- Carbon Finance

- Posts

- 💡 5 Investment Ideas (September 2025)

💡 5 Investment Ideas (September 2025)

5 Investment Ideas - September 2025

Welcome to the second edition of Investment Ideas.

Each month, I spotlight a select mix of quality businesses worth keeping on your radar.

Some are facing short-term challenges, external pressures, or perceived disruption that may be overstated.

Others are executing well and may continue compounding steadily.

A few names look close to attractive valuation ranges, some already trade at appealing levels, and others may appear pricey today but could prove cheap if growth persists.

This report is designed to be concise and does not capture every risk in full.

Instead, it highlights the key dynamics shaping each business and why they merit close attention.

Let’s dive in.

Note: This report is for informational purposes only and is not investment advice. Please see the full disclaimer at the end. As of the date of publication, the only positions held among the companies discussed are in $NBIS and $PYPL.

5/ PepsiCo

Ticker: $PEP

Market Cap: $193B

PepsiCo, founded in 1898 and based in New York, is a global food and beverage company best known for its iconic soda brands and snack portfolio.

It generates revenue across seven segments, led by Frito-Lay North America, PepsiCo Beverages North America, and Quaker Foods North America, alongside international operations spanning Latin America, Europe, Africa, and Asia-Pacific.

The company’s portfolio includes Lay’s, Doritos, Cheetos, Quaker, Mountain Dew, Gatorade, Tropicana, and Pepsi, reaching consumers worldwide through wholesale distributors, retailers, foodservice, and e-commerce.

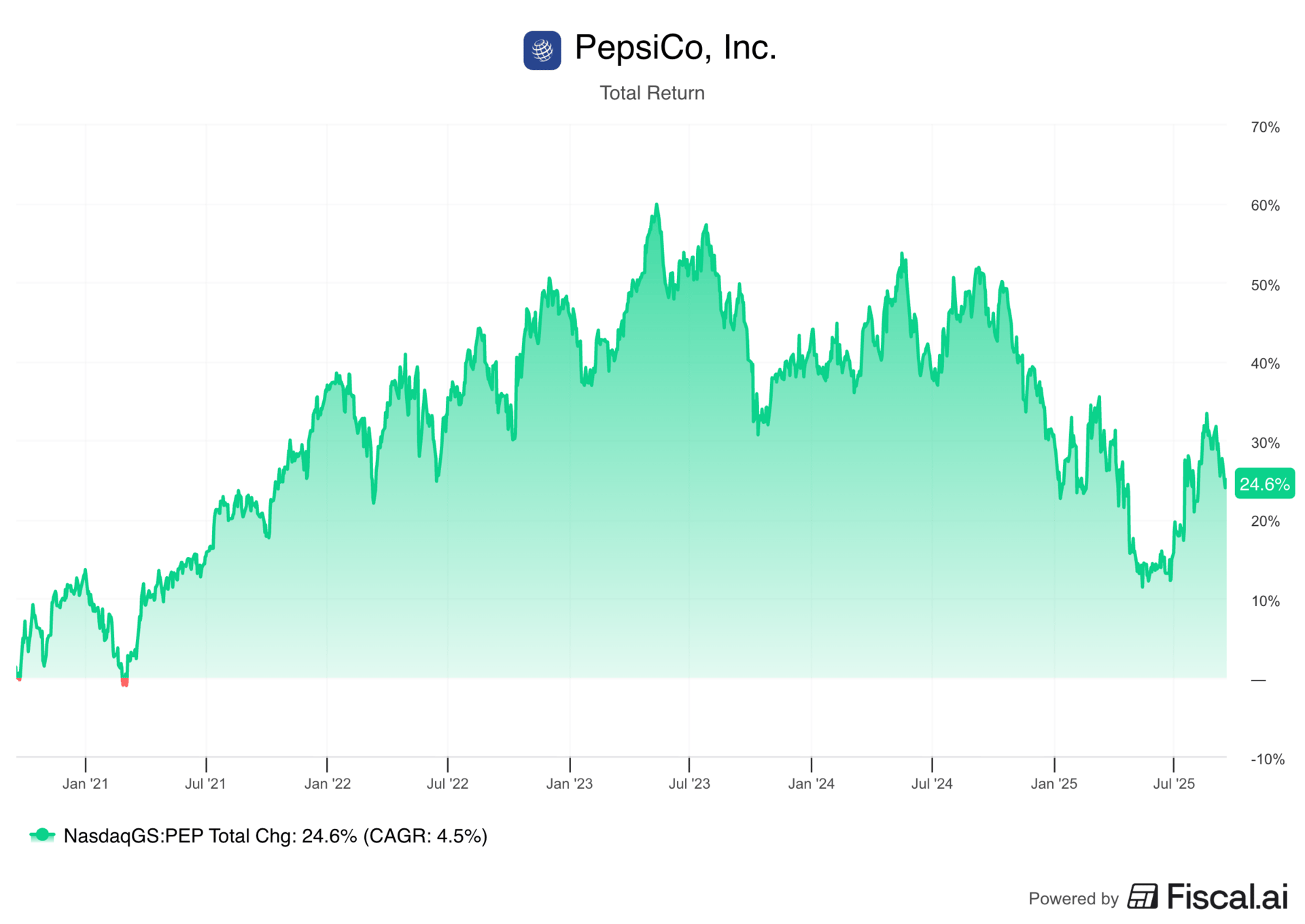

Over the last five years, PepsiCo has delivered a total return of just 25%, significantly trailing Coca-Cola’s 53% and underperforming the broader market.

Key Metrics:

5Y Revenue CAGR: 6.3%

5Y Diluted EPS CAGR: 2.3%

Operating Margin: 15.2%

5Y ROIC: 13.4%

Total Cash & Short Term Investments: $7.97B

Net Debt: $43.41B

Outlook (Estimates):

Forward 2Y Revenue CAGR: 2.3%

Forward 2Y EPS CAGR: 2.0%

Long Term EPS Growth: 3.9%

Recent Developments & Key Headwinds:

1/ Losing Market Share — PepsiCo fell to third place in U.S. soda market share, overtaken by Dr Pepper for the first time ever. This marks a major symbolic and competitive setback in beverages.

2/ Consumer Trade-Down — Inflation has made consumers more price-sensitive, pushing many toward private-label and generic brands, especially in snacks and beverages. In North America, PepsiCo’s food and beverage sales have been flat to slightly declining in recent quarters, with revenue growth increasingly reliant on price hikes rather than higher volumes.

3/ Health & GLP-1 Impact — Rising adoption of GLP-1 weight-loss drugs and broader health-conscious trends are pressuring demand for PepsiCo’s core brands like Lay’s, Doritos, Cheetos, and Mountain Dew. The shift toward healthier diets has weighed on brand momentum and pricing power.

Why This Might Be An Opportunity:

1/ Spin-Off Potential — PepsiCo could unlock shareholder value by divesting non-core or underperforming food and beverage brands. This would free up capital for shareholders and allow management to sharpen its focus on stronger segments.

2/ Productivity & Efficiency Gains — A multi-year integration of Frito-Lay and Beverages in North America aims to optimize the value chain, reduce costs, and expand margins. Management is targeting a 70% increase in productivity in the back half of 2025 compared to the first half.

3/ Healthier Alternatives & Portfolio Evolution — PepsiCo is relaunching key brands like Lay’s and Tostitos with simpler ingredients and pushing into categories like permissible snacks and functional beverages. With its scale, distribution, and brand power, these products could resonate strongly with shifting consumer preferences.

