- Carbon Finance

- Posts

- 📊 Intel Beats Nvidia

📊 Intel Beats Nvidia

1) Micron Insiders Are Buying 2) Netflix Just Got Bigger 3) Software Bloodbath and more!

Happy Sunday!

Many expected metals to cool off this year. The opposite happened.

Gold and Silver both pushed to new all time highs this week thanks to rising geopolitical tensions and economic uncertainty.

Gold hit $4,990 per ounce while Silver crossed $100 per troy ounce for the first time ever.

As a result, forecasts are moving higher.

Goldman Sachs raised its year end gold target to $5,400, an 8% increase from current levels.

Gold is now up 15% this year, while Silver is up an incredible 45%. Can anything stop this rally?

Key Data Bites From This Week:

Bloomberg published its latest where to invest $100,000.

JPMorgan shared a list of its top 24 short ideas.

Russia has gained more than $216B from Gold’s rally since 2022.

China saw Q4 GDP grow 4.5%, its weakest in nearly 3 years.

Chris Hohn posted largest annual hedge fund profit ever at $19B.

CEO revenue confidence has reached a 5-year low.

Threads has reached 141.5M daily active users on mobile.

Trump sues JPMorgan Chase for $5B over alleged debanking.

Berkshire Hathaway is preparing to exit its 28% stake in Kraft Heinz.

Strategy purchased $2.1B in Bitcoin in 8 days.

OpenAI is looking to raise $50B from Middle East investors.

Bank of America will award $1B in stock to nearly all employees.

Americans are reportedly bearing 96% of U.S. tariff costs.

Capital One will acquire Brex in a $5.15B deal.

Earnings & Guidance:

Interactive Brokers saw customer accounts jump 32% YoY to 4.4M.

Charles Schwab delivered a 42% increase in core net new assets to $519B in 2025.

GE Aerospace reported a 74% surge in total orders to $27B.

In today’s newsletter:

🧾 Micron Insiders Are Buying

🍿 Netflix Just Got Bigger

🩸 Software Bloodbath

💨 Intel Beats Nvidia

🪡 The Robot Monopoly

Let’s jump right in.

Not subscribed yet? Sign up today!

