- Carbon Finance

- Posts

- 📲 Meta Platforms: Walking on Thin Ice

📲 Meta Platforms: Walking on Thin Ice

Investment Research Report: Meta Platforms

📅 Publication Date: 1/17/2026

Investing is a game of conviction, and conviction is built on clarity. My research is an attempt to distill my thoughts, challenge my assumptions, and refine my decision-making. It is not a display of expertise, but a foundation, one that will evolve over time. My goal is simple: to become a sharper, more disciplined investor. If you take away even a single insight from this, then it has served its purpose. Feedback is always welcome. After all, the best investors never stop learning.

Note: This report is for informational purposes only and does not constitute investment advice; please refer to the full disclaimer at the end.

1. Investment Thesis in One Sentence

Meta operates one of the strongest advertising platforms ever built, but the stock today prices in successful execution of a capital-intensive AI strategy with limited margin of safety.

2. Introduction & Brief History

Meta Platforms needs no introduction.

If you have a smartphone, chances are you’re already using one of its products. I’d also bet that you found my content through Instagram. I started posting there in April of 2020, and since then the page has grown to over 420,000 followers and reaches millions of users each month, a reminder of just how powerful Meta’s distribution truly is.

For the origin story, The Social Network captures it well. While I’m not a big movie person, it’s one of the few I genuinely enjoyed. It walks through how Mark Zuckerberg and his roommates at Harvard built Facebook in 2004, starting as a simple campus directory that was easy to join and inherently social. Growth followed naturally.

Company Timeline, Source: Meta Platforms

In 2007, Facebook launched Facebook Ads, marking the beginning of monetizing attention at scale and laying the foundation for what would become one of the most powerful advertising businesses ever built.

Then in 2012, Facebook acquired Instagram for $1B. At the time, many believed Zuckerberg had overpaid, given Instagram had no meaningful revenue. In hindsight, it stands as one of the best acquisitions in tech history. FTC filings made public in 2024 revealed that Instagram generated over $32B in revenue in 2021 alone, a figure that is almost certainly much higher today.

The same year as the Instagram acquisition, Facebook went public at a market cap just over $100B, the largest tech IPO at the time. Expansion continued with the $19B acquisition of WhatsApp and the $2B purchase of Oculus in 2014.

As Meta scaled, controversy became unavoidable. The most notable example came in 2018 with the Cambridge Analytica scandal, when data tied to roughly 87M users was accessed without consent for political targeting. Since then, Meta has faced ongoing scrutiny around election interference, misinformation, social media addiction, and more. At this size, controversy is not optional, but part of operating a global attention platform.

Meta’s Family of Apps, Source: Carbon Finance

In 2021, Zuckerberg rebranded the company from Facebook to Meta Platforms, signaling a push toward the Metaverse and arguably serving as a reputational reset. The timing proved difficult. In 2022, rising rates, a slowing ad market, Apple’s privacy changes, and intense competition from TikTok led to brutal earnings results. In just over a year, Meta’s stock fell roughly 80%, an extraordinary drawdown for a mega-cap company.

What followed was a repair. Meta cut costs, restructured teams, refocused on efficiency, and re-centered the core business. Engagement improved, margins rebounded, and revenue growth reaccelerated.

Today, Meta is once again among the ten most valuable companies in the world. It owns one of the most robust portfolios of consumer social platforms and operates a massive advertising network fueled by scale, data, and engagement. Despite that, the stock trades roughly in line with the S&P 500 on a forward earnings basis, around 22x. Some view this as a bargain. Others believe the discount exists for a reason.

There’s only one way to find out.

3. Business Overview

Meta Platforms builds global digital platforms that enable people and businesses to connect, communicate, and transact, monetized primarily through targeted advertising at massive scale.

The company operates two segments:

Family of Apps, which includes Facebook, Instagram, WhatsApp, and Messenger.

Reality Labs, which houses Meta’s long-term investments in virtual and augmented reality hardware, software, and content.

Company-Level Summary:

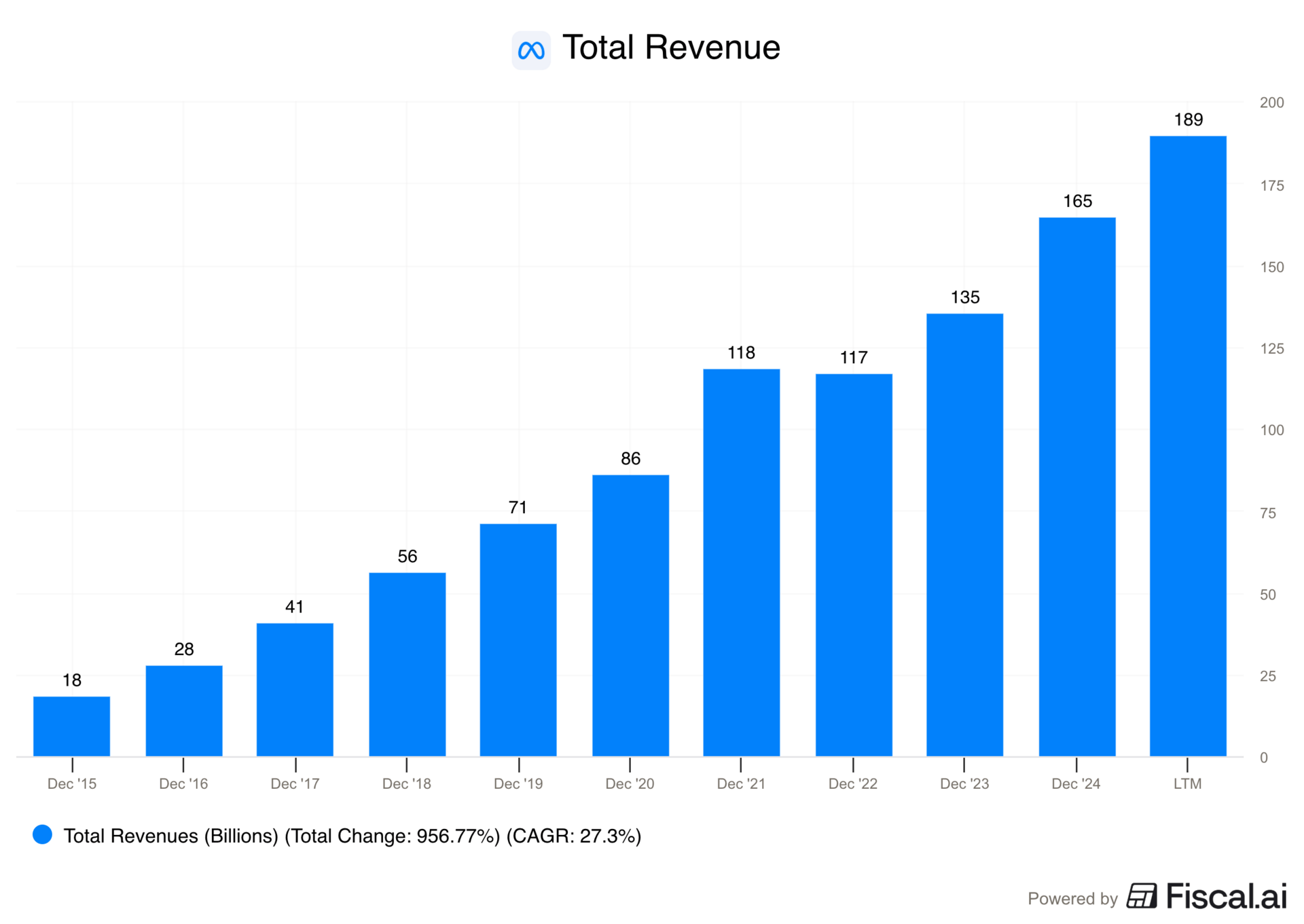

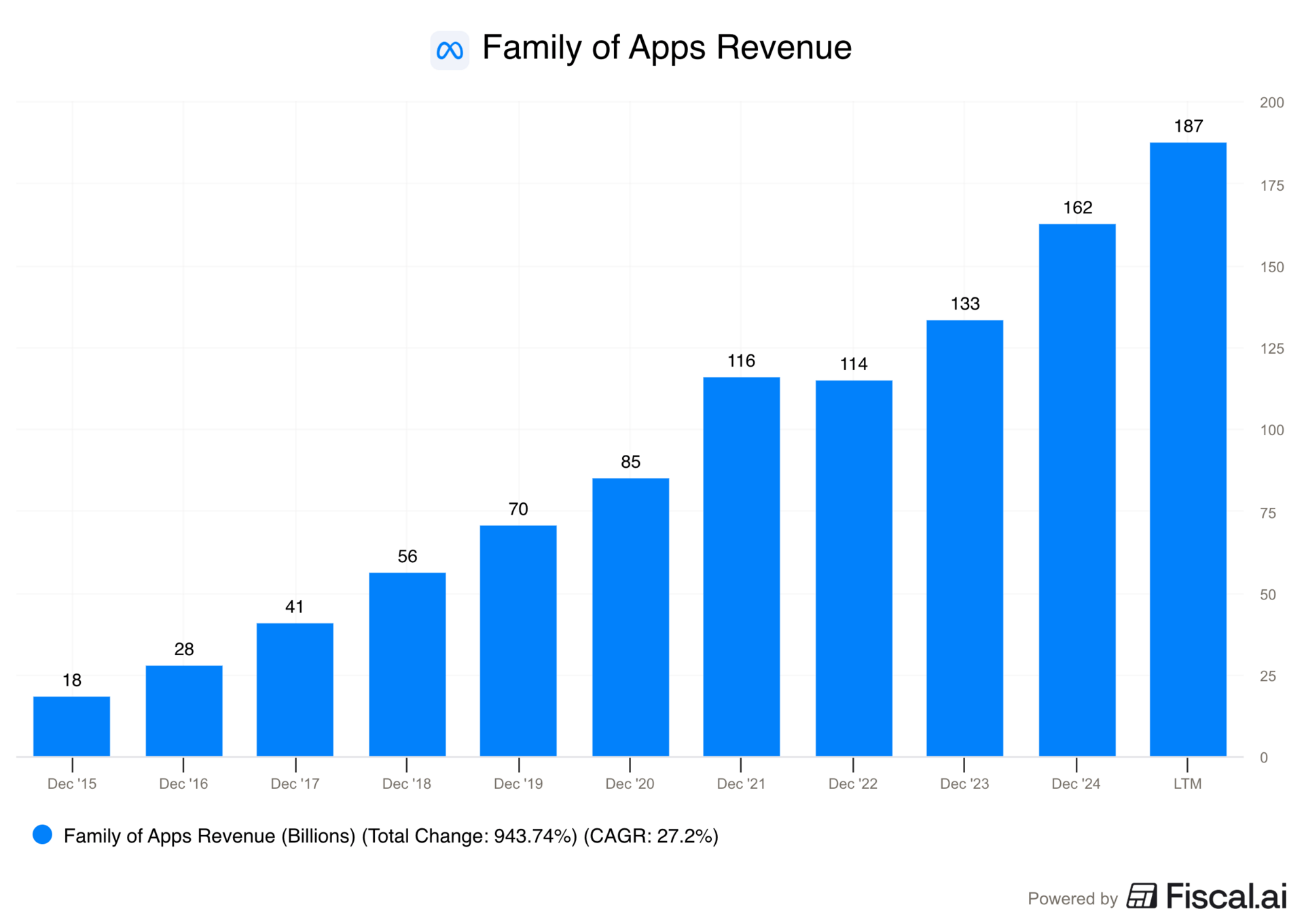

This chart does most of the talking. Over the last twelve months, the company generated $189B in revenue and has grown at a remarkable 27% CAGR over the past decade. And despite its current size, Meta grew revenue 26% YoY in the most recent quarter, an exceptional rate for a company of this size.

