Happy Sunday!

The past few weeks have been chaotic.

Between headlines, market swings, and nonstop noise, I’ve been doing my best to separate signal from it all and send you only what actually matters.

If you've found Carbon Finance helpful, here’s one small ask:

Share it with a friend who cares about investing.

We’re just shy of a major milestone, 30,000 subscribers, and every referral gets us closer.

Here’s your unique referral code to copy and share:

As a thank you, you’ll get a free 2025 Dividend Kings List sent straight to your inbox when they sign up.

Thanks again for being part of this, I wouldn’t be here without your support.

Let’s keep cutting through the noise together.

Some key data bites from this week that you should know:

JPMorgan raised recession risk odds to 60%.

Tesla delivered 337K vehicles in Q1, below 408K estimated.

US economy added 228K jobs in March, above 140K estimate.

US unemployment rate increased to 4.2%, above 4.1% forecast.

US employers cut 275,240 jobs in March.

Republicans are considering new tax bracket for $1M earners.

Apple has been fined $162M by France’s antitrust regulator.

Chipotle used 132M pounds of avocados in 2024.

Circle filed for IPO, targeting up to a $5B valuation.

Chinese companies placed $16B in Nvidia H20 chip orders in Q1 2025.

RH said they are facing the worst housing market in almost 50 years.

ChatGPT users generated over 700M images since last week.

EU is preparing to fine Elon Musk’s X more than $1B.

In today’s newsletter:

📈 OpenAI Hits $300B Valuation

💰 World’s Richest Billionaires

📉 Trump’s 1st Term vs 2nd Term

🧸 Magnificent 7 Bear Market

💵 Popular Stocks & Forward PE

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Together With RYSE

Big Tech Has Spent Billions Acquiring AI Smart Home Startups

The pattern is clear: when innovative companies successfully integrate AI into everyday products, tech giants pay billions to acquire them.

Google paid $3.2B for Nest.

Amazon spent $1.2B on Ring.

Generac spent $770M on EcoBee.

Now, a new AI-powered smart home company is following their exact path to acquisition—but is still available to everyday investors at just $1.90 per share.

With proprietary technology that connects window coverings to all major AI ecosystems, this startup has achieved what big tech wants most: seamless AI integration into daily home life.

Over 10 patents, 200% year-over-year growth, and a forecast to 5x revenue this year — this company is moving fast to seize the smart home opportunity.

The acquisition pattern is predictable. The opportunity to get in before it happens is not.

Past performance is not indicative of future results. Email may contain forward-looking statements. See US Offering for details. Informational purposes only.