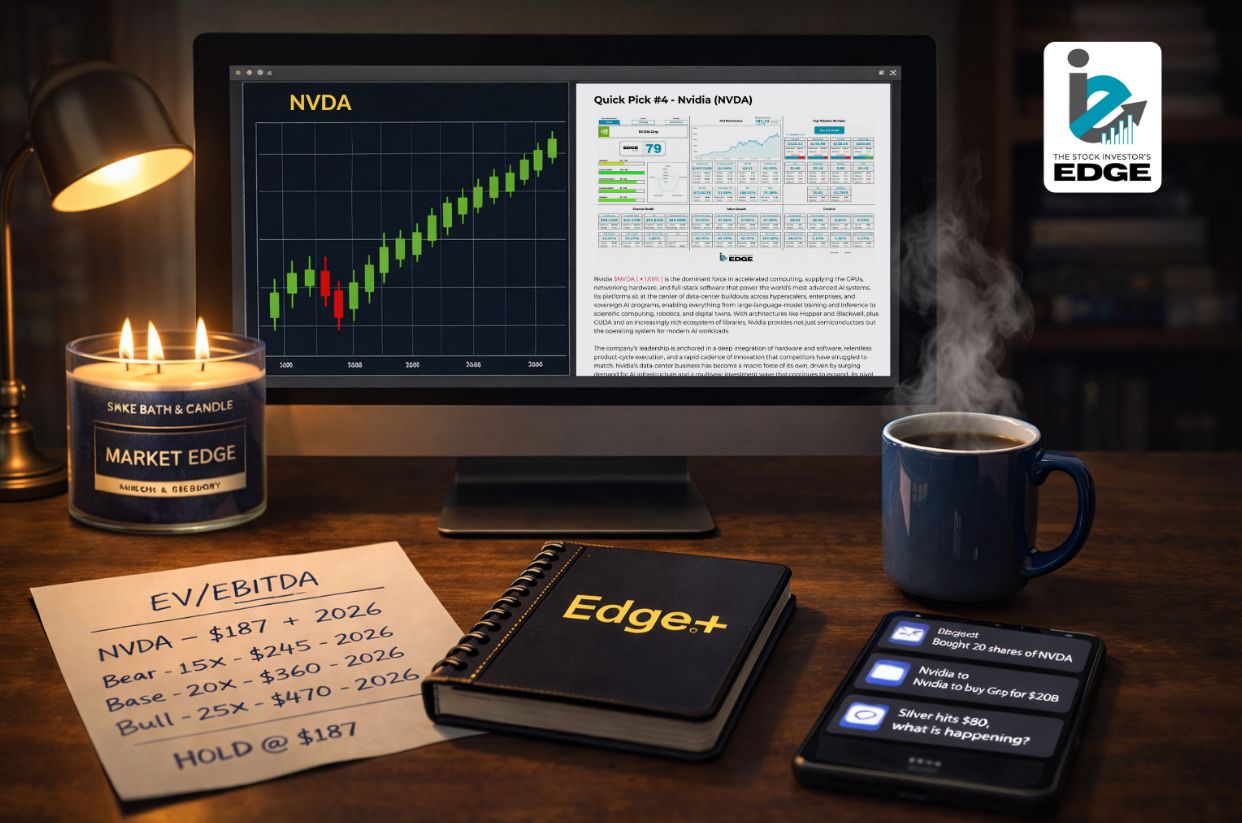

📣 Together With The Investor’s Edge

Investing isn’t about reacting faster.

It’s about understanding what actually matters, and recognizing it before it becomes obvious.

The Stock Investor’s Edge helps you cut through the noise with deep research, clearly explained investment and options ideas, and ongoing market context.

If you want to make calmer, more confident decisions grounded in research and process, this community is built for you.

