Happy Sunday!

Despite a flood of negative headlines, the S&P 500 still ended the week up just under 1%.

The CNN Fear & Greed Index briefly dipped into extreme fear before closing the week in the fear zone.

Even with sentiment shaky, corporate dealmaking continues to heat up.

Salesforce pledged $15B toward San Francisco and lifted its 2030 revenue guidance to $60B, ahead of expectations.

This comes as shares are down 26% YTD and 6% over the past five years.

Meanwhile, Google is committing $15B to expand in India, while Novo Nordisk is strengthening its pipeline with a $2.1B biotech drug acquisition.

AI partnerships are also accelerating.

Brookfield recently joined forces with Bloom Energy on a $5B infrastructure deal and OpenAI partnering with Broadcom to deploy 10GW of custom AI accelerators.

Some key data bites from this week that you should know:

Barrons shared a list of the 12 best ‘buyback aristocrat' stocks.

Trump administration is looking to provide $40B in financing for Argentina.

Oracle Cloud will deploy 50,000 AMD AI chips starting in H2 2026.

U.S. has seized $15B of Bitcoin in ‘pig-butchering’ case.

AI stocks are in a bubble according to 54% of global fund managers.

Average U.S. new car prices crossed $50,000 for the first time.

General Motors will take a $1.6B hit due to slower EV adoption.

Apollo made a $64-per-share offer to take over Papa John’s.

Grindr is exploring a take private at a $3B valuation.

Nestle plans to cut 16,000 jobs, or 6% of its workforce.

AI cloud company Nscale is looking to IPO after $14B deal with Microsoft.

U.S. government shutdown could cost the economy $15B a week.

PayPal’s crypto partner accidentally minted $300T worth of stablecoins.

Harvard posted its biggest operating loss in 14 years.

Earnings & Financial Results:

J&J will spin off its orthopedics business which makes up 10% of total sales.

Bank of America saw investment banking fees surge 43%.

Morgan Stanley beat estimates by the widest margin in nearly 5 years.

Charles Schwab reported 25% higher trading revenue on strong volumes.

Interactive Brokers announced client stock trading volumes surged 67%.

American Express saw revenue from net card fees climb 18%.

Louis Vuitton Moët Hennessy posted a surprise 1% organic sales growth.

In today’s newsletter:

🍕 The Magic of Domino’s

🏦 Big Banks, Bigger Profits

📈 BlackRock Hits Yet Another Record

🖲️ ASML Runs On Asia

🏆 Gold Hits $30T

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Together With Deel

You found global talent. Now What?

Deel’s simplified a whole planet’s worth of information on global hiring. It’s time you got your hands on our international compliance handbook where you’ll learn about:

Attracting global talent

Labor laws to consider when hiring

Processing international payroll on time

Staying compliant with employment & tax laws abroad

With 150+ countries right at your fingertips, growing your team with Deel is easier than ever.

