and management quality have historically justified a premium valuation, with a median P/FCF of 27x over the past decade. Any signs of moderating growth or weaker sentiment could further pressure the valuation.

Why This Might Be An Opportunity:

1/ Leadership Continuity — Successor Mark Miller, a 30-year veteran who helped shape Constellation’s decentralized operating model, has emphasized continuity and discipline. The company’s structure allows operating groups and business units to run autonomously, minimizing disruption from leadership changes. Former CEO Mark Leonard will remain on the board, ensuring continued strategic oversight.

2/ AI Enablement — Constellation held a special investor call detailing its decentralized and pragmatic AI strategy. The company sees AI as a tool for augmentation, not replacement. It plans to use it to improve workflows, automate coding and testing, and enhance product quality. It has not changed M&A discipline or caused meaningful job cuts, and leadership believes AI will strengthen rather than disrupt its competitive moat.

3/ Proven Model & Sustained Compounding Power — Constellation’s acquisition engine remains unmatched. Over decades, it has integrated hundreds of VMS companies and maintained a disciplined capital allocation process. Free cash flow has grown at a 21% CAGR over the past decade and 29% over the last three years, demonstrating the model’s durability and scalability. While sustaining such growth at its current scale will be more difficult, Constellation’s decentralized model and disciplined deal selection provide a framework for continued compounding.

4/ Valuation Reset — After years of trading at premium levels, the company now trades around 24x TTM free cash flow, a discount to its long-term median. As billionaire investor Stephen Mandel once said, “I don’t need an analyst to tell me when a 10 PE stock is cheap. I need an analyst to tell me when a 40 PE stock is cheap.”

TLDR: Constellation Software’s 30% drawdown follows leadership change and AI-related uncertainty, but the company’s decentralized model, 30-year management continuity, and exceptional free cash flow growth highlight a business built for endurance. With shares now trading below their long-term free cash flow multiple, valuation looks far more reasonable for one of the market’s most proven compounders.

Disclaimer

This content is for informational and educational purposes only and should not be construed as financial, investment, tax, legal, or other professional advice. It does not constitute a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. You are solely responsible for any investment decisions you make, and you should consult with a qualified financial advisor before making any investment or financial decisions.

The author may hold, or may in the future acquire, sell, or otherwise change positions, long or short, in any of the securities, investments, or financial instruments mentioned in this content, without notice or obligation to update this information. Any such holdings or transactions should not be construed as an endorsement of any security or strategy.

The author and publisher make no representations or warranties, express or implied, as to the accuracy, completeness, or timeliness of the information provided, and assume no liability for any losses or damages of any kind arising from or related to the use of this content. Past performance is not indicative of future results. This report contains forward-looking statements that reflect current expectations and are subject to risks and uncertainties that may cause actual results to differ. All investments carry risk, including the potential loss of principal.

This content is intended for a general audience and may not be lawful or appropriate in certain jurisdictions. Readers are responsible for ensuring compliance with all applicable laws and regulations in their country or region.

This report was optimized using AI for clarity, structure, and conciseness. AI tools also assisted in research organization, idea generation, and analytical stress testing. All analysis, conclusions, and opinions remain the author’s own.

Reply