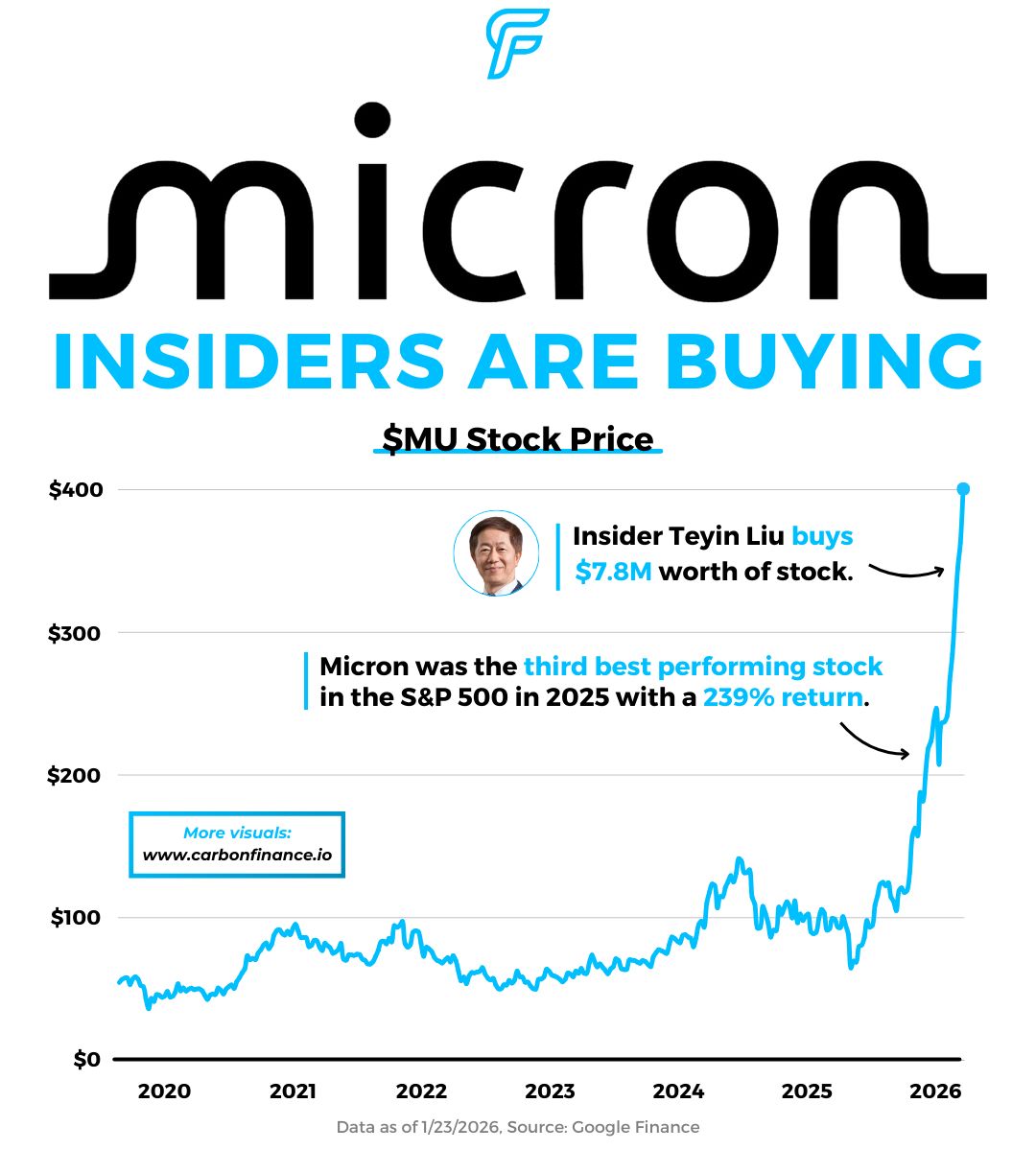

We all know that famous Peter Lynch quote.

"Insiders sell for all kinds of reasons…but they only buy for one reason, which is they think the stock is going up.”

And that signal just flashed in one of the market’s best performers.

On January 13 and 14, Micron director Teyin Liu purchased 23,200 shares of Micron Technology, spending nearly $8M.

This came after Micron delivered a staggering 239% return in 2025, making it one of the top performers in the S&P 500.

The rally has continued into 2026, with shares already up another 27% in just a few weeks.

Micron sits at the center of the AI infrastructure boom, supplying critical memory chips for data centers where demand remains red hot.

Buying near the highs suggests Liu believes this cycle still has room to run.

