Happy Friday!

Hope you all had a great week and are looking forward to the weekend.

In today’s newsletter:

🦾 The Biggest IPO of the Year

👨⚖️ The Google Antitrust Trial

🎨 Adobe’s Earnings Visualized

Let’s dive right in!

Not subscribed yet? Sign up today!

🦾 The Biggest IPO of the Year

ARM, the British chip designer owned by SoftBank, recently launched its shares on the Nasdaq, making it the biggest IPO of the year. The company's strong debut gave the chip designer a valuation of $67.9B and signals a potential resurgence in the IPO market that has been sluggish for nearly two years. This positive performance could pave the way for other tech companies to go public.

ARM's designs are pivotal in the tech industry, especially with the rise of artificial intelligence. However, the company’s performance over the next few quarters is definitely one to watch, given that 2/3rds of IPOs underperform the market three years after going public.

👨⚖️ The Google Antitrust Trial

On Tuesday, the U.S. Justice Department initiated a significant antitrust trial against Google, accusing the tech giant of using large payments to maintain its dominance in internet search.

The Justice Department argues that Google's agreements with companies like Apple and Samsung to make its search engine the default option have illegally sustained its monopoly. Google believes that it competes fairly for these contracts and that users can easily change default settings.

One thing that’s definitely interesting to note is that several of Google’s defense team previously worked on the government’s side during the landmark Microsoft antitrust case decades ago. The trial is scheduled to go through mid-November.

