- Carbon Finance

- Posts

- 📊 Buffett’s New Acquisition

📊 Buffett’s New Acquisition

1) Tesla Sees Record Deliveries 2) OpenAI vs Exxon Mobil 3) Nike Breaks A Losing Streak and more!

Happy Sunday!

Last week, I shared the latest 13F visuals featuring the top positions of the world’s best investors.

For those who missed it, you can explore over 20 portfolios on my website.

It’s a great resource for idea generation and tracking how top investors allocate capital.

Check it out by clicking the button below!

Some key data bites from this week that you should know:

Bloomberg shared a list of the top 10 companies to track in Q4 2025.

Dan Ives presented his top 6 AI stocks he thinks could be acquired.

Apollo’s Chief Economist shared 12 charts that show the economy is strong.

Costco will sell Ozempic and Wegovy for half price at $499/month.

U.S. gold reserves crossed $1T for the first time.

CoreWeave signed a $14.2B long-term cloud deal with Meta.

U.S. will impose 100% tariff on movies made outside the country.

Emerging markets just logged their 9th straight monthly gain, the longest run in 21 years.

AI boom will require $7T in global investment.

BlackRock’s GIP is looking to acquire Aligned Data Centers for $40B.

Tom Lee sees the S&P 500 crossing 7,000 by year-end.

Snapchat will charge users for keeping over 5GB worth of memories.

Exxon Mobil will cut 2,000 jobs, about 4% of total workforce.

Private companies cut 32,000 jobs in September, biggest decline in 2.5 years.

In today’s newsletter:

