- Carbon Finance

- Posts

- 📊 Best Investors In Congress

📊 Best Investors In Congress

1) World’s Largest Oil Reserves 2) Top 10 Hedge Funds 3) Google Jumps Past Apple and more!

Happy Sunday!

This week, President Trump announced a heap of policy announcements.

On Wednesday, he proposed banning large institutional investors, such as Blackstone, from purchasing single-family homes.

That same day, he signed an executive order barring defense contractors from paying dividends or buying back shares until they accelerate production and increase upfront investment in plants and equipment.

Defense stocks initially fell on the news, but later rebounded after Trump proposed raising the 2027 defense budget to $1.5T, nearly 70% higher than the 2026 allocation.

On Thursday, he directed the federal government to purchase $200B in mortgage-backed securities with the goal of lowering mortgage rates and monthly payments for homebuyers.

Then on Friday night, he called for a one-year cap of 10% on credit card interest rates, citing concerns that consumers are being overcharged with rates that often range from 20% to 30%.

These announcements come as midterm elections approach, with Trump warning that a Republican loss could lead to renewed impeachment efforts.

Key Data Bites From This Week:

Birinyi President only sees 3 buyable U.S. stocks in early 2026.

BofA believes these 5 tech stocks benefit most from next AI wave.

Trump’s tax cuts are estimated to return up to $100B to Americans.

Activists launched 255 attacks on global companies in 2025.

JPMorgan CEO Jamie Dimon made $770M last year.

U.S. trade deficit fell to 16-year low.

Anthropic is raising $10B at a $350B valuation.

Strategy posted a $17B unrealized loss in Q4 as Bitcoin fell.

Goldman Sachs advised on $1.5T in deals last year.

Taiwan Semi reported a 20% YoY increase in December revenue.

General Motors will take a $6B hit on EV pullback.

Rio Tinto and Glencore have restarted talks to create $200B mining giant.

Google Co-Founder Larry Page spent $173M on two Miami homes.

In today’s newsletter:

🛢️ World’s Largest Oil Reserves

💰 OpenAI’s $1.5M Compensation

🏛️ Best Investors In Congress

📈 Top 10 Hedge Funds

👟 Google Jumps Past Apple

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Together With The Investor’s Edge

Investing isn’t about reacting faster.

It’s about understanding what actually matters, and recognizing it before it becomes obvious.

The Stock Investor’s Edge helps you cut through the noise with deep research, clearly explained investment and options ideas, and ongoing market context.

If you want to make calmer, more confident decisions grounded in research and process, this community is built for you.

Venezuela is sitting on liquid gold.

According to OPEC data at the end of 2024, the country has the largest proven oil reserves in the world with 303B.

For context, the United States holds the 10th largest oil supply globally.

Many of the largest reserves remain concentrated among OPEC members in the Middle East, where oil is cheaper and easier to extract.

Following a military operation that captured President Nicolás Maduro last Saturday, President Trump announced that the U.S. would take control of Venezuela’s oil reserves.

On Tuesday, Trump said interim authorities in Venezuela would turn over up to 50M barrels of oil to the United States, with proceeds controlled by him.

Subsequently, Trump announced on Friday that oil companies will spend $100B to rebuild Venezuela’s energy sector with U.S. protection following a meeting with key executives from Exxon, Chevron, and others.

OpenAI is setting a historic pay record.

According to data compiled by the Wall Street Journal, employees receive about $1.5M each in stock compensation, on average, across a 4,000-person workforce.

That’s 7x higher than Google before its IPO and 34x the average of other major tech companies before going public, in inflation-adjusted terms.

OpenAI’s total compensation as a percentage of revenue is expected to reach nearly 50% in 2025.

The reason? An intense AI talent race.

To keep top researchers, equity payouts are surging as pressure mounts from competing firms like Meta Platforms.

