Happy Monday!

It was another jam-packed week of headlines.

The S&P 500 briefly entered a correction, wiping out $5.3T in market value over just three weeks.

Meanwhile, U.S. consumer sentiment plunged to 57.9 in March, its lowest level since November 2022.

Additionally, the Treasury Department’s latest report showed the federal budget deficit hit a record $1.1T in just the first five months of the fiscal year.

Last week, I ran a sentiment survey to see how everyone was feeling about the market.

71% of voters are currently bearish, reflecting a 29 sentiment score.

Here were some of the responses:

Thanks to everyone who voted and shared their thoughts, will definitely be doing this again in the future.

Some key data bites from this week that you should know:

Morningstar says these 4 of the Magnificent 7 are undervalued.

Goldman Sachs cut its S&P 500 year-end target to 6,200.

Hedge funds are paying up to $1M for weather modelers.

Strategy is raising up to $21B to purchase more Bitcoin.

Mike Wilson sees the S&P 500 dropping to 5,500 in H1 2025.

Spotify paid a record $10B to artists in 2024.

Rocket Companies will acquire Redfin in a $1.75B deal.

ServiceNow plans to buy AI firm Moveworks for $2.9B.

Number of multiple jobholders reached a record 8.9M in February.

CoreWeave signed an $11.9B contract with OpenAI.

Salesforce plans to invest $1B in Singapore over next five years.

36 companies account for 50% of global emissions.

Tesla has committed to doubling US vehicle production within 2 years.

Porsche plans to cut 3,900 jobs over the next few years.

US household wealth increased to $169T in Q4 2024.

Binance has secured $2B from Abu Dhabi’s MGX.

Pepsi is planning to acquire Poppi for $1.5B.

BMW expects tariffs to cost it $1.1B this year.

In today’s newsletter:

🩸 Tech Stocks Bloodbath

💸 Software Gross Margins

🏆 Gold Beats The S&P 500

❤️ Top Shareholder Yield Stocks

👞 The Fall Of Gucci

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Together With SoundSelf

Pharmaceuticals can’t do it all. Meet the immersive tech improving mental health.

SoundSelf uses sound, light, and biofeedback to help users reach states of profound mental stillness and clarity in as little as 15 minutes. You can become a shareholder and help bring this life-changing tech to more people.

Read the Offering information carefully before investing. It contains details of the issuer’s business, risks, charges, expenses, and other information, which should be considered before investing. Obtain a Form C and Offering Memorandum at https://wefunder.com/soundself

Tech stocks have been getting hammered recently.

A mix of tariff concerns, slowing economic growth, weaker consumer confidence, and inflation risks has investors on edge.

Additionally, notable figures like BlackRock CEO Larry Fink have warned that policy shifts will likely drive costs higher over the next six to nine months.

As a result, investors are cashing out, moving away from high-fliers and risk-on assets.

Some names have taken massive hits.

Tesla, which surged roughly 100% post-election, at one point shed nearly $800B since peaking in December.

On Monday alone, tech megacaps lost over $750B in market value.

If you’re feeling the pain, you’re not alone.

For a moment, the billionaires at Trump’s inauguration saw their fortunes shrink by $209B over the last seven weeks.

Fortunately, the bulls stepped in late in the week helping to lift stocks as key news, like cooler-than-expected inflation and easing U.S. government shutdown risks, provided a boost.

Adobe continues to leave investors unimpressed.

The SaaS giant reported this past week, with shares closing the week down 10%.

While the company beat estimates on both earnings and revenue for Q1, its soft outlook weighed on sentiment.

For the next quarter, Adobe expects sales between $5.77B and $5.82B, slightly below analyst expectations of $5.8B.

Profit per share is projected at $4.98 at the midpoint, missing the $5 estimate.

Shares have plunged nearly 30% over the past year.

Bears point to AI-driven disruption as a long-term threat, while bulls highlight Adobe’s sticky user base of creative professionals and its long-standing dominance.

SaaS businesses like Adobe are generally considered attractive because of their high gross margins, often exceeding 70-90%.

This means that most revenue turns into profit after covering product costs.

Unlike hardware or manufacturing, SaaS has low incremental costs.

Once the product is built, selling to more customers is nearly pure profit.

