- Carbon Finance

- Posts

- 📊 Stock Portfolios of Famous Investors

📊 Stock Portfolios of Famous Investors

1) Warren Buffett 2) Michael Burry 3) Bill Ackman and more!

Happy Sunday!

This week, all institutional investment managers with at least $100M in assets under management were required to file Form 13F for Q2.

These filings reveal their public equity holdings, giving us a glimpse into their trades and overall portfolios.

Keep in mind that 13Fs don’t reflect the latest portfolio updates or show the amount of cash held on hand.

I’ve updated my website to help you visualize the portfolios of some of the world’s top investors. You can check it out by clicking the button below!

Below, I’ll be covering five key portfolios with my brief thoughts and a rundown of notable trades.

As always, thank you for being a loyal subscriber.

Some key data bites from this week that you should know:

A Goldman Sachs $GS financial markets model shows a 41% chance of a recession.

U.S. inflation increased 2.9% YoY, below the +3% YoY expected.

U.S. retail sales surged 1% in July, far ahead of the +0.3% expected.

Americans collectively owe $1.14T on their credit cards.

Home Depot $HD saw Q2 comparable sales decline 3.3% YoY.

Norway’s Sovereign Wealth Fund, the world’s largest, posted $138B in first-half profit.

Cisco $CSCO is planning to lay off 7% of its total workforce.

M&M’s Owner Mars is buying Kellanova $K for roughly $36B.

Incoming Starbucks $SBUX CEO Brian Niccol is getting a $113M pay deal.

For every $1 spent on betting, stock investments drop by over $2.

Hackers steal 2.9B records, including Social Security numbers, from U.S., U.K., and Canadian citizens.

Walmart $WMT boosted its full-year sales forecast to up to 4.75%, up from 4.0%.

FanDuel owner Flutter $FLUT saw revenue jump 20% in Q2 2024.

In today’s newsletter:

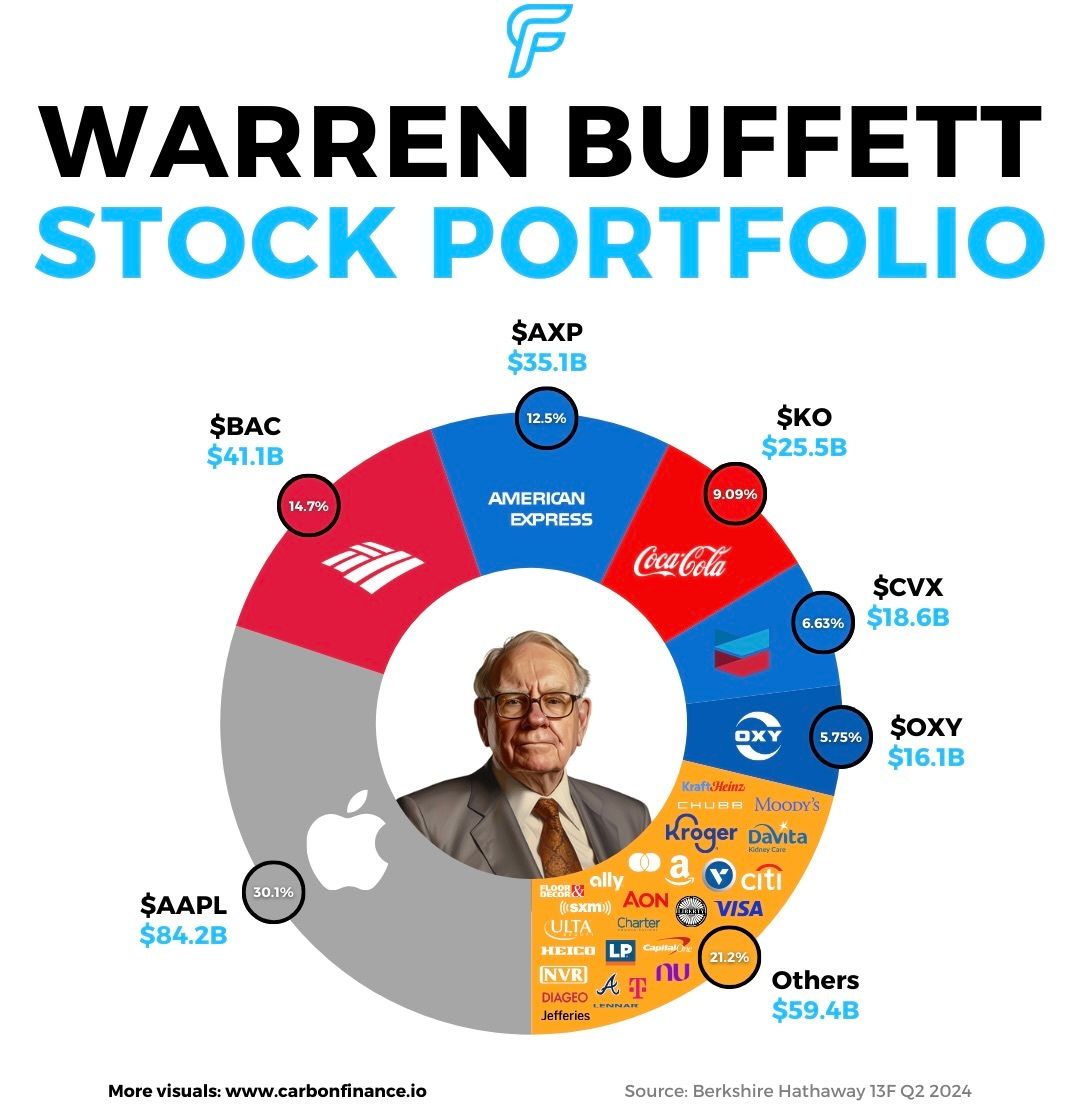

🐐 Warren Buffett’s Stock Portfolio

🇨🇳 Michael Burry’s Stock Portfolio

🚬 Stanley Druckenmiller’s Stock Portfolio

✔️ Bill Ackman’s Stock Portfolio

🧾 Terry Smith’s Stock Portfolio

Not subscribed yet? Sign up today!

📣 A Message From Our Sponsor

Track Company Earnings Like a Pro

Earnings Hub is designed for investors to give you everything you want to know about company earnings, including:

An Earnings Calendar

Expectations & Actuals

Listen to Earnings Calls Live (or replay)

Earnings Call Transcripts & AI Summaries

Realtime News on your favorite stocks

Alerts delivered via Text or Email

Most of the features are FREE! Premium features are 50% off right now at just $49 for an entire year.

What moves did the greatest investor of all time make in Q2?

Warren Buffett reduced his prized stake in Apple by roughly 50%, though it still represents a hefty 30% of his overall holdings, with a reported value of $84B.

Buffett also trimmed positions in Chevron, Capital One and T-Mobile and fully exited Snowflake and Paramount.

On the buying side, Berkshire Hathaway took a small position in Ulta Beauty, a cosmetic retailer that has struggled this year.

Before the news of this purchase, Ulta was down 34% but has since increased by 15% after news of the investment.

The Ulta position is a tiny fraction of the overall portfolio, just 0.10%, and it’s likely that Ted Weschler or Todd Combs, Berkshire's other money managers, initiated the buy.

Either way, it’ll be interesting to see if they continue to add to this position.

Michael Burry is known for being an active trader, but this quarter, one detail caught my attention more than his trades.

Burry’s portfolio value dropped nearly 50%, from $103M in Q1 to $52M in Q2, raising questions about how much cash he’s holding.

On the trading front, Burry completely exited positions in Citi, Sprott Physical Gold Trust, and Square, among other exits.

He reduced his stake in J.D., a major Chinese e-commerce platform, while boosting his position in Alibaba by 24%. Alibaba now makes up 21% of his portfolio.

