It’s been a busy week.

Some of the biggest companies are reporting earnings this week. There’s a lot to dive into so let’s get right into it.

In today’s newsletter:

🥤Coca-Cola Earnings Visualized

💻 Microsoft Earnings Visualized

🔎 Alphabet’s Earnings Visualized

Let’s dive right in!

Not subscribed yet? Sign up today!

🥤Coca-Cola’s Earnings Visualized

Coca-Cola exceeded third-quarter expectations, posting earnings of $0.74 a share and revenue of $11.9B, surpassing estimates of $0.69 and $11.4B, respectively. The beverage giant witnessed a 2% rise in unit case volume, driven by growth in markets like Mexico, Japan, India, and the Philippines, and raised its full-year revenue and earnings guidance.

Despite Coca-Cola's price increases due to inflation, consumers continue to spend on beverages, showcasing the resilience of U.S. consumers. Meanwhile, concerns have arisen about the weight loss drug Ozempic reducing demand for food and beverage products, but RBC Capital Markets believes these fears are premature.

CEO James Quincey stated that U.S. inflation is decelerating and anticipates the company’s price increases to moderate further. However, currency translation is expected to impact the bottom line by 6% this year, a jump from the previously estimated 4-5%.

💻 Microsoft’s Earnings Visualized

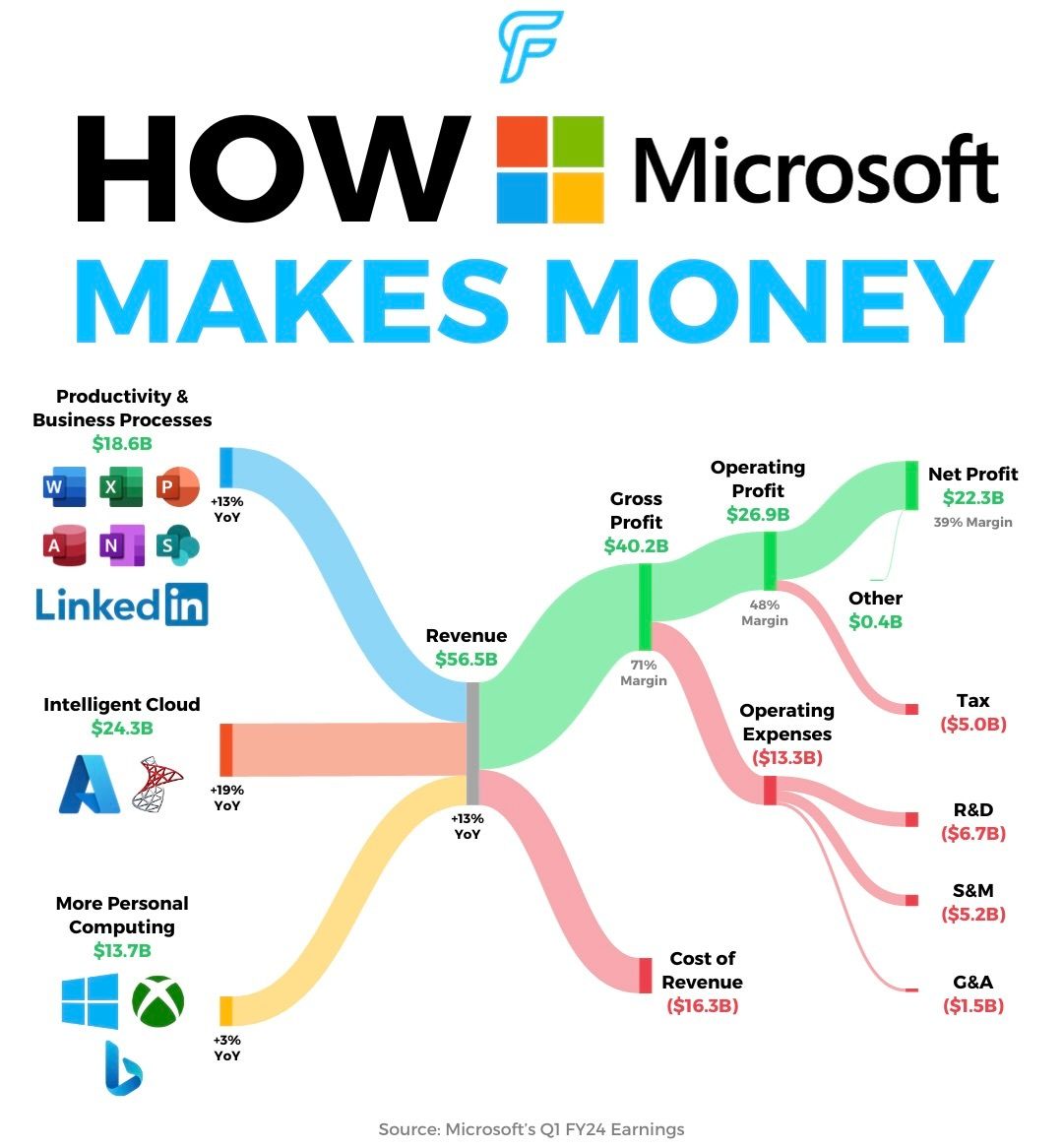

Microsoft shares surged after surpassing Wall Street expectations, reporting earnings per share of $2.99 and a revenue of $56.5B, surpassing estimates of $2.65 and $54.5B respectively. The company's Intelligent Cloud segment experienced a 19% growth, producing $24.3B in revenue, and Azure's revenue alone jumped 29% during the quarter. Additionally, Microsoft's recent $68.7B acquisition of Activision Blizzard will play a role in next quarter's earnings.