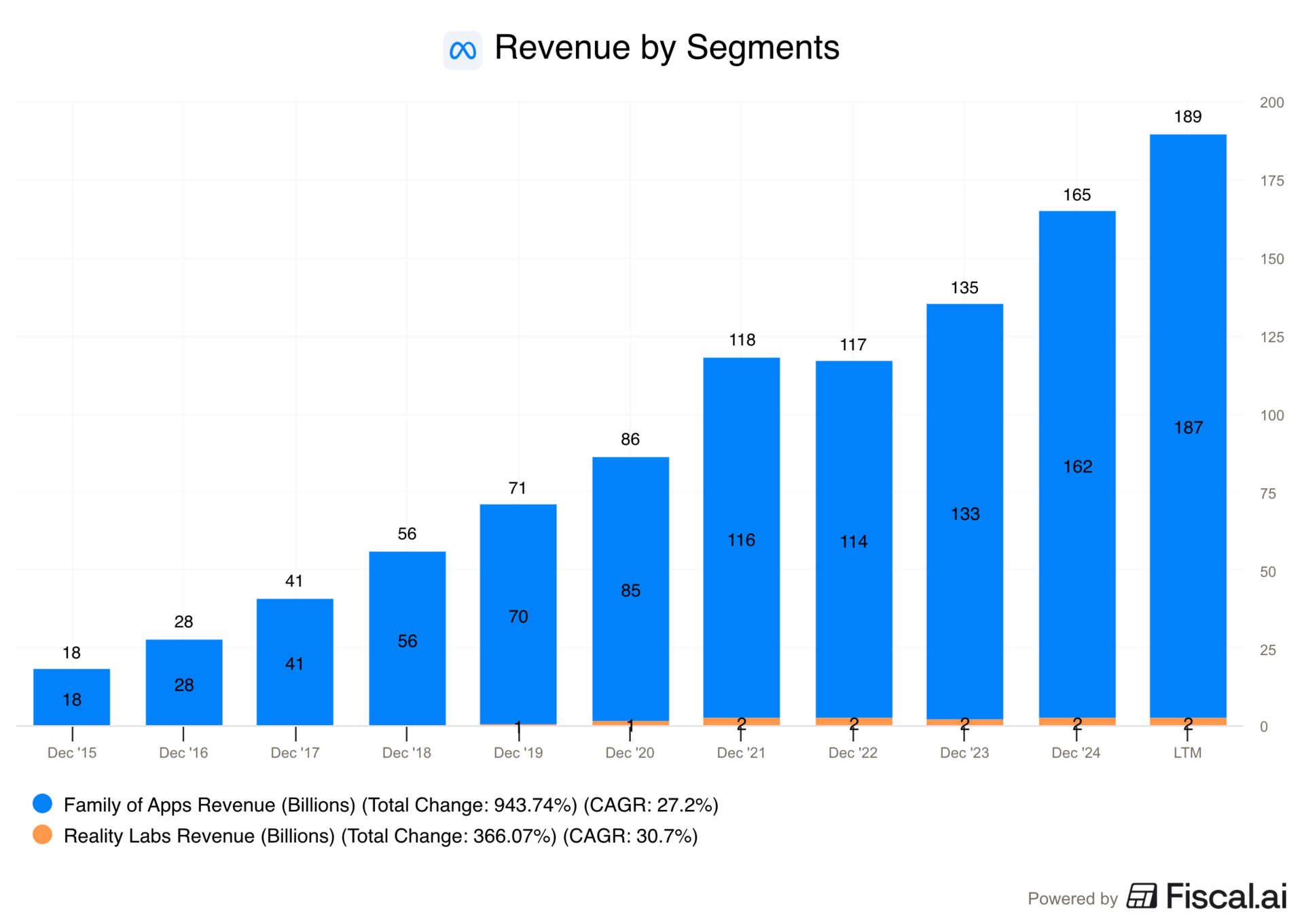

Nearly all revenue comes from Family of Apps, which accounted for roughly 99% of total revenue in the last twelve months. This reinforces a simple point: Meta today is still an advertising business first.