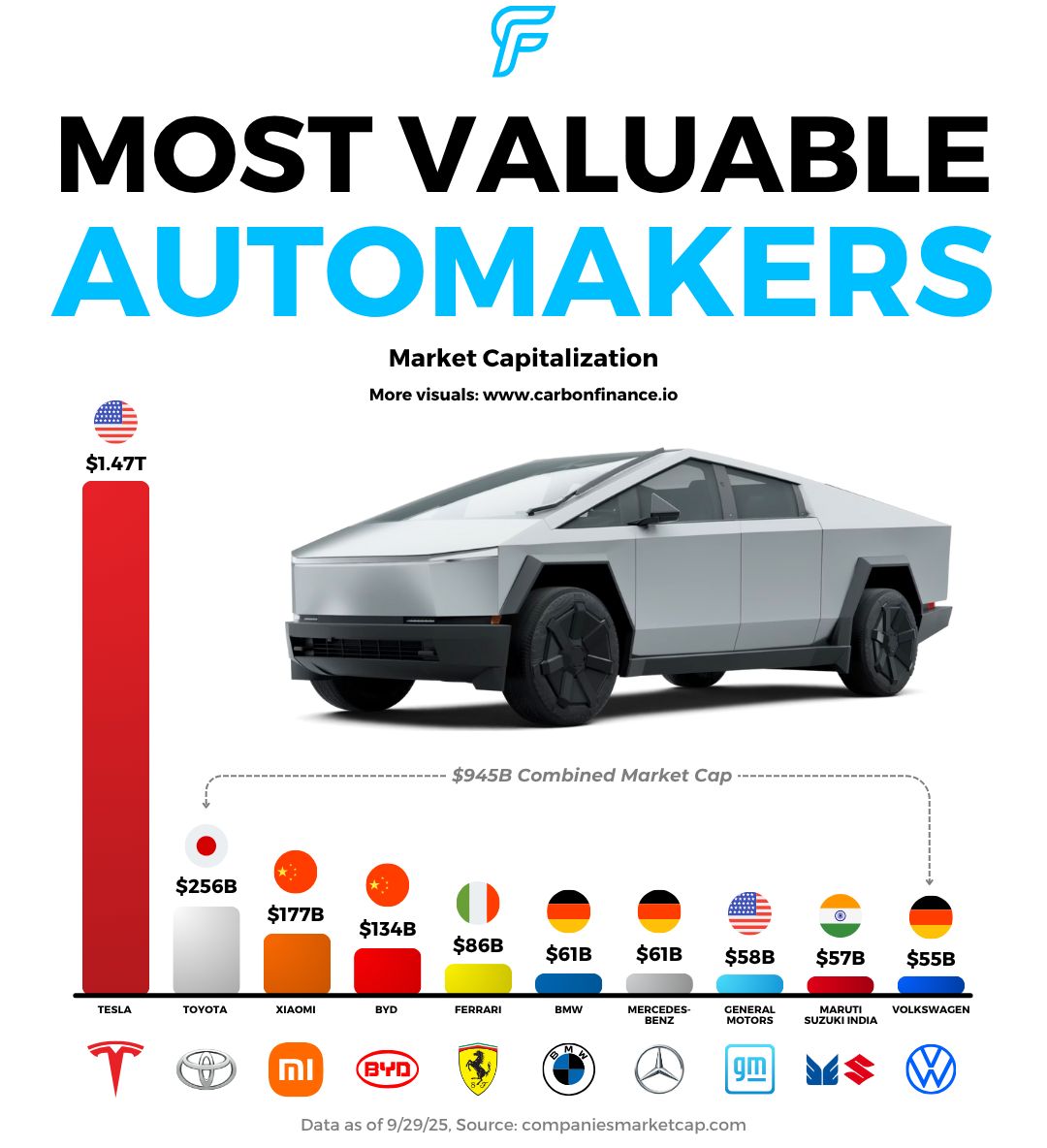

🚗 Most Valuable Automakers

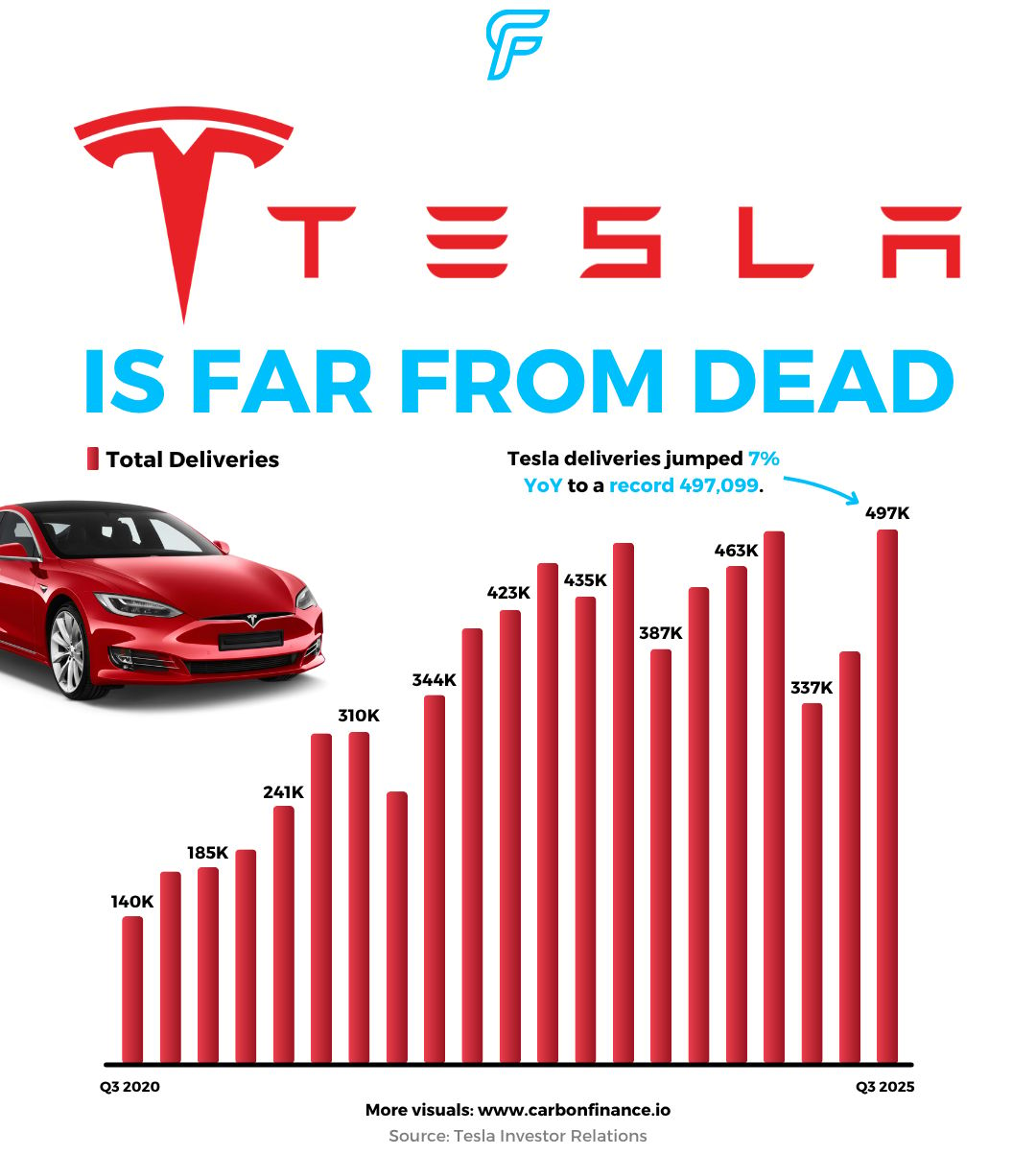

📈 Tesla Sees Record Deliveries

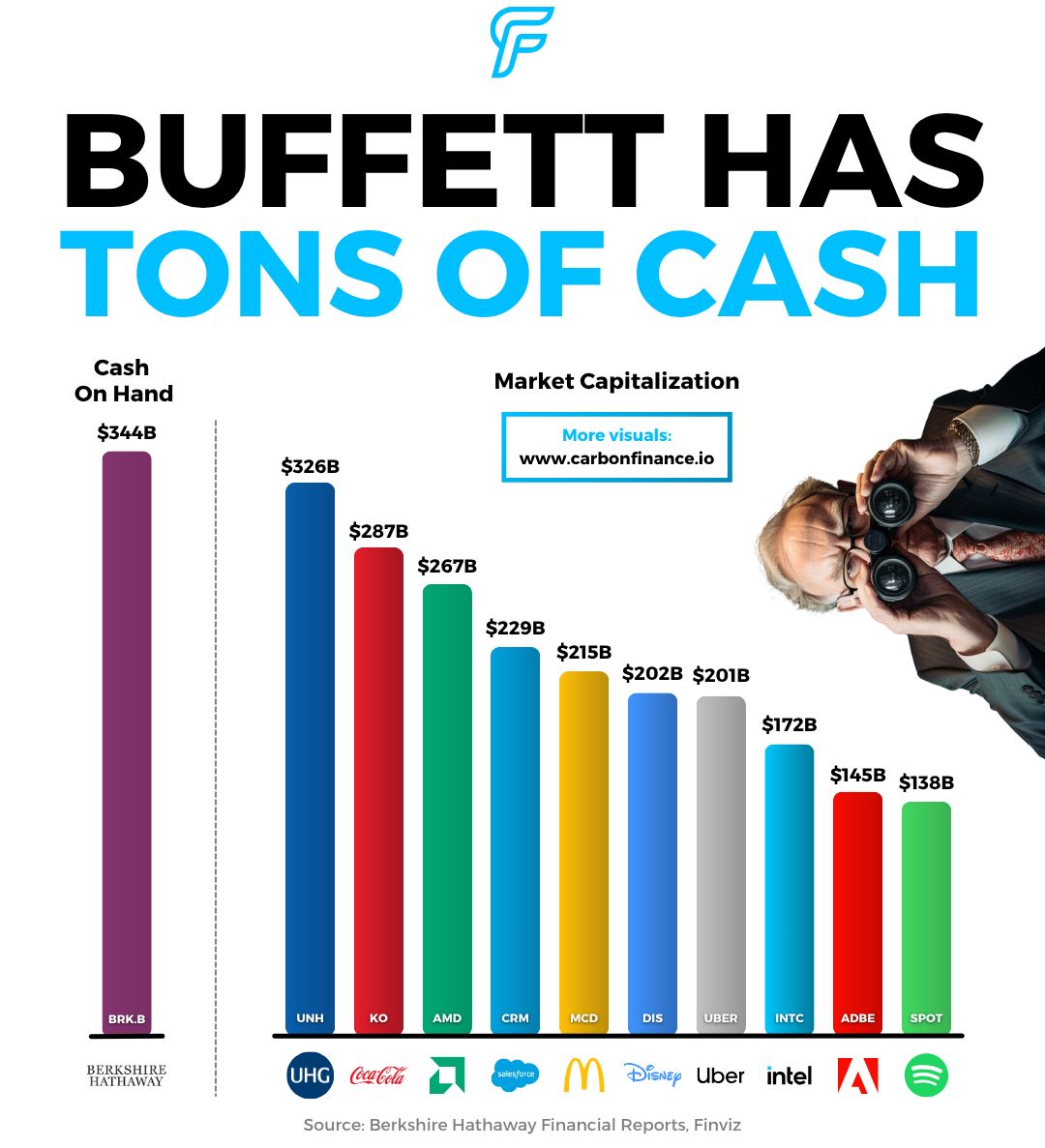

💰 Buffett’s New Acquisition

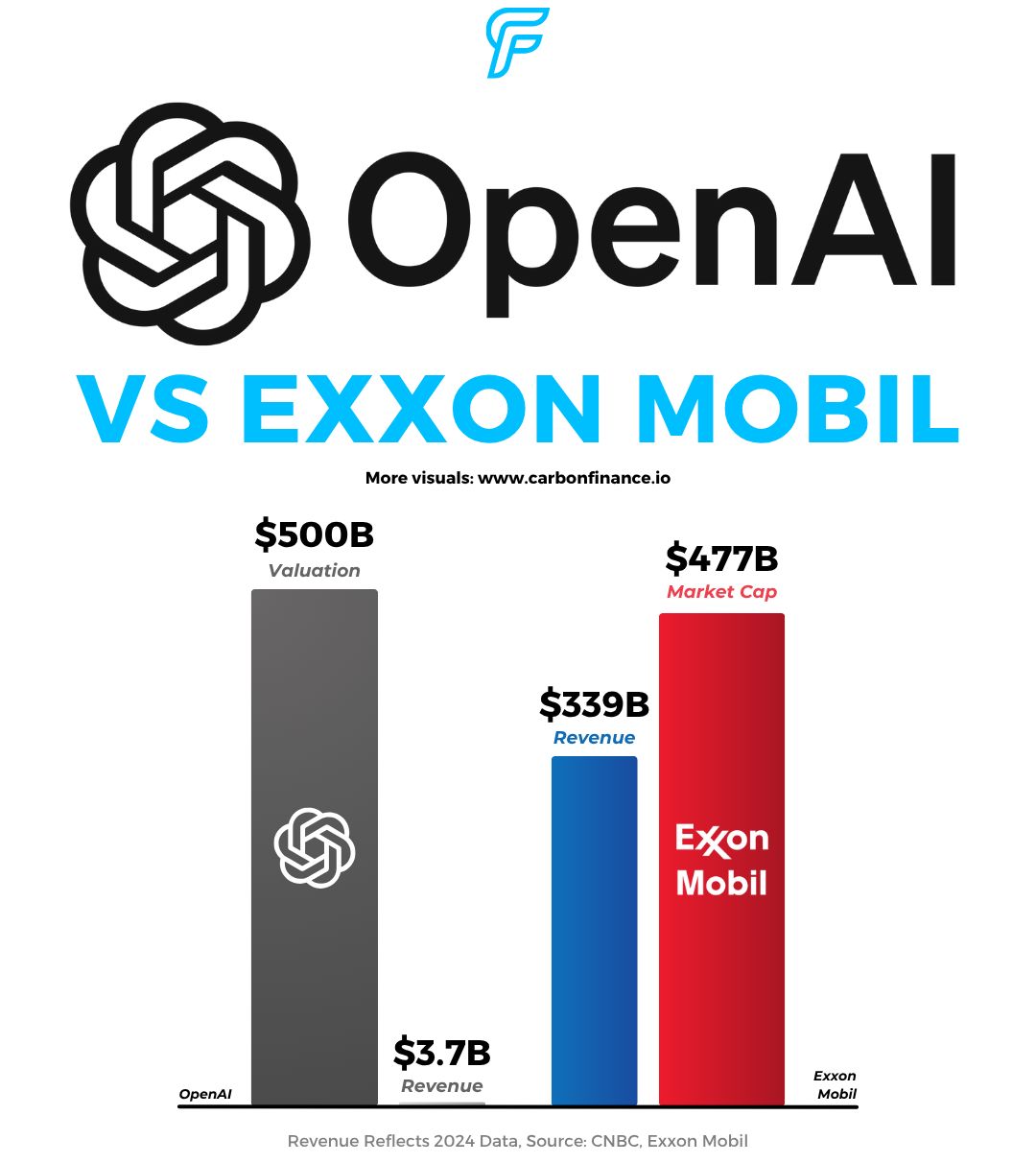

🥊 OpenAI vs Exxon Mobil

✔️ Nike Breaks A Losing Streak

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Together With Fisher Investments

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

EVs are taking a bigger share of the road.

According to Cox Automotive, electric vehicles are on track to make up a record 10% of new car sales in the U.S.

EV sales are expected to hit 410,000 in Q3, up more than 20% YoY.