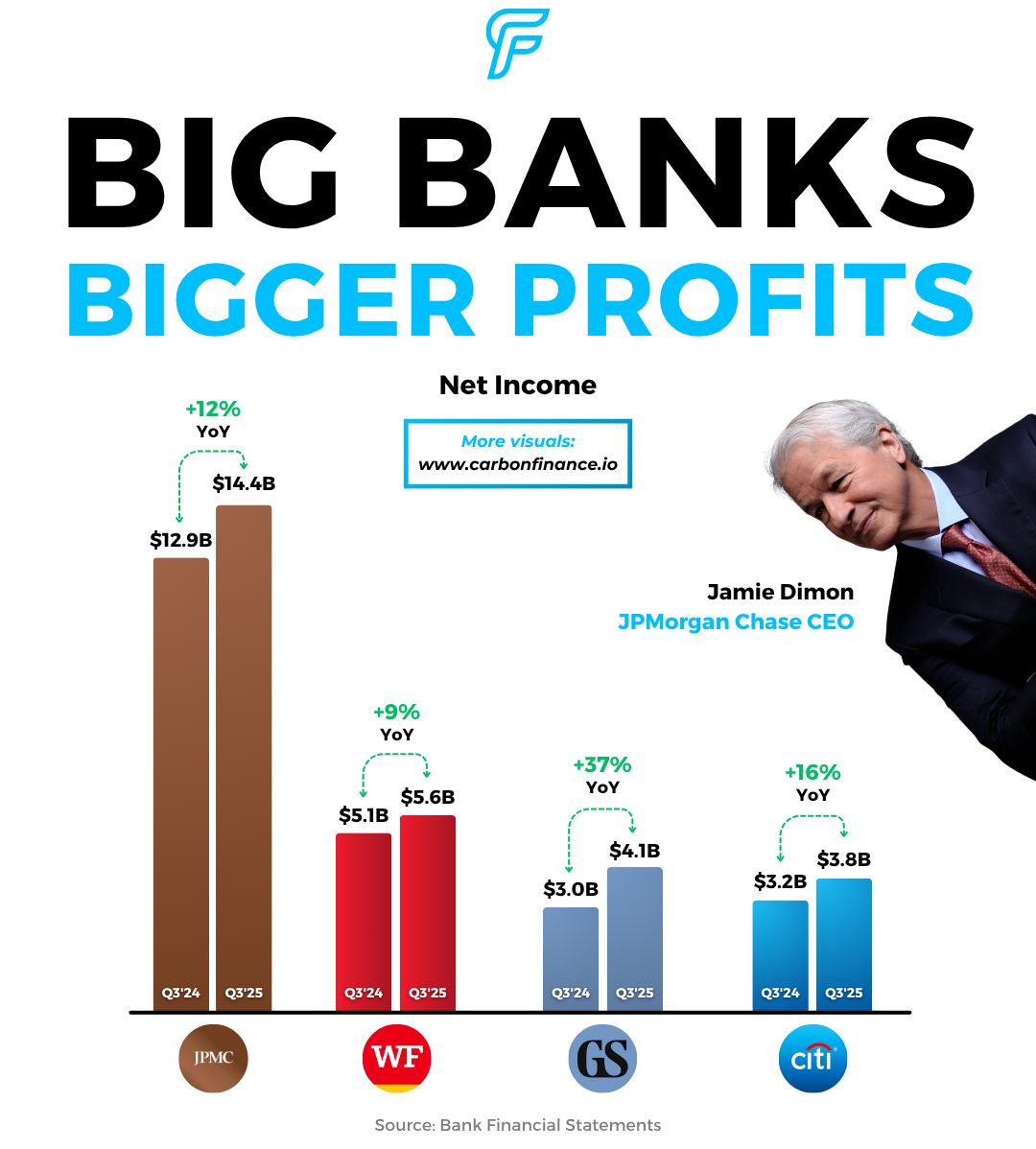

Big Banks kicked off earnings season this past week, and they didn’t disappoint.

EPS: $5.07 vs. $4.84 est.

Revenue: $47.1B vs. $45.4B est.

The world’s largest bank posted another strong quarter, with every major segment showing growth.

Investment banking fees rose 16% to $2.6B as M&A activity rebounded under looser regulatory conditions.

Trading revenue hit a third-quarter record of $8.9B, driven by 21% growth in fixed income and 33% in equities.

CEO Jamie Dimon said the U.S. economy remains resilient but warned of risks tied to tariffs, inflation, and geopolitics.

On Monday, JPMorgan also announced a $10B investment in U.S. industries critical to national security.

EPS: $1.66 vs. $1.55 est.

Revenue: $21.4B vs. $21.2B est.

Wells Fargo led the group in price action, with shares jumping 6% this week after the bank boosted its forecast thanks to regulators lifting its $1.95T asset cap in June.

The move allowed Wells to raise its profitability target, now guiding for an 18% ROTCE versus 15% prior.

Investment banking fees climbed 25% to a record $840M, while credit card and wealth management growth lifted non-interest income nearly 10%.

EPS: $12.25 vs. $11.02 est.

Revenue: $15.2B vs. $14.1B est.

Goldman delivered the biggest profit jump of all the big banks, with net income up 37% to $4.1B.

Growth was fueled by a 42% surge in investment banking revenue to $2.66B.

Separately, Goldman sent a memo to staff with plans for another round of job cuts this year to trim costs and expand its use of AI.

On Monday, it also agreed to acquire Industry Ventures, a $7B venture capital firm, to strengthen its alternatives investment platform.

EPS: $2.24 vs. $1.90 est.

Revenue: $22.09B vs. $21.09B est.

Citi reported a solid quarter, with every business segment delivering record revenue.

Banking rose 34%, markets 15%, and services 7%.

CEO Jane Fraser credited investments in digital assets and AI for driving stronger performance and innovation across the franchise.

Another quarter, another record for BlackRock.

The world’s largest asset manager reported Q3 assets under management of $13.5T, a new all-time high and a 17% increase YoY.

Adjusted EPS came in at $11.55, ahead of estimates, while revenue rose 25% to $6.5B, topping expectations.

CEO Larry Fink highlighted 10% annualized organic base fee growth and emphasized the firm’s broad-based momentum across its systematic franchise, private markets, digital assets, and iShares ETFs.

America can’t get enough of Domino’s.

While many fast-casual chains are struggling with declining same-store sales, Domino’s continues to thrive.

In Q3, the company reported EPS of $4.08, topping the $3.97 estimate, while revenue rose 6.2% to $1.15B, slightly above expectations.

As consumers prioritize value, Domino’s has leaned on its $9.99 pizza deal and new menu items to drive traffic.

