Hello! Hope you all are having a great weekend.

In today’s newsletter:

📉 Goldman Sachs Predicts 20% Recession Risk Next Year

💵 US Dollar Dips Below 1 Year Low

📖 Senators Introduce Bipartisan Ban On Stock Ownership

💻 Microsoft Reveals 365 AI Copilot

💰 Blackstone Reaches $1T AUM

👨⚖️ Top 10 Stocks Congress Loves To Trade

Let’s dive right in!

Read time: 5 minutes

Not subscribed yet? Sign up today!

📉 Goldman Sachs Predicts 20% Recession Risk Next Year [GS]

Goldman Sachs Research forecasts a lower recession risk as positive indicators like easing financial conditions and a rebounding housing market suggest continued economic growth, albeit slower.

Encouraging inflation data and factors pointing towards ongoing disinflation, such as falling used car prices and rent inflation, support this outlook. Despite concerns over the U.S.'s inverted yield curve, economists argue the current cycle is different due to a lower term premium and a potential path to Federal Reserve easing via lower inflation.

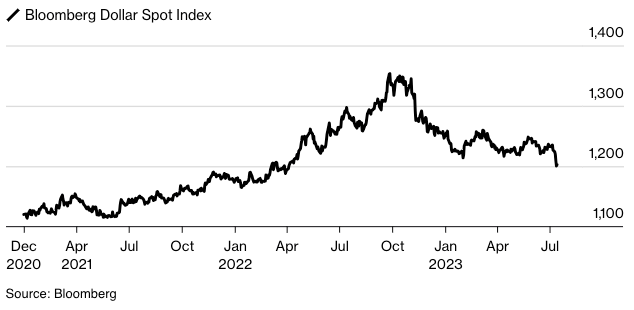

💵 US Dollar Dips Below 1 Year Low [BB]

The US dollar is facing its worst slump since November, leading investors and strategists to predict a significant turning point for the world's primary reserve currency. This shift is attributed to signs of waning inflation and speculation that the Fed will soon cease raising interest rates, with market consensus foreseeing potential rate cuts by 2024.

A prolonged decline in the dollar could lower import costs for developing nations, aiding their inflation issues. This shift could boost currencies like the yen. The US' twin deficits and the "dollar smile theory" are seen as key factors influencing the dollar's future trajectory.

📖 Senators Introduce Bipartisan Ban On Stock Ownership [CNN]

Senators Kirsten Gillibrand and Josh Hawley are presenting a bipartisan bill to ban members of the executive and legislative branches, along with their families, from trading individual stocks.

The bill also seeks to prohibit blind trusts, enhance filing transparency, and impose harsher penalties for violations. The senators argue that politicians should prioritize public interest over personal profit.

💸 The Fed Launches Instant Payments Service [RT]

The U.S. Federal Reserve's "FedNow" service, designed to modernize payments by enabling real-time fund transfers, has launched with 41 banks, aiming to provide a competitive edge for its users and align the U.S. with countries already offering similar services.

🇨🇳 Chinese Reveals Weak Economic Data [RT]

in Q2 2023, China's economic recovery has slowed, with year-on-year GDP growth of 6.3%, falling short of the anticipated 7.3%. This downturn raises doubts about China meeting its 5% growth target for 2023 and puts pressure on policymakers due to rising youth unemployment.

Retail sales growth decreased significantly, and despite a small increase in industrial output, overall demand remains weak. Private investment has also shrunk, reflecting low business confidence.

🪫 Elizabeth Warren vs Tesla [CNN]

Senator Elizabeth Warren has requested an SEC investigation into Tesla $TSLA and CEO Elon Musk, citing potential securities law violations and conflicts of interest due to Musk's control over Twitter.

💻 Microsoft Reveals 365 AI Copilot [F]

Microsoft $MSFT announced an AI-powered version of its productivity platform, Microsoft 365 Copilot, to be offered for an additional $30 a month to existing customers, pushing the company's market cap to $2.67 trillion.

🚙 Carvana Debt Reduction Deal [F]

Carvana $CVNA announced a plan to reduce its $6.54B debt by over $1.2B, funded partly by a $350M stock raise including $125M from its CEO, marking a significant recovery from its weak 2022 performance.

🚪 Cathie Wood Exits China [CNBC]

Cathie Wood recently disclosed that her flagship fund $ARKK has completely withdrawn from China due to concerns over China’s economic slowdown and regulatory tightening.

💊 Eli Lilly’s Alzheimer’s Drug Data [NBC]

Eli Lilly's $LLY experimental Alzheimer's drug, donanemab, slows cognitive decline by 29% in early-stage patients but comes with serious side effects.

💰 Blackstone Reaches $1T AUM [WSJ]

Private equity firm Blackstone $BX has achieved its target of $1T in assets under management ahead of its 2026 deadline, attributing the success to a shift to lower-risk strategies and robust inflows.

🤖 AppleGPT [CNBC]

Apple $AAPL is reportedly developing its own AI large language model internally, with plans for a significant AI announcement next year.