Much of that growth came as buyers rushed to take advantage of the $7,500 federal tax credit before it expired at the end of September.

Tesla is the clear leader in the space, selling more EVs than the next four brands combined in the U.S., and worth more than the next nine automakers combined.

And thanks to Tesla’s rise, along with his other ventures, Elon Musk recently became the first person in history to reach a $500B net worth.

Naturally, Tesla, the world’s leading EV maker, was one of the biggest beneficiaries of the pre-expiration rush.

The company posted its biggest quarter ever, delivering 497,099 vehicles in Q3, a 7% YoY increase and well above the 447,600 estimate.

Ford also saw a boost in Q3, with sales climbing 8.2%, driven by strong truck demand and growing EV adoption.

Tesla’s record comes despite waning consumer demand in Europe, backlash against Elon Musk’s political activism, and rising competition across the EV space.

The company will release its full Q3 financial results on October 22nd.

Is this Warren Buffett’s last big deal?

On Thursday, Berkshire Hathaway announced plans to acquire Occidental Petroleum’s petrochemical unit, OxyChem, for $9.7B in cash.

It’s Buffett’s largest acquisition in three years, following Berkshire’s $11.6B purchase of insurer Alleghany in 2022.

With $344B in cash and equivalents as of Q2 2025, Berkshire still holds a massive war chest, larger than the market caps of companies like UnitedHealth Group, Coca-Cola, and AMD.

But this deal could mark the end of an era.

Buffett is set to step down as Berkshire’s CEO at the end of 2025, passing leadership to Greg Abel.

OpenAI continues to hit new milestones.

This past week, the company completed an employee stock sale valuing the firm at $500B, a nearly 70% jump from its prior $300B valuation earlier this year.

Current and former employees sold roughly $6.6B worth of shares to investors.