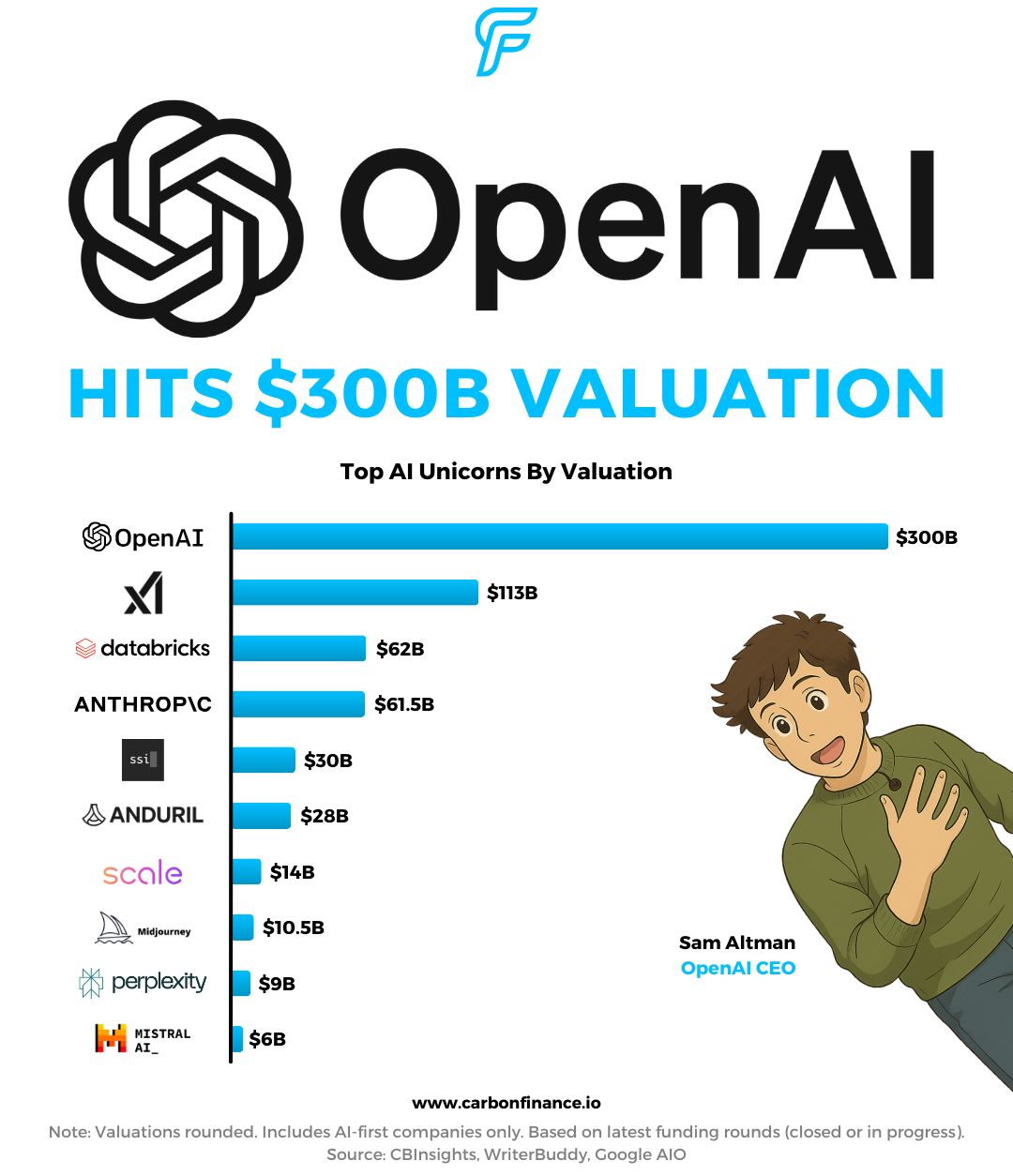

It gets lonely at the top. Just ask OpenAI.

The company has officially closed a $40B funding round led by SoftBank, marking the largest private tech raise in history.

That puts OpenAI at a $300B valuation, making it the third most valuable unicorn behind SpaceX and ByteDance.

If public, it would rank among the 30 largest companies in the world.

The company’s latest version has been so popular, that Sam Altman said new releases would be delayed due to GPU capacity challenges.

Nonetheless, OpenAI now stands far ahead of other AI unicorns.

The next closest is Elon Musk’s xAI, which recently merged with X at a combined valuation of $113B.

The world’s billionaire count just hit a record high.

Forbes released its annual list this week, revealing 3,028 billionaires globally.

Back in 1987, the list featured just 140.

Collectively, today’s billionaires are worth $16.1T in total, nearly $2T more than last year.

The United States leads the way with 902 billionaires, followed by China with 516 and India with 205.

Eight of the top ten richest individuals are from the U.S., with France’s Bernard Arnault and Spain’s Amancio Ortega rounding out the list.