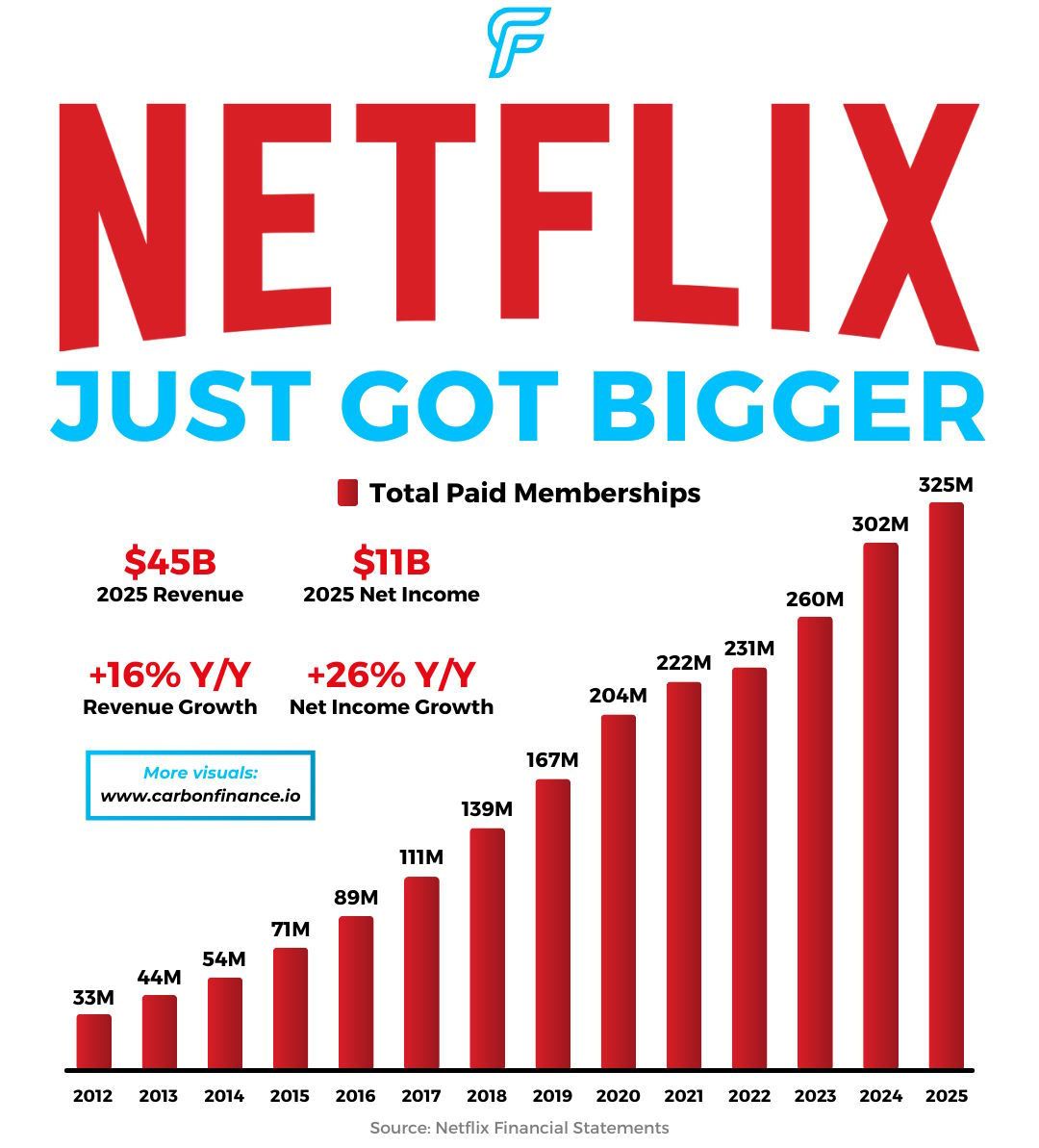

Netflix investors hit pause.

Shares fell after the company delivered a modest Q4 earnings beat but issued a mixed outlook.

Revenue climbed 18% to $12.05B, slightly ahead of expectations.

Earnings per share rose 30% to $0.56, narrowly topping the $0.55 estimate.

Growth was driven by subscriber additions, price increases, and higher advertising revenue.

Netflix also reached a record 325M global paid subscribers, up 8% YoY.

Strategically, the company amended its bid for Warner Bros’ film assets to an all-cash offer and said it would pause share repurchases to help fund the deal.

Looking ahead, Q1 guidance came in just below expectations, with revenue of $12.16B and earnings of $0.76 per share.

For the full year, revenue guidance of $51.4B narrowly beat estimates but implies a slowdown from 2025.

The combination of cautious guidance and acquisition uncertainty weighed on the stock.