According to The Information, OpenAI generated $4.3B in revenue during the first half of 2025, already 16% higher than all of 2024.

However, the company also burned through $2.5B on R&D and infrastructure to support ChatGPT and model development.

Putting things into perspective: at a $500B valuation, OpenAI is now worth more than Exxon Mobil, even though Exxon generated 92x more revenue last year.

Investors are clearly betting that OpenAI’s growth story is only just beginning.

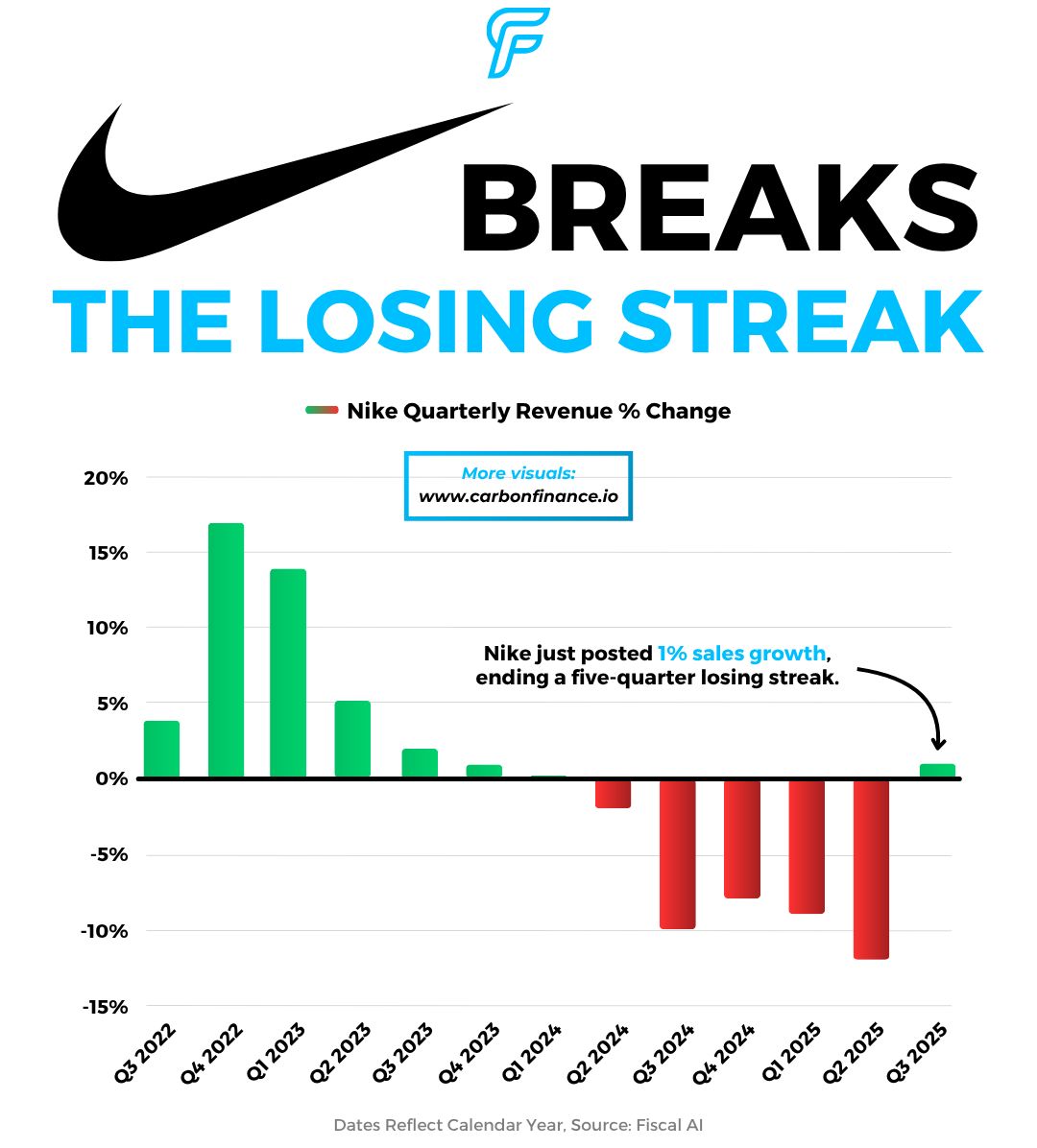

Is Nike turning a corner?