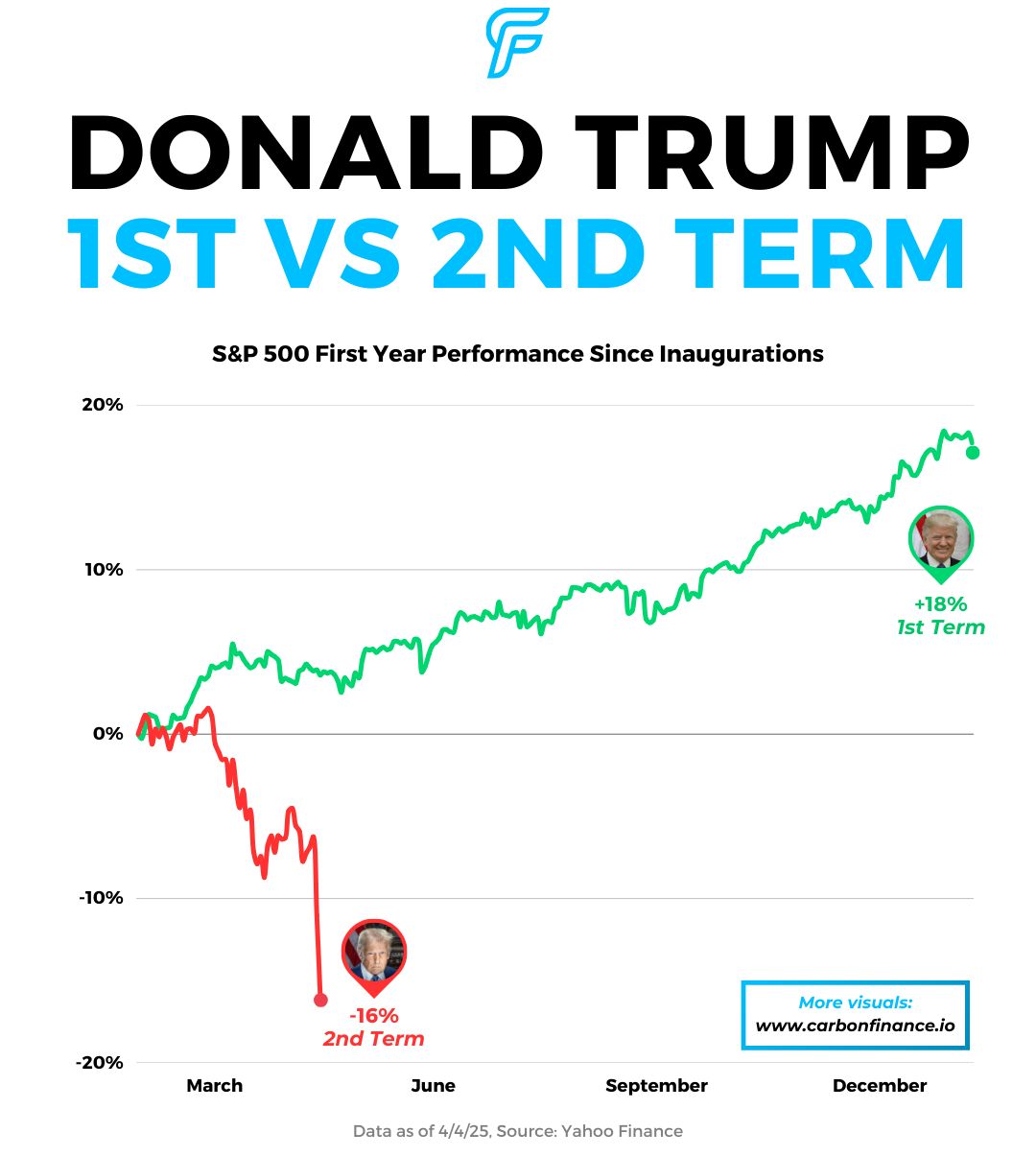

Liberation Day arrived this week.

On Wednesday, President Trump announced a universal 10% tariff on all imports.

Additional reciprocal tariffs were introduced, varying by country based on the size of the U.S. trade deficit with each one.

The new policies pushed the effective tariff rate above levels last seen during the Great Depression.

The announcement caught markets off guard, with tariffs far exceeding even worst-case expectations, sending indices sharply lower.

Companies with heavy exposure to countries facing the steepest tariffs, such as China and Vietnam, were hit the hardest.

These included notable names like Apple, Walmart, Target, Nike, and Lululemon.

President Trump reasserted the use of tariffs to rebalance trade and bring manufacturing jobs back domestically.

The universal 10% tariff took effect April 5th, with reciprocal tariffs starting on April 9th.

The rhetoric began to shift slightly on Thursday, when Trump signaled a willingness to negotiate if “phenomenal offers” were made.

Then on Friday, China escalated tensions, matching the 34% U.S. tariff on Chinese goods with a 34% tariff on U.S. imports.

They also added 11 American companies to a list of unreliable entities, effectively barring them from doing business in China.

But there was a glimmer of hope for bulls late Friday.

Trump shared that Vietnam’s leader expressed interest in cutting tariffs to zero, which sent shares of Nike, ON Holding, Lululemon, and others higher on the news.

Some of the biggest names that helped drive markets higher over the last few years are now leading the decline.