Additionally, Burry purchased stakes in small caps like Hudson Pacific Properties, a real estate investment trust, and Olaplex, a hair care brand.

Stanley Druckenmiller seems to be having a falling out with the Magnificent 7.

In Q2, Druckenmiller sold off 64% of his Microsoft holdings, slashed his Nvidia position by 88%, and cut his Apple stake by 79%.

He also completely exited his position in Meta. However, it is fair to call out that Apple and Meta were relatively small positions in his portfolio.

Beyond the Magnificent 7, Druckenmiller appears to have either closed out his calls on IWM, the ETF tracking the Russell 2000 index, or let the options expire.

While he did take on a handful of new positions, the most intriguing move was his entry into tobacco giant Philip Morris, accompanied by the purchase of call options on the company.

Similar to Ulta's surge after Berkshire Hathaway’s investment, Nike also saw a boost, thanks to news of Bill Ackman’s stake.

Ackman’s position in Nike is relatively small, less than 3% of his portfolio, and it’ll be interesting to see if he continued to buy in Q3.

Over the past five years, Nike's stock has risen just 4% and has faced challenges recently as competition from brands like On and Hoka intensifies.

As for the rest of his portfolio, Ackman trimmed his Chipotle stake by 23%.

His investment in Chipotle has been a home run, notably influencing the appointment of Brian Niccol back in 2018, the former Chipotle CEO who recently joined Starbucks.

Terry Smith appears to be taking a wary approach this past quarter.

For those unfamiliar, he is the CEO of Fundsmith and is often called “The English Warren Buffett.”

In Q2, Smith trimmed nearly all of his positions across the board.

The only exceptions were Fortinet, Texas Instruments, and Oddity Tech, where he added to his stakes, though these remain relatively small components of his overall portfolio.

Whether Smith is being cautious or freeing up funds for a significant new investment remains to be seen and only time will tell.

💊 MDMA Rejection. The FDA has rejected psychedelic MDMA-assisted therapy for PTSD - S

👾 Pixel Powerup. Google $GOOG announced a ton of new AI features coming to its new Pixel devices - GOOG

🔎 Search Monopoly. The U.S. Justice Department is considering breaking up Google $GOOG - NYT

☕️ Coffee Takeover. Activist Starboard Value has joined Elliott Management with a stake in Starbucks $SBUX - IV

🇮🇳 Adani Controversy. Hindenburg has accused India’s market regulator chief of previously investing in offshore funds used by the Adani Group - R

📱 iPhone SE Upgrade. Apple $AAPL plans to launch the fourth-generation of the iPhone SE as early as the beginning of 2025 - MR

Notable Companies Reporting Earnings This Week:

Monday (8/19):

Palo Alto Networks $PANW, Estee Lauder $EL

Tuesday (8/20):

Lowe’s $LOW, Medtronic $MDT

Wednesday (8/21):

TJX Companies $TJX, Analog Devices $ADI, Synopsys $SNPS, Target $TGT, Snowflake $SNOW, Zoom $ZM

Thursday (8/22):

Intuit $INTU, Workday $WDAY, Cava $CAVA

All of the companies that are reporting earnings next week can be viewed here.

Major Trades Published 08/12 - 08/16. Trades may be those of family members. [Source: 2iQ]

Buys

Doug Lamborn (R)

Company: NetApp ($NTAP)

Amount Purchased: $45K - $150K

Greg Landsman (D)

Company: Ulta Beauty ($ULTA)

Amount Purchased: $15K - $50K

Sells

Kevin Hern (R)

Company: Bank of Montreal ($BMO)

Amount Sold: $250K - $500K

Michael McCaul (R)

Company: Visa ($V)

Amount Sold: $200K - $500K

Major Trades Published 08/12 - 08/16

Buys

Sells

How was today's newsletter?I value all of the feedback that I receive. Let me know how I did so I can continue to make this the best investing newsletter available! |

🤝 Review of the Week

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Reply