- Carbon Finance

- Posts

- 📊 Gold Hits New All-Time Highs

📊 Gold Hits New All-Time Highs

1) Cathie Wood’s Top Holdings 2) U.S. Housing Hits New Record 3) Robinhood Joins The S&P 500 and more!

Happy Sunday!

The newsletter is back and Q4 will be packed with premium content.

As mentioned previously, alongside this flagship Sunday edition, I’ll occasionally send high-quality research outside the usual cadence.

Expect deep dives, stock analysis, investor insights, hedge fund portfolio breakdowns, and more.

If this newsletter has been valuable to you, I have one small ask:

Share it with a friend who loves investing.

We’re on the verge of a major milestone, 40,000 subscribers, and every referral gets us one step closer.

Here’s your unique referral code to copy and share:

As a thank you, you’ll get a free 2025 Dividend Kings List sent straight to your inbox when they sign up.

Thanks again for being part of this, I wouldn’t be here without your support.

Some key data bites from this week that you should know:

Morningstar shared a list of 10 best dividend stocks to buy in 2025.

MarketWatch screened 20 international value stocks with future growth.

Job growth was revised down by 911,000, the largest cut since 2002.

Trump Family gained $1.3B in crypto wealth within weeks.

Health insurance costs will jump to biggest levels in 15 years.

Novo Nordisk will lay off 9,000 people, or 11% of its global workforce.

OpenAI will burn through $115B in cash through 2029.

Google Cloud forecasts $58B revenue boost by 2027.

Microsoft and Nebius signed a $17.4B AI Infrastructure deal.

Nebius will raise $3B to fuel growth in its AI cloud business.

ASML has taken a $1.5B stake in French startup Mistral AI.

U.S. inflation increased 2.9% annually in August, in line with estimates.

Wholesale prices fell 0.1% in August, below 0.3% estimate.

Anglo American and Teck will merge into a $53B copper giant.

UnitedHealth sees 78% of members in high-rated Medicare plans.

Vimeo will go private in a $1.38B deal.

Adobe saw its AI-influenced ARR surpass $5B.

In today’s newsletter:

👩🏻 Cathie Wood’s Top Holdings

📈 Gold Reaches All-Time Highs

🏠 U.S. Housing Hits New Record

🏹 Robinhood Joins The S&P 500

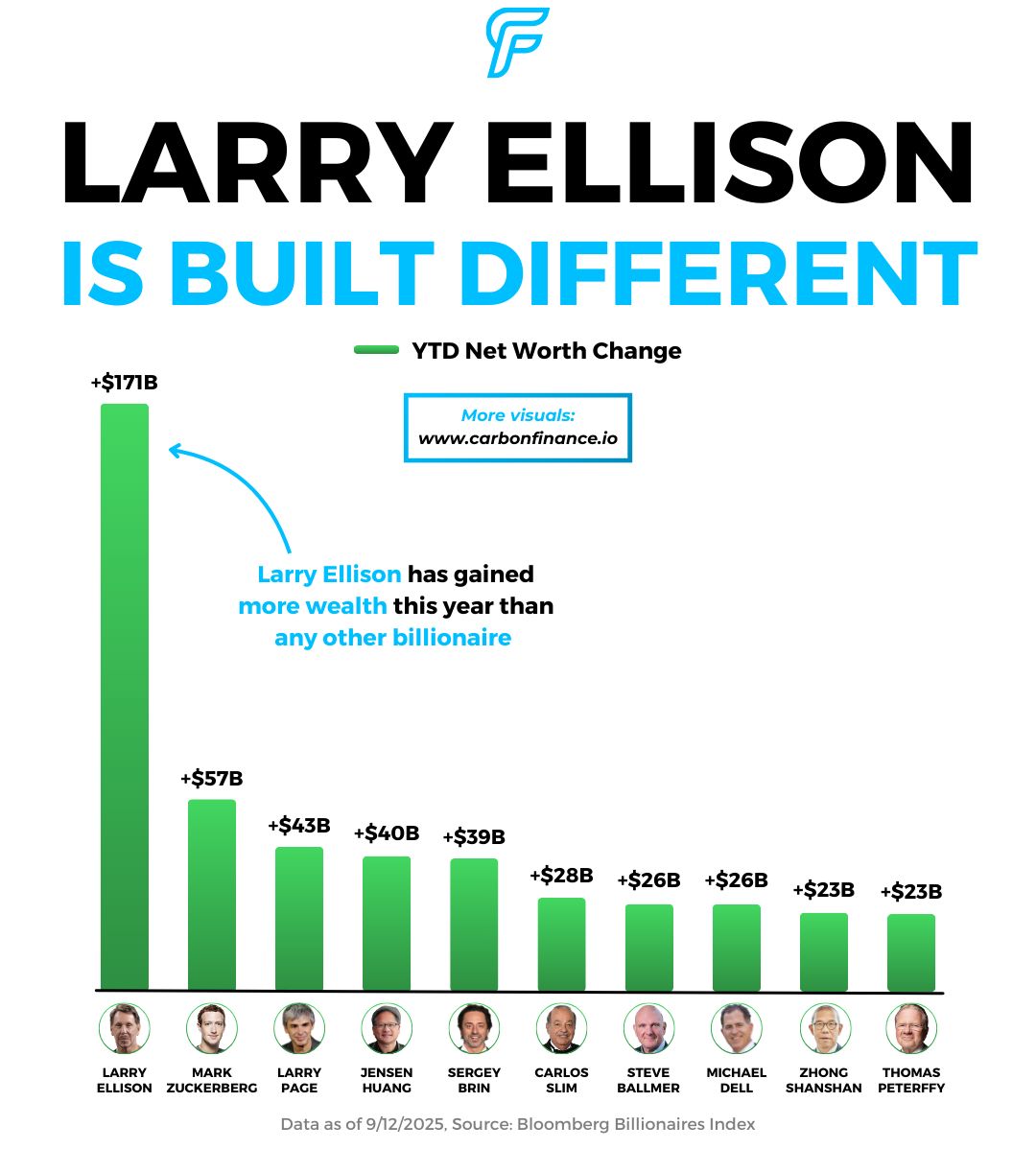

💰 Larry Ellison Is Built Different

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Together With Wallstreet Prep

Get Real Estate Training from Wharton Experts

Gain the skills top firms demand with the Wharton Online + Wall Street Prep Real Estate Investing & Analysis Certificate.

In 8 weeks, learn from leaders at Blackstone, KKR, Ares, and more while analyzing real deals.

Save $300 with code SAVE300 + $200 with early enrollment by January 12.

Is Cathie back for revenge?

Cathie Wood’s ARK Innovation ETF has surged 38% this year, more than triple the S&P 500’s return.

The rally has been powered by several of her top holdings:

Robinhood is up 192% YTD, Palantir 128%, Tempus AI 152%, and Roblox 127%.

But while 2025 has been impressive, the longer view tells a different story.

Over the past five years, ARKK is down 8%, sharply underperforming the S&P 500, which has gained 97%.