4/ Refranchising Upside — Activist investors, including Elliott Management, are pushing PepsiCo to refranchise its bottling network. Coca-Cola successfully executed a similar move, which improved margins and efficiency, suggesting PepsiCo could follow suit.

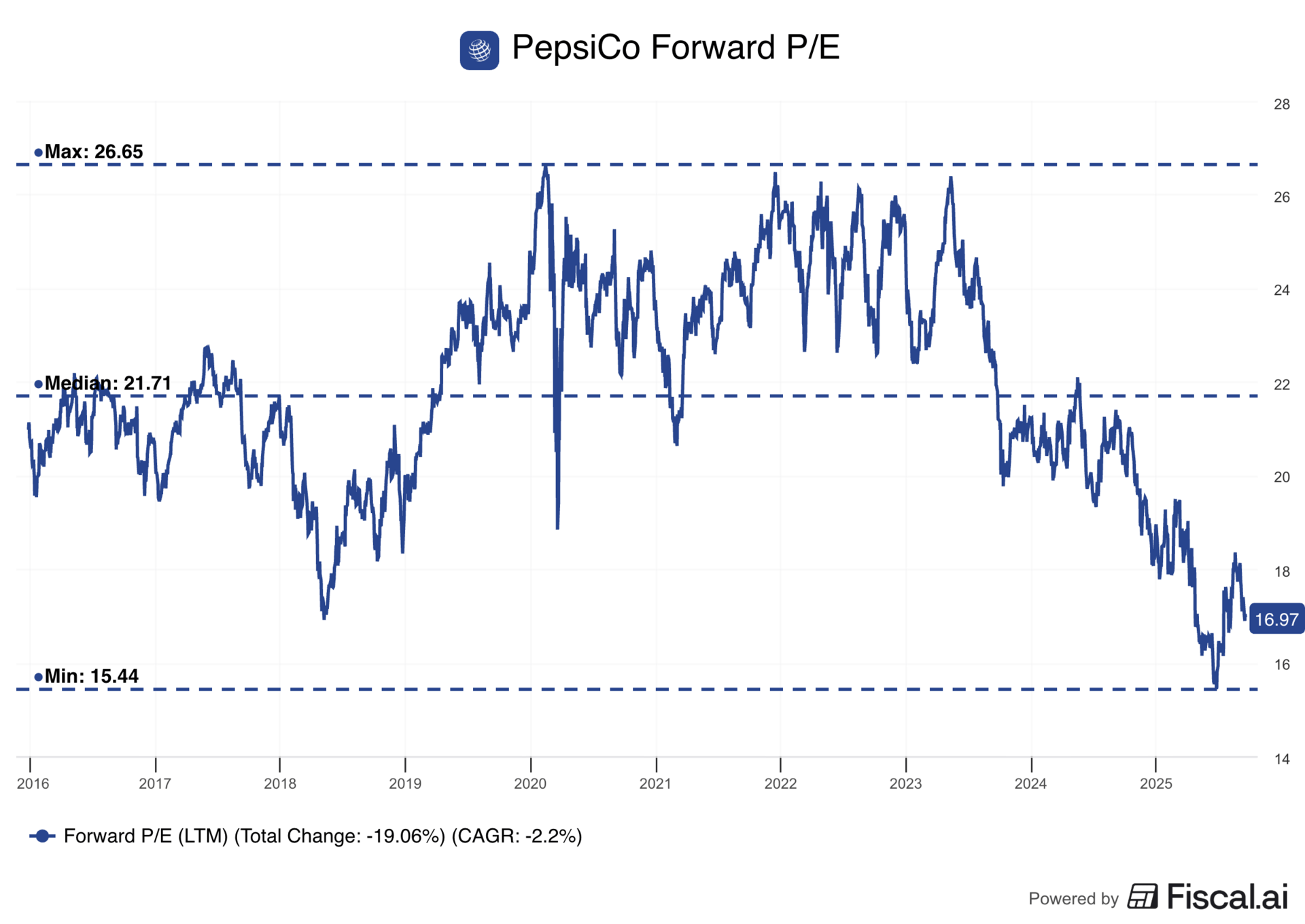

3/ Attractive Valuation & Dividend Yield — Trading at ~17x forward earnings versus the S&P 500’s ~24x, PepsiCo offers value for a global brand of its scale. On top of that, investors collect a 3.9% dividend yield, backed by a 10-year dividend CAGR of 7.5%.

TLDR: PepsiCo faces market share losses, cost-conscious consumers, and health-driven demand shifts pressuring its core portfolio. Yet, potential spin-offs, productivity gains, healthier portfolio evolution, and bottling refranchising could unlock new tailwinds. Trading at ~17x earnings with a 3.9% dividend, Pepsi remains a resilient American brand with upside if catalysts materialize.

4/ PayPal Holdings

Ticker: $PYPL

Market Cap: $66B

PayPal, founded in 1998 and based in California, operates a global payments platform that enables digital transactions for merchants and consumers.

Its ecosystem includes PayPal, Braintree, Venmo, Honey, and other brands, allowing users to send, receive, and hold funds across ~200 markets and nearly 100 currencies.

