- Carbon Finance

- Posts

- 📊 Google’s Spending Shock

📊 Google’s Spending Shock

1) Palantir Has Been Unstoppable 2) Disney’s Lost Decade 3) AMD Crosses $10B and more!

Happy Monday!

Software is facing an apocalypse. And this past week, Anthropic accelerated those fears.

Last Monday, the company released an AI automation tool capable of handling tasks like contract review and legal briefings, triggering sharp selloffs across legal and workflow software names like Experian, Thomson Reuters, and LegalZoom.

The impact quickly spread, pulling down broader software stocks as investors reassessed where AI could sit in the stack.

Then on Thursday, Anthropic upgraded Claude Opus 4.6, its most advanced model.

The new release significantly improves autonomous work, including coding, analysis, financial research, and document creation.

That added pressure to financial data and research providers like FactSet and S&P Global.

The selloff has been lucrative for bears, with short sellers booking roughly $24B in profits so far this year.

Key Data Bites Over The Last Week:

Morningstar updated its list of the 10 most undervalued stocks.

Walmart reached a $1T market cap for first time.

U.S. will cut tariffs on India from 25% to 18% in new trade deal.

Trump will launch $12B critical mineral stockpile.

Waymo is looking to raise $16B near $110B valuation.

SpaceX has combined with xAI at $1.25T valuation.

Oracle plans to raise up to $50B for its Cloud business.

4 companies plan to spend $650B this year in AI CapEx.

Adobe boosted ad spending to $1.4B to push back on AI fear.

U.S. companies announced most January job cuts in 17 years.

Texas Instruments to acquire Silicon Laboratories for $7.5B.

PepsiCo plans up to 15% price cuts on major snacks.

Novo Nordisk expects 2026 sales and op. profit to decline up to 13%.

In today’s newsletter:

🚀 Palantir Has Been Unstoppable

🐭 Disney’s Lost Decade

📈 AMD Crosses $10B

🚨 Google’s Spending Shock

👟 Amazon Overtakes Walmart

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Together With Beehiiv

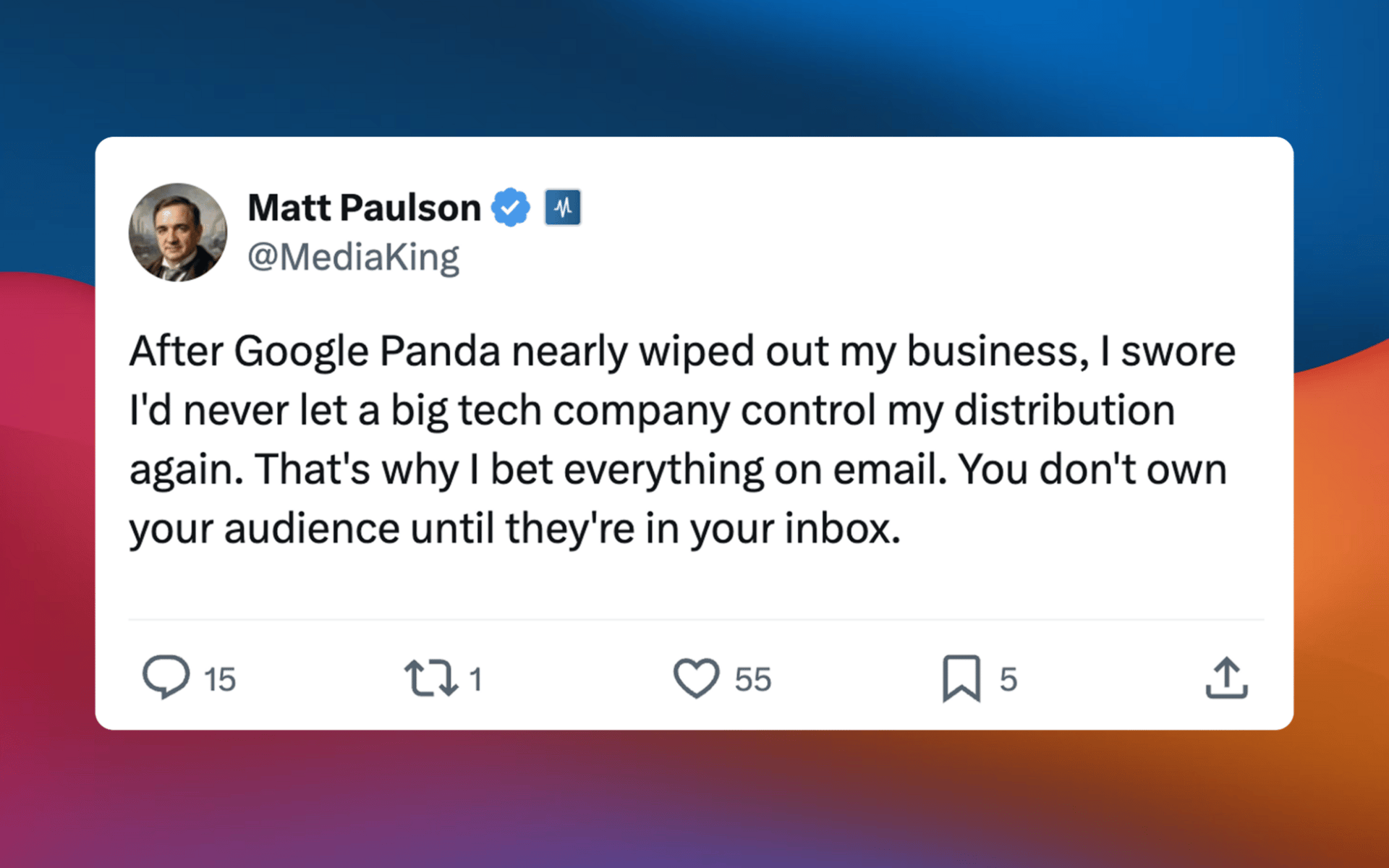

Why is everyone launching a newsletter?

Because it’s how creators turn attention into an owned audience, and an audience into a real, compounding business.

The smartest creators aren’t chasing followers. They’re building lists. And they’re building them on beehiiv, where growth, monetization, and ownership are built in from day one.

If you’re serious about turning what you know into something you own, there’s no better place to start. Find out why the fastest-growing newsletters choose beehiiv.

And for a limited time, take advantage of 30% off your first 3 months with code LIST30.

Palantir’s flywheel is spinning.

After years of heavy investment, the financials are flipping fast.

In Q4, Palantir delivered $0.25 EPS versus $0.23 expected on $1.41B in revenue, beating estimates.

Revenue surged 70%, while net income skyrocketed 670%.

The biggest shift is in profitability.

Operating profit has swung from deep losses between 2020 and 2023 to over $1.4B in the most recent quarter, as scale finally met demand.

U.S. government revenue grew 66%, driven by large defense contracts, including a $10B U.S. Army deal.

U.S. commercial revenue more than doubled, with remaining deal value up 145% to $4.38B.

Looking ahead, Palantir now expects $7.19B in 2026 revenue at the midpoint, well above the $6.22B consensus estimate.

Disney has been dead money for a decade.

A $10,000 investment ten years ago would be worth just $12,013 today, even after dividends and stock splits.

A shrinking linear TV business, years of unprofitable streaming investments, leadership churn, and pandemic fallout have all weighed on performance.

In the most recent quarter, Disney modestly beat expectations, posting $1.63 in adjusted earnings on $25.98B in revenue.

Theme parks were the bright spot, with the Experiences division surpassing $10B in quarterly revenue for the first time.

Shares initially dipped after Disney failed to name a new CEO during its earnings release.

The next day, the company announced Josh D’Amaro, a 28-year Disney veteran, will succeed Bob Iger as CEO in March 2026.

Lisa Su delivered another big win for AMD.

The company crossed $10B in quarterly revenue for the first time ever.

Despite that milestone, shares fell nearly 20% the following day.

The reason came down to expectations.