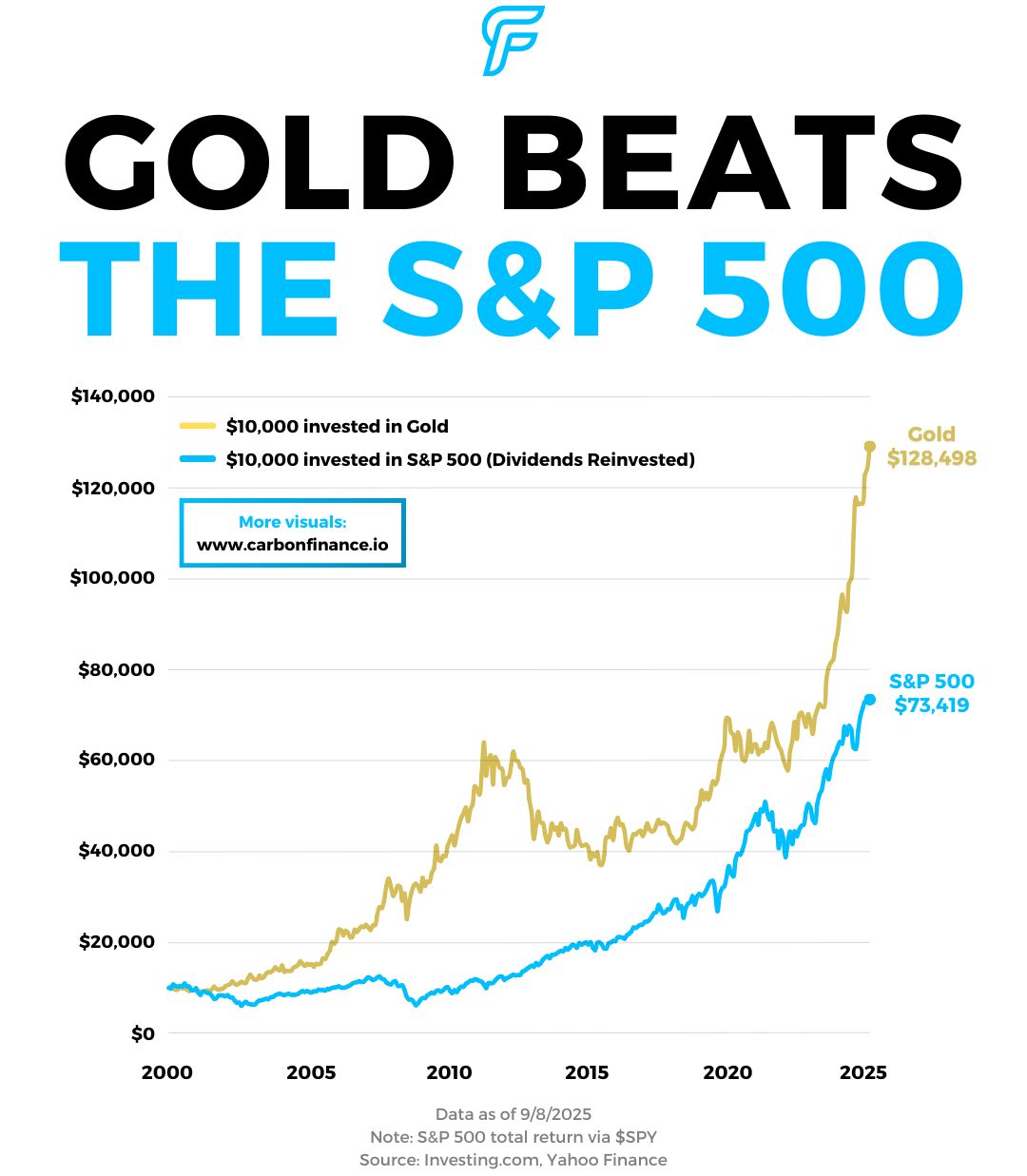

Gold is shining brighter than ever.

The metal recently broke its inflation-adjusted record from 1980, hitting an all-time high of $3,695 an ounce.

Even more striking, it has set more than 30 nominal records this year.

The bull run has been fueled by geopolitics, the ongoing trade war, steady central bank buying, and the prospect of rate cuts.

China alone has purchased gold for 10 straight months, adding 1.22M troy ounces to its reserves as it diversifies away from the U.S. dollar.

Gold is now up 38% in 2025, far outpacing the S&P 500.

Since the start of the century, it has actually outperformed the index on a total return basis, though across most time frames the S&P 500 has delivered higher returns.

But gold’s recent performance has been eye-catching, and Goldman Sachs believes it could continue.

The bank sees prices climbing well above its $4,000 mid-2026 baseline if private investors shift more heavily into gold.