The company is heavily investing in AI, with CEO Satya Nadella emphasizing its integration across the company’s tech stack. This commitment to AI has led to the launch of generative AI-powered Copilot apps for various Microsoft products, designed to boost productivity.

Microsoft previously indicated that AI would not yield significant results until after the start of 2024. However, Azure's growth is already being influenced by generative AI, helping to outpace expectations. Overall, the company anticipates a sales increase of up to 8.7% in the upcoming quarter, surpassing analyst forecasts.

📣 A message from today’s sponsor:

Billionaires wanted it, but 54,578 everyday investors got it first… and profited

When incredibly rare and valuable assets come up for sale, it's typically the wealthiest people that end up taking home an amazing investment. But not always…

One platform is taking on the billionaires at their own game, buying up and securitizing some of history’s most prized blue-chip artworks for its investors. In just the last few years, its investors have realized annualized net returns of 17.8%, 21.5%, 35% and more from these opportunities.

It's called Masterworks. Their nearly $1 billion collection includes works by greats like Banksy, Picasso, and Basquiat, all of which are collectively owned by everyday investors. When Masterworks sells a painting – like the 16 it's already sold – investors reap their portion of the net proceeds.

It's easy to get started but offerings can sell out in minutes. However, as a trusted partner, readers can skip the waitlist to join with this exclusive link.

Performance of exited investments is not representative of artwork that has not yet sold and past performance is not indicative of future results. See important disclosures at masterworks.com/cd