Most are scalable and predictable, with the ultimate goal of becoming highly cash-flow generative and positioned for long-term growth.

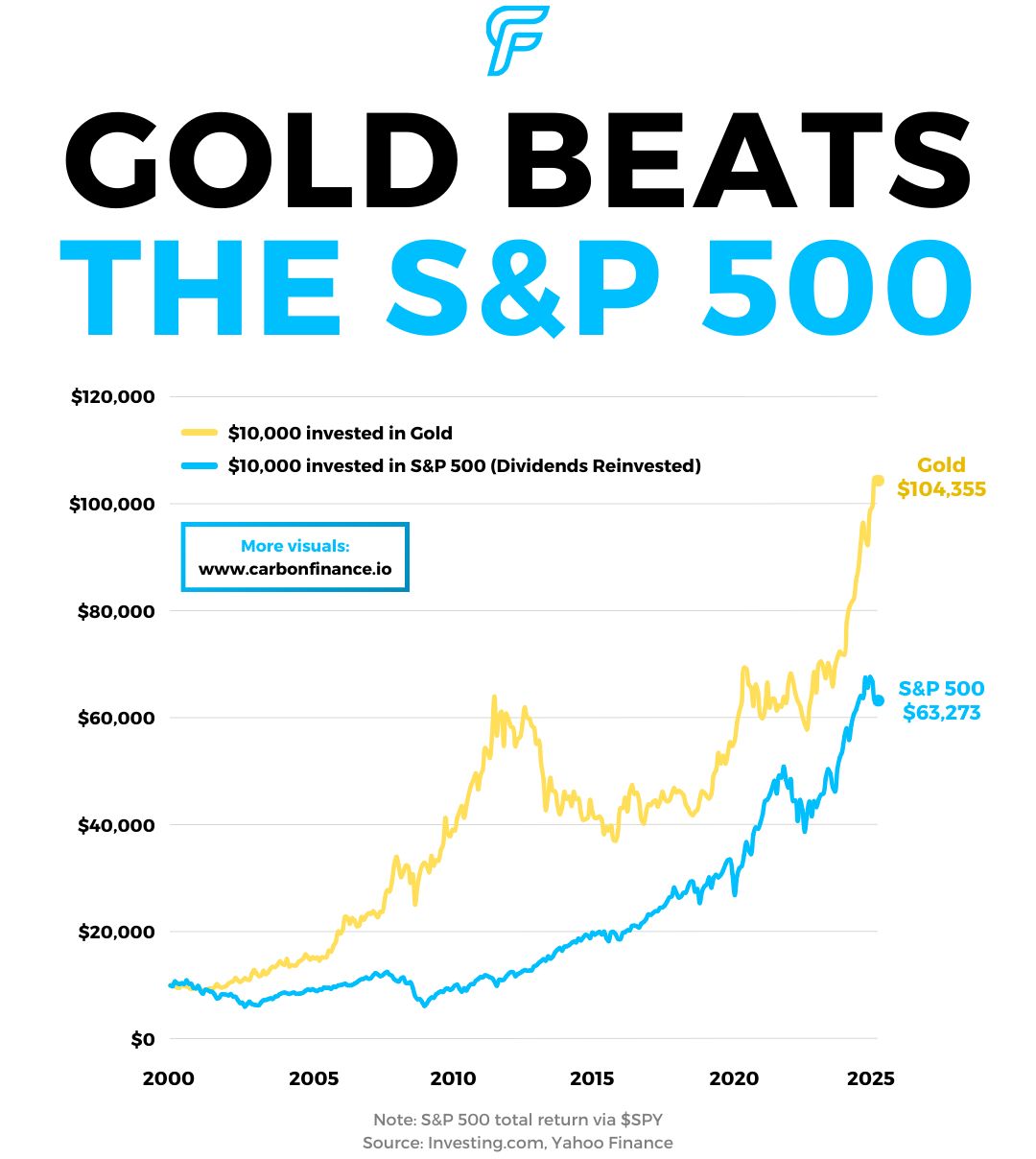

This week, Gold hit a historic milestone, crossing $3,000 per ounce for the first time ever.

The bullion is up 12% YTD and 38% over the past year, quadrupling the S&P 500’s gain over the same period.