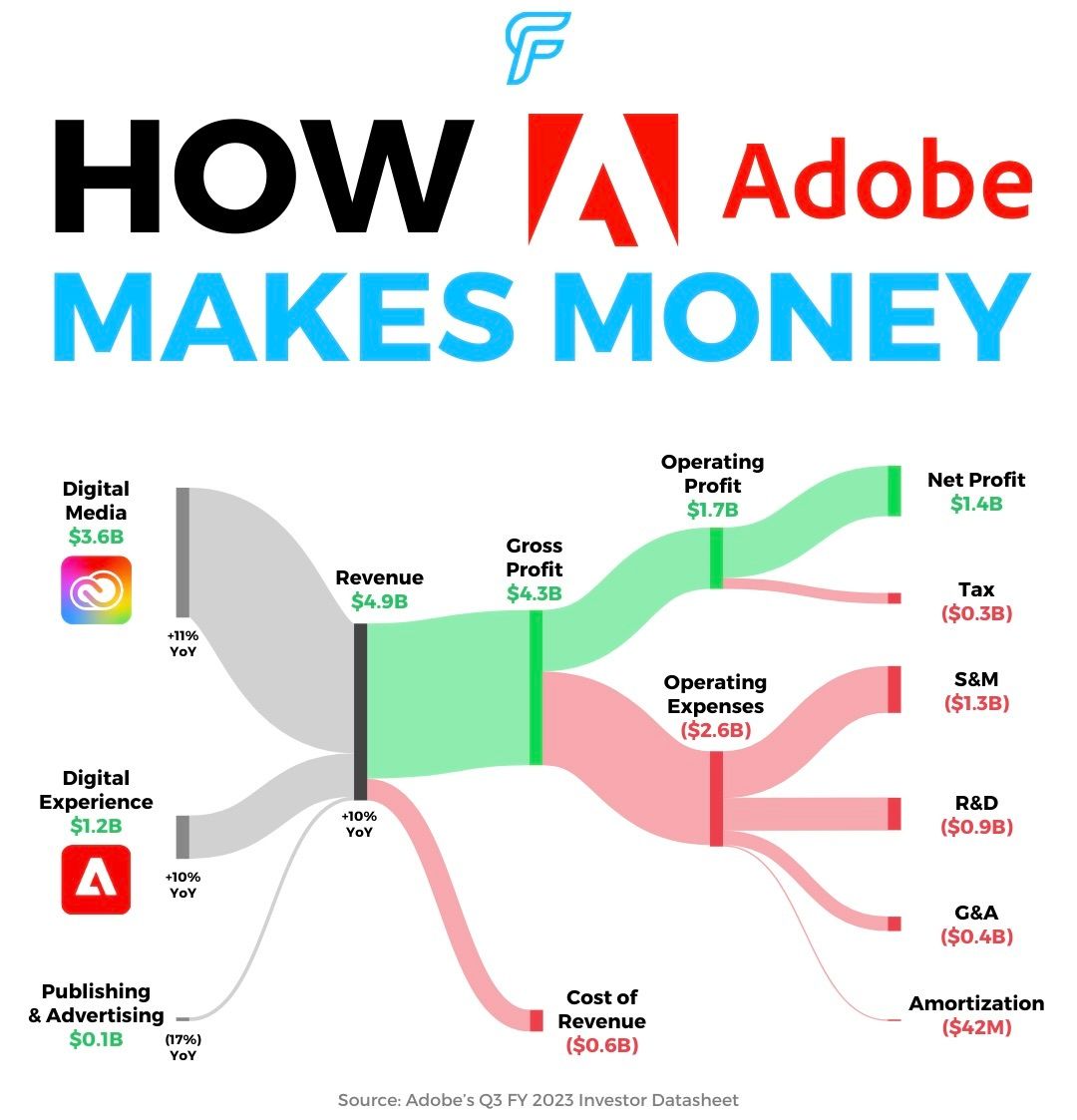

🎨 Adobe’s Earnings

Adobe reported slightly better earnings than expected, with Q3 revenue of $4.9B, a 10% increase from the previous year. This surpassed both the company's guidance and the Street's forecast. The company's Digital Media segment saw an 11% revenue increase, while the Digital Experience segment grew by 10%.

This week, Adobe launched a new AI-powered Creative Cloud release, integrating generative AI capabilities into apps like Photoshop and Illustrator. This release also introduces Adobe Express Premium and the Adobe Firefly web application, enhancing user creativity with AI-driven features.

Adobe also announced a pricing update for Creative Cloud subscriptions, reflecting the added value of the new AI features, effective from November 1, 2023.

🔥 Inflation Rises. In August, inflation saw its largest monthly rise this year, with the CPI increasing by 0.6%, driven by higher energy prices and housing costs. Core inflation, which excludes food and energy, rose by 0.3%. [CNBC]

🍎 New Apple Products. Apple $AAPL introduced the iPhone 15 series, new Apple Watches with innovative features, and emphasized sustainability, with the iPhone 15 maintaining most of its pricing except for the Max variant. [YF]

🚙 More F-150s. Ford $F plans to double its hybrid F-150 production despite slower electric vehicle sales, aiming for the hybrid model to constitute about 20% of U.S. sales in 2024. [CNBC]

👟 Birkenstock IPO. Birkenstock has filed for an IPO on the NYSE, potentially valuing the company at over $8B, following its significant growth in recent years. [F]

👨💼 BP CEO Resigns. BP's CEO, Bernard Looney, has resigned over incomplete disclosures about past relationships with colleagues, with CFO Murray Auchincloss stepping in temporarily. [ABC]

🚧 Citi Restructure. Citigroup $C is undergoing a major reorganization, removing a management layer and expecting job cuts, to simplify operations and give CEO Jane Fraser more direct oversight. [R]

Notable Companies Reporting Earnings Next Week:

Tuesday:

AutoZone ($AZO), CoPart ($CPRT)

Wednesday:

FedEx ($FDX), General Mills ($GIS)

Thursday:

Darden ($DRI), FactSet ($FDS)

All of the companies that are reporting earnings this week can be viewed here.

Major Trades Published 9/11 - 9/14

Buys

Asana ($ASAN)

Insider: Dustin Moskovitz

# of Shares Purchased: 80,000

$ Amount: $1,631,200

SEC Forms: [1]

Sells

Nvidia ($NVDA)

Airbnb ($ABNB)

Insider: Brian Chesky (CEO)

# of Shares Sold: 150,000

$ Amount: $22,509,300

SEC Forms: [1]

Automatic Data Processing ($ADP)

Insider: Carlos Rodriguez (Executive Chair)

# of Shares Sold: 52,254

$ Amount: $12,955,404

SEC Forms: [1]

Doordash ($DASH)

Insider: Tony Xu (CEO)

# of Shares Sold: 132,300

$ Amount: $11,025,357

SEC Forms: [1]

How was today's newsletter?

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.