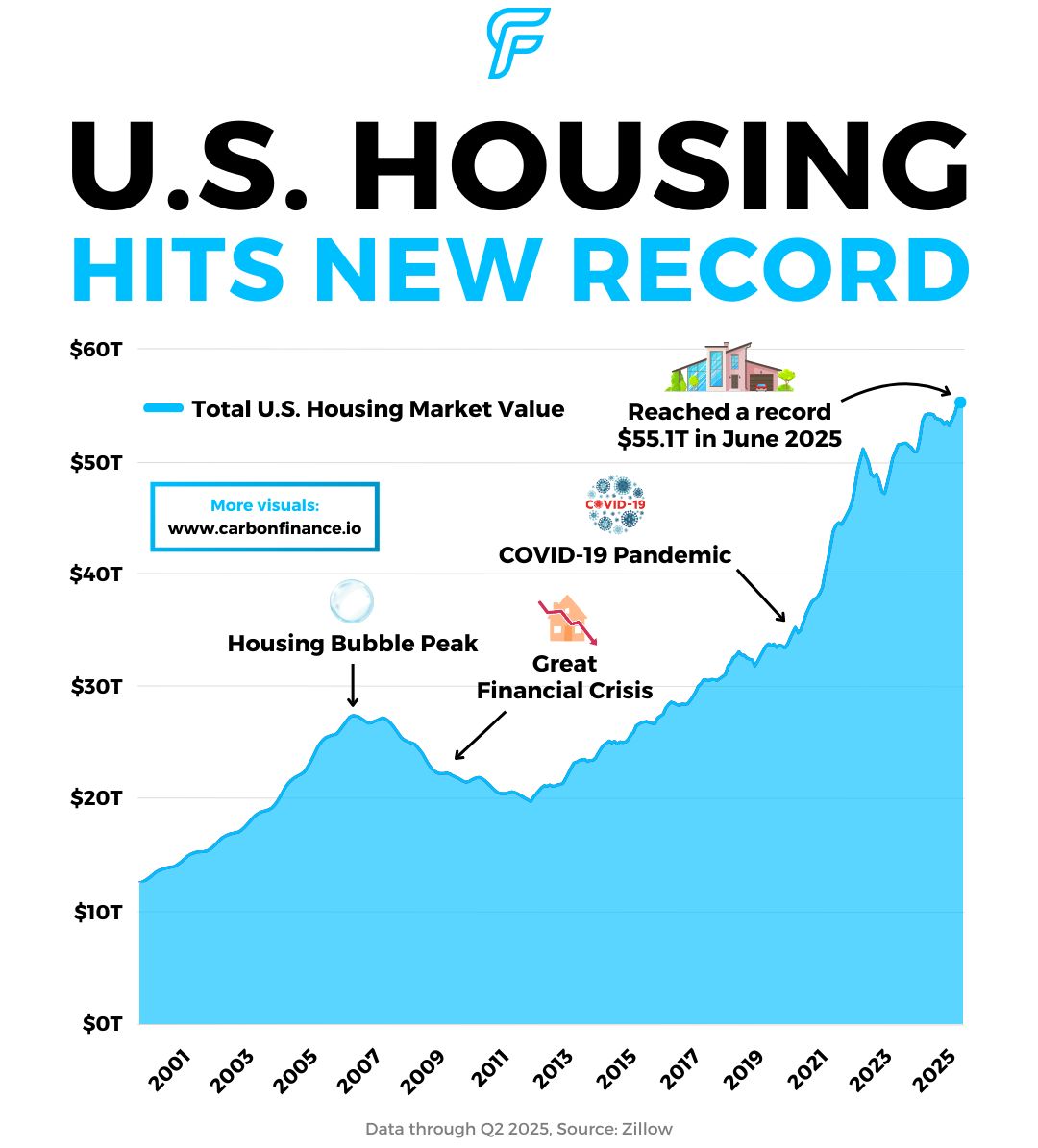

Gold isn’t the only thing hitting all-time highs.

U.S. housing market value reached a record $55.1T in June 2025, according to Zillow.

The biggest one-year state level gains came from New York (+$216B), New Jersey (+$101B), and Illinois (+$89B).

On the flip side, Florida (-$109B), California (-$106B), and Texas (-$32B) posted the largest declines.

Since early 2020, the U.S. housing market value has surged by $20T, reflecting a 57% jump.

But growth has cooled over the past year, with U.S. housing wealth rising just 1.6%, or $862B.