Gold’s remarkable run has outpaced the S&P 500’s total return since the start of the century, driven by increased central bank purchases and rising geopolitical tensions.

Several countries have been aggressively stockpiling gold, with Poland, India, and China among the biggest buyers in Q4.

Bloomberg recently reported that China’s central bank has been buying gold for four consecutive months, despite record prices.

Could the rally continue? Macquarie Group analysts see gold hitting $3,500/oz by Q3.

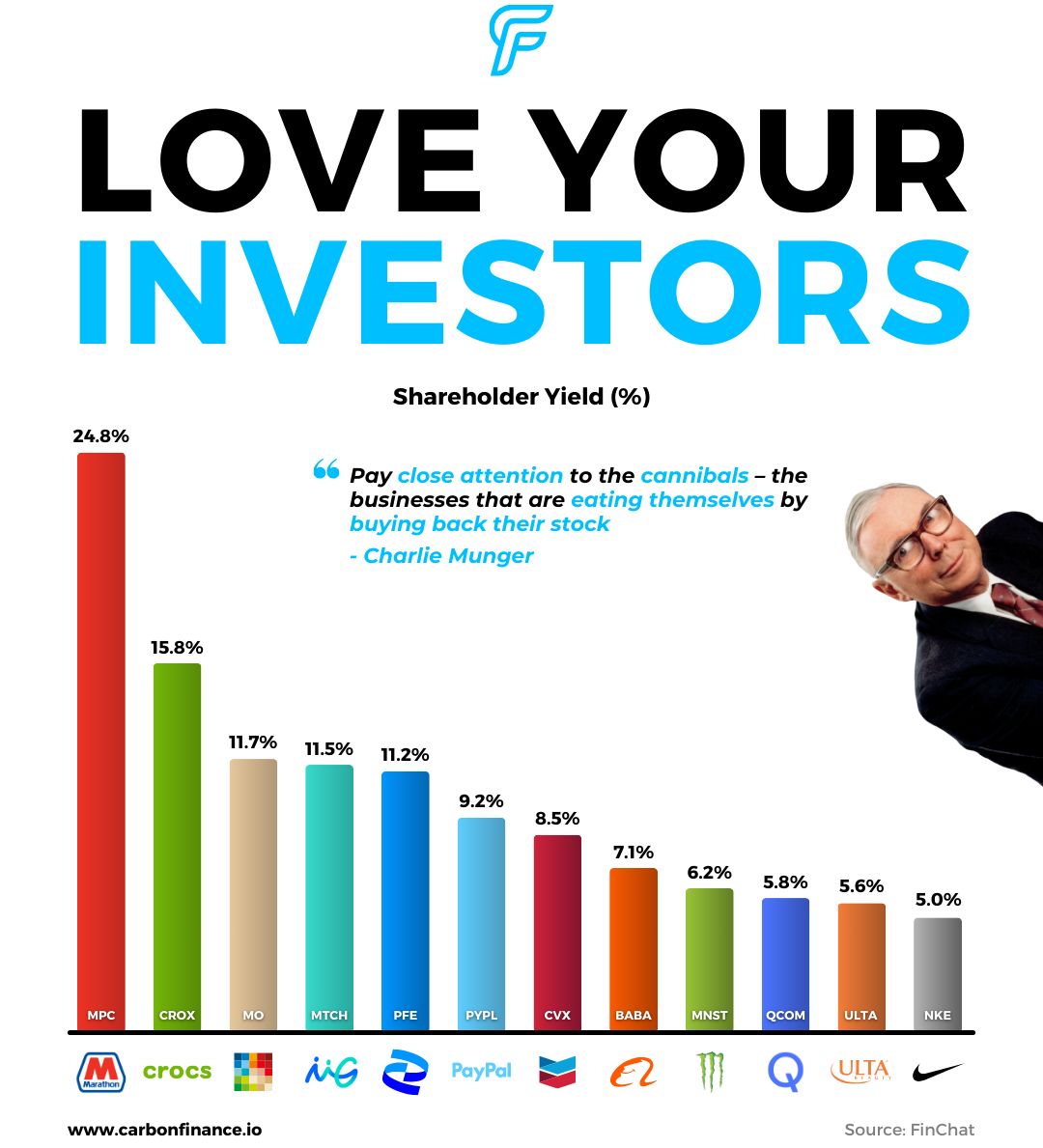

Companies that truly love their investors don’t just pay dividends.