AMD reported Q4 revenue of $10.27B, beating the $9.67B estimate, and guided the current quarter to $9.8B, above the $9.38B consensus.

While the guidance beat estimates, it fell short of the far higher expectations priced into the stock after shares had more than doubled.

Some investors focused on a sequential revenue slowdown, even though growth remains strong, as massive industrywide CapEx spending had led to hopes of uninterrupted, exponential growth.

The beat was also narrower than expected after AMD included Chinese revenue that some analysts had not modeled.

Even after the selloff, shares are still up nearly 90% over the past year.

Meta’s AI spending raised eyebrows. Alphabet’s raised the ceiling.

After Meta guided 2026 CapEx to roughly $125B, well above the $110B consensus, Alphabet went even further.

The company expects roughly $180B in capital spending in 2026, nearly double last year and far above the $115B analysts were estimating.

Shares initially sold off, but losses were largely pared by the end of the week.

The reason was execution.

Alphabet delivered record annual revenue, crossing $400B for the first time.

Google Cloud revenue surged 48% YoY to $17.7B, while backlog doubled to $240B.

Those results reinforced investor confidence that AI demand is already translating into real revenue.

Alphabet is showing rapid cloud growth alongside rising backlog, accelerating search growth, and expanding enterprise adoption of Gemini, making the heavy spend easier for the market to digest.

Amazon just crossed a historic milestone.

For the first time, Amazon now generates more annual revenue than Walmart, the company that defined global retail dominance for decades.

Since 2005, Amazon’s revenue has compounded at roughly 25% per year.

Walmart’s revenue has grown just over 4% annually over the same period.

That gap explains the crossover.

Amazon is also leaning into the future.

Management plans to spend $200B in CapEx in 2026, well above the $147B Wall Street consensus, targeting AI infrastructure, chips, and robotics.

In Q4, revenue reached $213.4B, beating expectations.

AWS revenue jumped 24% YoY to $35.6B, its fastest growth in 13 quarters.

Advertising revenue climbed 23% to $21.3B.

📣 Presented by The Hustle Daily

200+ AI Side Hustles to Start Right Now

AI isn't just changing business—it's creating entirely new income opportunities. The Hustle's guide features 200+ ways to make money with AI, from beginner-friendly gigs to advanced ventures. Each comes with realistic income projections and resource requirements. Join 1.5M professionals getting daily insights on emerging tech and business opportunities.

💾 Chip Friction↗ – OpenAI is reportedly unsatisfied with some Nvidia chips and looking for alternatives.

🚀 Fast Inclusion↗ – SpaceX is looking for early inclusion in major stock indexes following its planned IPO.

🪙 Silver Short↗ – Chinese trader who made $3B on Gold built the largest net short position in Silver on the Shanghai Futures Exchange.

👻 Fear Rejection↗ – Nvidia CEO Jensen Huang pushed back on fears that AI will replace software and related tools.

Notable Companies Reporting Earnings Week of February 8, 2026:

Major Trades Published 2/2 - 2/6. Trades may be those of family members. [Source: Capitol Trades]

Buys

Cleo Fields (D)

Company: Alphabet Inc. ($GOOGL)

Amount Purchased: $101K - $265K

Company: Netflix ($NFLX)

Amount Purchased: $50K - $100K

Company: Meta Platforms ($META)

Amount Purchased: $50K - $100K

Company: Iren ($IREN)

Amount Purchased: $50K - $100K

Sells

Sheldon Whitehouse (D)

Company: McDonald’s ($MCD)

Amount Sold: $15K - $50K

Major Trades Published 2/2 - 2/6

Buys

Veradermics Inc ($MANE)

Insider: Patrick Enright (Director)

# of Shares Purchased: 1,075,000

$ Amount: $18,275,000

SEC Forms: [1]

Sells

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

This newsletter is sponsored by Beehiiv and The Hustle Daily. Sponsorship does not influence our editorial content. We do not endorse the sponsor’s products, services, or views, and we are not responsible or liable for any interaction or transaction between readers and the sponsor.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Reply