Happy Sunday.

This week, the S&P 500 closed up nearly 3%.

Just a few weeks ago, the index was on the verge of a bear market after falling nearly 20%.

Now, it's up about 2% for the year, after rebounding 20% from its April lows.

A major catalyst came Monday, when the U.S. and China agreed to roll back tariffs for 90 days, easing trade tensions.

Meanwhile, last Thursday marked the 13F deadline, where fund managers with over $100M in assets disclosed their latest positions.

These filings offer a rare look into what some of the world’s top investors have been buying and selling.

Below, I break down eight key portfolios and their most notable trades.

Some key data bites from this week that you should know:

Inflation increased 2.3% YoY in April, slowest pace since early 2021.

Trump to mandate up to an 80% cut in US prescription drug costs.

Steve Cohen sees US recession probability at 45%.

Perplexity is planning to raise $500M at a $14B valuation.

Qatar gifted the Trump admin a $400M super luxury jet.

Qatar pledged $244B in deals with the US.

Boeing and Qatar Airways have agreed to a $96B deal.

Trump and MBS pledge $1T in commercial deals.

Nvidia to sell 18,000 AI chips to Saudi firm Humain.

Nvidia set to export 500,000 AI chips annually to UAE.

AMD will provide AI chips and software to Saudi Arabia in a $10B project.

AMD announced a $6B share buyback.

CrowdStrike’s CEO gifted over $1B of stock to undisclosed recipients.

McDonald’s plans to hire 375,000 workers this summer.

Cava saw Q1 same-store sales climb nearly 11%.

Microsoft to lay off 6,000 people, or 3% of its workforce.

Netflix’s ad tier now has 94M monthly active users.

Father-son duo sentenced over $100M New Jersey deli fraud.

Dick’s Sporting Goods to buy Foot Locker for $2.4B.

Coinbase’s breach may cost up to $400M after support agents were bribed.

Charter and Cox will merge in a $34.5B deal.

In today’s newsletter:

🐐 Warren Buffett Stock Portfolio

🐻 Michael Burry’s Stock Portfolio

🚕 Bill Ackman’s Stock Portfolio

🇨🇳 David Tepper’s Stock Portfolio

🧠 Stanley Druckenmiller’s Stock Portfolio

📱 Chase Coleman’s Stock Portfolio

💸 Seth Klarman’s Stock Portfolio

🚗 Pat Dorsey’s Stock Portfolio

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Together With GoldCo

Gold hitting record highs

The price of gold keeps heating up. If the record-breaking year of 2024 wasn't enough, gold hit a major historic 2025 milestone by crossing the $3,000/ounce threshold!

Here are 3 Key Reasons:

Looming economic & political uncertainty

Increasing central bank demand

Rising National Debt - over $36 Trillion

So, could gold surge even higher?

According to a recent statement from Jeffrey Gundlach, famed American business man and investor… “Gold continues its bull market that we’ve been talking about for a couple of years, ever since it was down to $1,800.” He expects gold to reach $4,000/oz.

Is it time you learn more about precious metals?

Get all the answers in your free 2025 Gold & Silver Kit. Plus, if you request your free kit today, you could qualify for up to 10% Instant Match in Bonus Silver*.

*Offer valid on qualified orders of Goldco premium products only. Receive up to 10% in free silver based on purchase amount; cannot be combined with other offers. Additional terms apply—see your customer agreement or contact your representative for details.

Warren Buffett’s portfolio is always the most closely watched when 13F filings drop, and for good reason.

This week, in a phone interview with the WSJ, the legendary investor reflected on aging, saying he didn’t start to feel old until around 90.

Since then, he’s become more conscious of the physical toll, which played into his decision to step down.

He’ll continue to lead Berkshire Hathaway through the end of the year, and stay on as chairman afterward.

From a portfolio standpoint, the changes were minimal.

The most notable move was a 7.15% trim to Bank of America, shifting it from a top-three position to his fourth-largest holding.

Buffett also fully exited Citigroup and Nu Holdings, while modestly adding to Constellation Brands.

Still, these moves had little impact overall.

His core holdings, Apple, American Express, Coca-Cola, and Chevron, remain largely unchanged.

Michael Burry has long been known for his bearish takes and his famous bet against the housing market in 2008.

This quarter, he stuck to that playbook, exiting every single common stock holding except Estee Lauder, which he doubled down on.

At the same time, he initiated put options on Nvidia and a slate of Chinese names including Alibaba, Pinduoduo, JD.com, and Baidu.

He also opened a new put position against Trip.com.

One important note: the portfolio weightings for these options are based on notional value, the full value of the underlying stocks, not the actual premiums paid.

That makes the positions look much larger than the capital he likely deployed.

Also keep in mind that this snapshot reflects Burry’s positions at the end of Q1.

Since Burry is an active trader, he may have already exited many of these bets.

Bill is betting big on Uber.

In Q1, he initiated a sizable new position that now makes up 18.5% of his equity portfolio.

He also added to his holdings in Brookfield and Hertz.