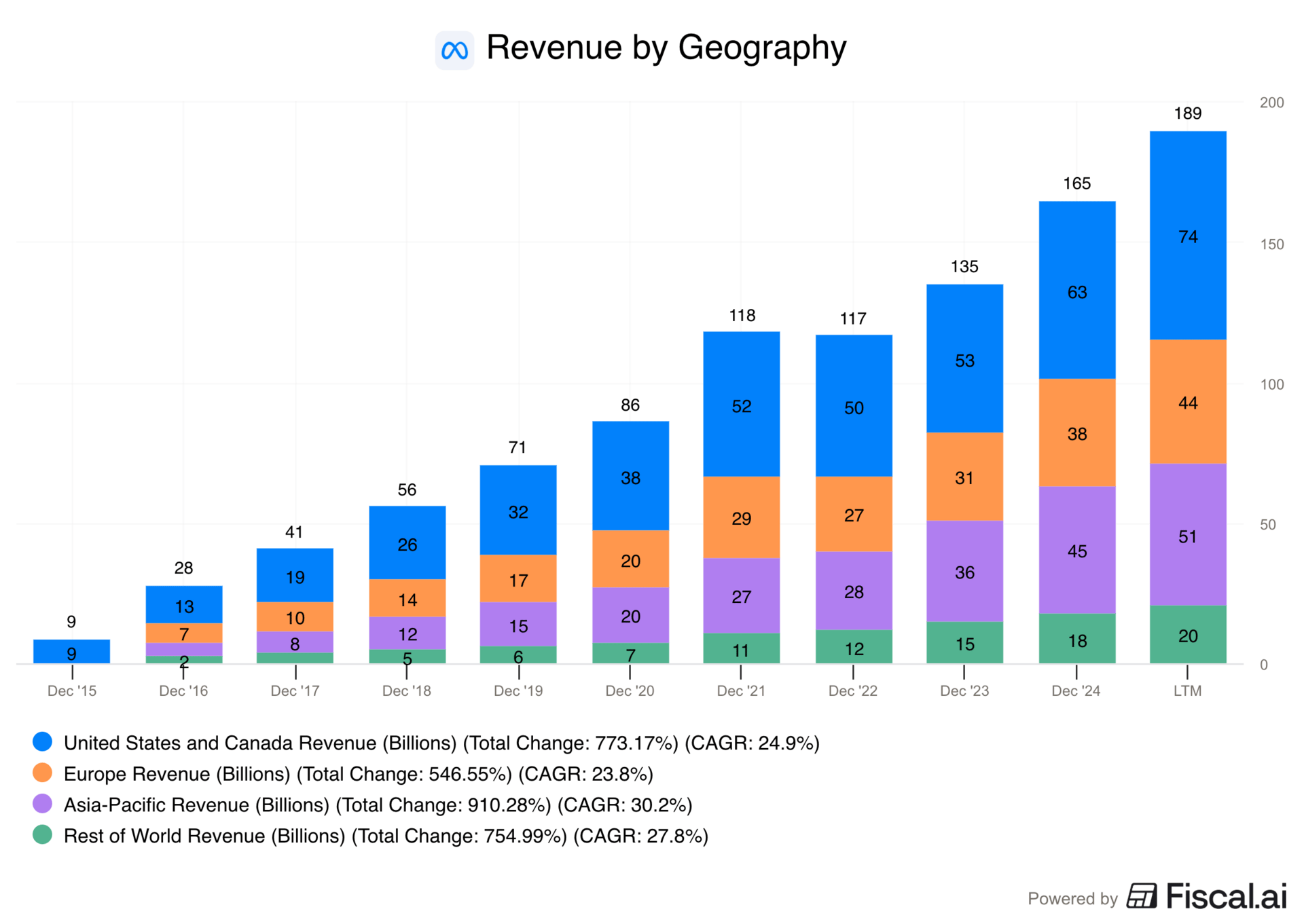

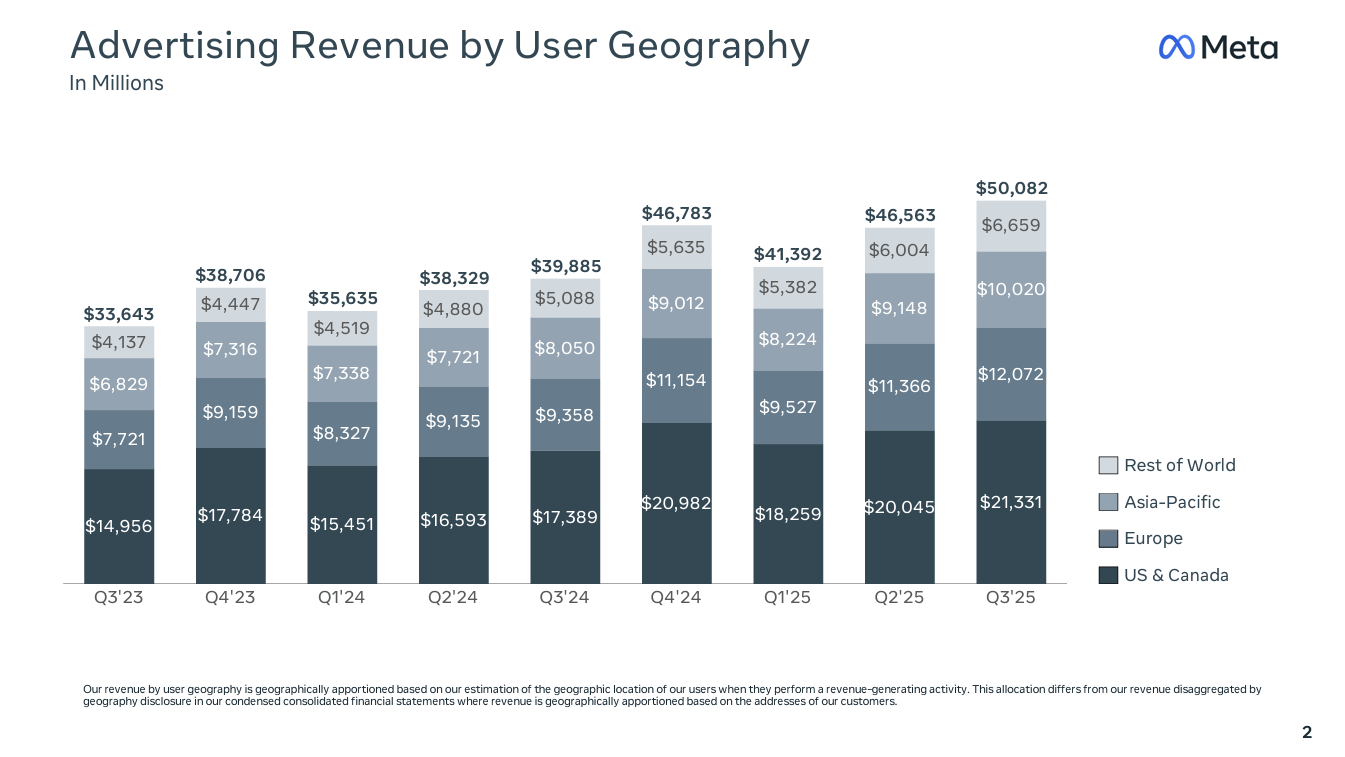

Geographically, Meta is diversified across four regions: United States and Canada, Europe, Asia-Pacific, and Rest of World.

The United States and Canada remains the largest market at roughly 40% of revenue, followed by Asia-Pacific at 27%. What stands out is consistency. All regions have compounded revenue in the 20–30% range, which speaks to the global durability of the platform.

From a profitability standpoint, Meta is raking in dough. The impact of the 2021–2022 Metaverse pivot and ad slowdown is visible, with net income plunging 41% during that period. Since then, profits have rebounded sharply.

One nuance often missed in headline coverage is around accounting optics. In the most recent quarter, Meta recorded a $15.93B one-time, non-cash income tax charge, which depressed reported net income to $2.7B. Excluding that charge, quarterly profit would have been $18.64B, and trailing twelve-month net income would be approximately $74B, the highest level in the company’s history. The business itself is operating at peak profitability.

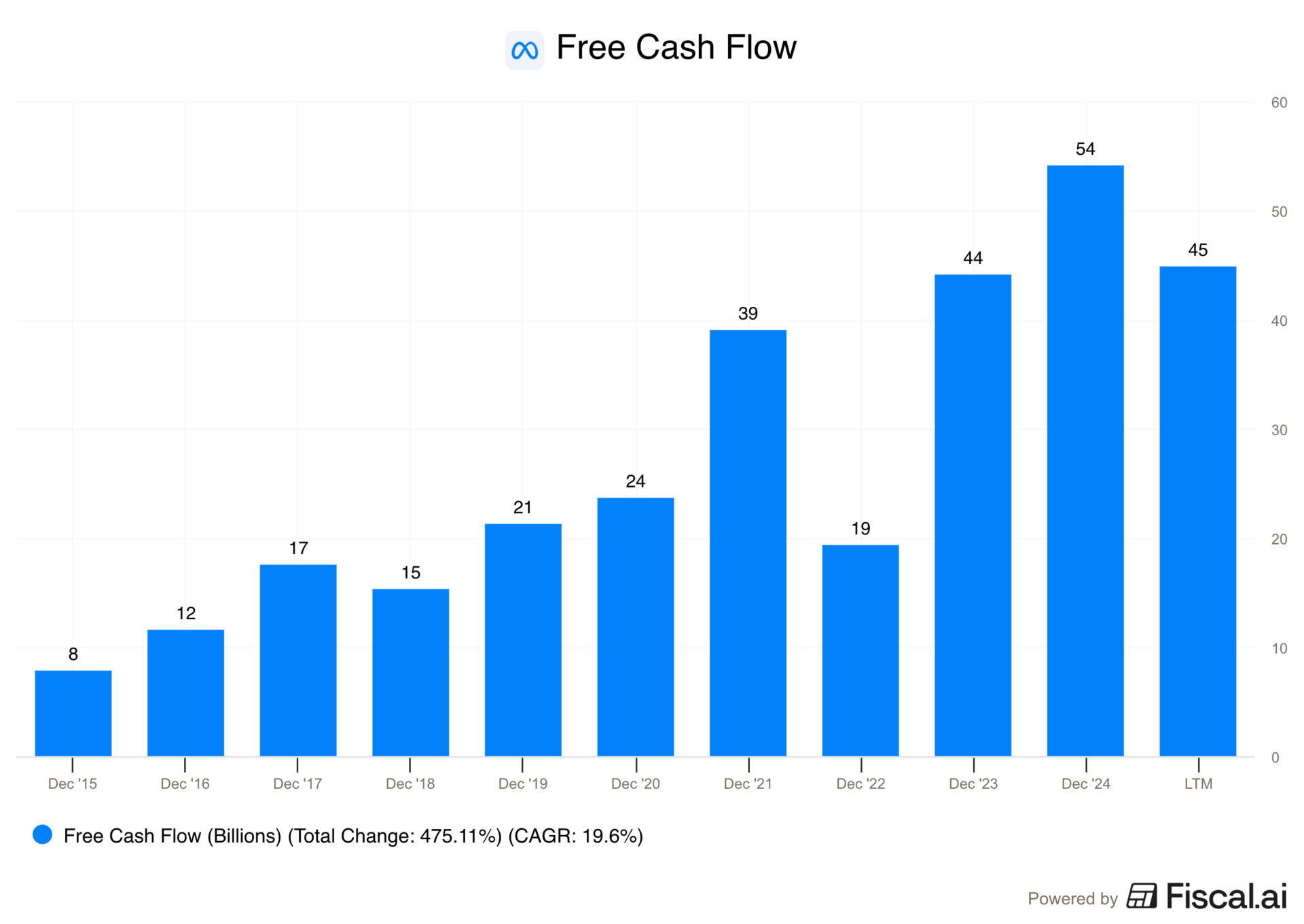

Free cash flow follows a similar pattern. There was a clear dip in 2022, followed by a strong rebound toward historical highs. Operating cash flow reached a record $108B over the last twelve months, while investment spending tied to AI infrastructure has also increased meaningfully.

Meta is spending aggressively to invest in what it believes is the next phase of the business. Importantly, it is doing so from a position of strength. The core business is throwing off enough cash to fund that investment internally.

Segment Breakdown:

Let’s walk through Meta’s two segments to understand where value is created today and where future growth resides.

A/ Family of Apps

Family of Apps is Meta’s core business and economic engine. It includes Facebook, Instagram, Messenger, and WhatsApp. Monetization is straightforward in theory but powerful in execution. Meta sells advertising by leveraging its massive user base, deep engagement, and an enormous volume of behavioral signals collected across its platforms. Those signals allow Meta to build detailed user profiles and deliver highly targeted ads seamlessly across its ecosystem.

With Family of Apps revenue at an all-time high and compounding at a solid double digit rate, Meta’s core advertising engine remains structurally healthy.

Growth is also broad-based geographically. Every region is growing YoY and posting record numbers. The business is not reliant on a single geography to drive incremental dollars.

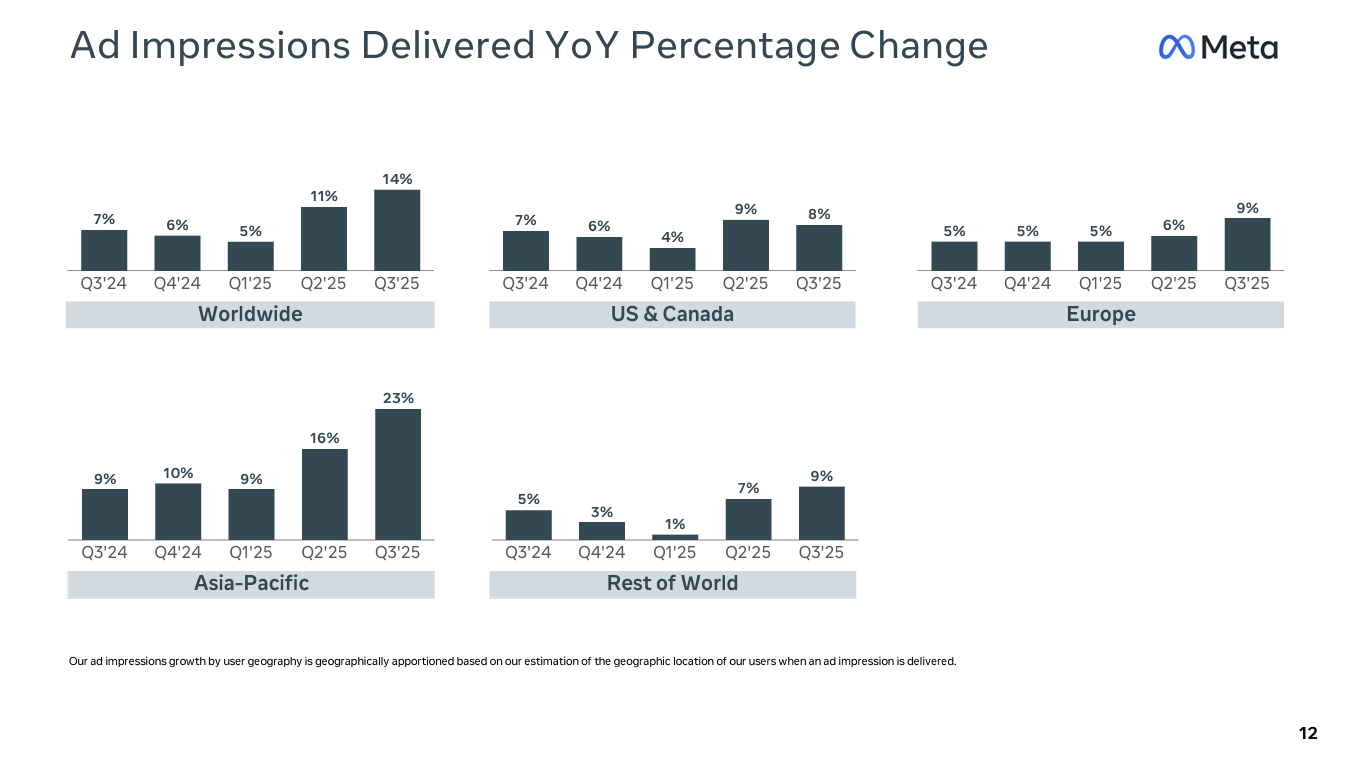

Ad impressions, which measure the total number of ads delivered to users, continue to scale rapidly and are a key indicator of core platform health. In Q3 2025, global ad impressions grew 14% YoY. The U.S. and Canada, Meta’s most important market, posted the “slowest growth” at 8%, while Asia-Pacific stood out with 23% growth. That divergence matters, particularly when viewed alongside pricing trends.