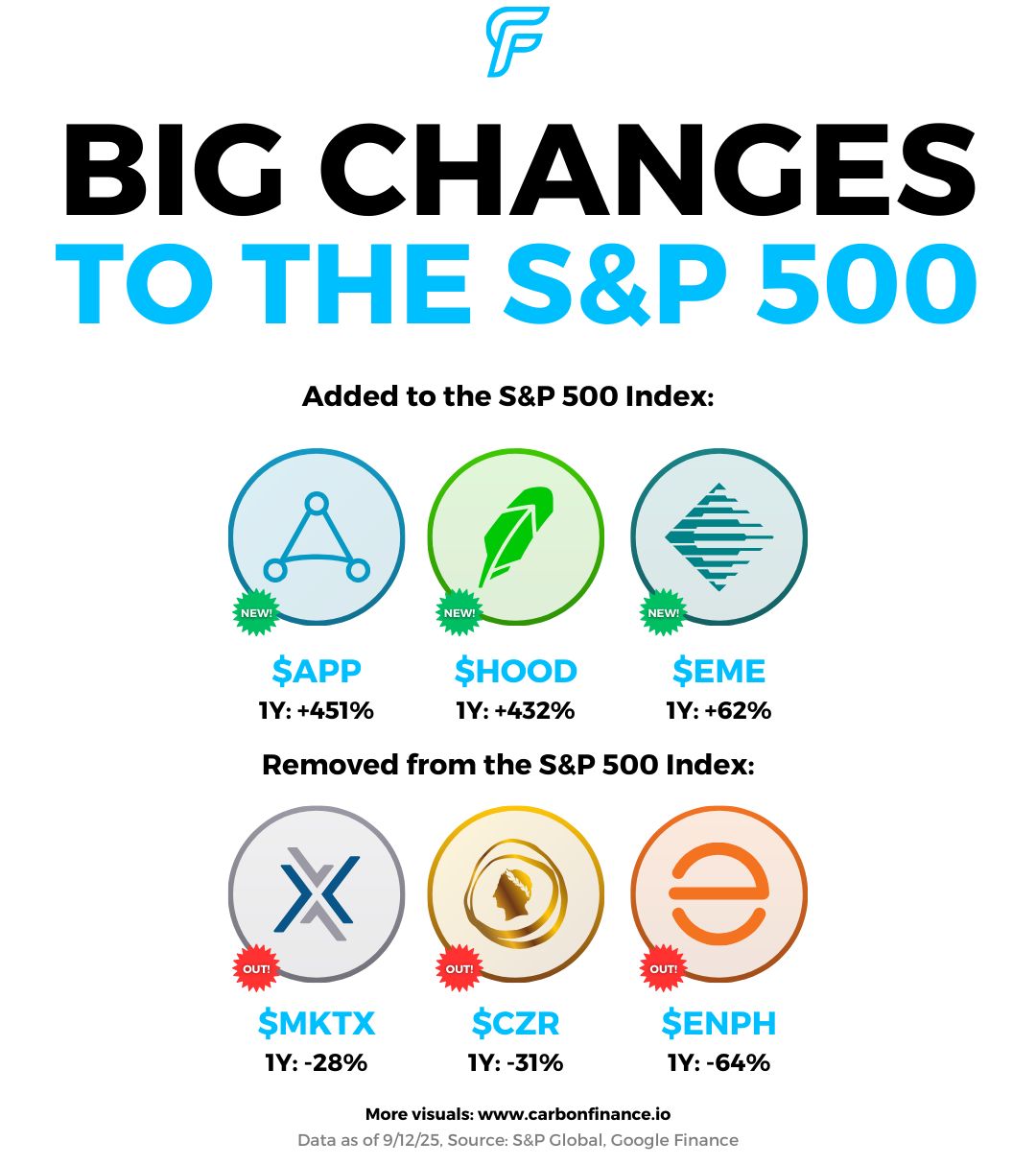

Robinhood bulls finally got their wish.

S&P Global announced that Robinhood will join the S&P 500, replacing Caesars Entertainment.

The company has been on a rapid growth streak.

In its most recent quarter, net revenue rose 45% to $989M, net income jumped 105% to $386M, and platform assets nearly doubled to $279B.

That momentum has carried into the stock, which has surged 432% over the past year.

As part of the same rebalancing, AppLovin will replace MarketAxess, and Emcor Group will swap in for Enphase Energy.

The changes take effect before market open on September 22.

The richest man in the world, for a moment.

Oracle founder Larry Ellison briefly passed Elon Musk as the world’s richest this past week.

He has since slipped back to second place with a net worth of $349B, but his climb this year has been unmatched.

He’s added $171B this year alone to his fortune, more than Zuckerberg, Larry Page, and Jensen Huang combined.

This year’s surge has come from Oracle’s booming cloud business.

Despite missing on EPS and revenue in the most recent quarter, the company revealed $455B in contracted revenue, up 359% YoY.

Cloud infrastructure brought in $3.3B last quarter and is now projected to reach $144B by fiscal 2030.

📣 Presented by Pacaso

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

🏹 Social Investing. Robinhood is launching a social media network, letting users share trades, follow others, and track avatars of politicians and executives - AX

📣 Dimon Warning. JPMorgan CEO Jamie Dimon says recent job revisions point to a weakening economy and leave uncertainty over a potential recession - CNBC

🍎 Launch Day. Apple unveiled a full lineup of new products, including iPhones, three Apple Watch models, and the latest AirPods - AAPL

📝 Policy Rebuke. Billionaire and Republican Megadonor Ken Griffin published a WSJ op-ed critiquing Trump’s feud with the Fed - WSJ

🇺🇸 Government Fallout. France’s government collapsed after the prime minister resigned following a failed confidence vote - CNN

Courtesy of our affiliate partner, EarningsHub.

Notable Companies Reporting Earnings Week of September 14th, 2025:

Major Trades Published 9/8 - 9/12. Trades may be those of family members. [Source: 2iQ]

Buys

Byron Donalds (R)

Company: Lam Research ($LRCX)

Amount Purchased: $2K - $30K

Sells

Kelly Morrison (D)

Company: Accenture ($ACN)

Amount Sold: $33K - $145K

Company: Thermo Fisher Scientific ($TMO)

Amount Sold: $32K - $130K

Major Trades Published 8/18 - 8/22

Buys

Sells

How was today's newsletter?I value all of the feedback that I receive. Let me know how I did so I can continue to make this the best investing newsletter available! |

🤝 Review of the Week

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Reply