On the flip side, Ackman trimmed his stakes in Hilton, Alphabet, and Chipotle, and fully exited his Nike common stock position.

However, while many headlines noted he sold out of Nike stock, they missed that Pershing Square still owns over-the-counter call options in a similar notional amount.

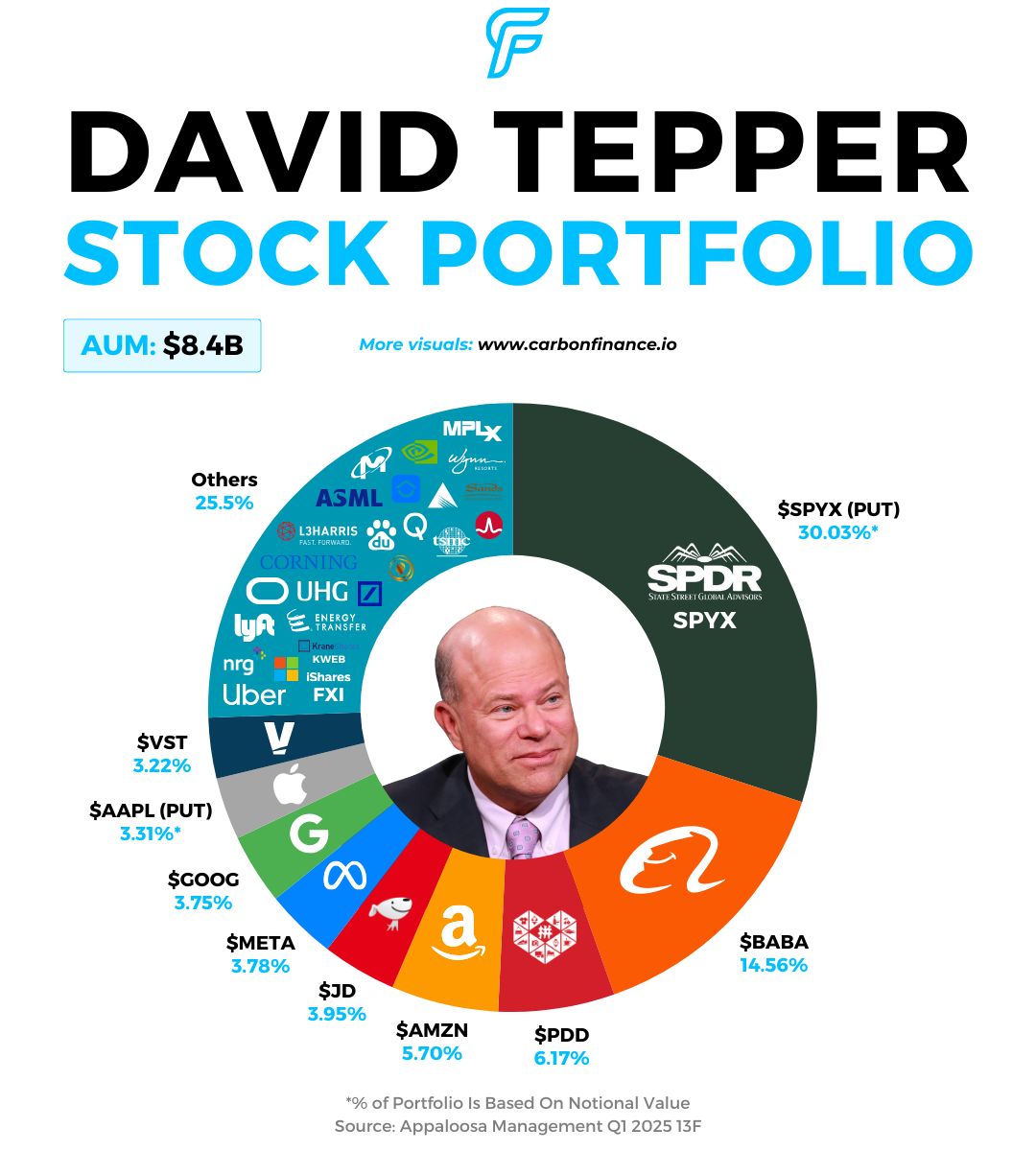

Last fall, David Tepper was a vocal bull on Chinese equities, citing the potential for stronger than expected government stimulus.

But this past quarter, he pulled back.

Tepper trimmed several of his top Chinese positions, cutting Alibaba by 22%, Pinduoduo by 18%, JD by 23%, and Baidu by 49%.

He also added some bearish bets, including a put position on the S&P 500 Fossil Fuel Reserves Free ETF, which screens out companies with fossil fuel reserves, and a smaller put position on Apple.

Still, Tepper hasn’t turned bearish overall.

He boosted his stakes in major U.S. tech names like Meta, Google, and Uber, signaling continued optimism in the sector.

Legendary investor Stanley Druckenmiller had a notably active quarter.

He initiated a new stake in DocuSign, which now makes up 2.86% of his portfolio, placing it among his top 10 positions.

He also increased several existing bets, including Teva Pharmaceutical by 65%, Coupang by 4.5%, Insmed by 131%, and Taiwan Semi by a striking 456%.