While Asia-Pacific is seeing the fastest growth in impressions, it is not yet translating into equivalent pricing power. Average price per ad in the region grew only 1%, compared to mid-teens growth across other geographies. This reflects the mix of emerging markets, where advertiser budgets are still maturing. Over time, this should improve as businesses in the region scale and spend more aggressively. In the near term, however, pricing growth there remains more cyclical, while developed markets offer greater stability.

All that being said, the core business is getting stronger economically, and that strength is being driven by multiple levers rather than a single cyclical tailwind.

1/ Ads System Optimization

One of the most important drivers of improving monetization is Meta’s overhaul of its ads infrastructure. Management has been explicit that rearchitecting its systems is a priority, and the results are beginning to show.

One way that I think about our company overall is that there are three giant transformers that run Facebook, Instagram, and ads recommendations…(and) we're also working on combining these three major AI systems into a single unified AI system that will effectively run our family of apps and business -- using increasing intelligence to improve the trillions of recommendations that it will make for people every day.

Meta is consolidating its ads models into a unified AI architecture called Lattice. Rather than operating hundreds of smaller, specialized models, Lattice learns across placements and objectives simultaneously. This reduces complexity while improving performance. In Q3, when Lattice was rolled out to app ads, it drove nearly a 3% increase in conversions. Meta has since retired roughly 100 smaller models and rolled them into Lattice since its launch in 2023.

At the same time, Meta is improving Andromeda, its AI-driven ad retrieval system. Andromeda analyzes user behavior and ad creatives in real time, moving beyond basic targeting to understand visual elements, emotional tone, and engagement signals. Management noted that combining early-stage retrieval and ranking models led to a 14% increase in ad quality on Facebook surfaces.

Runtime models are another critical component. These lightweight models operate in milliseconds and scale billions of times per day, determining what content and ads users see as they scroll. In Q3, Meta began piloting a new runtime ad ranking model on Instagram that uses more compute and data than prior versions, resulting in a +2% lift in conversions.

The takeaway here matters. Meta’s monetization gains are coming from measurable improvements in conversion quality and efficiency, not just from a cyclical rebound in ad demand. When Meta deploys compute directly into its core business, the returns are tangible.

2/ Improved Advertiser Experience

Source: Meta Platforms

Beyond model-level improvements, Meta is reshaping how advertisers interact with its platform. The company is moving toward full end-to-end automation, which structurally increases advertiser reliance on Meta’s systems.

Advantage+ is central to this effort. In Q3, Meta completed the rollout of streamlined campaign creation across sales, app, and lead campaigns. Advertisers now hand more decision-making over to Meta’s systems, including targeting, placement, and optimization. The annual run rate of revenue flowing through Meta’s automated ad solutions has now reached $60B, and advertisers using Advantage+ for lead campaigns are seeing roughly 14% lower cost per lead. Importantly, many advertisers are still using automation for only part of their campaigns, leaving meaningful runway for deeper adoption.

Mark Zuckerberg summarized the long-term vision clearly:

Advertisers are increasingly going to be able to give us a business objective and give us a credit card…and have the AI system basically figure out everything else that’s necessary, including generating video or different types of creative that might resonate with different people…

Over time, this should shift Meta from an ad marketplace to an advertising operating system. Meta is already moving in that direction. The number of advertisers using video generation tools grew 20% QoQ, and generative AI features are increasingly embedded across ad creation. As this evolves, Meta’s platform becomes both harder to replace and easier to scale.

Source: Meta Platforms

WhatsApp and Business AI add another vector of growth. Ads are being gradually introduced into WhatsApp Status, with full rollout expected in 2026. Click-to-WhatsApp ads grew revenue 60% YoY in Q3, and Business AI tools are improving the path from ad to purchase. Management’s cautious approach here is appropriate. Poor execution could damage WhatsApp’s perception as a private messaging platform. No one, including myself, wants to see randomly placed ads while messaging friends or family.

3/ User Growth & Engagement Acceleration

Ads optimization alone does not explain Meta’s momentum. The other half of the equation is user growth and engagement.

In the most recent quarter, 3.5B people were using at least one of Meta’s apps every day. Instagram reached 3B monthly actives, and Threads surpassed 150M daily active users. At the same time, AI-driven recommendation systems are increasing time spent across platforms.

Our AI recommendation systems are delivering higher quality and more relevant content, which led to 5% more time spent on Facebook in Q3 and 10% on Threads…(and) video time spent on Instagram up more than 30% since last year. As video continues to grow across our apps, Reels now has an annual run rate of over $50 billion.

Meta has fundamentally evolved its apps to reflect what drives engagement today. Instagram has shifted from a photo-sharing app to a video-first platform. While this has frustrated some users, the engagement data supports the strategy. According to estimates from Sensor Tower cited by The Wall Street Journal, the average Instagram user now spends 27 minutes per day watching Reels, compared to 21 minutes on YouTube Shorts. TikTok remains ahead, but Meta has clearly established Reels as the leading scaled alternative rather than a marginal follower.

Source: Meta Platforms

Virality and discovery now sit at the center of the experience, driven by signals such as sends, likes, and comments. This creates a reinforcing loop. More users lead to more engagement. More engagement produces better signals. Better signals improve recommendations and ad performance. By combining data-driven decision-making with advanced technology, Meta is staying ahead of the curve and driving measurable gains in both engagement and monetization.

Threads introduces both opportunity and uncertainty. User growth has been strong, but engagement quality remains soft. Some activity is driven by Instagram integration, which may overstate organic usage. Based on early observations, viewership appears solid, while interaction and outbound link engagement lag.

That said, Meta is building Threads deliberately and leanly. Regulatory constraints limit the company’s ability to acquire, thus forcing internal product development. Over a longer horizon, it is reasonable to expect Threads to mature into another monetizable surface once user behavior stabilizes. Ten years from now, I believe Threads will represent yet another meaningful platform within Meta’s ecosystem.

Overall, Meta’s Family of Apps remains highly resilient. Revenue, impressions, and pricing are strengthening. Ads systems are becoming more efficient. Advertiser workflows are increasingly automated. Engagement is accelerating. And Meta retains multiple levers to continue compounding its core business.

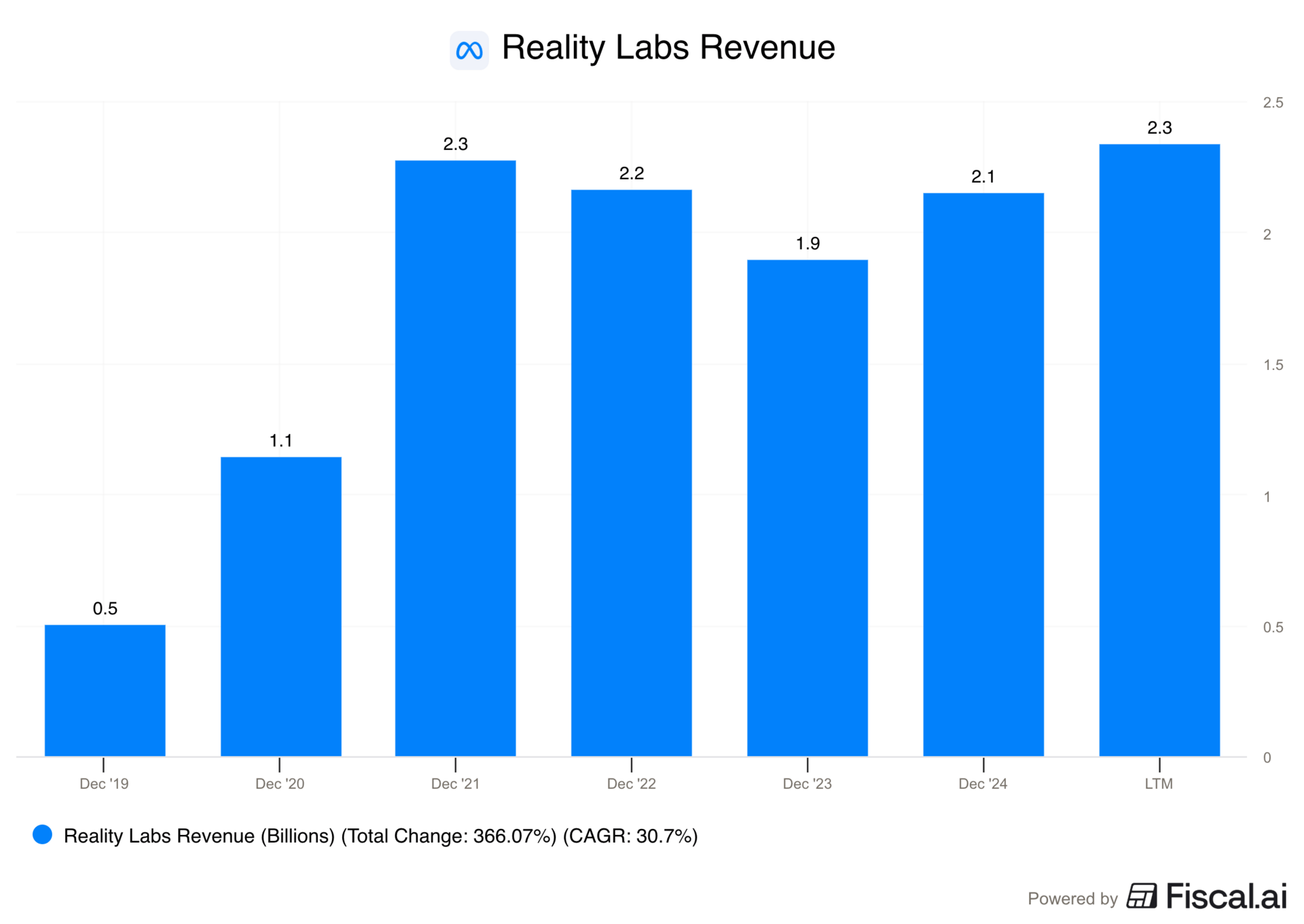

B/ Reality Labs

Reality Labs is arguably the most frustrating part of Meta’s business for investors.

