- Carbon Finance

- Posts

- 📊 Nasdaq Hits All Time Highs

📊 Nasdaq Hits All Time Highs

1) $10,000 Invested In Nvidia 2) The Race To $4T 3) Nike Sales Keep Dropping and more!

Happy Sunday!

A ton happened this week, so let’s get right into it.

But if you want more visuals, daily market insights, and data I don’t always share here…

You should definitely be following me on X!

Some key data bites from this week that you should know:

Jensen Huang has started selling $865M worth of Nvidia stock.

Palantir short sellers have paper losses of $7B since October.

Barron’s released its 2025 Top CEOs list featuring 26 leaders.

US IPOs are averaging a 53% return in 2025.

Bumble will cut 30% of its global workforce.

Tinder’s paid users have dropped for eight straight quarters.

Amazon will invest $54B over next three years in the UK.

CoreWeave is in talks to acquire $5B Core Scientific.

Anthony Pompliano’s ProCap plans to hold up to $1B in Bitcoin.

Tesla saw EU new vehicle registrations fall 41% in May.

Salesforce says AI is doing up to 50% of the company’s work.

Micron saw sales jump 38% on strong AI memory demand.

War between Russia and NATO would cost the world $1.5T.

In today’s newsletter:

💰 $10,000 Invested In Nvidia

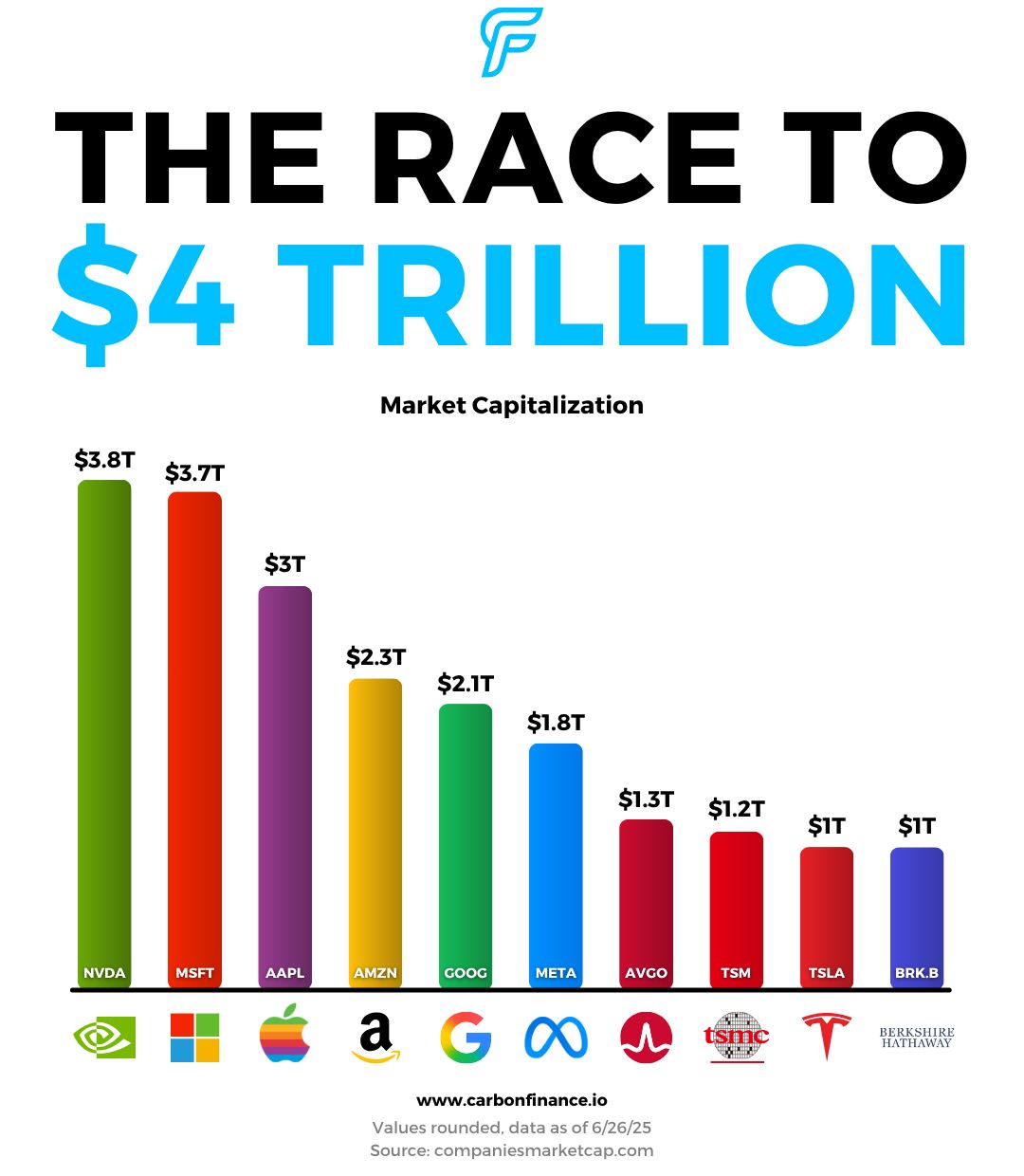