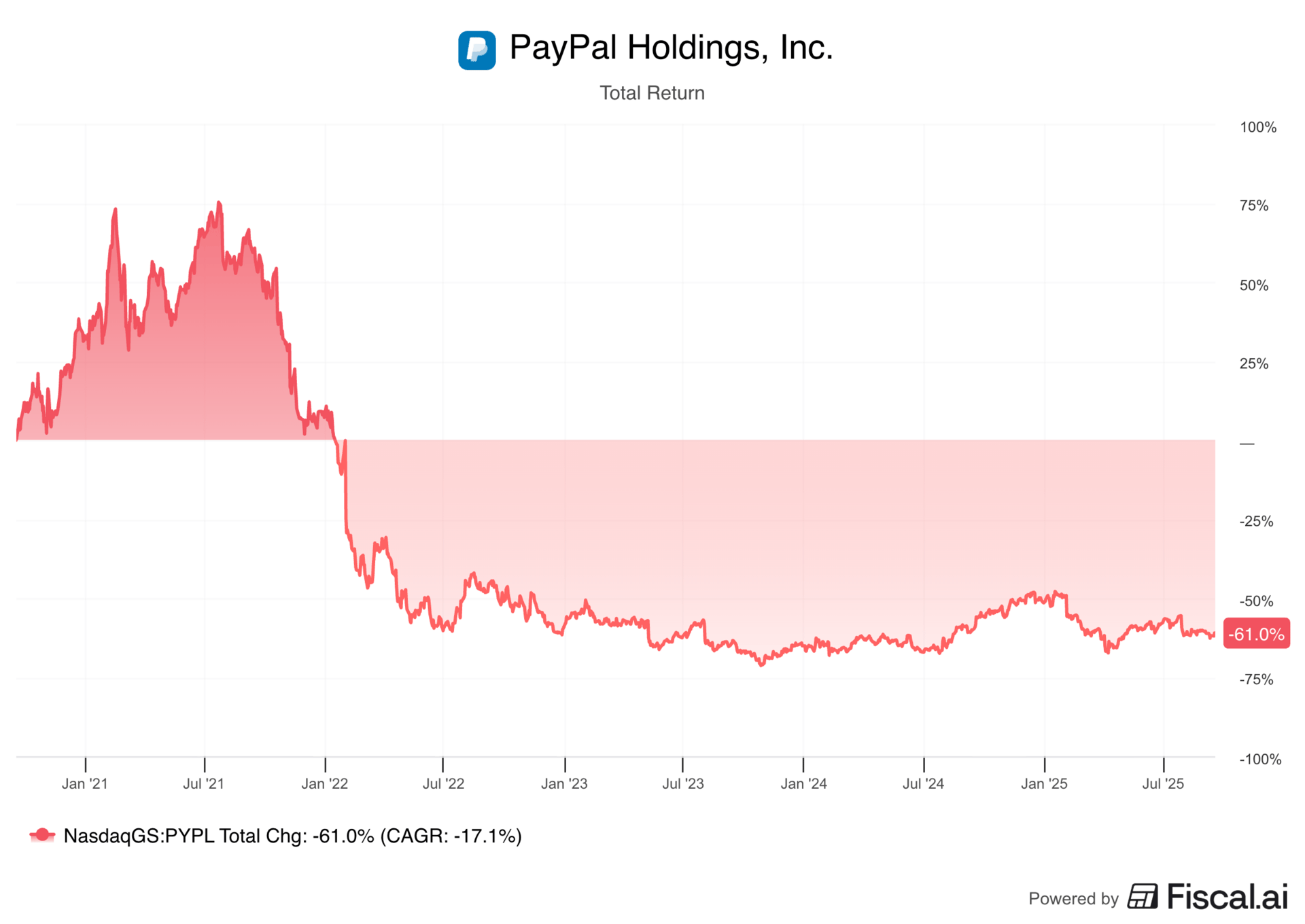

The company has built one of the largest digital wallets in the world, but over the past five years its stock has delivered a total return of -61%, massively underperforming the S&P 500’s 114% return.

Key Metrics:

5Y Revenue CAGR: 10.9%

5Y Diluted EPS CAGR: 16.4%

Operating Margin: 18.7%

5Y ROIC: 6.1%

Total Cash & Short Term Investments: $10.01B

Net Debt: $2.16B

Outlook (Estimates):

Forward 2Y Revenue CAGR: 4.9%

Forward 2Y EPS CAGR: 11.1%

Long Term EPS Growth: 9.8%

Recent Developments & Key Headwinds:

1/ Pandemic Reversal Trend — PayPal’s growth exploded during COVID-19 as e-commerce boomed, but folded back to mid-single digits as consumers returned to in-person spending and online growth normalized.

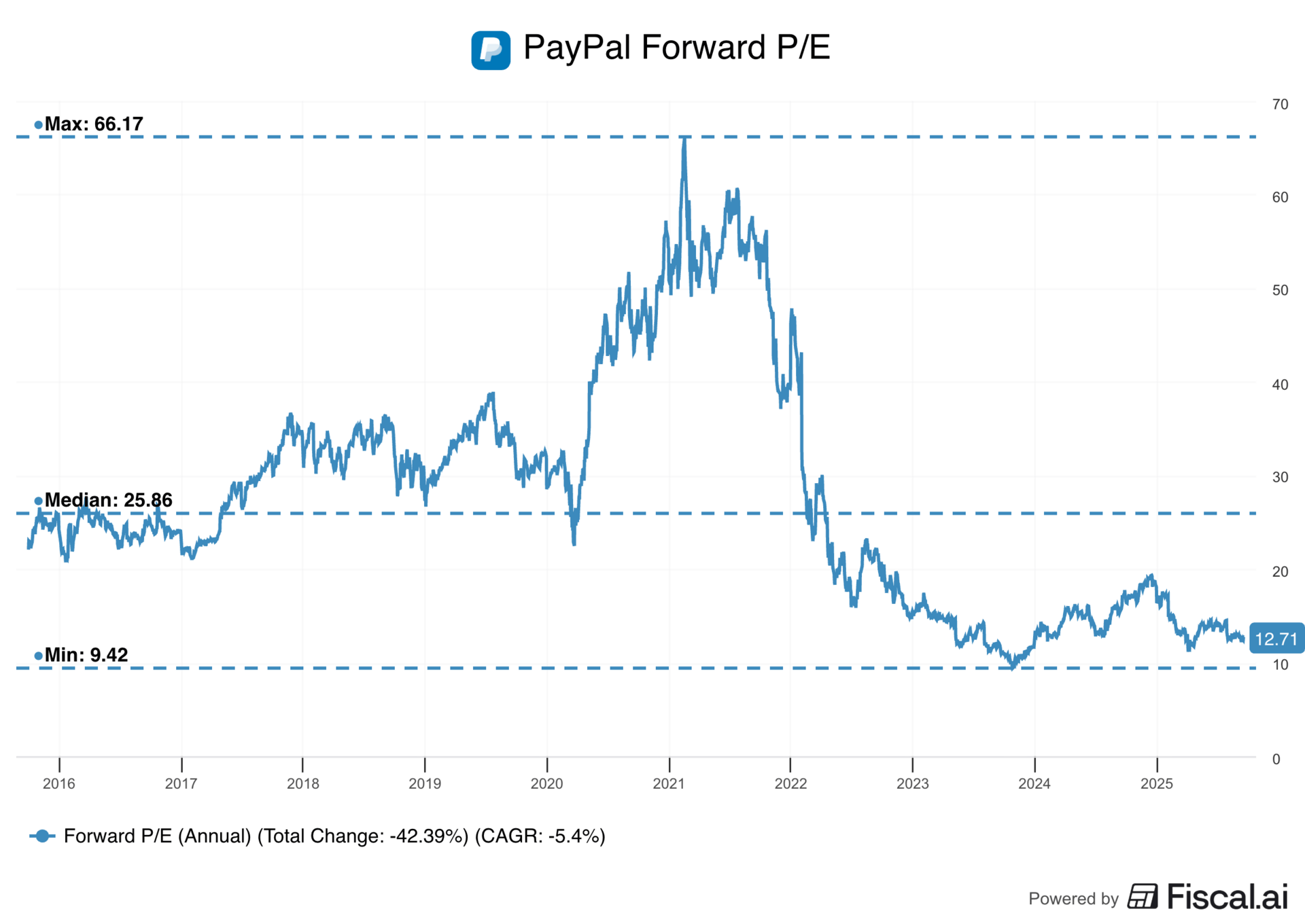

2/ Heightened Competition — Rival offerings from Apple Pay, Google Pay, Zelle, Cash App, Stripe, Shopify and others are putting pressure on PayPal’s margins. Its total payment volume growth has softened and take-rate (the cut PayPal keeps per transaction) has steadily declined (2.3% in Q4 2019 to 1.7% in Q2 2025)

3/ Venmo Monetization Still Lagging But Improving — Venmo revenue grew more than 20% YoY in Q2 2025 (highest growth rate since 2023), and total payment volume grew 12%. However, profits from Venmo haven’t yet made up for softness elsewhere.

4/ Guidance Uncertainty & Missteps — Under former product pushes like super-app ambitions or crypto initiatives, PayPal lost some focus. Aggressive targets sometimes emphasized growth over margin, which exposed its business during slowdown periods.

5/ Broader Macro Pressure — High interest rates, geopolitical risk, easing consumer spending, and tariff-related cost pressures have added headwinds to both total payment volume growth and discretionary digital payments.

Why This Might Be An Opportunity:

1/ New Growth Pursuit — PayPal is building out an advertising channel that leverages its data and user base, while also expanding its Buy Now Pay Later service and pushing deeper into cross-border payments. All three carry execution risk and could distract from the core business, but if successful, they would add powerful new legs of growth alongside payments. Complementing these initiatives, PayPal is also pursuing strategic partnerships, such as a multi-year collaboration with Google focused on agentic shopping experiences.