It has been a cash burner since inception with no real returns. The segment represents Meta’s push into augmented and virtual reality, primarily through consumer hardware. This includes Quest headsets and, more recently, AI-enabled smart glasses.

Revenue growth has been uneven for several years. Despite the Metaverse rebrand and heavy investment, Reality Labs revenue has effectively been flat. That reality is difficult to ignore.

What has changed is emphasis. While Reality Labs still receives attention, it no longer appears to be Mark Zuckerberg’s central focus. In my view, that shift is visible and rational. At its core, Reality Labs remains a consumer hardware business, with economics driven by product launches, adoption cycles, and scale. In the most recent quarter, revenue increased 74% YoY, but management was quick to note that this reflected retail partners front-loading Quest headsets ahead of the holidays rather than a step-change in underlying demand.

Looking ahead, management guided that Q4 revenue would likely decline YoY due to the absence of a new headset launch. This reinforces the point that revenue remains lumpy and release-driven.

For Meta shareholders, this is where patience wears thin. Reality Labs has delivered inconsistent revenue growth while operating losses have expanded every year since inception. Cumulative losses have reached nearly $70B between 2019 and 2024, and it would not be surprising to see that figure push toward $100B over the next year or two.

That said, there is now a credible bright spot, and it is not VR headsets. It is AI-enabled smart glasses.

Early demand has been encouraging. Improvements in battery life, camera quality, design, and AI functionality are resonating with consumers. Display-enabled versions reportedly sold out within 48 hours in Q3, prompting Meta to invest in scaling manufacturing. From a product-market fit perspective, smart glasses make far more sense than VR. VR remains constrained by comfort, eye strain, and limited portability. It is something people experiment with at home, not something they integrate into daily life.

Source: Meta Platforms

AI glasses are different. They work with prescriptions, are portable, and fit naturally into everyday routines. Rather than competing with smartphones or laptops, they layer on top of existing devices. In my view, the value proposition is clearer. Smart glasses enhance productivity, notifications, and real-world interaction rather than attempting to replace entrenched hardware.

Early sell-through suggests this is where genuine consumer interest lies. Recent reporting supports that view. Meta has paused the near-term rollout of its Ray-Ban Display smart glasses internationally, citing unprecedented demand and limited inventory. At the same time, Meta and EssilorLuxottica are reportedly considering doubling annual production capacity to 20M units by year-end, with the potential to exceed 30M if demand holds. If this trend continues, VR headsets may eventually be deemphasized. And this is already showing up in headcount decisions. Meta recently began cutting more than 1,000 roles from Reality Labs, roughly 10% of the division, as it redirects resources away from virtual reality and metaverse products and toward AI wearables.

That said, Reality Labs remains a long-duration platform bet. It will continue to pressure margins as Meta invests in infrastructure and R&D to support it. Management’s long-term vision is ambitious. They see Reality Labs reaching hundreds of millions, or even billions, of users. Monetization is expected to come not just from device sales, but from services and AI-driven functionality layered on top. At roughly 1% of total revenue today, Reality Labs is not economically meaningful. But if executed well, it represents a massive opportunity. The closest parallel is Apple’s iPhone, which began as a hardware product and later evolved into a services platform, a process that took years, not quarters.

Reality Labs may never reach that scale, but smart glasses are the first product in this segment that feel like a legitimate path rather than a science project.

4. Risk Radar

Many of Meta’s risks are not isolated. They form a chain. Strategic decisions influence capital allocation, which in turn shapes asymmetric impact. I will intentionally not focus on broad macro risks here. Advertising cyclicality, interest rates, a recession, or a black swan event would affect the entire industry. Instead, this section focuses on risks that are more directly tied to Meta’s more recent strategy and execution.

A/ Regulatory Overhang

Regulatory pressure remains a persistent overhang, particularly in Europe and the United States.

In Europe, the key issue is Meta’s Less Personalized Ads framework, which limits targeting to contextual signals and basic demographics rather than detailed user behavior. While this addresses regulatory and privacy concerns, it reduces ad relevance and advertiser effectiveness. Management acknowledged on the most recent earnings call that this could have a meaningful negative impact on European revenue. Given that Europe represents nearly 25% of Meta’s revenue over the last twelve months, the exposure here is material.

In the United States, Meta is facing a wave of youth-related litigation. More than 40 states have sued the company, alleging negative mental health impacts from Facebook and Instagram. These cases begin progressing through the courts this year and could result in mandated product changes, financial penalties, or both. Meta has navigated controversy before, but sustained legal pressure could force product changes and ongoing compliance that meaningfully impact revenue and long-term financial flexibility.

B/ Organization Before Strategy

Meta Superintelligence Labs (MSL) represents both the company’s most ambitious initiative and one of its most consequential risks. Formed in mid-2025, MSL was designed to unify Meta’s AI efforts under a single organization with the explicit goal of building artificial superintelligence at global scale.

Source: Meta Platforms

On paper, the strategy is logical. Meta recruited elite AI talent at significant cost, invested heavily in compute infrastructure, and acquired a 49% stake in Scale AI for $14.3B, bringing Alexandr Wang in to lead the effort. Mark Zuckerberg has stated that he believes MSL has the highest talent density of any AI lab today.

Alexandr Wang, Meta’s Chief AI Officer, Source: Meta Platforms

The issue here is not talent, but alignment. In today’s AI landscape, many top researchers are motivated as much by mission and intellectual direction as by compensation. Concentrating highly paid, high-profile talent does not guarantee speed or coherence. In some cases, it can slow progress.

A useful analogy is Paris Saint-Germain’s former superstar lineup of Neymar, Mbappé, and Messi. The talent was unquestionable. The spending was enormous. Yet the team failed to achieve its ultimate objective of winning the Champions League until that era ended. Excess leadership density and misaligned incentives can undermine execution.

Since MSL’s formation, signs of organizational strain have emerged. Meta has restructured its AI division, split MSL into four groups, frozen AI hiring, and later laid off roughly 600 AI employees. These moves raise questions about strategic clarity and internal cohesion. Concerns intensified when Meta’s Chief AI Scientist, Yann LeCun, announced his departure to form a new startup. LeCun publicly criticized MSL’s leadership, questioned the direction of the organization, and suggested that internal results around Llama 4 were overstated. He also reiterated his belief that large language models may be a dead end for achieving true superintelligence, directly conflicting with MSL’s stated objective.

At the same time, Meta appears to be reconsidering its long-standing commitment to open-source AI. Recent reporting suggests the company may be pursuing a closed model codenamed Avocado, with a potential launch in early 2026. If true, this would represent a meaningful strategic shift. Additionally, that uncertainty is reinforced by Meta’s recent agreement to acquire AI startup Manus for over $2B. Manus builds closed, productized AI agents largely on top of third-party models. This begs to ask the question: is Meta converging on a coherent direction, or assembling disconnected assets while it searches for one?

Source: Manus

In the midst of all of this, there is a growing consensus that large language models are increasingly being commoditized, with value accruing primarily at the application layer rather than the model layer itself. Switching costs between models remain low, leadership shifts rapidly, and differentiation is fleeting. In that context, Meta’s decision to pursue superintelligence directly is debatable. The company already owns one of the most powerful application layers in the world through Family of Apps. Doubling down on engagement, advertiser lock-in, and end-to-end monetization may offer a more reliable path to moat expansion than competing at the most capital-intensive layer of the stack.

What stands out most is the lack of external visibility. Management has provided no timelines, capability benchmarks, or revenue targets tied to MSL outputs. When pressed by analysts, Zuckerberg declined to offer specifics, stating only that Meta expects to build novel models and products and will share more when ready.

This opacity creates a real attribution problem. Even if engagement, monetization, or model performance improves, it becomes difficult to determine whether those gains stem from MSL, internal product teams, or natural platform evolution. Without that clarity, evaluating returns on tens of billions in AI investment becomes inherently challenging.

There is a real possibility that MSL could become a high-cost, low-velocity organization where incentive misalignment and coordination overhead slow the translation of research into products that meaningfully impact the business. Initiatives like Vibes, Meta’s AI-generated video product, raise legitimate questions about whether top-tier AI talent is being deployed toward the highest-return use cases.