On Thursday alone, the Magnificent 7 lost a staggering $1.03T in collective market cap.

All seven have now entered a technical bear market, each down over 20% from their 52-week highs.

Tesla has been hit the hardest, down 51%, while Microsoft has held up best with a 23% decline.

Despite the selloff, retail traders are buying the dip.

JPMorgan reported $4.7B in retail stock purchases on Thursday, the highest in a decade.

Buyers piled into names like Nvidia, while pulling back on Tesla.

In an interview released Friday, Treasury Secretary Scott Bessent commented on the selloff, saying, “What’s happening with the market, I’d say it’s more of a Mag 7 problem, not a MAGA problem.”

As we’ve seen, plenty of popular names have taken sizable hits this week.

But just because something drops doesn’t mean it’s cheap.

The S&P 500 is down roughly 17% from its peak, yet its forward P/E still sits at roughly 19x.

Meanwhile, the S&P 500’s historical mean PE ratio hovers around 16x.

To revert to that long-term average, the index would need to fall another 16%.

So while the index looks expensive, how do individual stocks compare?

As always, some names are trading below the market’s valuation.

Others, despite sharp drops, still sit well above it.

Even comparing individual names to each other can yield surprising results.

Nvidia, often labeled overvalued, actually trades at a lower forward P/E than Walmart, Netflix, and Chipotle.

Forward P/E isn’t everything, but it’s a useful lens for comparing expectations and spotting disconnects, especially when factoring in future growth.

📣 Presented By RYSE

Apple Is Coming for the Smart Home — And Fast

Apple’s rumored Face-ID door lock and smart display hub are more than just new products. It’s a clear signal: they’re going all-in on smart home automation.

The tech giant is doubling down on the smart home, the $158B industry that’s growing 23% annually.

And with Apple’s entry, investors are looking for the next breakout company - and potential acquisition target.

They’re chasing Google (acquired Nest, $3.2B) and Amazon (acquired Ring, $1.2B).

History shows: when Apple plays catch-up, they go big.

And there’s one startup perfectly positioned to benefit.

With 10+ patents, distribution in over 100 Best Buy stores, and a Home Depot launch in 2025, RYSE is built for a breakout.

Early investors in Ring and Nest saw life-changing returns.

Now, RYSE is open at just $1.90/share.

Past performance is not indicative of future results. Email may contain forward-looking statements. See US Offering for details. Informational purposes only.

💨 Court Escape. Zuckerberg is lobbying Trump to help Meta avoid an antitrust trial - WSJ

🏭 Infra Freeze. Microsoft is continuing to pull back or halt data center projects around the world - BB

💾 Chip Partnership. Intel and TSMC have agreed to form a chipmaking joint venture in US - R

💵 Reserve Risk. BlackRock’s Larry Fink said rising U.S. debt could jeopardize the dollar’s reserve currency role - YF

❤️ Flirt Bot. Tinder has released an AI chatbot to increase engagement - TNDR

🇨🇳 Investment Block. China is restricting companies from investing in US - BB

📚 Recommended Reading

The Daily Recap isn’t just your average daily investing newsletter.

It provides fast, accurate, consistent, and reliable market updates delivered daily right after the bell.

Trusted by over 750K followers across social media, my friend Evan is a trusted news source and makes staying informed effortless.