2/ Business Still Growing — Despite slower growth, PayPal is showing signs of stabilization. Revenue accelerated from +1.2% YoY in Q1 2025 to +5.1% in Q2 2025. Operating income over the last twelve months hit a record $5.9B. Total payment volume reached an all-time high of $1.7T, and active accounts crossed 438M. With digital payments still expected to expand at a 21.4% CAGR through 2030, PayPal retains a large market opportunity.

3/ Strong Financial Position & Buybacks — PayPal holds $10B in cash and has ramped up share repurchases. Shares outstanding have declined 15% over the past five years, roughly a 3.7% annualized reduction, with the last two years seeing the highest pace of buybacks.

4/ Compelling Risk-Reward — At ~12x forward earnings, PayPal trades near historic lows. Investors are effectively getting a stable payments business with margin expansion underway, while gaining upside if new revenue streams like advertising succeed or if core growth re-accelerates.

TLDR: PayPal is still growing, with record operating income and a massive user base, but faces intense competition, slower e-commerce tailwinds, and execution risk around new initiatives. With limited downside and potential upside from advertising, BNPL, or a rebound in core growth, the setup looks attractive for patient investors.

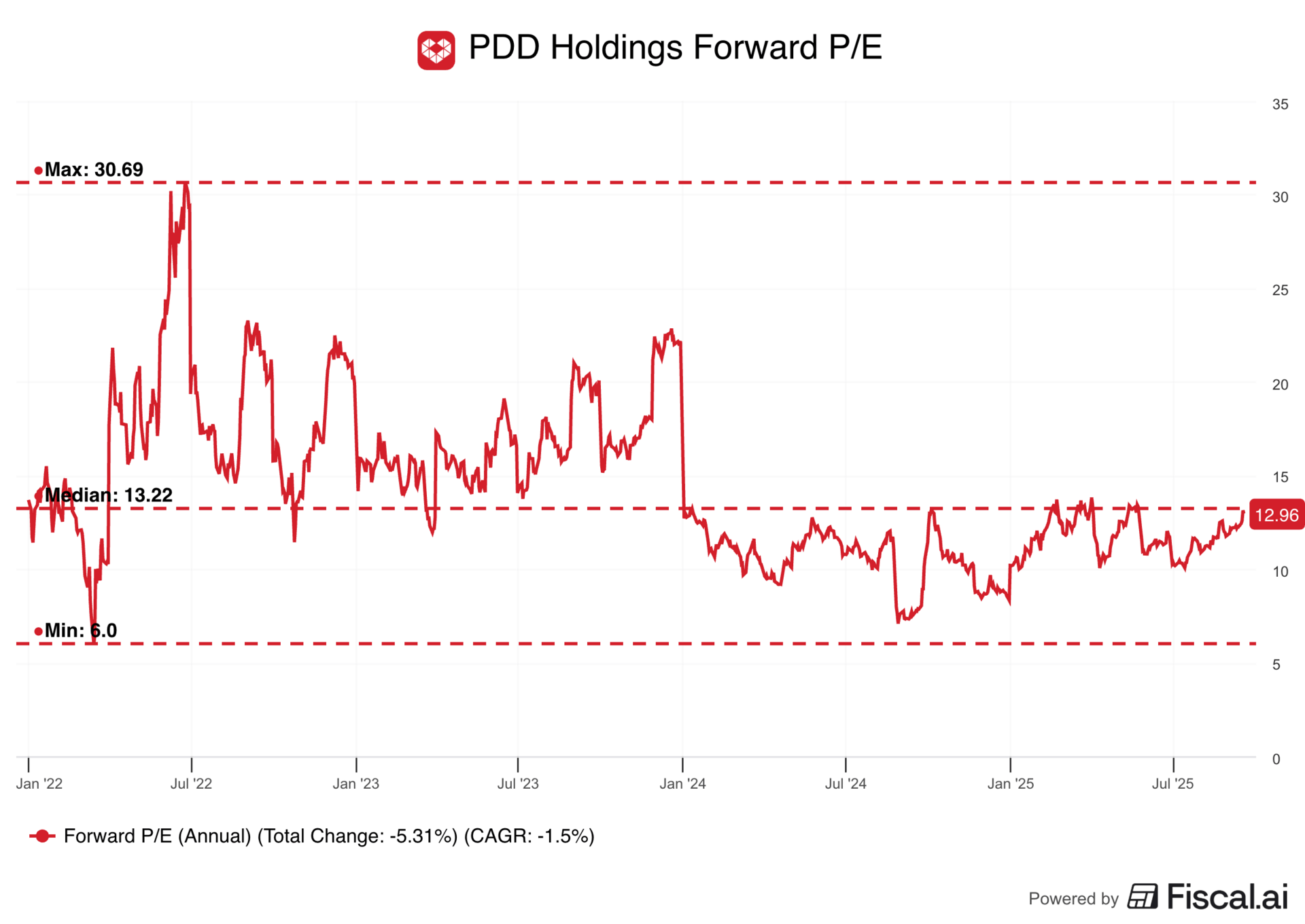

3/ Pinduoduo

Ticker: $PDD

Market Cap: $191B

PDD Holdings, founded in 2015 and based in Ireland, is a multinational commerce group best known for its e-commerce platforms Pinduoduo and Temu.

Pinduoduo is a leading online marketplace in China, offering categories ranging from fresh produce to apparel, electronics, and household goods.

Temu, launched in 2022, is its fast-growing international platform focused on low-cost cross-border shopping.

Key Metrics:

5Y Revenue CAGR: 61.7%

5Y Diluted EPS CAGR: 53.4%

Operating Margin: 22.4%

5Y ROIC: 66.3%

Total Cash & Short Term Investments: $54.4B

Net Debt: -$52.9B

Outlook (Estimates):

Forward 2Y Revenue CAGR: 12.1%

Forward 2Y EPS CAGR: 1.7%

Long Term EPS Growth: 4.4%

Recent Developments & Key Headwinds:

1/ End of De Minimis — The U.S. removed the “de minimis” exemption for low-value imports (valued under $800), ending duty-free entry for many small parcels starting in August 2025. This change strips Temu of a cost advantage, raises import and logistics costs, and puts pricing and profitability under pressure.

2/ Weak Consumer Demand in China — Sluggish spending and a slow recovery in China’s economy are weighing on Pinduoduo’s core platform growth, making it harder to sustain domestic momentum.

3/ Escalating Competition — Intense rivalry from Alibaba, JD.com, Douyin, and global players is forcing PDD to spend heavily on subsidies and marketing. This supports user and merchant retention but adds margin pressure.

4/ Trust & Quality Concerns — Temu’s ultra-low-cost model has raised recurring concerns about counterfeit goods, product quality, and slow delivery. These risks could erode customer loyalty and brand reputation if not addressed.

5/ Margin Sacrifice for Ecosystem Health — Management is deliberately prioritizing long-term ecosystem health over near-term profits through its RMB100B support program, which funds merchant subsidies, logistics improvements, and consumer coupons. While this strengthens the ecosystem, it has driven a sharp decline in operating margins and cash flow.

Why This Might Be An Opportunity:

1/ Global Growth Runway for Temu — Temu is still in the early stages of international expansion, rapidly gaining traction in markets like the U.S. and Europe. With low prices and aggressive customer acquisition, it has significant room to scale globally.