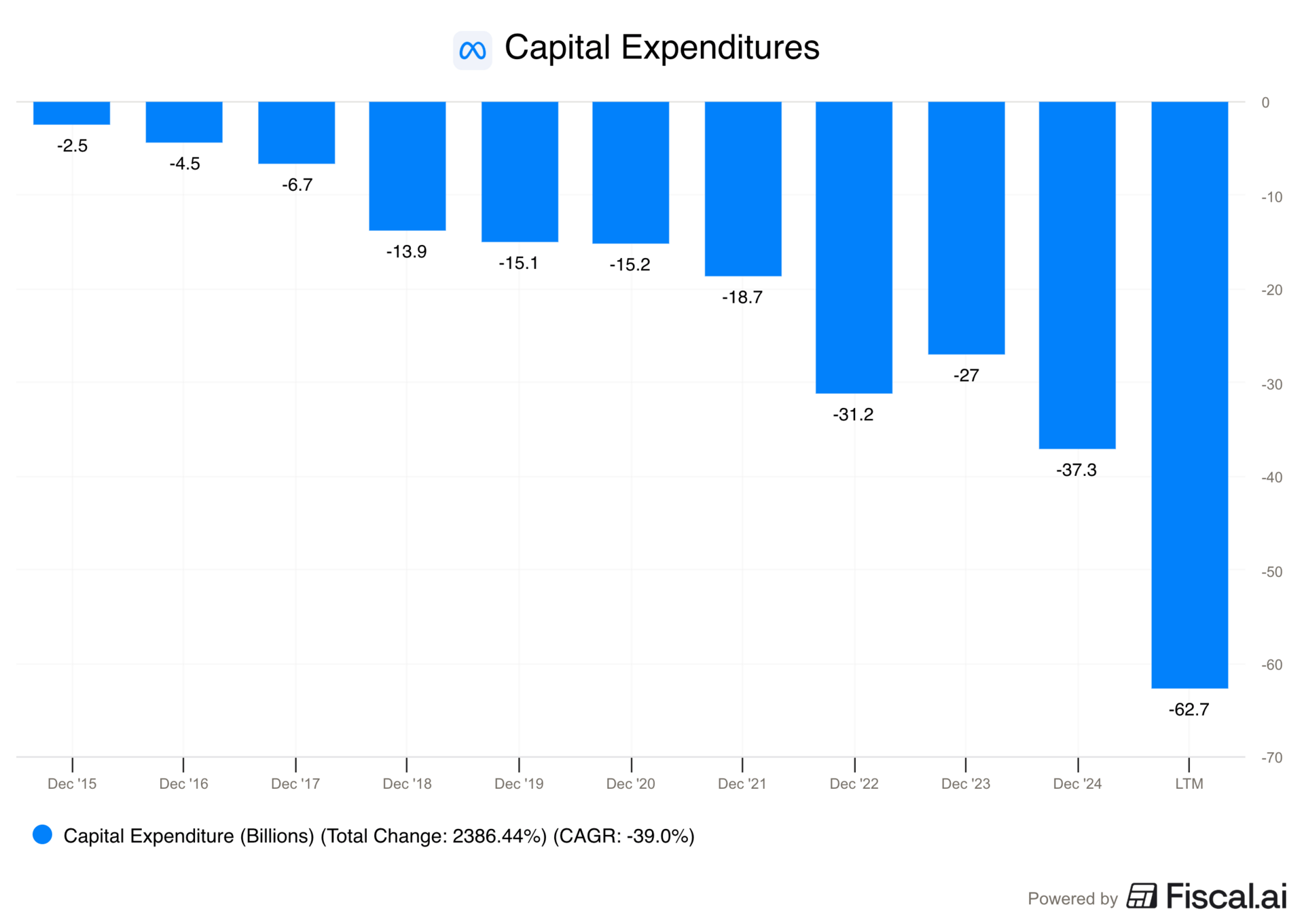

C/ Never Ending Capital Intensity

Strategic ambiguity becomes more dangerous when paired with rising capital intensity. Meta made it clear on its most recent earnings call that compute requirements continue to expand meaningfully and are consistently exceeding even aggressive internal expectations.

When asked about CapEx growth and returns on invested capital, CFO Susan Li noted that 2026 CapEx growth will be driven by Meta Superintelligence Labs, core AI initiatives, and non-AI investments, with MSL-related needs growing the fastest. That distinction matters.

Management has also been clear that compute deployed directly into the core business is delivering measurable results. AI-driven recommendation systems and advertising optimizations are improving engagement and ad performance in tangible ways. In contrast, compute allocated to long-dated research efforts carries a far more uncertain payback profile.

Mark Zuckerberg framed this tradeoff directly:

So I think that that suggests that being able to make a significantly larger investment here is very likely to be a profitable thing over some period, because if the primary use of it is going to be to accelerate the AI research and the new AI work that we’re doing and how that relates to both the core business and new products, but any compute that we don’t need for that, we feel pretty good that we’re going to be able to absorb a very large amount of that to just convert into more intelligence and better recommendations in our Family of Apps and ads in a profitable way.

The logic is straightforward. Invest heavily to accelerate AI research tied to both new products and the core business. If compute capacity overshoots research needs, redeploy it into Family of Apps and advertising systems where returns are already visible.

The risk lies in execution and prioritization. When viewed alongside concerns around MSL’s coherence, this raises the question of whether incremental capital is being allocated to the highest-return opportunities. Management has acknowledged that Family of Apps and ads are operating in a compute-constrained state, suggesting there may be opportunity cost in diverting capital toward speculative research rather than scaling proven drivers of economic return.

Meta Data Center: Source Meta Platforms

There is also an obligation risk. Once Meta commits to competing at the frontier, it may feel compelled to continue investing regardless of near-term returns. Falling behind could be perceived as strategically unacceptable, even if marginal returns deteriorate. This dynamic symbolizes arms-race behavior and could restrict Meta financially.

That commitment was reinforced recently when Zuckerberg announced the creation of a new top-level initiative called Meta Compute. The group is explicitly responsible for planning and scaling tens of gigawatts of infrastructure this decade, and potentially hundreds over time. Leadership spans long-term capacity strategy, supplier partnerships, financing, and global datacenter execution, with direct involvement from Meta’s president and vice chair to coordinate with governments and sovereign partners.

Clearly, Meta is no longer treating compute as a flexible input that can expand or contract with demand. It is positioning it as a permanent strategic asset. Most notably, Zuckerberg closed the announcement by reiterating that the objective remains delivering “personal superintelligence to billions of people,” making it clear this is not a temporary buildout but a long-horizon commitment that further embeds capital intensity into Meta’s operating model.

Los Lunas Data Center Construction, Source: Meta Platforms

Zuckerberg has floated the idea of selling excess compute if Meta overbuilds. In practice, that optionality appears limited. If Meta is overbuilding, other large technology firms likely are as well. That dynamic would pressure pricing and could lead to a race to the bottom in compute economics. Also, unlike Microsoft or Google, Meta lacks a diversified cloud platform to bundle compute with higher-margin enterprise services.

Even if superintelligence is achieved, capital intensity may not decline. The cost of maintaining and scaling such systems could remain extremely high. That would represent a structural shift from Meta’s historical profile as a software-driven business with exceptional margins and low capital requirements toward a more infrastructure-heavy model with volatile free cash flow.

Capital structure adds another layer of asymmetry. Meta’s cash and cash equivalents have declined meaningfully, in part due to expensive acquihires and the Scale AI investment. The company has also used private credit structures, including an SPV arrangement with Blue Owl, to finance AI infrastructure. While this lowers reported CapEx and preserves flexibility if monetization materializes, it introduces off-balance-sheet obligations that resemble leverage.

This risk is compounded by accounting assumptions. Michael Burry has argued that Meta may be overstating earnings by as much as 21% by 2028, citing GPU depreciation schedules that exceed the economic life of the hardware. While GPUs remain usable for several years, rapid innovation cycles shorten their economic relevance. Accelerated depreciation or future write-downs would compress margins and reported profitability, directly impacting valuation.

From my perspective, Meta does not have a near-term solvency risk. But their financial decisions meaningfully alter the downside profile. That approach may prove correct. However, it also raises the bar for capital discipline in an environment where mistakes are expensive.

Risk-Closing Bridge

None of these risks imply an inevitable negative outcome. If anything, they highlight how difficult the future is to forecast, including for management itself.

Meta retains meaningful degrees of freedom. If the economics of frontier research prove less attractive, excess compute can be absorbed by Family of Apps, which continues to operate in a compute-constrained state and has demonstrated a clear ability to translate incremental capacity into engagement and monetization gains.

Even in a downside scenario, capital is not stranded. Assets may be written down, but they are not useless, and the core business provides a natural sink for capacity. Over time, capital intensity can normalize as investment shifts from exploration to utilization.

Other potential concerns were not emphasized here because they fall into areas where Meta has repeatedly demonstrated an ability to adapt.

Meta has options. What remains uncertain is how expensive those options become and how clearly success can be measured along the way.

5. Moat & Competitive Positioning

The Risk Radar may read as blunt, but it should not be mistaken for a challenge to Meta’s dominance. Below I will outline why the company possesses a structurally wide moat and why that moat remains intact.

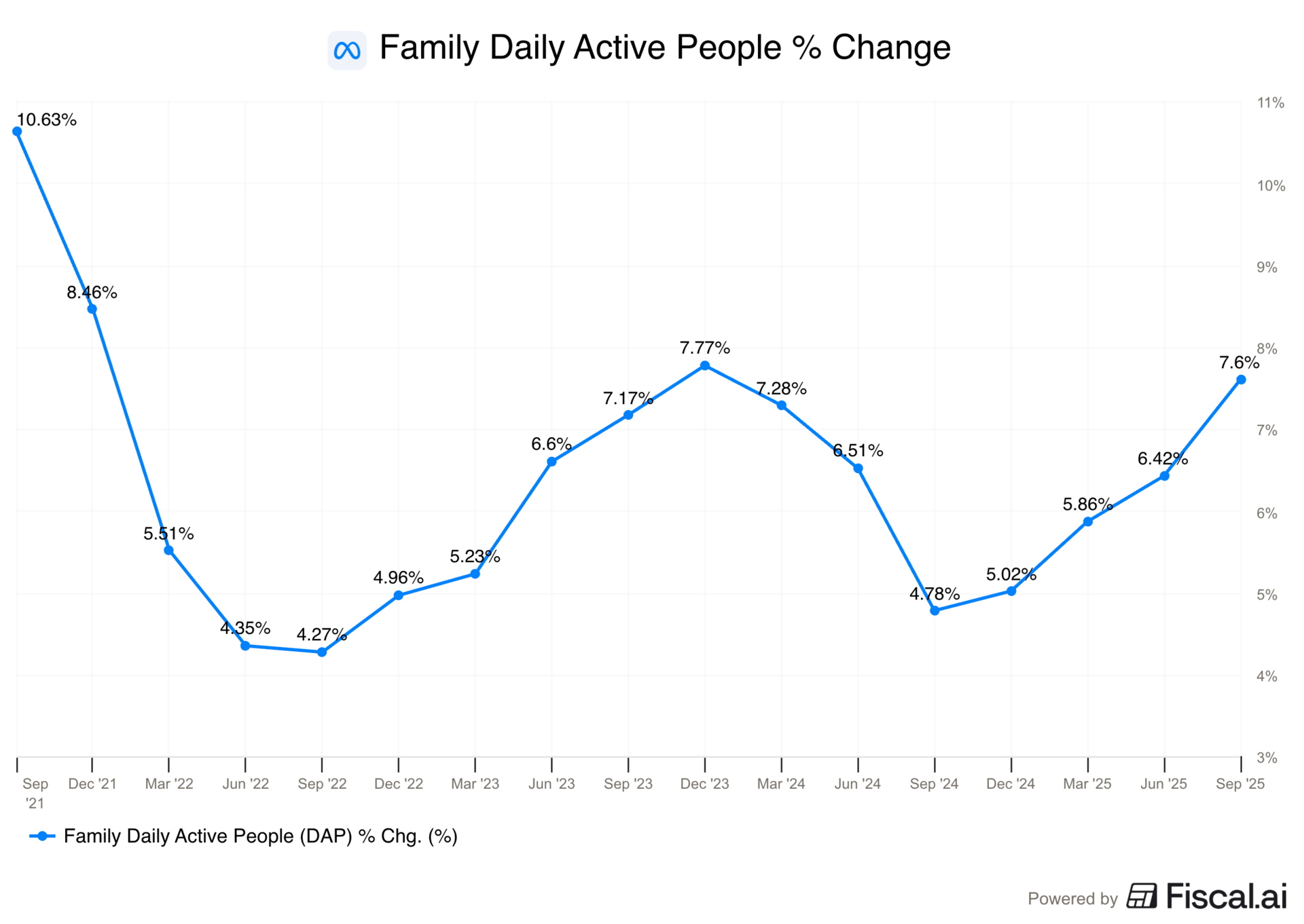

A/ Network Effects

The foundation of Meta’s moat is sheer network scale and global distribution. In the most recent quarter, Meta reported 3.54B Family Daily Active People. With a global population of roughly 8.1B, Meta’s platforms are used daily by 44% of the world. Viewed through the lens of internet access, the reach is even more striking. With approximately 6B people online globally, Meta reaches nearly 59% of all internet users every day.