They buyback stock, reduce debt, and maximize returns.

Shareholder yield measures how much cash a company returns to investors through a combination of all of these factors, offering a clearer picture of total capital return.

A high shareholder yield can signal a company that prioritizes rewarding investors.

But not all high yields are created equal.

Some stem from financial engineering or temporary boosts from one-time events.

Shareholder traps exist when buybacks are poorly timed, dividends are unsustainable, or debt reduction masks deeper issues.

A high shareholder yield is a great starting point, but true gems are paired with strong fundamentals and smart leadership.

Right now, several well known companies boast shareholder yields above 5%, including Nike, Ulta Beauty, Monster Beverage, Alibaba, and PayPal.

Many of these names are weathering tough times, but they’re still rewarding shareholders along the way.

Luxury might be flashy, but returns haven’t been.

The sector has struggled due to sticky inflation and consumers pulling back on heavy spending.

Now, consolidation could be on the horizon.

This week, Reuters reported that Prada is in talks to acquire Versace in a deal valued at nearly $1.6B, potentially uniting two Italian fashion giants.

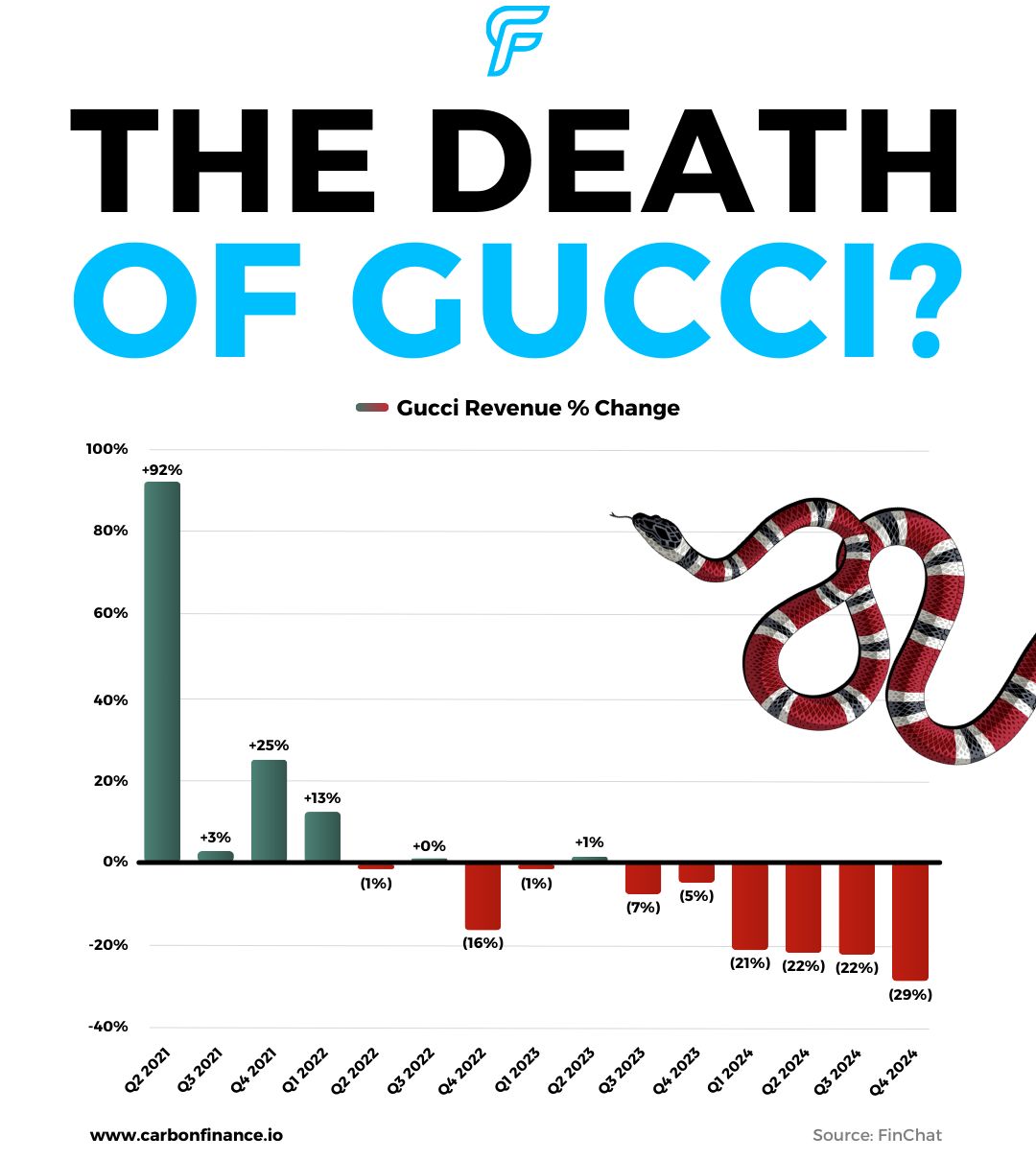

Meanwhile, Gucci’s struggles keep mounting.

The iconic fashion house, under Kering, has now seen six straight quarters of revenue declines, with the last four down over 20% YoY.

Investors were further disappointed this week after Gucci’s new creative lead came from within Kering’s Balenciaga, rather than an external hire who could bring fresh energy to revitalize the brand.

Shares dropped over 10% on the news, and Kering’s stock has fallen nearly 75% since peaking in August 2021.

📣 Presented By SoundSelf

Self-care is booming and so is SoundSelf.

SoundSelf uses immersive psychedelic tech to help people find clarity and relaxation. Now, you can invest in its growth and help expand access to this groundbreaking experience.

Read the Offering information carefully before investing. It contains details of the issuer’s business, risks, charges, expenses, and other information, which should be considered before investing. Obtain a Form C and Offering Memorandum at https://wefunder.com/soundself