2/ Operational Efficiency via AI — AI-driven logistics, personalization, and supply chain optimization could help Temu and Pinduoduo streamline costs, improve user experience, and sustain margins even at scale.

3/ Value Investing Heritage & Long-Term Vision — Colin Huang, PDD’s founder, attended Warren Buffett’s 2006 charity lunch as a guest of his mentor Duan Yongping, who paid for the auctioned meal. This reflects admiration for Buffett’s long-term, value-driven philosophy. More recently, Li Lu, a legendary Chinese value investor whom Charlie Munger entrusted with managing his personal money, took a stake in PDD through Himalaya Capital, signaling confidence in its long-term potential.

4/ Resilient in Weak Macro Environments — PDD’s value-oriented model resonates with price-sensitive consumers. In a slow global economy or under continued macro pressure, its cheap offerings can help shield demand while competitors selling higher-priced goods face bigger hits.

5/ Scale, Grocery Penetration & Capital Strength – PDD’s core China business remains profitable and supports global expansion. Initiatives like Duo Duo Grocery, now covering 70% of Chinese villages, deepen domestic stickiness, while Temu drives international growth. With $54.4B in total cash and short-term investments, the company has a buffer to invest aggressively, absorb shocks, and fund growth even in volatile conditions.

TLDR: PDD’s profitable Pinduoduo core and global expansion through Temu position it for sustained growth, especially as value-conscious consumers turn to cheaper options in a weaker economy. Its long-term discipline, AI-driven efficiency push, and strong financial base strengthen the case, though execution risks around Temu’s global rollout and rising regulatory scrutiny remain key watchpoints.

2/ Chipotle Mexican Grill

Ticker: $CMG

Market Cap: $53B

Chipotle, founded in 1993 and based in California, is a fast-casual restaurant chain specializing in Mexican-style bowls, burritos, tacos, and salads made to order.

The company generates nearly all its revenue from food and beverage sales, with delivery services contributing only a small share.

Performance is driven by comparable restaurant transactions, digital and drive-thru pickup orders, and new restaurant openings.