Nike is in the midst of a turnaround led by longtime company veteran and new CEO, Elliot Hill.

Sales grew 1% in the most recent quarter, reversing expectations for a mid–single digit decline, while both earnings and revenue topped estimates.

Earnings came in at $0.49 per share versus $0.27 expected, though still down 30% from last year.

Revenue reached $11.72B, beating forecasts of $11B.

Through Hill’s Win Now program, Nike highlighted progress in North America, Wholesale, and Running.

However, China remains a weak spot, with sales down 9%, showing the turnaround hasn’t reached every market yet.

Management said the recovery is underway but will take time and won’t be linear.

As Nike clears out old inventory, invests in new initiatives, and manages tariffs, profitability remains under pressure.

Looking ahead, Nike expects sales to fall by a low single digit percentage in the current holiday quarter.

📣 Presented by Wallstreet Prep

Get the Certificate That Opens Doors in Private Equity

Gain the skills top professionals use to analyze PE investment opportunities.

Over 8 weeks, learn directly from Wharton faculty and senior leaders at Carlyle, Blackstone, and KKR.

Join 5,000+ graduates worldwide, earn a respected certificate, and save $300 with code SAVE300 at checkout.

P.S. Save $200 more with early enrollment by January 12.

🇺🇸 Political Stalemate↗ - The U.S. government shutdown after Republicans and Democrats failed to get enough bipartisan support for their proposals.

⚠️ Market Warning↗ - Famous investor Leon Cooperman believes we’ve reached the stage of the bull market that Warren Buffett warned about.

💾 Foundry Deal↗ - Intel is in early talks to add AMD as a foundry customer.

💬 Chat Targeting↗ - Meta will be using people’s AI chats to personalize ads across its apps.

💊 Drug Deal↗ - Trump administration struck a deal with Pfizer to cut U.S. drug prices in exchange for tariff relief and new domestic investments.

🦾 Robo Catalyst↗ - Nvidia launched new open models and simulation libraries to accelerate robotics R&D.

🏹 Global Expansion↗ - Robinhood reached an all-time high after the company announced it would be expanding its prediction platform out of the U.S.

📲 Vision Feed↗ - OpenAI launched a new social app for AI-generated videos called Sora.

🚪 Trump Blocked↗ - Supreme Court refused to let President Trump oust Fed Governor Lisa Cook.

🎧 Founder Farewell↗ - Spotify announced founder and CEO Daniel Ek will step down beginning January 2026.

🤝 Checkout Partnerships↗ - OpenAI launched Instant Checkout, letting users buy single items from Etsy now, with Shopify support coming soon.

✈️ Sky Dominance↗ - Delta’s CEO expects most U.S. airlines to lose money, with Delta and United capturing the bulk of industry profits.

🇺🇸 Economic Acceleration↗ - Goldman’s CEO expects the U.S. economy to accelerate into 2026, driven by ongoing stimulus and tech investments.

🫧 Industrial Bubble↗ - Jeff Bezos said AI is in an “industrial bubble” but the technology is “real” and is going to change every industry.