🏇 The Race To $4T

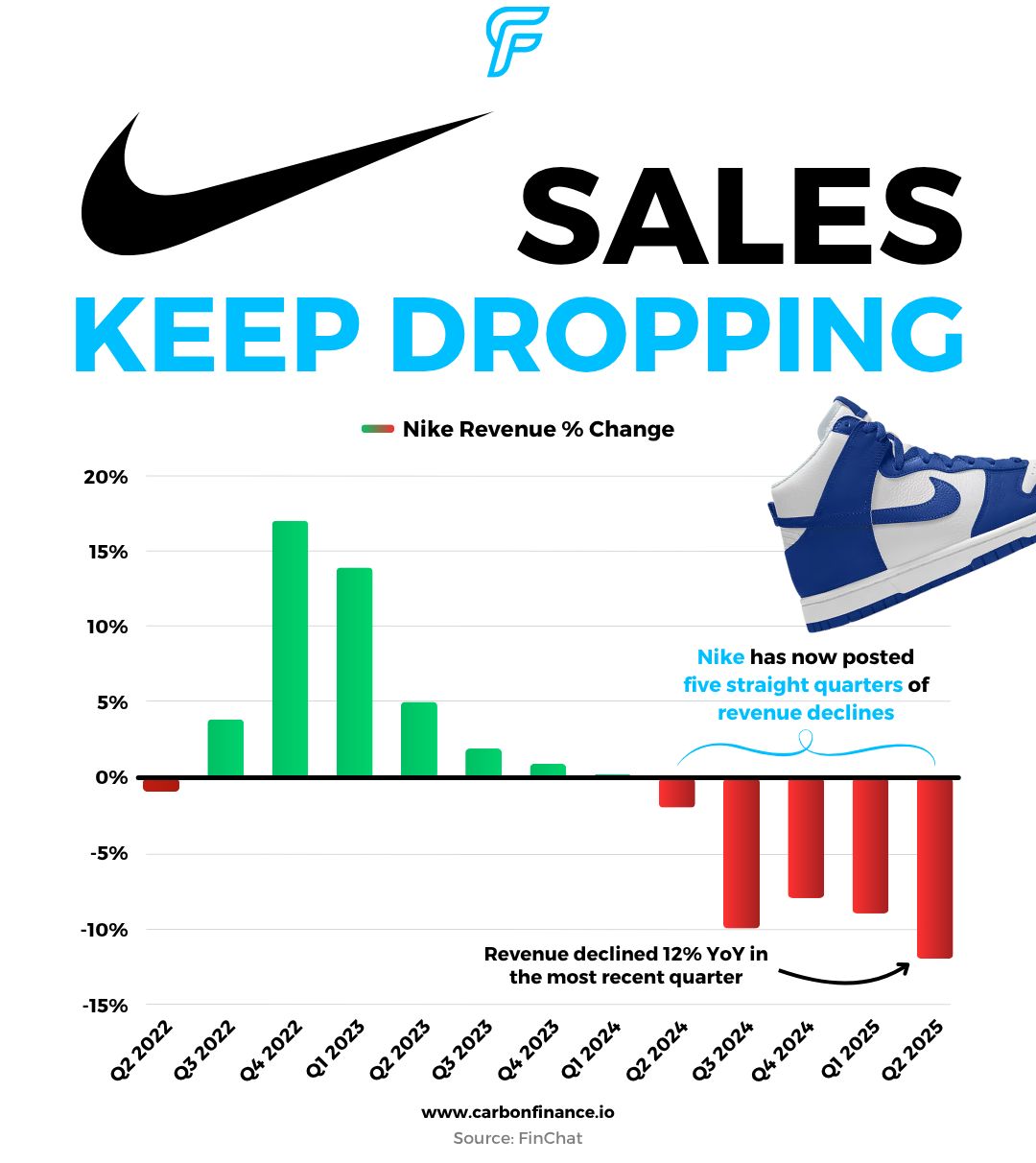

✔️ Nike Sales Keep Dropping

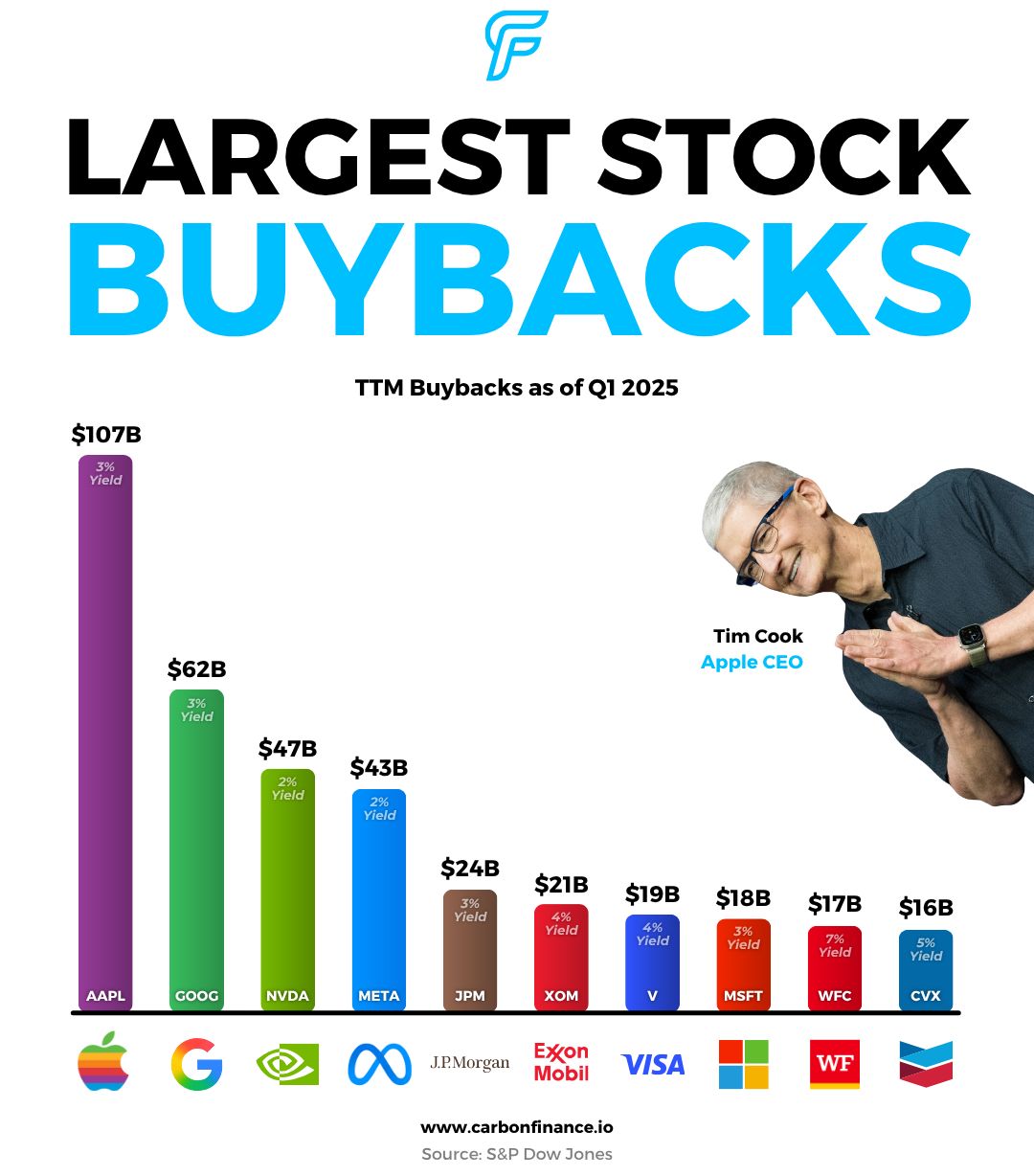

💵 Largest Stock Buybacks

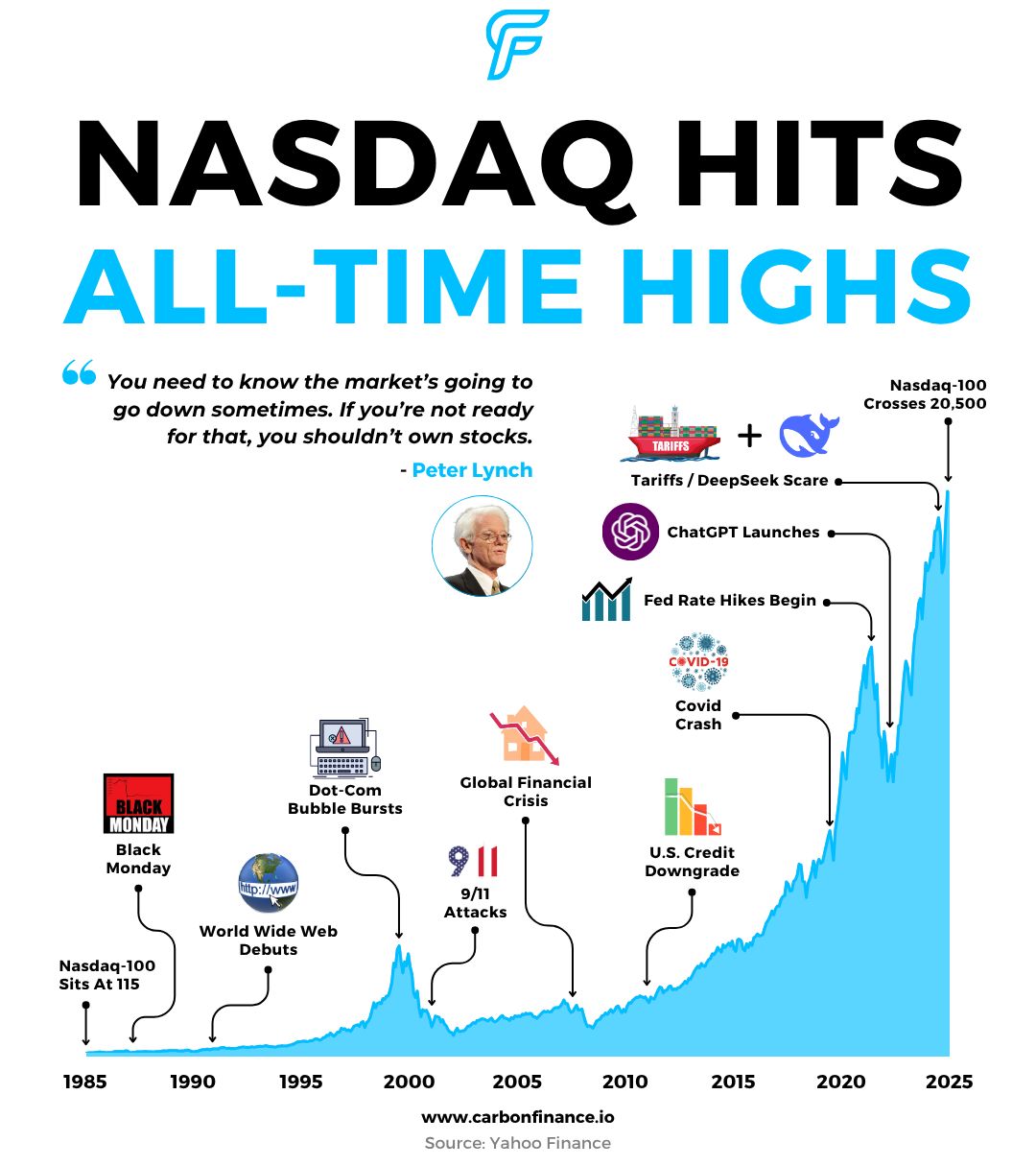

📈 Nasdaq Hits All Time Highs

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Together With Money.com

Outsmart college costs

Ready for next semester? June is a key time to assess how you’ll cover college costs. And considering federal aid often isn’t enough, you might have to consider private student loans.

You’re just in time, though—most schools recommend applying about two months before tuition is due. By now, colleges start sending final cost-of-attendance letters, revealing how much you’ll need to bridge the gap.

Understanding your options now can help ensure you’re prepared and avoid last-minute stress. View Money’s best student loans list to find lenders with low rates and easy online application.

Nvidia has re-emerged from the ashes.

After falling nearly 40% from its all-time high, the stock has surged 65% and is now back at record levels.

At the company’s annual shareholder meeting, CEO Jensen Huang highlighted robotics as the next major growth frontier beyond AI, calling it a multitrillion-dollar opportunity.