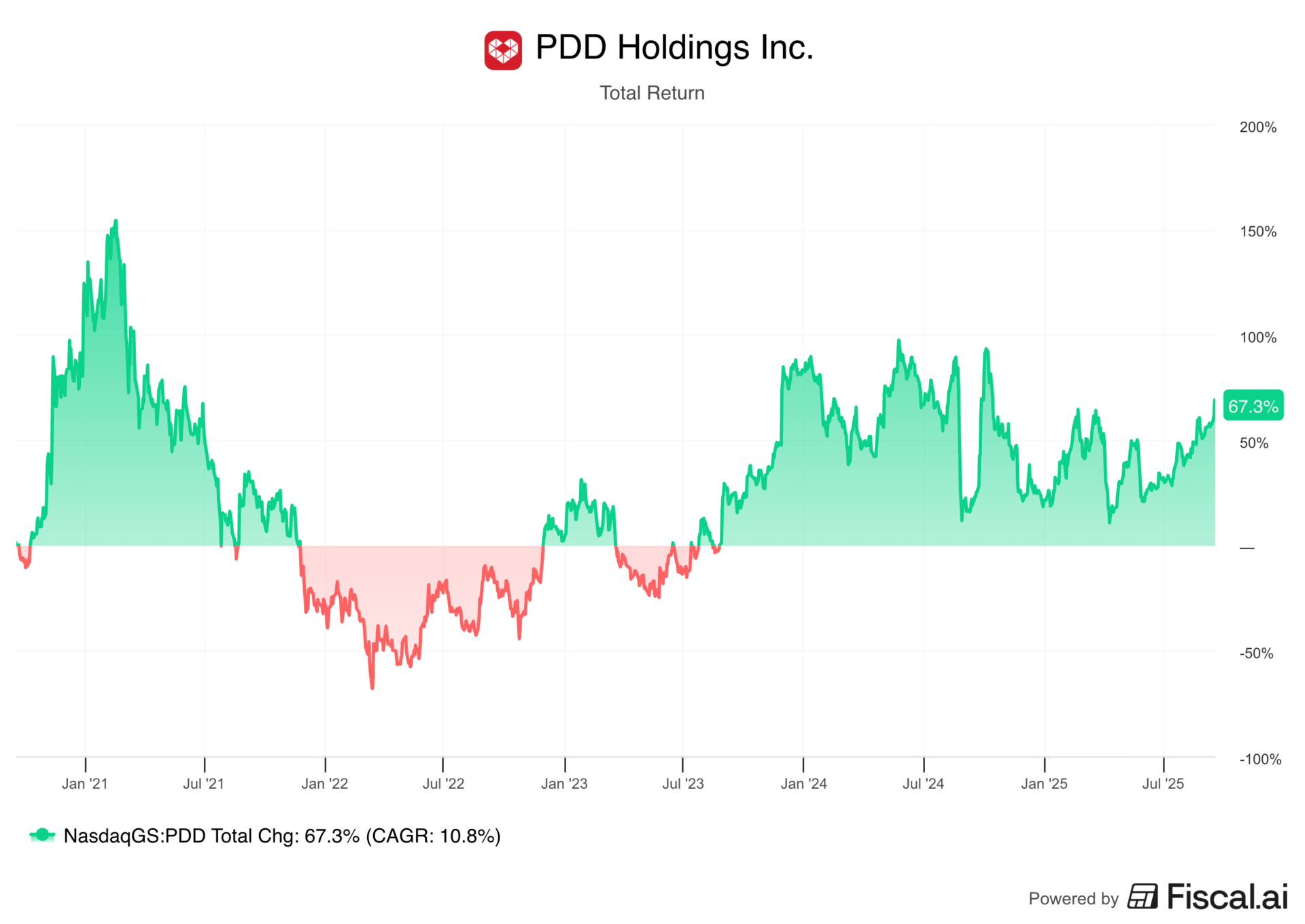

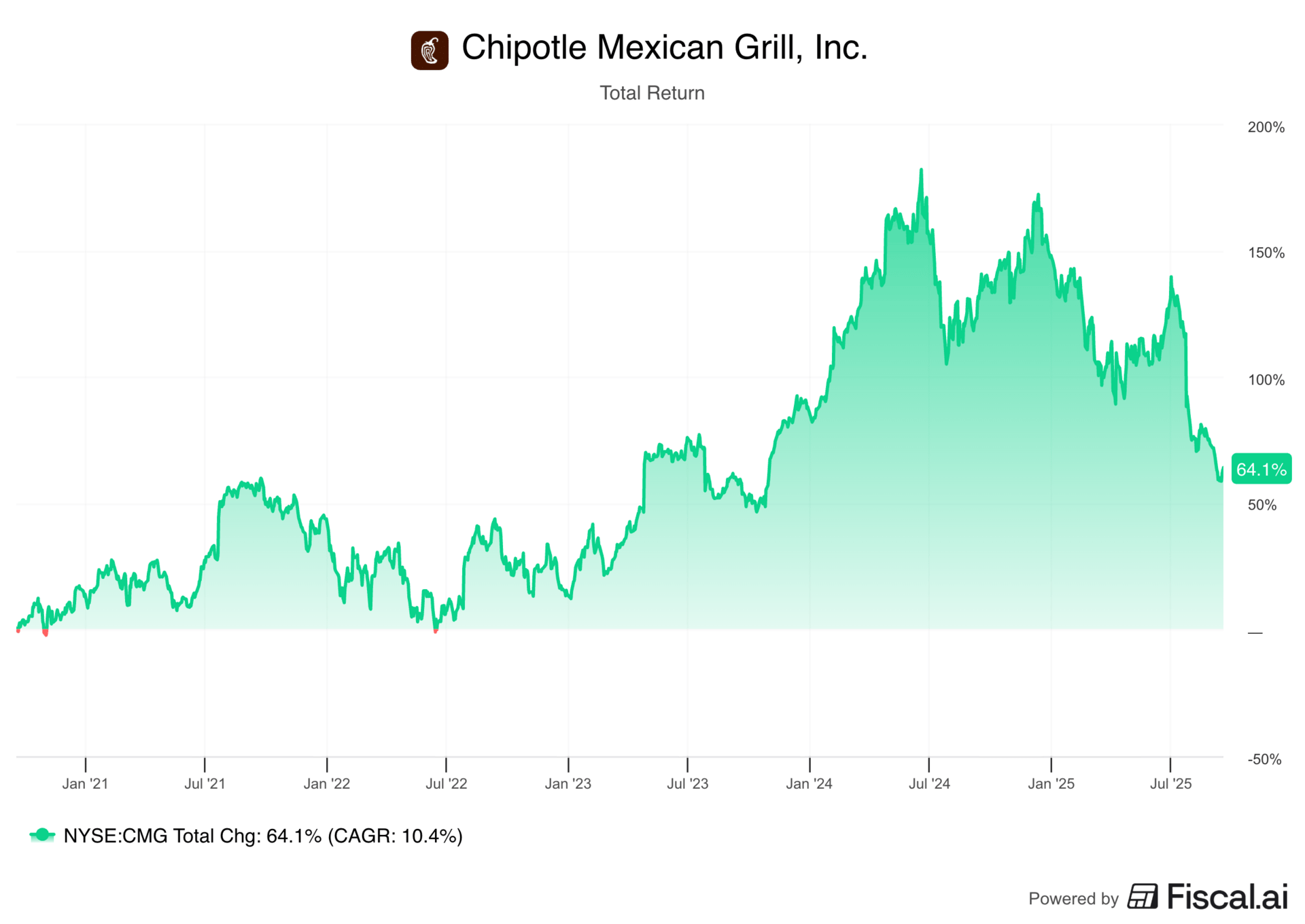

Shares are down more than 40% from their all-time high in June 2024.

Over the past five years, Chipotle has delivered a 62% total return, while net income has increased 338% in the same period, reflecting valuation multiple contraction.

Key Metrics:

5Y Revenue CAGR: 15.6%

5Y Diluted EPS CAGR: 44.3%

Operating Margin: 17.2%

5Y ROIC: 16.9%

Total Cash & Short Term Investments: $1.55B

Net Debt: $3.23B

Outlook (Estimates):

Forward 2Y Revenue CAGR: 9.9%

Forward 2Y EPS CAGR: 12.5%

Long Term EPS Growth: 17.6%

Recent Developments & Key Headwinds:

1/ Leadership Change — Former CEO Brian Niccol left for Starbucks in August 2024. Scott Boatwright, initially interim CEO, was appointed permanent CEO in November 2024. The abrupt transition raised concerns about whether new leadership can sustain Chipotle’s momentum and execute at Niccol’s level.

2/ Pricing Pressures — Profitability has weakened, with operating margin slipping from 19.7% in June 2024 to 18.2% most recently. Restaurant-level margin fell 150 basis points to 27.4% as steak and chicken costs pushed food expenses higher, labor rose to 24.7% of sales on softer volumes, and tariffs added about 50 basis points of ongoing pressure.

3/ Consumer Sensitivity — Fast-casual demand is softening as customers are likely trading down to cheaper options. Transactions rose 8.7% in June 2024 but fell to –4.9% a year later, while comparable restaurant sales flipped from +11.1% to –4% over the same period. In recent quarters, average checks have inched up just 1–2% from menu price hikes, but customers are shifting to cheaper items, leading to consistently negative check mix. In the most recent quarter, overall sales grew only 3%, driven mainly by new restaurant openings rather than existing stores.

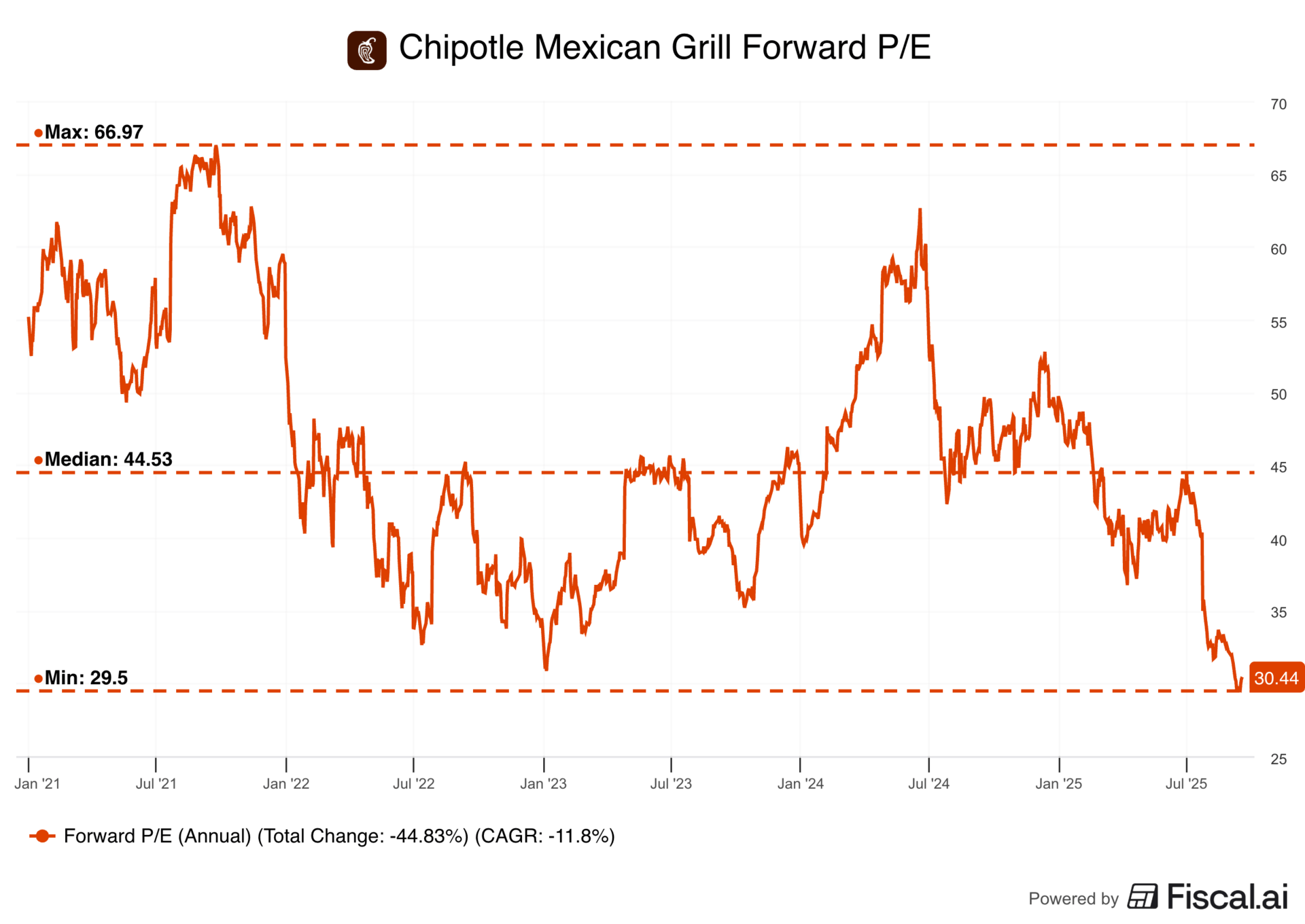

4/ Rich Valuation — For much of the last five years, Chipotle traded at around a median 45x forward earnings, reflecting its brand power and unit economics. That multiple has compressed to a five-year low of ~30x, which is still an expensive valuation.