🔎 Alphabet’s Earnings Visualized

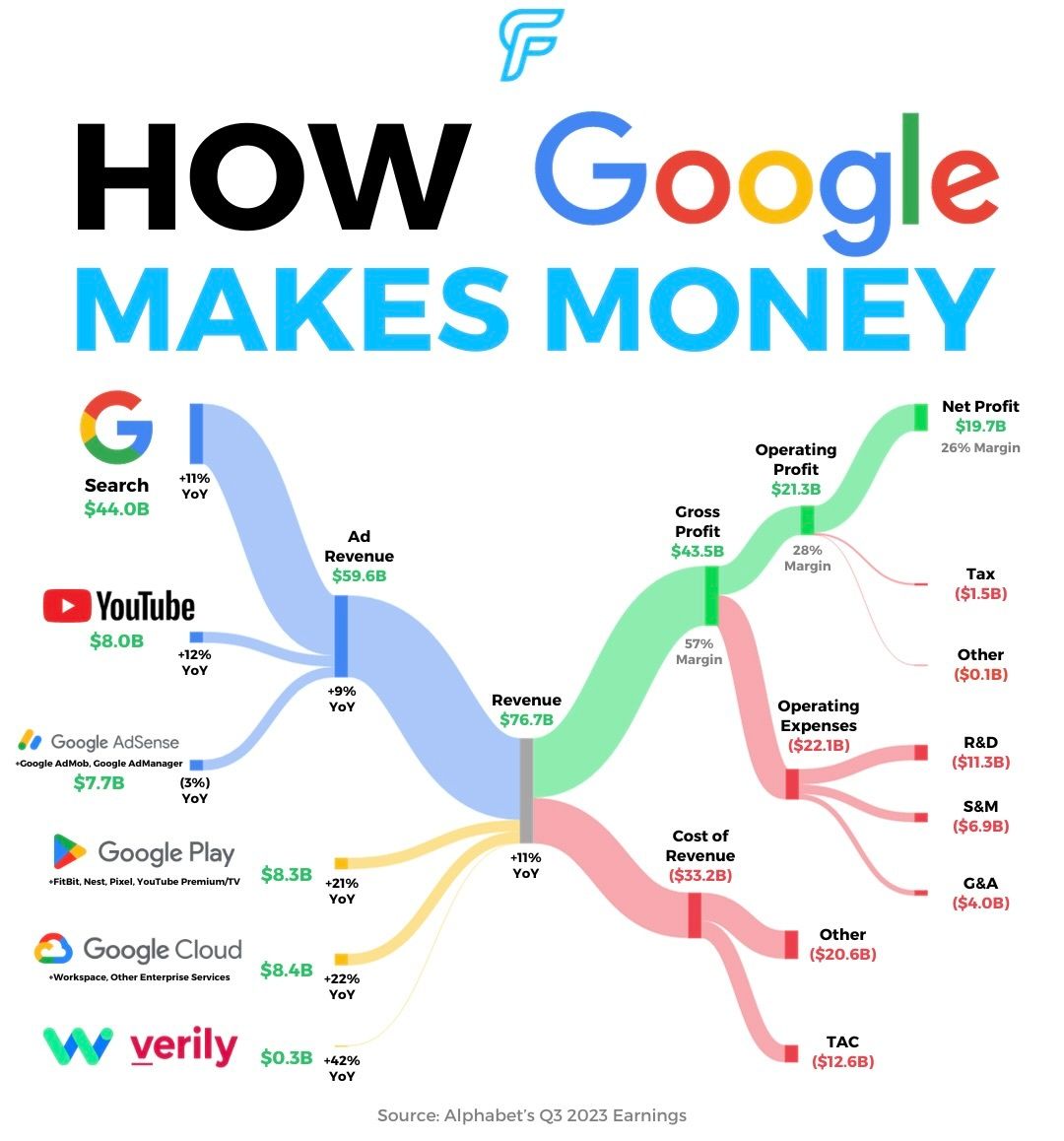

Alphabet, Google’s parent company, reported earnings of $1.55 per share and revenue of $76.7B, beating the FactSet consensus estimates of $1.45 and $75.9B respectively. However, shares declined by roughly 6% postmarket, likely due to slowed growth in cloud sales. Google’s cloud business reached $8.4B in revenue, falling short of the $8.6B expected.

Surrounded by intensifying competition in AI and cloud computing and facing global antitrust challenges, Google has been investing in generative AI to bolster its market position and counter rivals.