🇺🇦 Truce Talks. Ukraine has agreed to a U.S.-lead ceasefire plan if Russia accepts - CNBC

🧑💻 OS Revamp. Apple is gearing up for a major software overhaul across iPhone, iPad, and Mac - CNET

🇨🇦 New Leader. Mark Carney, a former central banker, has become Canada’s next prime minister - NPR

💾 Chip Coalition. TSMC has approached Nvidia, AMD, and Broadcom about investing in a joint venture to operate Intel’s factories - R

👨💼 CEO Tap. Intel has appointed Lip-Bu Tan as its new CEO - INTC

🇰🇷 Korean Bulls. South Korean investors are loading up on US leveraged ETFs - BB

Courtesy of our paid partner, EarningsHub.

Notable Companies Reporting Earnings Week of March 17th, 2025:

I use EarningsHub to track earnings, estimates, and receive AI summaries of investor calls.

If you’d like an all-in-one earnings tool and see all other companies reporting, I definitely recommend you check it out!

Major Trades Published 3/10 - 3/14. Trades may be those of family members. [Source: 2iQ]

Buys

Ro Khanna (D)

Company: National Bank of Canada ($NTIOF)

Amount Purchased: $400K - $850K

Company: Morgan Stanley ($MS)

Amount Purchased: $182K - $480K

Company: The Bank of Nova Scotia ($BNS)

Amount Purchased: $180K - $450K

Tim Moore (R)

Company: Harley-Davidson ($HOG)

Amount Purchased: $200K - $450K

Jefferson Shreve (R)

Company: Broadcom ($AVGO)

Amount Purchased: $100K - $250K

Sells

Mikie Sherrill (D)

Company: UBS Group ($UBS)

Amount Sold: $250K - $500K

Tim Moore (R)

Company: Harley-Davidson ($HOG)

Amount Sold: $200K - $450K

Major Trades Published 3/10 - 3/14

Buys

Firstsun Capital Bancorp ($FSUN)

Insider: Mollie Carter (Executive Chair)

# of Shares Purchased: 1,025,450

$ Amount: $38,003,177

SEC Forms: [1]

Trimas Corporation ($TRS)

Insider: Shawn Sedaghat (Director)

# of Shares Purchased: 554,149

$ Amount: $13,339,586

SEC Forms: [1]

Prospect Capital Corp ($PSEC)

Insider: John Barry (CEO)

# of Shares Purchased: 2,000,000

$ Amount: $8,640,000

SEC Forms: [1]

Sells

How was today's newsletter?

🤝 Review of the Week

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.