Why This Might Be An Opportunity:

1/ Experienced Management — While Scott Boatwright may not have the same name recognition as Brian Niccol, he had served as COO since 2017 and was instrumental in Chipotle’s turnaround and growth over the last several years. Before Chipotle, he spent 18 years at Arby’s in senior leadership roles, giving him deep operational experience.

2/ Pricing Power and Efficiencies — Menu price increases, supply chain improvements, and new in-store equipment are cushioning inflation and offsetting labor costs. Management still targets restaurant-level margins of 29–30% as volumes recover and average unit volumes approach $4M, with 40% flow-through on incremental sales. This suggests Chipotle has the levers to restore margins despite inflation, labor, and tariff pressures.

3/ Strong Brand + International Growth — Chipotle has built loyalty and differentiation through quality, speed, and customization, which makes it difficult to replicate. Management described Q2 as an “aggregate storm” but noted that share gains returned in June–July after weakness in April–May. Looking ahead, the company expects to open 315–345 new restaurants this year and targets 8–10% annual unit growth to reach 7,000 locations long term (currently at 3,839). International growth also looks promising: Canada’s business has nearly tripled in five years with U.S.-comparable economics, and the Middle East has outperformed, with its Kuwait location surpassing average U.S. unit volumes.

4/ More Sensible Valuation — Chipotle now trades at ~30x forward earnings with long term EPS growth of roughly 18% expected. While still premium, further compression could make the stock even more attractive if current pressures prove temporary.

TLDR: Chipotle is facing margin pressure, weaker U.S. demand, and a still-premium multiple, but its brand remains intact with no clear signs of deterioration. With long-term growth supported by pricing power, global expansion, and strong unit economics, the stock could become especially compelling if broader market weakness drives the valuation into even more attractive territory.

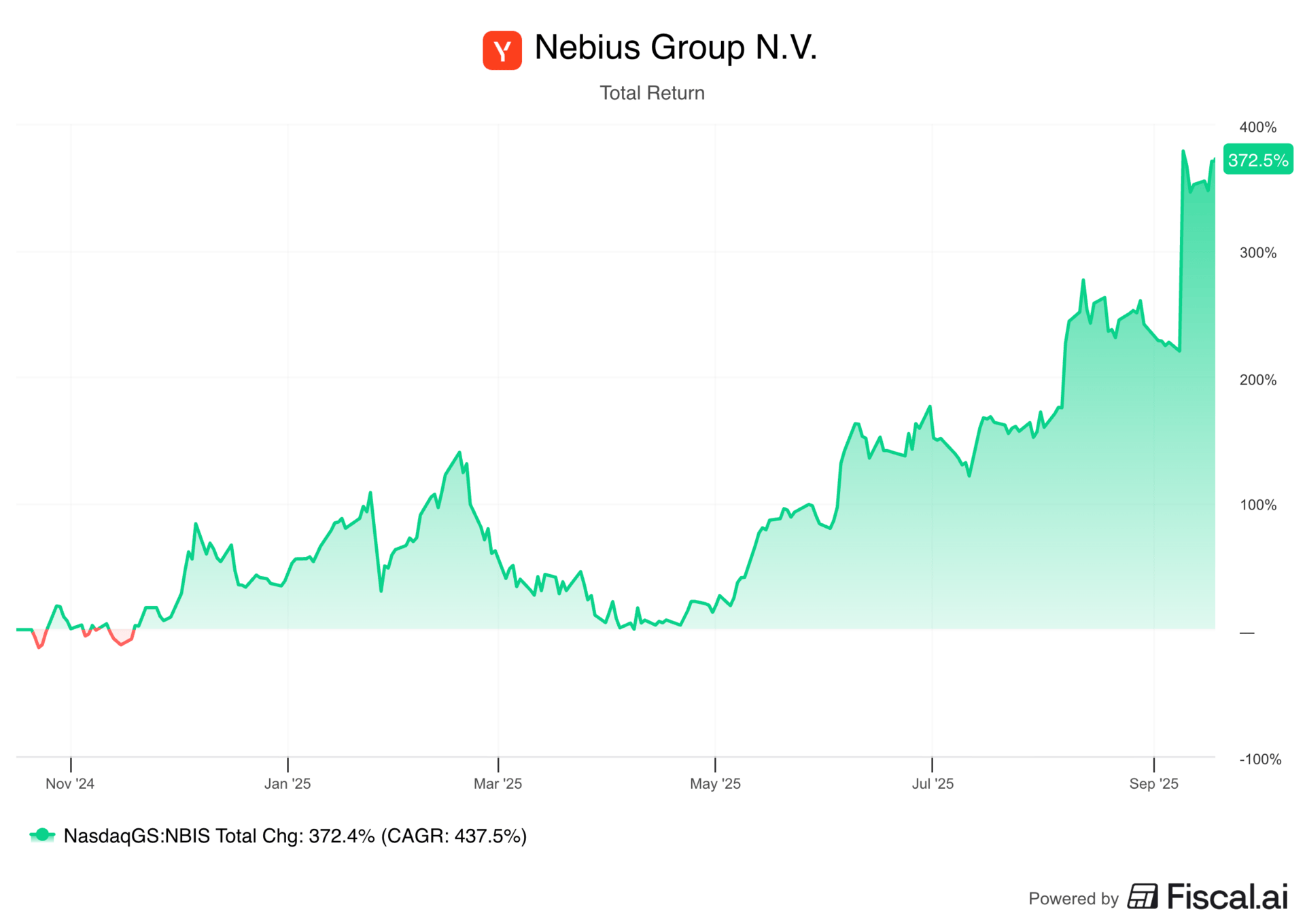

1/ Nebius Group

Ticker: $NBIS

Market Cap: $22B

Nebius Group, founded in 1989 and formerly known as Yandex, is a technology company based in the Netherlands focused on building full-stack AI infrastructure.

Its core business is Nebius, an AI-centric cloud platform designed for intensive AI workloads, offering large-scale GPU clusters, cloud services, and developer tools.

Beyond its core platform, Nebius is also expanding into adjacent markets. Toloka AI supports generative AI development by providing high-quality training data, TripleTen focuses on reskilling workers for tech careers through online education, and Avride is developing autonomous driving solutions for both passenger and delivery applications.