Major Earnings Recap Week of July 17th:

Tesla ($TSLA) reported record quarterly revenue, surpassing expectations, but saw lower margins due to price cuts and incentives. The stock fell after hours after uncertainties surrounding Cybertruck deliveries and factory shutdowns. [CNBC]

✅ EPS $0.91 Beats $0.82 Estimate

✅ Sales $24.93B Beats $24.47B Estimate

Netflix’s ($NFLX) quarterly revenue and subscriptions increased due to its new policy curbing password sharing, but its stock fell 8% in after-hours due to revenue falling short of analyst expectations and uncertainties around its ad-supported tier and new password policy. [CNBC]

✅ EPS $3.29 Beats $2.86 Estimate

❌ Sales $8.19B Misses $8.30B Estimate

Bank of America’s ($BAC) Q2 profits and revenues exceeded expectations due to increased interest income amid higher rates, with shares rising 4% after hours, despite concerns over slowing loan and deposit growth. [CNBC]

✅ EPS $0.88 Beats $0.84 Estimate

✅ Sales $25.33B Beats $25.05B Estimate

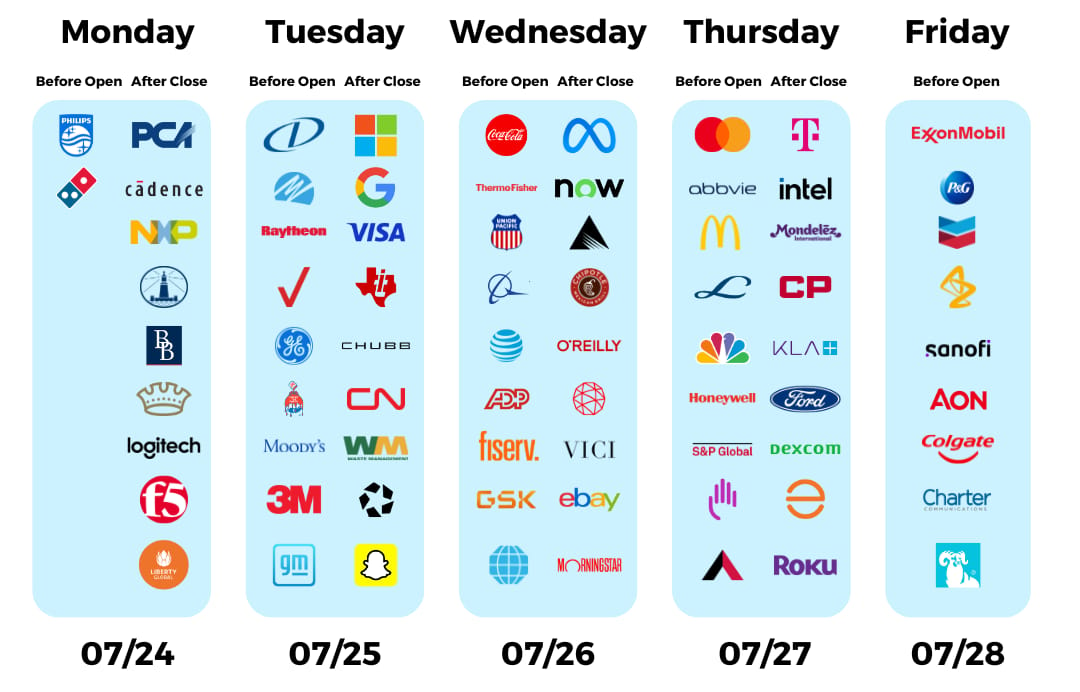

Biggest Companies Reporting Earnings This Week:

Here is a breakdown of the most popular stocks traded by Congress in the last 180 days, based on the # of trades published. Out of these 10, it’s clear that Congress loves to trade Big Tech and the Big Banks. However, it is interesting to see that the office furniture company MillerKnoll and retail corporation CVS have made it onto the list. This is definitely worth looking into.

All times in ET

MONDAY, JULY 24

9:45 am S&P "Flash" U.S. Manufacturing PMI - July

9:45 am S&P "Flash" U.S. Services PMI - July

TUESDAY, JULY 25

9:00 am S&P Case-Shiller Home Price Index (20 cities) - May

10:00 am Consumer Confidence - July

WEDNESDAY, JULY 26

10:00 am New Home Sales - June

2:00 pm FOMC Decision On Interest-Rate Policy

2:30 pm Fed Chairman Powell Press Conference

THURSDAY, JULY 27

8:30 am Initial Jobless Claims - July

8:30 am GDP (advanced report) Q2

8:30 am Advanced Retail Inventories - June

8:30 am Advanced Wholesale Inventories - June

10:00 am Pending Home Sales - June

FRIDAY, JULY 28

8:30 am Personal Income (nominal) - June

8:30 am Personal Spending (nominal) - June

8:30 am PCE Index - June

8:30 am Core PCE Index - June

8:30 am PCE (YoY)

8:30 am Core PCE (YoY)

8:30 am Employment Cost Index Q2

10:00 am Consumer Sentiment (final) - July

How was today's newsletter?

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author.

Carbon Finance is a publisher of financial information, not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.