Scale alone would be impressive. Growth at this scale is extraordinary. Family DAP grew 7.6% YoY in the most recent quarter, with acceleration over the past several quarters. Over the last four years, growth has never dipped below 4%, demonstrating how the company has sustained relevance despite massive penetration.

Mark Zuckerberg addressed this directly on the most recent earnings call:

I would guess that Meta, I think has the best track record of any company out there of taking a new product that people love and getting it to billions of people in terms of usage.

Meta has built a tightly integrated ecosystem where engagement on one surface reinforces others. Facebook users rely on Messenger. Instagram users are seamlessly onboarded to Threads. Businesses running Facebook pages almost always operate Instagram accounts in parallel. This interconnection reduces churn, increases time spent within the ecosystem, and allows Meta to capture value even if users actively engage with only one product.

For advertisers, the implication is just as powerful. Meta offers unmatched inventory breadth, placement diversity, and cross-format reach. Its expansion into WhatsApp and business messaging further increases available surfaces, making outbound communication and customer engagement more integrated and scalable.

B/ Data Advantage and Feedback Loops

Meta’s economic power is reinforced by compounding feedback loops, as mentioned previously. Higher engagement produces more data. More data improves recommendations. Better recommendations drive even higher engagement. At Meta’s scale, this loop becomes nearly impossible to replicate. The company captures behavioral signals across geographies, demographics, and use cases at a depth few competitors can match. In an AI-driven world where training data and real-time feedback are critical, this advantage compounds.

Meta’s end-to-end advertising tooling and automation simplify execution and materially improve outcomes. For large advertisers, Meta is effectively required. Spend may be diversified, but Meta is almost always included.

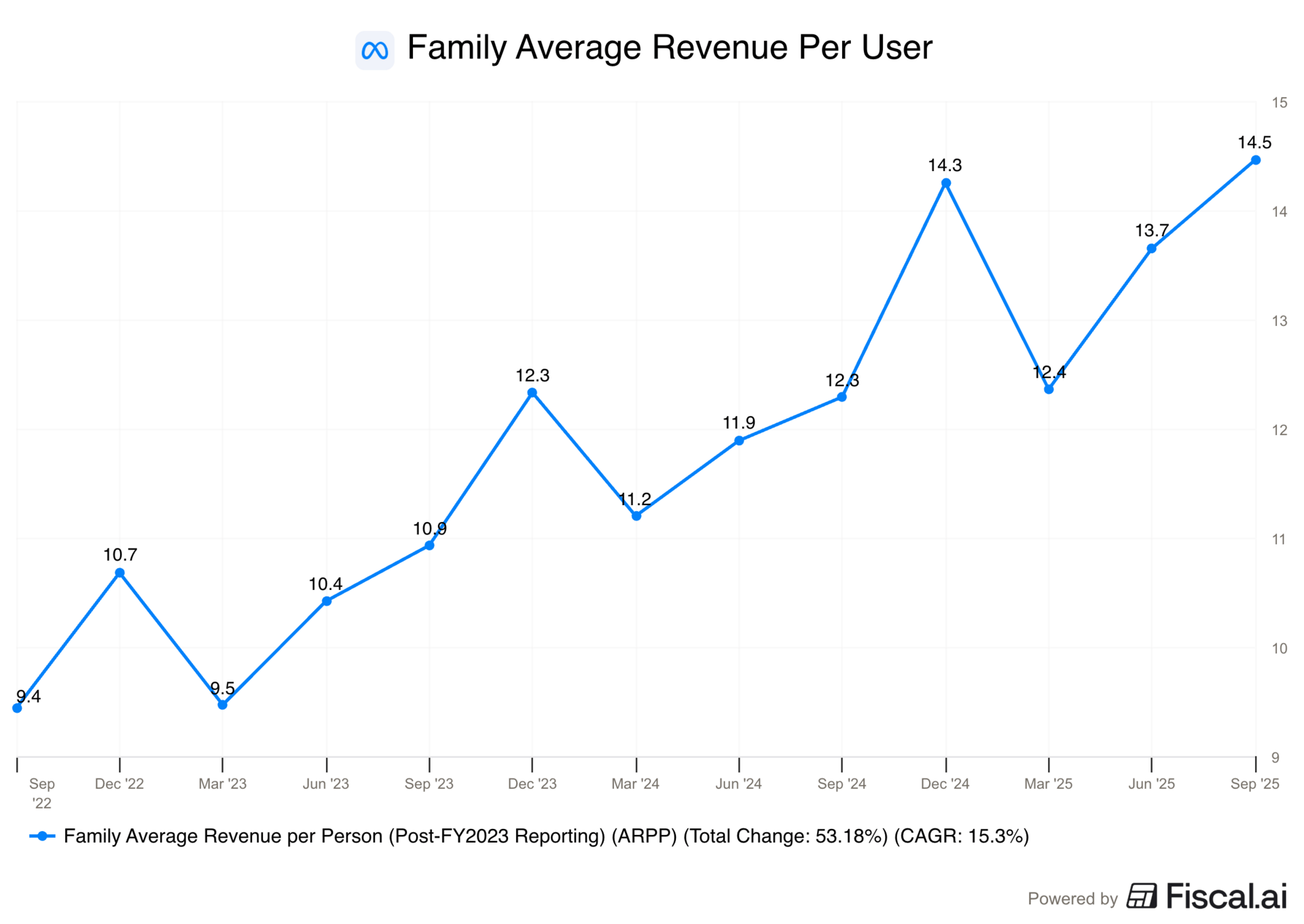

The economic proof is visible in Average Revenue Per User, which rose from $9.4 in Q3 2022 to $14.5 in Q3 2025. That growth reflects both stronger monetization and sustained advertiser demand, occurring alongside continued user expansion.

C/ Competitive Positioning

Meta operates several of the largest social platforms in the world. It does face competition, but the nature of that competition is often misunderstood.

YouTube is primarily long-form video, even as it expands into short-form. TikTok is the closest direct competitor to Instagram in short-form video, but in practice, most users engage with both platforms rather than choosing one over the other. Snapchat has struggled to maintain relevance as Meta successfully integrated many of Snap’s core features, such as Stories, directly into Instagram and Facebook.

The key point is not the absence of competition, but that Meta’s platforms serve different intents and coexist within users’ daily routines. This reduces winner-take-all dynamics and positions Meta as a core digital utility.

D/ Founder-Led

Mark Zuckerberg, Source: Meta Platforms

Meta’s moat has also been shaped by founder leadership.

Mark Zuckerberg has led the company since inception and is still only 41 years old. He has navigated platform evolutions, regulatory cycles, and public controversies, often prioritizing long-term positioning over short-term optics.

Zuckerberg sits at a rare intersection. He understands Meta’s user base across generations, maintains deep technical fluency, and retains the authority to make unpopular decisions when required. That combination matters when stewarding platforms at this scale.

More recently, Zuckerberg has demonstrated political adaptability. After years of strained relationships, he has recalibrated Meta’s posture in response to different U.S. political dynamics. This includes board and leadership appointments, adjustments to content moderation, a move toward community notes, and the rollback of certain DEI initiatives.

President Trump Applauds Mark Zuckerberg’s Hiring Decision, Source: Truth Social

These actions may prove controversial, and some may backfire. But they reflect a consistent pattern: prioritizing platform stability, regulatory survivability, and long-term operating freedom over ideological rigidity.

That willingness to adapt, even when uncomfortable, has been a defining contributor to Meta’s endurance.

6. Valuation

Meta is attracting attention because it screens as the cheapest name within the Mag 7.

Some investors are buying on the view that Meta will repeat Google’s recent rerating, simply because it appears optically cheap relative to peers.

That framing misses the point. Buying the “cheapest” mega-cap for the sake of a multiple expansion reflects herd behavior, not margin-of-safety investing. The real question is whether today’s price adequately compensates for the range of outcomes ahead.