U.S. same-store sales grew 5.2%, beating the 4% forecast and marking the fastest growth since Q1 2024.

Internationally, results were softer, with same-store sales up 1.7% versus expectations for 1.9%, as demand across certain markets remained uneven.

Since 2005, Domino’s has been one of the most successful capital allocation stories in the market.

Through strategic investments, financial engineering, and disciplined growth, the company has grown EPS at a 13% CAGR, rising from $2 to $17.

Over that same period, Domino’s has aggressively repurchased stock, cutting its share count by 50% in 20 years.

Demand for the world’s most advanced machines is booming.

ASML, the only company capable of making EUV lithography machines used for cutting-edge chips, reported €5.4B in new bookings in Q3, ahead of analyst expectations of €4.9B.

The company struck a cautiously optimistic tone after uncertainty last quarter, with CEO Christophe Fouquet saying 2026 sales will “not be below 2025.”

Q3 revenue came in slightly below forecasts at €7.5B, but net income beat expectations at €2.13B.

ASML remains caught in geopolitical crossfire, with U.S. export restrictions limiting what it can sell to China, one of its most important markets.

China accounted for nearly 50% of net system sales in Q3, followed by Taiwan at 30%.

During the earnings call, ASML noted that the company expects a significant decline in China sales for 2026, with levels returning to a more normalized business level.

All together, Asia makes up 94% of the company’s net system sales.

Shares are now up 47% this year, cementing ASML’s position as Europe’s most valuable company.

Gold keeps shining brighter.

The historic metal just hit a milestone, becoming the first asset in history to reach a $30T market cap.

This came after bullion prices climbed to a new record of $4,378 per ounce.

For perspective, gold’s total value now exceeds that of the next nine largest assets combined, which together are worth $25.9T.

It’s also worth nearly seven times Nvidia’s market cap.

Wall Street leaders continue to chime in.

JPMorgan CEO Jamie Dimon said this environment is one of the few times it’s “semi-rational” to hold gold, adding he could easily see it rise to $10,000 if conditions persist.

And it’s not just gold.

Silver recently broke a 45-year-old record, hitting a new all-time high for the first time since 1980.

📣 Together With Deel

Are Your IT Costs Scaling Too Fast?

IT costs scale fast without standards. Deel’s free IT Policy Template helps reduce unnecessary spend, enforce best practices, and support compliance globally. Download it now to take control of your IT operations.

🛒 Smart Commerce↗ - Walmart has partnered with OpenAI to create AI-first shopping experiences.

👙 Adult Allowance↗ - ChatGPT will allow a wider range of content, including erotica, for adult users.

🎙️ Video Podcasts↗ - Spotify is partnering with Netflix to bring video podcasts to the streaming platform.

🇪🇺 Tech Surrender↗ - The EU is considering requiring Chinese firms to share technology with European companies to maintain local operations.

📟 Data Alliance↗ - Snowflake and Palantir announce strategic partnership for enterprise-ready AI and analytics.

🇨🇳 Trade Bluff↗ - Chinese leader Xi Jinping believes Trump will fold and offer concessions rather than launch new tariffs.

Courtesy of our affiliate partner, EarningsHub.

Notable Companies Reporting Earnings Week of October 19th, 2025:

Major Trades Published 10/13 - 10/17. Trades may be those of family members. [Source: 2iQ]

Buys

Michael McCaul (R)

Company: Core & Main ($CNM)

Amount Purchased: $1.265M - $2.55M

Tim Moore (R)

Company: Hyster Yale ($HY)

Amount Purchased: $50K - $100K

Sells

Michael McCaul (R)

Company: nVent Electric ($NVT)

Amount Sold: $100K - $250K

Major Trades Published 10/13 - 10/17

Buys

Vivani Medical ($VANI)

Insider: Greg Williams (Director)

# of Shares Purchased: 1,737,764

$ Amount: $1,983,333

SEC Forms: [1]

Sells

Nvidia ($NVDA)

Insider: Jensen Huang (President and CEO)

# of Shares Sold: 225,000

$ Amount: $41,338,563

SEC Forms: [1]

Airbnb ($ABNB)

Insider: Joseph Gebbia (Director)

# of Shares Sold: 236,000

$ Amount: $28,137,090

SEC Forms: [1]

CoreWeave ($CRWV)

Insider: Brian Venturo (Chief Strategy Officer)

# of Shares Sold: 154,479

$ Amount: $21,390,060

SEC Forms: [1]

How was today's newsletter?

🤝 Review of the Week

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

This newsletter is sponsored by Deel. Sponsorship does not influence our editorial content. We do not endorse the sponsor’s products, services, or views, and we are not responsible or liable for any interaction or transaction between readers and the sponsor.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.