The best part? It’s completely free. Sign up now👇

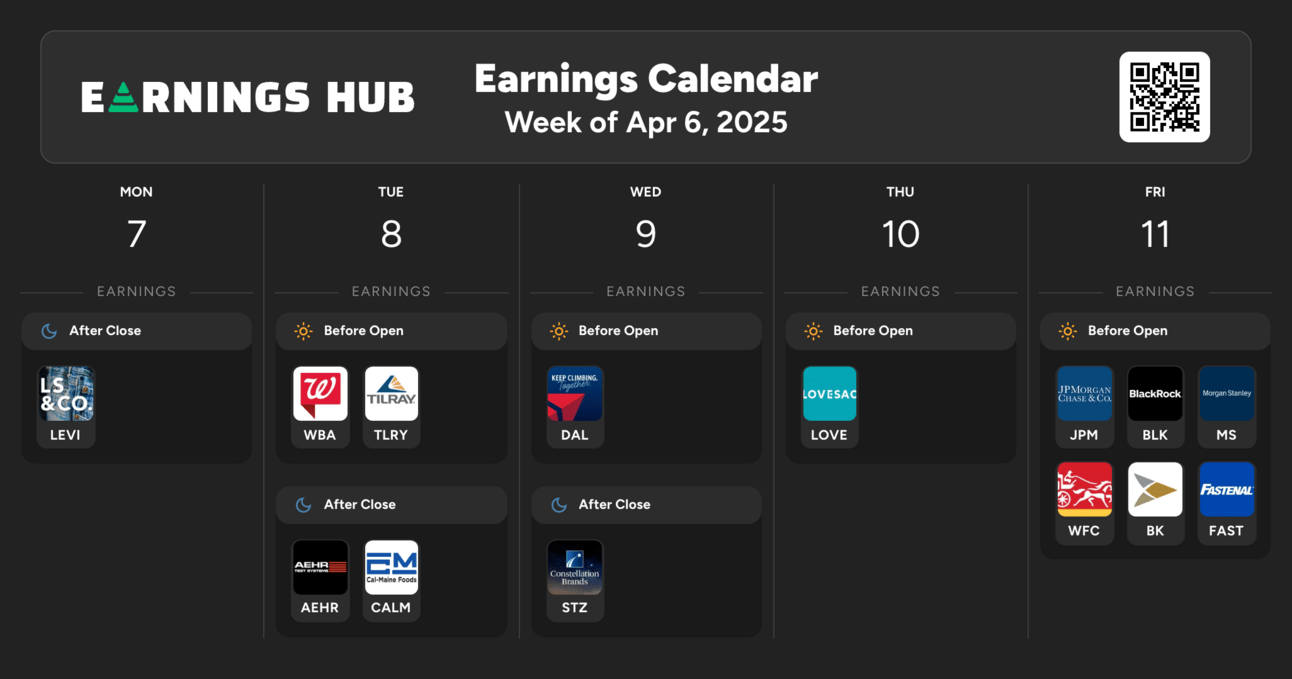

Courtesy of our paid partner, EarningsHub.

Notable Companies Reporting Earnings Week of April 6th, 2025:

I use EarningsHub to track earnings, estimates, and receive AI summaries of investor calls.

If you’d like an all-in-one earnings tool and see all other companies reporting, I definitely recommend you check it out!

Major Trades Published 3/30 - 4/5. Trades may be those of family members. [Source: 2iQ]

Buys

Dave McCormick (R)

Company: Bitwise Bitcoin ETF ($BITB)

Amount Purchased: $260K - $600K

April Delaney (D)

Company: Markel Corp ($MKL)

Amount Purchased: $17K - $80K

Debbie Dingell (D)

Company: Walmart ($WMT)

Amount Purchased: $15K - $50K

Sells

Dave McCormick (R)

Company: The Goldman Sachs Group ($GS)

Amount Sold: $1M - $5M

Company: Paramount Global ($PARA)

Amount Sold: $250K - $500K

Vincente Gonzalez (D)

Company: Tesla ($TSLA)

Amount Sold: $100K - $250K

Major Trades Published 3/30 - 4/5

Buys

Edgewise Therapeutics ($EWTX)

Insider: Peter Thompson (Director)

# of Shares Purchased: 496,771

$ Amount: $10,000,000

SEC Forms: [1]

Asana ($ASAN)

Insider: Dustin Moskovitz (President, CEO, & Chair)

# of Shares Purchased: 225,000

$ Amount: $3,242,250

SEC Forms: [1]

Petco Health and Wellness ($WOOF)

Insider: Joel Anderson (CEO)

# of Shares Purchased: 849,541

$ Amount: $2,574,109

SEC Forms: [1]

Sells

Palo Alto Networks ($PANW)

Insider: Nikesh Arora (CEO)

# of Shares Sold: 788,396

$ Amount: $133,328,070

SEC Forms: [1]

Robinhood ($HOOD)

Insider: Vladimir Tenev ($CEO)

# of Shares Sold: 750,000

$ Amount: $31,468,775

SEC Forms: [1]

Apple ($AAPL)

Insider: Timothy Cook ($CEO)

# of Shares Sold: 108,136

$ Amount: $24,184,658

SEC Forms: [1]

How was today's newsletter?

🤝 Review of the Week

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.