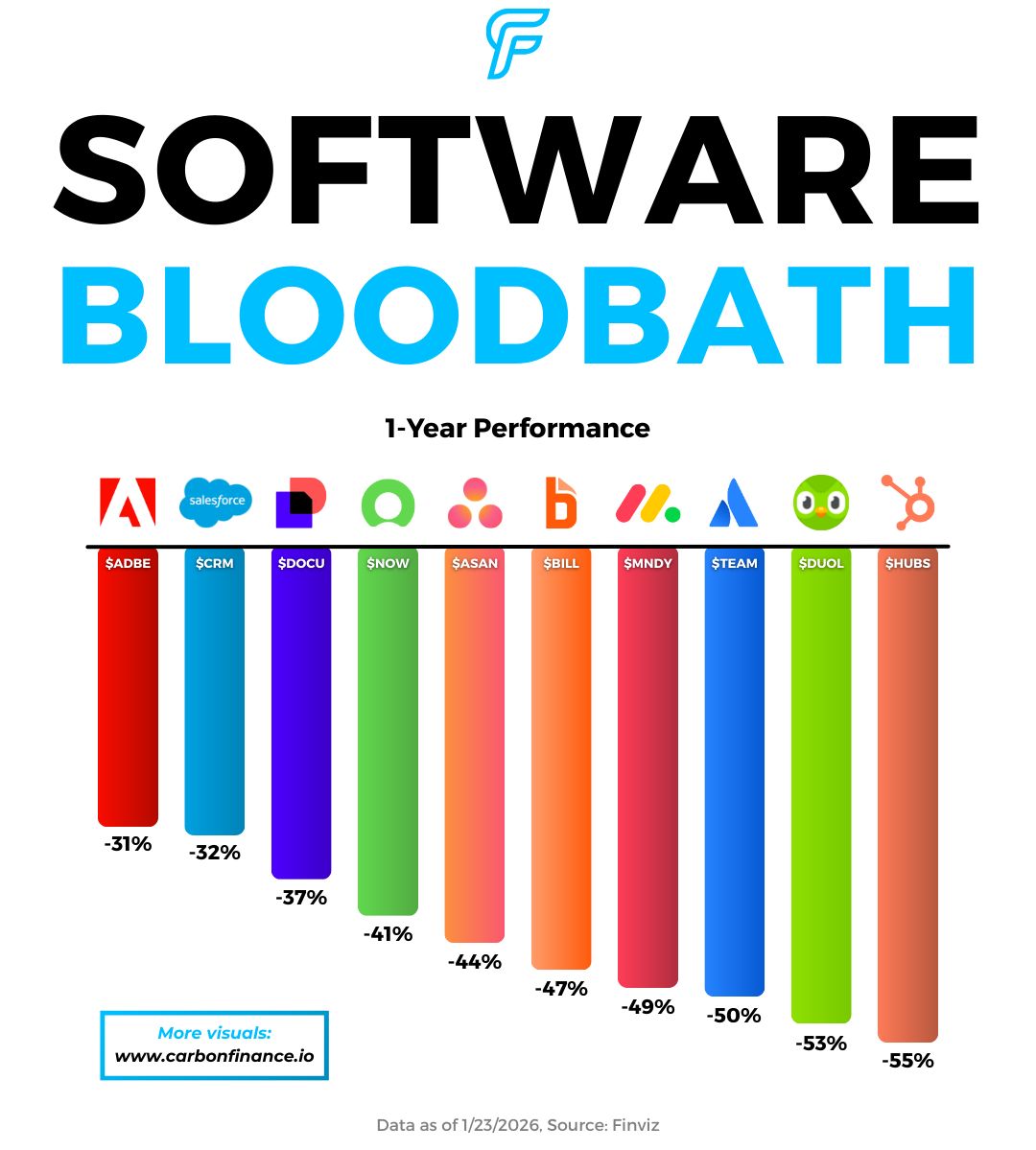

Software stocks are getting hit hard.

Since the start of the year, major software names have continued to fall after an already difficult 2025.

Investor anxiety spiked after Anthropic unveiled Claude Cowork, a general purpose AI agent designed for non-coding tasks.

The concern is that AI agents may sit above existing workflows, making specialized software less essential.