In the most recent quarter, Nvidia’s automotive and robotics division generated $567M in revenue.

While that’s just 1% of total sales, it grew 72% YoY, pointing to a long runway ahead.

Self-driving cars are expected to be the first major application, as both the vehicles and the AI software that powers them depend on Nvidia’s chips.

Nvidia’s recent rally has propelled it back to the top.

The AI giant is now the most valuable company in the world, with a market cap of $3.8T.

Microsoft sits just behind at $3.7T, while Apple, whose AI rollout has underwhelmed investors, holds third at $3T.

If Nvidia crosses the $4T mark, it would become the first company in history to do so.

Are Nike’s worst days behind it?

The company reported earnings this past week that beat expectations on both revenue and profit, but the bar was low.

EPS came in at $0.14, slightly above the $0.13 estimate.

Revenue reached $11.10B, topping forecasts of $10.72B.

Still, the year-over-year numbers were harsh.

EPS fell 86%, and sales dropped 12%.

Nike said this was the deepest financial hit expected from its ongoing turnaround strategy, one it had previously guided for.

Looking ahead, the company expects declines in both sales and profit to begin leveling out.

But new headwinds are emerging.

Nike estimates tariffs could carry a gross incremental cost of $1B, raising fresh concerns about the near-term recovery.

For the current quarter, the company expects sales to decline in the mid-single digits, in line with analyst expectations.

Stock buybacks are one of the most powerful tools companies use to return value to shareholders.

By repurchasing their own shares, companies reduce the total number of shares outstanding, boosting earnings per share and often supporting the stock price.

Buybacks also signal confidence from management, especially when companies believe their stock is undervalued.

Over the last twelve months ending Q1, some of the biggest names in tech have led the charge.

Apple bought back $107B worth of stock, more than any other company.

Google followed with $62B, and Nvidia came in third with $47B.

Markets face constant disruption, but resilience is the common thread.

From Black Monday to 9/11, the dot-com crash to COVID, and now the rise of AI and geopolitical tensions, headlines will always continue to pour in.

Yet through it all, the Nasdaq has continued to push higher.

Even after falling into correction territory earlier this year, it has rebounded and is now up 5% on the year.

History shows that while setbacks are inevitable, long-term growth prevails.

📣 Presented By With Vincent

Investment picks returning 200%+

AIR Insiders get weekly expert investment picks and exclusive offers and perks from leading private market investing tools and platforms. So if you’re looking to invest in private markets like real estate, private credit, pre-IPO venture or crypto, the time to join FOR FREE is now.

🔫 Coup Scandal. Jane Street’s co-founder said he was tricked into funding AK-47’s for a coup in South Sudan - BB

💔 Terminated Trust. Novo Nordisk terminated its partnership with Hims due to concerns about illegal mass compounding and deceptive marketing - PRN

🚕 Robotaxi Trouble. Tesla’s first public robotaxi test in Texas faced several traffic hiccups and driving issues - R

☢️ Nuclear Revival. New York will build the first major U.S. nuclear plant in over 15 years - WSJ

⚛️ Atomic Intelligence. Palantir is developing AI software to build nuclear plants cheaper, safer, and faster - BB

Courtesy of our paid partner, EarningsHub.

Earning Calendar for the Month of July:

Next month is going to be huge!

EarningsHub helps me stay on top of earnings, forecasts, and AI-powered call recaps.

It’s free, and perfect if you want to track every major company reporting.

Major Trades Published 6/23 - 6/27. Trades may be those of family members. [Source: 2iQ]

Buys

Jefferson Shreve (R)

Company: Microsoft ($MSFT)

Amount Purchased: $500K - $1M

Company: Nvidia ($NVDA)

Amount Purchased: $100K - $250K

Company: General Electric ($GE)

Amount Purchased: $50K - $100K

Sells

Jefferson Shreve (R)

Company: Apple ($AAPL)

Amount Sold: $600K - $1.25M

Company: Nvidia ($NVDA)

Amount Sold: $500K - $1M

Company: Microsoft ($MSFT)

Amount Sold: $500K - $1M

Company: Amazon ($AMZN)

Amount Sold: $250K - $500K

Company: Alphabet ($GOOG)

Amount Sold: $200K - $500K

Major Trades Published 6/23 - 6/27

Buys

Sells

How was today's newsletter?I value all of the feedback that I receive. Let me know how I did so I can continue to make this the best investing newsletter available! |

🤝 Review of the Week

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Reply