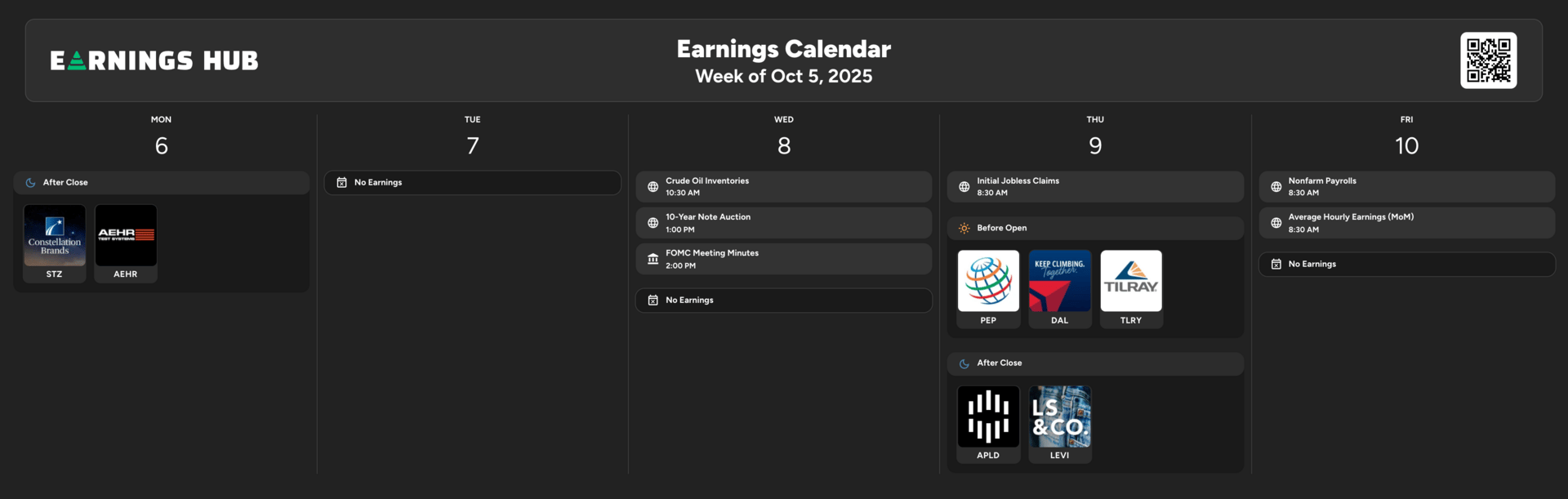

Courtesy of our affiliate partner, EarningsHub.

Notable Companies Reporting Earnings Week of October 5th, 2025:

Major Trades Published 9/29 - 10/3. Trades may be those of family members. [Source: 2iQ]

Buys

Cleo Fields (D)

Company: Alphabet ($GOOGL)

Amount Purchased: $131K - $365K

Company: Oracle ($ORCL)

Amount Purchased: $80K - $200K

Company: Meta Platforms ($META)

Amount Purchased: $65K - $150K

Company: Nvidia ($NVDA)

Amount Purchased: $50K - $100K

Markwayne Mullin (R)

Company: Intuitive Surgical ($ISRG)

Amount Purchased: $50K - $100K

Company: UnitedHealth Group ($UNH)

Amount Purchased: $15K - $50K

Company: Intuit ($INTU)

Amount Purchased: $15K - $50K

Sells

Markwayne Mullin (R)

Company: Westinghouse Air Brakes Technologies ($WAB)

Amount Sold: $31K - $115K

Company: Adobe ($ADBE)

Amount Sold: $15K - $50K

Major Trades Published 9/29 - 10/3

Buys

Atlassian Corporation ($TEAM)

Insider: Scott Belsky (Director)

# of Shares Purchased: 1,566

$ Amount: $239,752

SEC Forms: [1]

Sells

How was today's newsletter?I value all of the feedback that I receive. Let me know how I did so I can continue to make this the best investing newsletter available! |

🤝 Review of the Week

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

This newsletter is sponsored by Wallstreet Prep and Fisher Investments. Sponsorship does not influence our editorial content. We do not endorse the sponsor’s products, services, or views, and we are not responsible or liable for any interaction or transaction between readers and the sponsor.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Reply