That threatens per seat pricing models, as a single agent could replace the work of multiple users.

It also raised eyebrows that the tool was reportedly built in under two weeks using Anthropic’s own AI.

The takeaway for investors is simple. Software companies now face a “show me” moment.

They must prove they can use AI to extend their moats and growth, rather than be commoditized by it.

Intel’s turnaround just hit another speed bump.

Shares of Intel fell nearly 10% this week after a mixed quarter and soft guidance.

On the surface, the results looked fine.

Adjusted earnings came in at $0.15, well above the $0.08 estimate, and revenue topped expectations at $13.7B.

Underneath, the picture was weaker.

Intel posted a $600M net loss, sharply worse than the $100M loss a year ago.

Guidance also disappointed.

Q1 revenue was guided to $12.2B, below the $12.5B estimate, and management expects earnings to break even.

Executives pointed to supply constraints and weak manufacturing yields, reiterating that the turnaround will take multiple years.

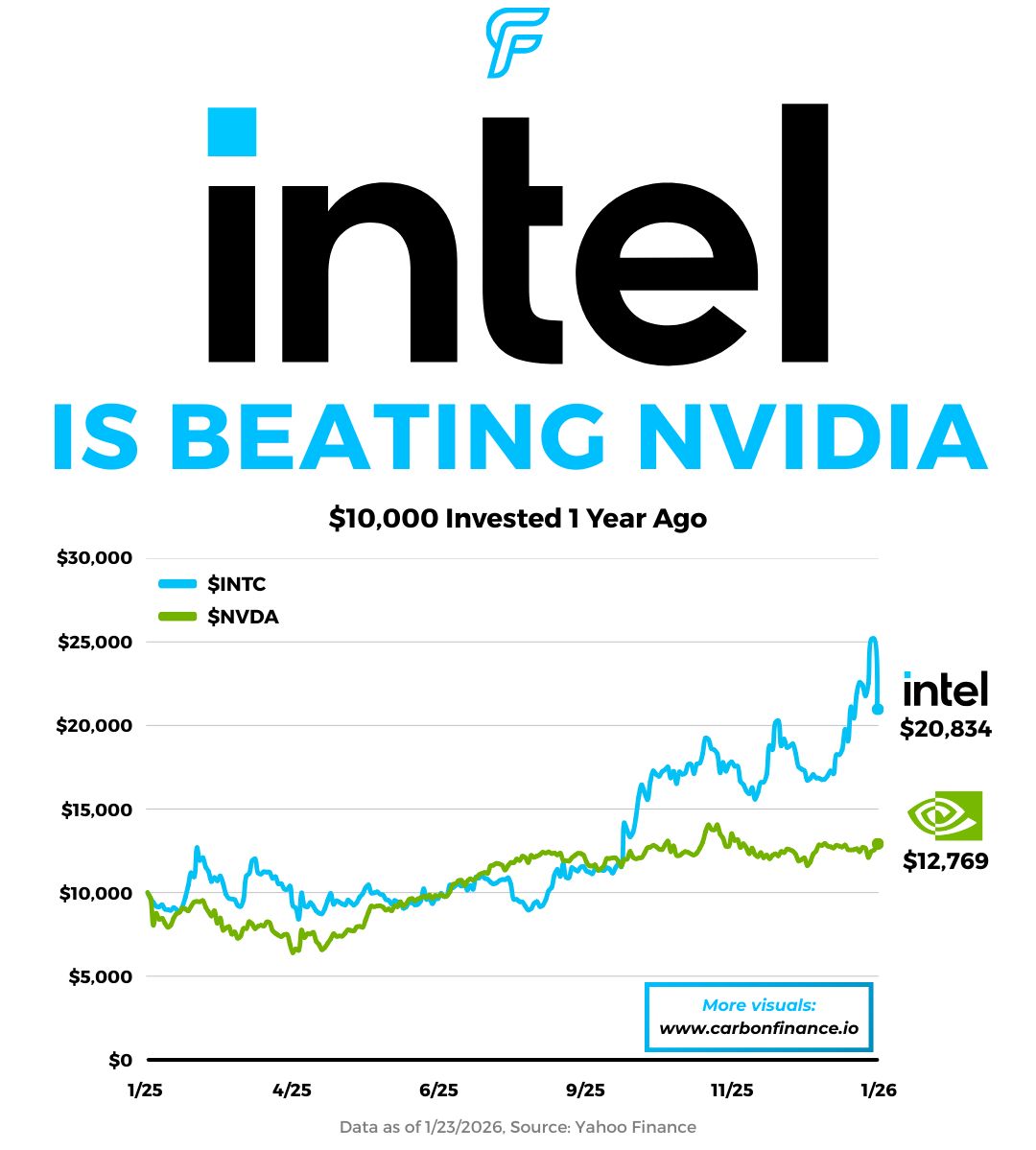

Despite the pullback, Intel’s longer term rebound remains notable.

Shares have more than doubled over the past year, driven by U.S. government support, backing from Nvidia and SoftBank, and its push to become a leading independent foundry.

This performance has allowed Intel to quietly outperform Nvidia.

A $10,000 investment in Intel would be worth about $20,834, versus roughly $12,769 in Nvidia.