1/ Forward PE

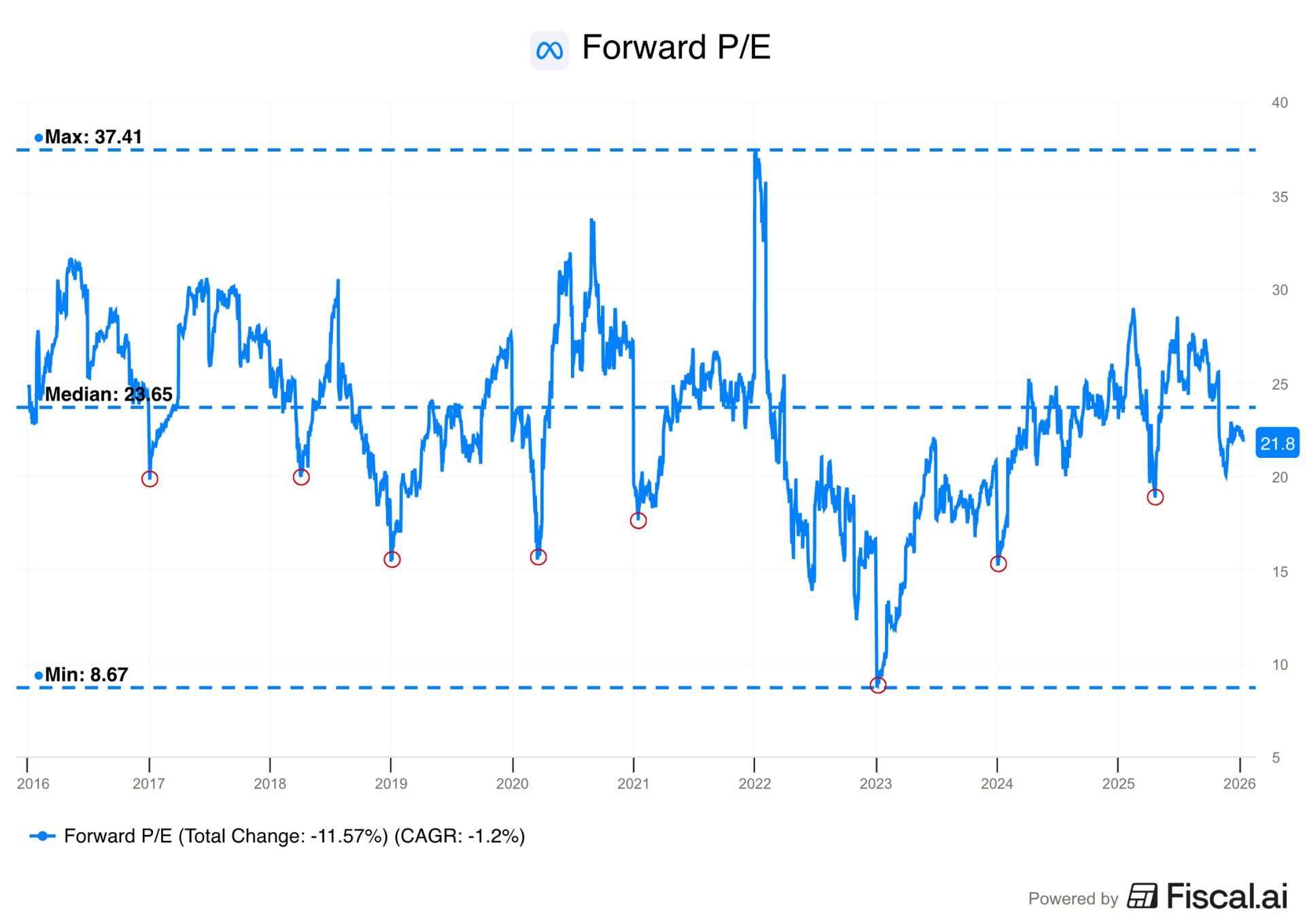

On a forward P/E basis, Meta trades at roughly 22x, just under an 8% discount to its historical median of 24x. Despite the prevailing narrative, Meta is not trading at a distressed valuation, but instead broadly in line with history. What makes this moment different is the setup. The core business is accelerating, but capital intensity is rising considerably.

It is also worth noting that Meta has repeatedly traded around 15x earnings, including one extreme drawdown below 10x during the 2022 fiasco. Those entry points occurred before today’s level of capital commitment to AI infrastructure.

The takeaway is simple. There is no urgency to own the stock purely on valuation. History suggests that opportunities to buy Meta at meaningfully better prices tend to emerge.

2/ Discounted Cash Flow

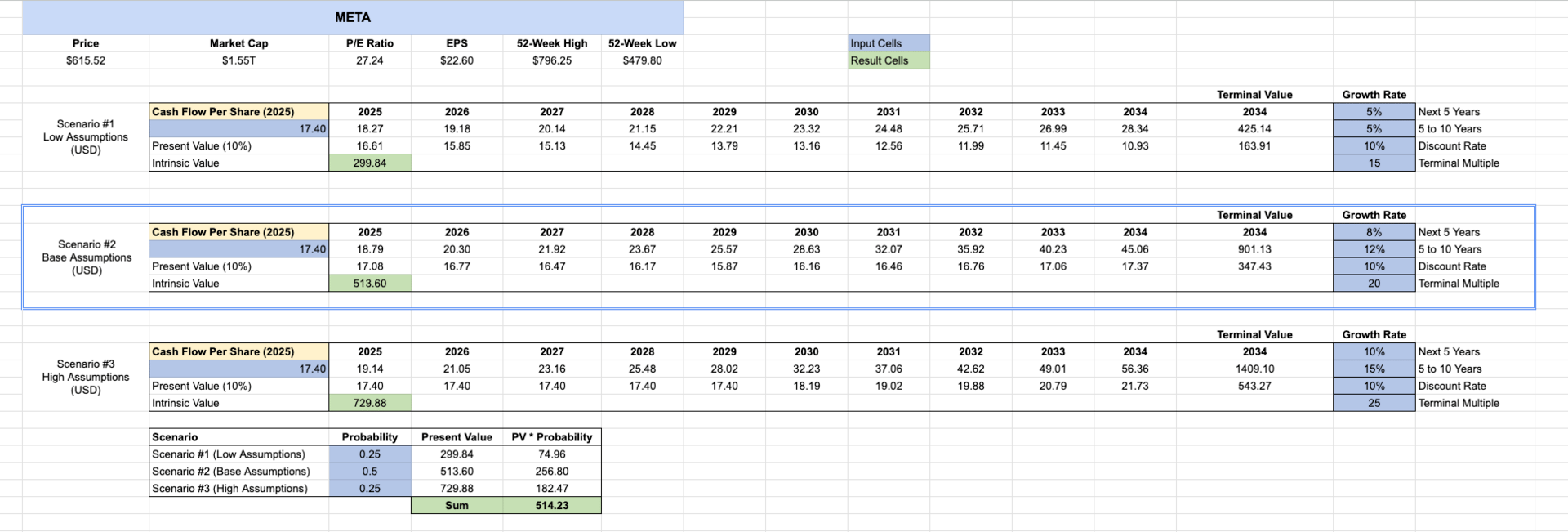

Analyzing Meta through a discounted cash flow lens leads to a more cautious conclusion. Under conservative assumptions, the current share price implies that Meta is trading roughly 20–25% above intrinsic value.

What stands out most is not the output, but the difficulty of forecasting Meta’s cash flows with confidence over the next decade. There are too many divergent paths, and that uncertainty likely mirrors the challenge management itself faces.

The range of outcomes is unusually wide. Meta could eventually slow its pace of investment, redirect excess compute toward its core advertising business, and regain operating leverage. Alternatively, success in AI could require sustained or even higher capital intensity, where revenue and engagement grow but free cash flow remains constrained by ongoing infrastructure spending, depreciation, and refresh cycles.

This uncertainty highlights an important point. At today’s price, there is little margin of safety. Depending on which path materializes, the model can look either too conservative or not conservative enough. The market today appears to be pricing Meta somewhere between my base and high cases. That may prove correct, but it leaves little room for error given the asymmetry of Meta’s long-term strategy and capital allocation decisions.

To frame the assumptions, Meta has historically traded at a median ~30x TTM P/FCF over the past decade. This valuation framework deliberately applies a lower multiple range to reflect a structurally more capital-intensive future.

Low case: Meta remains dominant with durable cash flows, but reinvestment stays structurally high and operating leverage never fully returns.

Base case: Capital intensity peaks and moderates, compute shifts toward core businesses, and Meta matures into a slower-growing but still highly profitable platform, warranting a multiple below its historical median.

High case: Meta sustains double-digit free cash flow growth into maturity, with AI investment improving return on invested capital rather than suppressing it.

In short, the DCF does not argue that Meta is broken. It suggests that at current prices, the stock already reflects a favorable long-term outcome, while offering limited protection if execution or capital efficiency disappoints.

7. Final Take

Meta has built one of the most extraordinary businesses of our generation. The Family of Apps portfolio remains among the strongest platforms ever created, with global reach, accelerating engagement, and an advertising ecosystem that continues to deliver best-in-class outcomes for marketers.

Even at its current scale, Meta is still growing users, increasing time spent, and improving monetization through data-driven product decisions and end-to-end automation for advertisers.

At the same time, Meta is no longer the same company it was a few years ago. The strategic path ahead is meaningfully different. The company is pursuing an AI-led future that could prove transformative, but also far more capital intensive, complex, and asymmetric than its historical model.

That path could pay off, but history suggests that large-scale infrastructure buildouts rarely deliver clean, linear returns, and the downside risk if capital intensity remains structurally elevated is real. If Meta ultimately becomes a computationally expensive business, it should be valued as such.

Importantly, Meta has shown before that moments of pressure can create opportunity.

The post-metaverse drawdown and subsequent “year of efficiency” is a reminder that this company can course-correct, refocus on its core strengths, and emerge stronger after periods of strategic miscalculation. If today’s investment cycle disappoints and forces another hard reset, that future setup could be an incredible opportunity.

At present, however, Meta does not trade at a bargain, nor does it offer a meaningful margin of safety. The stock appears to be pricing in a favorable long-term outcome, despite a wide range of possible paths and limited visibility into where capital intensity ultimately settles.

Because of that, I am comfortable watching Meta from the sidelines. The business may continue to execute well and the stock could move higher. But with confidence constrained and outcomes highly dispersed, I’d much prefer to be patient.

Meta is a company I would be excited to own at the right price and under clearer economic conditions. That day may come.

It just isn’t today.

Disclaimer

I do not hold a position in $META.

This report is for informational and educational purposes only and does not constitute financial, investment, tax, legal, or other professional advice. The content provided herein is based on publicly available information and independent research at the time of publication and may not be accurate, complete, or up-to-date. No guarantees are made regarding the accuracy or completeness of the information or analysis provided.

Any opinions expressed are solely those of the author and do not represent the opinions or views of any past, present, or future employers. The author is not a licensed financial advisor, broker-dealer, or tax professional. Readers are strongly advised to conduct their own due diligence and consult with qualified professionals before making any financial, investment, or legal decisions.

You should assume that, as of the publication date of this report or any communication referencing publicly traded securities or assets, the author may have a position in the securities or assets mentioned and may stand to realize significant gains if the price moves. Following publication, the author may continue transacting in the securities discussed and may be long, short, or neutral at any time thereafter, regardless of the initial position. The author reserves the right to alter any position at any time without notice.

There is no obligation to update any information after publication. The author and affiliated parties are not responsible for any changes in market conditions, economic shifts, or new developments that may impact the accuracy of the content.

Forward-Looking Statements

This report may contain forward-looking statements, including but not limited to projections, estimates, and expectations regarding financial performance, market trends, and future company developments. These statements are based on assumptions that may prove incorrect, and actual results may differ materially. The author assumes no responsibility for updating forward-looking statements in light of new information or future events.

Third-Party Data & External Sources

This report may rely on data from third-party sources believed to be reliable. However, the accuracy, completeness, or timeliness of such data cannot be guaranteed. The author assumes no liability for errors, omissions, or inaccuracies in third-party data and does not endorse or take responsibility for the methodologies used by these external sources.

AI-Generated Enhancements

This report was optimized using AI for clarity, structure, and conciseness. AI tools also assisted in research organization, idea generation, and analytical stress testing. All analysis, conclusions, and opinions remain the author’s own.

Confidentiality & Redistribution

Readers are welcome to share this report with others; however, copying, reproducing, republishing, or modifying its content in any form without prior written permission is strictly prohibited.

Investment Risk Disclosure

Investing involves risks, including the loss of principal. Past performance is not indicative of future results. The mention of any securities, companies, or investment strategies does not constitute an endorsement or recommendation. Any reliance placed on the information in this report is strictly at the reader’s own risk.

The author and affiliated parties shall not be held liable for any direct, indirect, incidental, consequential, or other damages arising out of the use of this report or any reliance on the information provided. By accessing this report, you agree to indemnify and hold harmless the author and affiliated parties from any claims, liabilities, or damages resulting from your use of the content.

You are solely responsible for your own decisions. Proceed at your own risk.

Reply