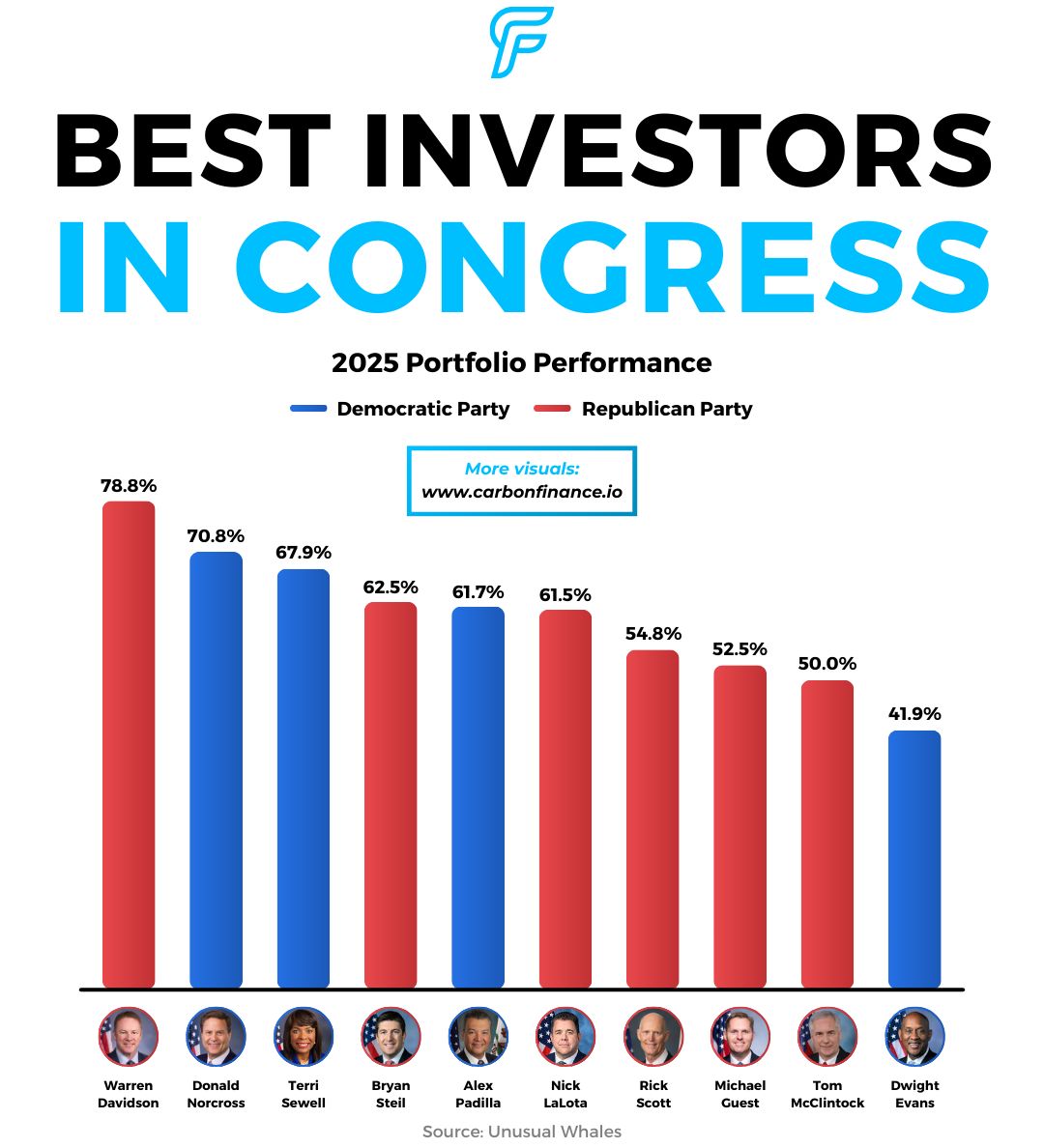

Many members of Congress once again outperformed the market.

According to research compiled by Unusual Whales, several lawmakers posted returns above the S&P 500 in 2025.

Republican Warren Davidson led the group with a 79% return, followed by Democrats Donald Norcross and Terri Sewell at 71% and 68%, respectively.

Notably, Davidson reported zero active trades during the year.

Among the top ten performers, six were Republicans and four were Democrats.

On average, Republicans posted returns of 17.3% in 2025.

That compares with 16.8% for the S&P 500 and 14.4% for Democrats.

Hedge funds delivered a comeback year in 2025.

Globally, hedge funds returned an average of 16%, up from 8% in 2024, and broadly in line with overall market performance.

But results were far from uniform.

Several large multi-manager funds posted standout gains.

According to data compiled by Reuters, Sachem Head Capital Management led the industry with a return of nearly 41%.

Ray Dalio’s Bridgewater Associates placed four separate funds in the top ten, with its Asia fund delivering the strongest performance among them.

Returns also varied significantly by region.

Asian hedge funds led the way with an average return of 24% in 2025.

Funds based in Europe, the Middle East, and Africa followed with 16% returns.

U.S. hedge funds trailed, posting an average gain of 12%, despite representing the largest share of the industry.

Bank of America noted that hedge fund assets reached all-time highs this year, supported by continued net inflows.

There’s a new silver medalist in the world.

This week, Google’s parent company Alphabet surpassed Apple in market capitalization for the first time since 2019.

The jump reflects growing investor confidence that Alphabet has emerged as one of the strongest leaders in the AI race, supported by deep vertical integration across its products.

Alphabet was also the best-performing stock in the Magnificent 7 in 2025, delivering a 65% return.

Now ahead of Alphabet sits only Nvidia, with a market capitalization of roughly $4.5T.

In related news, Google announced Thursday that Gmail’s user base sat at a whopping 3 billion users.

The company said Gemini AI features would be integrated into the email platform to further expand capabilities.

📣 Presented by Masterworks

3 Tricks Billionaires Use to Help Protect Wealth Through Shaky Markets

“If I hear bad news about the stock market one more time, I’m gonna be sick.”

We get it. Investors are rattled, costs keep rising, and the world keeps getting weirder.

So, who’s better at handling their money than the uber-rich?

Have 3 long-term investing tips UBS (Swiss bank) shared for shaky times:

Hold extra cash for expenses and buying cheap if markets fall.