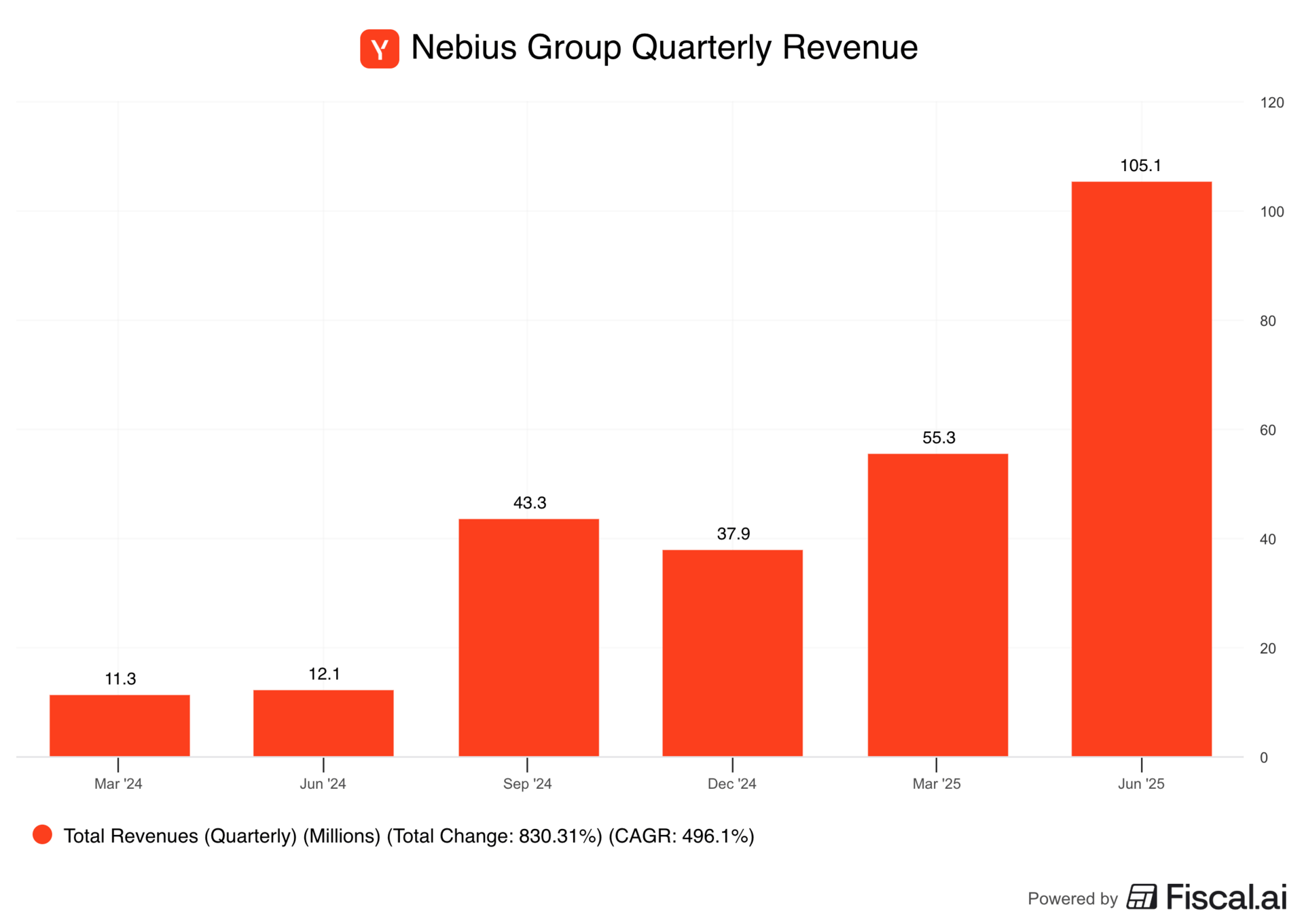

Because Nebius divested from Yandex and listed publicly in October 2024, available financial metrics only cover recent periods, making year-over-year comparisons limited to roughly one year of data.

Key Metrics:

Q2 2025 Revenue Growth YoY: 770%

Q2 2025 Gross Margin: 71.4%

Total Cash & Short Term Investments: $1.68B

Net Debt: -$0.5B

Outlook (Estimates):

Forward 2Y Revenue CAGR: 258.8%

Forward 2Y EPS CAGR: 176.7%

Long Term EPS Growth: 28.0%

Recent Developments:

1/ Microsoft Deal — Nebius signed a $17.4B contract (which could go up to $19.4B with additional services) to provide GPU infrastructure capacity to Microsoft through 2031. While revenue will be recognized over the life of the deal, the agreement implies a multibillion-dollar annual contribution.

2/ Strong Growth & Raised Guidance — Before the Microsoft deal, Nebius reported 106% QoQ revenue growth and raised ARR guidance from $900M to $1.1B (previously $750M–$1B). The core business also turned adjusted EBITDA positive ahead of schedule and is running near peak utilization.

3/ Capacity Expansion — Nebius is scaling rapidly, targeting 220 MW of connected power by year-end 2025 and 1 GW by 2026, a 4.5x increase. Expansion includes new sites and additional capacity in Kansas City, the UK, Israel, Finland, and New Jersey, with more in the pipeline.

Why This Might Be An Opportunity:

1/ Demand Validation & Customer Growth — The multiyear Microsoft deal underscores strong demand for Nebius’s AI-first infrastructure and could serve as a springboard for additional large-scale partnerships. Additionally, the company has already expanded its customer base with major names like Cloudflare, Prosus, and Shopify. That said, investors should closely monitor how the company structures its contract terms to ensure Nebius isn’t boxed into low-margin supply agreements.

2/ Industry Growth — AI data center capacity is projected by Brookfield to reach 82 GW by 2034, a tenfold increase in a decade. Nebius targets 1 GW by 2026, so capturing even a fraction of the total addressable market by 2034 could drive extraordinary growth.

3/ Strong Financial Position — With $1.68B in cash and net debt of –$0.5B, Nebius has flexibility to scale. It also raised $3.75B from convertible notes and equity to fund land and GPU purchases following the Microsoft deal. Competitors like CoreWeave operate with $1.15B in cash but $13.4B in net debt, highlighting Nebius’s relative strength.

4/ Technology Expertise & Scale — Nebius brings decades of experience from its Yandex heritage, with engineers who built advanced AI, search, and cloud systems. The company designs its own data centers, hardware, and software stack, enabling superior efficiency, scalability, and cost control compared to peers. Execution will be critical to ensure Nebius continues to differentiate itself rather than risk being viewed as just another GPU capacity provider while supply remains tight.

TLDR: Nebius is scaling rapidly with surging revenue, industry-leading margins, and a $17B+ Microsoft contract deal. Its strong balance sheet, deep engineering expertise, and aggressive expansion pipeline position it as a formidable AI infrastructure player. The risks lie in execution, dependence on sustained AI demand, and avoiding commoditization or unfavorable contract terms as it scales globally.

Disclaimer

This content is for informational and educational purposes only and should not be construed as financial, investment, tax, legal, or other professional advice. It does not constitute a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. You are solely responsible for any investment decisions you make, and you should consult with a qualified financial advisor before making any investment or financial decisions.

The author may hold, or may in the future acquire, sell, or otherwise change positions, long or short, in any of the securities, investments, or financial instruments mentioned in this content, without notice or obligation to update this information. Any such holdings or transactions should not be construed as an endorsement of any security or strategy.

The author and publisher make no representations or warranties, express or implied, as to the accuracy, completeness, or timeliness of the information provided, and assume no liability for any losses or damages of any kind arising from or related to the use of this content. Past performance is not indicative of future results. All investments carry risk, including the potential loss of principal.

This content is intended for a general audience and may not be lawful or appropriate in certain jurisdictions. Readers are responsible for ensuring compliance with all applicable laws and regulations in their country or region.

AI tools were used to refine, expand, or edit portions of this content for clarity, flow, and digestibility.

Reply