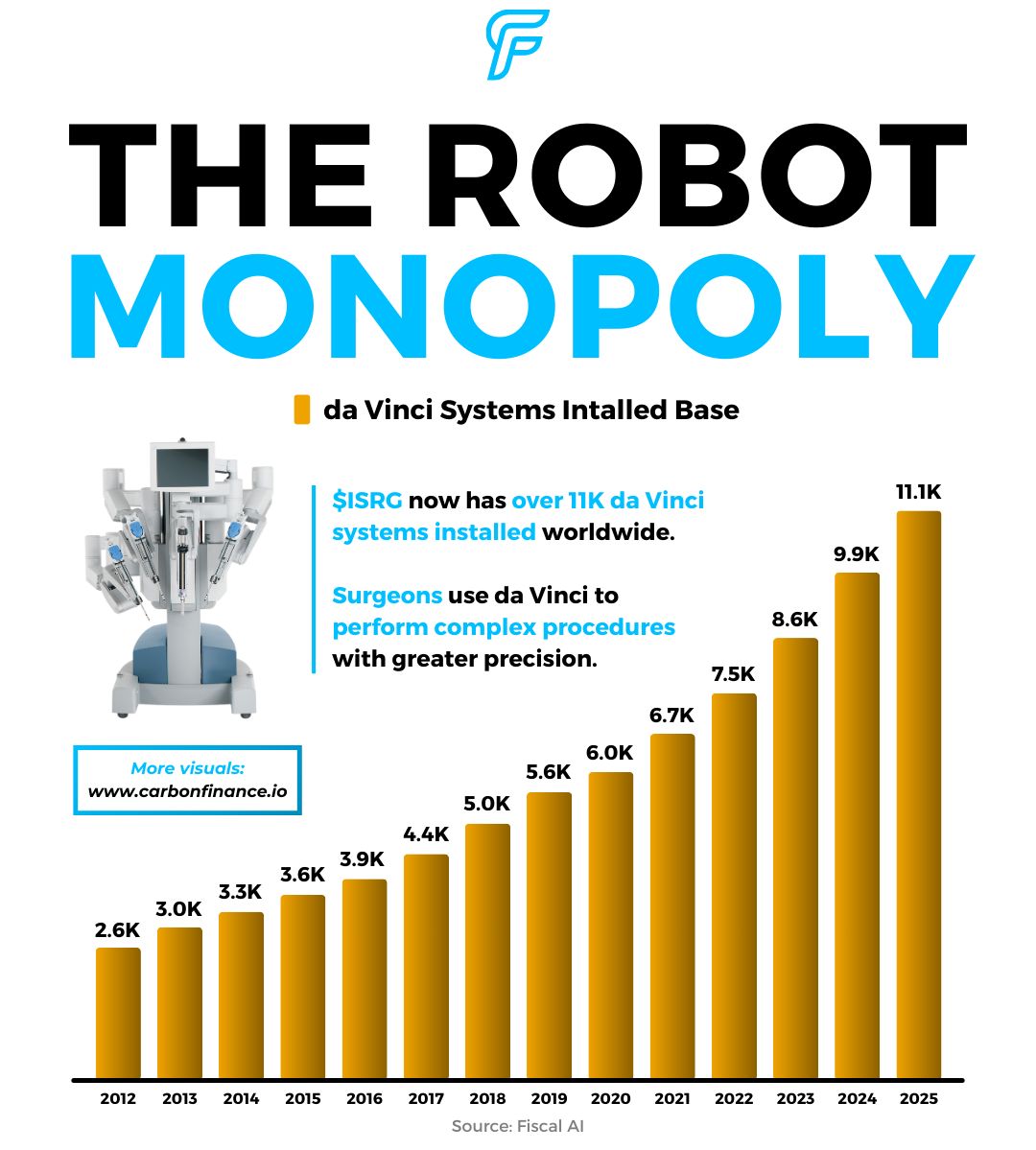

Many investors are chasing next generation AI robotics. One company is already winning.

Intuitive Surgical is a medtech leader best known for the da Vinci surgical system.

Hospitals use da Vinci for complex, minimally invasive procedures, creating recurring revenue from instruments, accessories, and service contracts.

Intuitive Surgical now has more than 11,000 da Vinci systems installed worldwide.

That installed base has more than tripled over the past decade.

In Q4, the company delivered another solid quarter.

Earnings came in at $2.53 per share on $2.87B in revenue, both ahead of expectations.

Procedures grew 18%, and the company placed 532 new systems during the quarter.

Looking ahead, management expects da Vinci procedure growth of 13% to 15% in 2026.

While growth is moderating, Intuitive Surgical remains the dominant force in soft tissue surgical robotics, a position it has held for more than 25 years.

📣 Presented by Fisher Investments

Ready to Plan Your Retirement?

Knowing when to retire starts with understanding your goals. When to Retire: A Quick and Easy Planning Guide can help you define your objectives, how long you’ll need your money to last and your financial needs. If you have $1 million or more, download it now.