Diversify outside stocks (Gold, real estate, etc.).

Hold a slice of wealth in alternatives that tend not to move with equities.

The catch? Most alternatives aren’t open to everyday investors

That’s why Masterworks exists: 70,000+ members invest in shares of something that’s appreciated more overall than the S&P 500 over 30 years without moving in lockstep with it.*

Contemporary and post war art by legends like Banksy, Basquiat, and more.

Sounds crazy, but it’s real. One way to help reclaim control this week:

*Past performance is not indicative of future returns. Investing involves risk. Reg A disclosures: masterworks.com/cd

💾 Next-Gen Compute↗ - Nvidia announced the launch of its next-generation Vera Rubin superchip at CES 2026.

🇬🇱 Arctic Ambition↗ - Secretary of State Marco Rubio has told lawmakers that Trump aims to buy Greenland.

🇸🇦 Open Markets↗ - Saudi Arabia plans to open its financial markets to all foreign investors in February.

💬 IPO Whisper↗ - Discord has filed confidentially to go public.

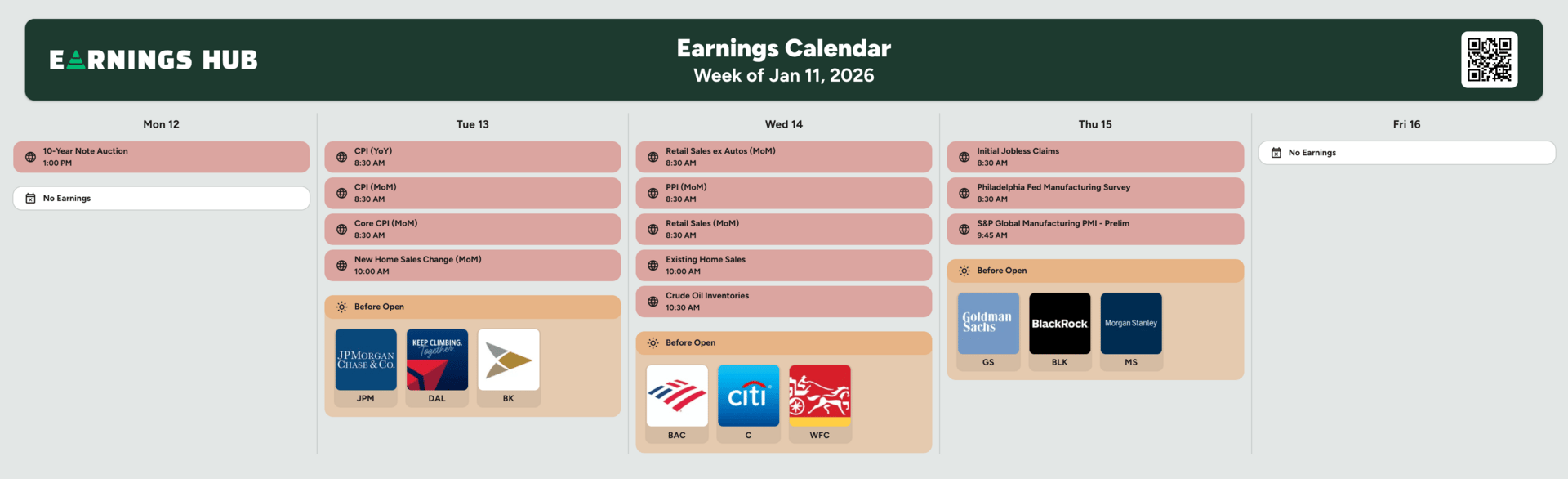

Courtesy of our affiliate partner, EarningsHub.

Notable Companies Reporting Earnings Week of January 11th, 2025:

Major Trades Published 1/5 - 1/9. Trades may be those of family members. [Source: Capitol Trades]

Buys

Jonathan Jackson (D)

Company: Shopify ($SHOP)

Amount Purchased: $50K - $100K

Sells

John Hickenlooper (D)

Company: Formula One Group ($FWONK)

Amount Sold: $65K - $150K

Jonathan Jackson (D)

Company: Netflix ($NFLX)

Amount Sold: $50K - $100K

Major Trades Published 1/5 - 1/9

Buys

Sells

Rocket Lab Corp ($RKLB)

Insider: Adam Spice (CFO)

# of Shares Sold: 1,365,665

$ Amount: $103,112,280

SEC Forms: [1]

Affirm Holdings ($SNAP)

Insider: Max Levchin (CEO)

# of Shares Sold: 666,666

$ Amount: $53,747,814

SEC Forms: [1]

Michael Wirth ($CVX)

Insider: Michael Wirth (CEO)

# of Shares Sold: 320,700

$ Amount: $52,271,978

SEC Forms: [1]

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

This newsletter is sponsored by The Investor’s Edge and Masterworks. Sponsorship does not influence our editorial content. We do not endorse the sponsor’s products, services, or views, and we are not responsible or liable for any interaction or transaction between readers and the sponsor.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Reply