Google is strategically focusing on integrating AI into its search function, with its AI-powered Search Generative Experience currently available on an opt-in basis. CEO Sundar Pichai envisions evolving this feature over the next decade and ensuring its seamless integration with advertising opportunities.

Last month, Google confirmed its intentions to reduce several hundred positions within its recruiting sector, aligning with its ongoing cost-saving measures. This decision follows Alphabet's earlier action in January when it eliminated approximately 12,000 roles, or 6% of its total employees.

📡 Nokia Layoffs. Nokia $NOK will cut 14,000 jobs after a significant drop in third-quarter earnings due to industry challenges. [CNBC]

💉 More Pharma Tests. Novo Nordisk $NVO and Eli Lilly $LLY are testing GLP-1 weight loss injections on children, despite unknown long-term effects. [BI]

🍎 $1B AI Investment. Apple $AAPL is investing $1B annually to compete in generative AI and develop a smarter Siri. [BB]

🛒 New Costco CEO. Craig Jelinek, Costco's $COST CEO since 2012, will step down, with former forklift driver and current president Ron Vachris succeeding him. [FAST]

🏦 Banks Cutting Jobs. Major U.S. banks like Wells Fargo $WFC and Goldman Sachs $GS are cutting jobs due to economic pressures, while JPMorgan $JPM, on the other hand, continues to expand. [CNBC]

Notable Companies Reporting Earnings This Week:

Monday:

Cadence Design Systems$CDNS,Brown & Brown$BRO,Logitech$LOGI

Tuesday:

Microsoft$MSFT,Alphabet$GOOG,Visa$V,Coca-Cola$KO,Novartis$NVS,Texas Instruments$TXN,Verizon$VZ,Waste Management$WM,3M$MMM,Spotify$SPOT,Snap Inc.$SNAP

Wednesday:

Meta Platforms $META, Thermo Fisher $TMO, T-Mobile $TMUS, IBM $IBM, ServiceNow $NOW, Boeing $BA, ADP $ADP, Moody’s $MCO

Thursday:

Amazon $AMZN, Mastercard $MA, Merck & Co $MRK, Linde $LIN, Comcast $CMCSA, Intel $INTC, UPS $UPS, Altria $MO, Ford $F

Friday:

Exxon Mobil $XOM, Chevron $CVX, AbbVie $ABBV, Charter $CHTR, Aon $AON

All of the companies that are reporting earnings this week can be viewed here.

Major Trades Published Week of 10/16. Trades may be those of family members. [Source: 2iQ]

Buys:

Michael McCaul (R)

Company: JPMorgan Chase & Co ($JPM)

Amount Purchased: $2M - $4M

Company: SAP ($SAP)

Amount Purchased: $200K - $400K

Company: Tapestry ($TPR)

Amount Purchased: $130K - $300K

Sheldon Whitehouse (D)

Company: Novartis ($NVS)

Amount Purchased: $15K - $50K

Company: Eli Lilly & Co ($LLY)

Amount Purchased: $15K - $50K

Sells:

Michael McCaul (R)

Company: JPMorgan Chase & Co ($JPM)

Amount Sold: $1M - $2M

Company: Citigroup ($C)

Amount Sold: $415K - $1M

Company: AT&T ($T)

Amount Sold: $115K - $300K

Company: Meta Platforms ($META)

Amount Sold: $100K - $200K

Pete Ricketts (R)

Company: Berkshire Hathaway ($BRKB)

Amount Sold: $100K - $250K

Company: Johnson & Johnson ($JNJ)

Amount Sold: $100K - $250K

Company: The Coca-Cola Company ($KO)

Amount Sold: $100K - $250K

James Vance (R)

Company: Walmart ($WMT)

Amount Sold: $50K - $100K

How was today's newsletter?

Disclosure: I own shares of Alphabet ($GOOG) and Microsoft ($MSFT).

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

The views and opinions expressed in this newsletter are solely those of Carbon Finance and do not reflect the official policy or position of any other agency, organization, employer or company.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.