🐻❄️ Arctic Deal↗ – President Trump announced he reached a Greenland deal framework with NATO.

🎢 Ads Rollout↗ – Meta is beginning to roll out ads on Threads to all users globally.

🤖 Humanoid Launch↗ – Elon Musk expects Tesla to sell humanoid robots to the public by the end of 2027.

🍎 Apple Wearable↗ – Apple is reportedly developing an AI wearable that users can wear on their clothing.

Courtesy of our affiliate partner, EarningsHub.

Notable Companies Reporting Earnings Week of January 25th, 2025:

Major Trades Published 1/19 - 1/23. Trades may be those of family members. [Source: Capitol Trades]

Buys

Cleo Fields (D)

Company: Alphabet ($GOOG)

Amount Purchased: $50K - $100K

David Taylor (R)

Company: IBM ($IBM)

Amount Purchased: $16K - $65K

Sells

Kevin Hern (R)

Company: Unitedhealth Group ($UNH)

Amount Sold: $250K - $500K

Cleo Fields (D)

Company: Iren Limited ($IREN)

Amount Sold: $50K - $100K

Major Trades Published 1/19 - 1/23

Buys

Sells

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

This newsletter is sponsored by The Investor’s Edge and Fisher Investments. Sponsorship does not influence our editorial content. We do not endorse the sponsor’s products, services, or views, and we are not responsible or liable for any interaction or transaction between readers and the sponsor.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Reply