On the trimming side, he pared back Natera by 5%, along with Woodward by 10% and Philip Morris by 18%.

Billionaire tech investor Chase Coleman was just as active this quarter.

He initiated new positions in AppLovin, Zillow, and GE Vernova, and made a major move in Veeva Systems, increasing his stake by 540%.

He also added to several high-profile names including Microsoft, Pinduoduo, Nvidia, Reddit, and Coupang.

On the trimming side, he reduced his Apollo stake by 49% and slashed his Uber position by 94%.

Lastly, Coleman fully exited positions in Qualcomm, Datadog, Atlassian, and several others.

Seth Klarman is often regarded as the second greatest investor of all time, having averaged a 20% CAGR since 1982.

But in recent years, his fund has faced challenges, including client withdrawals and weaker returns.

His biggest move this quarter was a new stake in Fidelity National Information Services, now 7.49% of his portfolio.

Among his top holdings, he boosted Alphabet by 46%, WESCO by 40%, and Restaurant Brands International by 34%.

On the other hand, he trimmed Liberty Global by 38%, Willis Towers Watson by 17%, and slashed Clarivate by 70%.

Pat Dorsey, best known for developing Morningstar’s economic moat ratings, runs a tightly concentrated portfolio centered on companies with wide moats.

Q1 brought plenty of activity.

He opened new positions in AerCap, Booking, and ASML, while also adding significantly to existing bets.

His stakes in Danaher and Meta rose 75% and 19%, respectively.

At the same time, he trimmed Wix by 45% and PayPal by 34%.

He also fully exited Upwork and HERC Holdings.

And while he previously held Smartsheet, the company was acquired in a take-private deal by Vista Equity Partners in Q1.

📣 Presented By Pacaso

The key to a $1.3T opportunity

A new real estate trend called co-ownership is revolutionizing a $1.3T market. Leading it? Pacaso. Led by former Zillow execs, they already have $110M+ in gross profits with 41% growth last year. They even reserved the Nasdaq ticker PCSO. But the real opportunity’s now. Until 5/29, you can invest for just $2.80/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

🆕 S&P Inclusion. Coinbase is joining the S&P 500 and replacing Discover Financial on May 19th - SPGI

💬 Chat Checkout. PayPal is partnering with Perplexity to enable in-chat shopping, letting users pay instantly with PayPal or Venmo - CNBC

🇨🇳 China Chill. Alibaba fell short of quarterly revenue estimates, and its AI unit also missed earnings projections - BB

🌱 FinTech Revival. FinTech IPOs are making a comeback with eToro going public and Chime filing this past week - B

🫁 Lung Lifeline. FDA has granted accelerated approval for AbbVie’s new lung cancer therapy - YF

🔎 Medicare Probe. DOJ is investigating UnitedHealth Group for possible Medicare fraud - R

🍎 Manufacturing Rift. Trump told Tim Cook to stop building plants in India - BB

Courtesy of our paid partner, EarningsHub.

Notable Companies Reporting Earnings Week of May 18th, 2025:

Here’s what I will be watching this week:

Monday: Trip.com $TCOM

Tuesday: Home Depot $HD, Palo Alto Networks $PANW

Wednesday: Baidu $BIDU, Snowflake $SNOW

Thursday: Analog Devices $ADI, Intuit $INTU

EarningsHub helps me stay on top of earnings, forecasts, and AI-powered call recaps.

It’s free, and perfect if you want to track every major company reporting.

Major Trades Published 5/12 - 5/16. Trades may be those of family members. [Source: 2iQ]

Buys

Kevin Hern (R)

Company: BNP Paribas ($BNPQY)

Amount Purchased: $1.25M - $5.5M

Company: Goldman Sachs ($GS)

Amount Purchased: $250K - $100K

Michael McCaul (R)

Company: Merck & Co ($MRK)

Amount Purchased: $100K - $250K

Company: Nucor ($NUE)

Amount Purchased: $100K - $250K

Sells

Greg Landsman (D)

Company: Kroger ($KR)

Amount Sold: $250K - $500K

Michael McCaul (R)

Company: AMD ($AMD)

Amount Sold: $100K - $250K

Company: CVS ($CVS)

Amount Sold: $100K - $250K

Major Trades Published 5/12 - 5/16

Buys

Middleby Corp ($MIDD)

United Health Group ($UNH)

Insider: Stephen Hemsley (CEO, UHG)

# of Shares Purchased: 86,700

$ Amount: $25,019,019

SEC Forms: [1]

Insider: John Rex (President & CFO)

# of Shares Purchased: 17,175

$ Amount: $4,999,919

SEC Forms: [1]

Insider: Kristen Gil (Director)

# of Shares Purchased: 3,700

$ Amount: $1,003,329

SEC Forms: [1]

Insider: Timothy Flynn (Director)

# of Shares Purchased: 1,533

$ Amount: $491,786

SEC Forms: [1]

Sells

How was today's newsletter?

🤝 Review of the Week

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.