Happy Sunday!

Before we jump in, a quick announcement that there will be no issue next Sunday, 7/7, due to the Independence Day Weekend! The newsletter will resume on 7/14!

This week was packed with news, with the highlight being the Trump-Biden debate.

According to a recent Economist and YouGov poll, nearly 60% of Americans view both candidates unfavorably.

Additionally, 44% of the 1,600 U.S. adults surveyed aren't enthusiastic about voting in November, reflecting widespread election apprehension.

Both candidates have agreed to one more debate in September, following their respective party nominations.

Some key data bites from this week that you should know:

Under Armour $UAA has agreed to a $434M settlement over misleading financial claims.

Apple $AAPL has been working to reduce 50% of its assembly line workers.

Trump Media $DJT announced it would receive more than $69.4M from the cash exercise of warrants.

American Express $AXP purchased reservation company Tock for $400M.

Microsoft $MSFT could face a fine equal to 10% of its annual global revenue for bundling Teams with its Office software.

Amazon $AMZN surpassed a $2T valuation for the first time ever.

FedEx $FDX raised guidance and announced a $2.5B stock buyback.

The average credit card interest rate now sits at 27.70%.

Walgreens $WBA is set to close roughly 8,600 locations across the U.S.

In today’s newsletter:

🇪🇺 Most Valuable European Companies

⛑️ Rivian Receives A Lifeline

🚀 SpaceX’s Valuation Hits $210B

✔️ Nike Is Running Into Trouble

🇺🇸 S&P 500 Returns By President

Not subscribed yet? Sign up today!

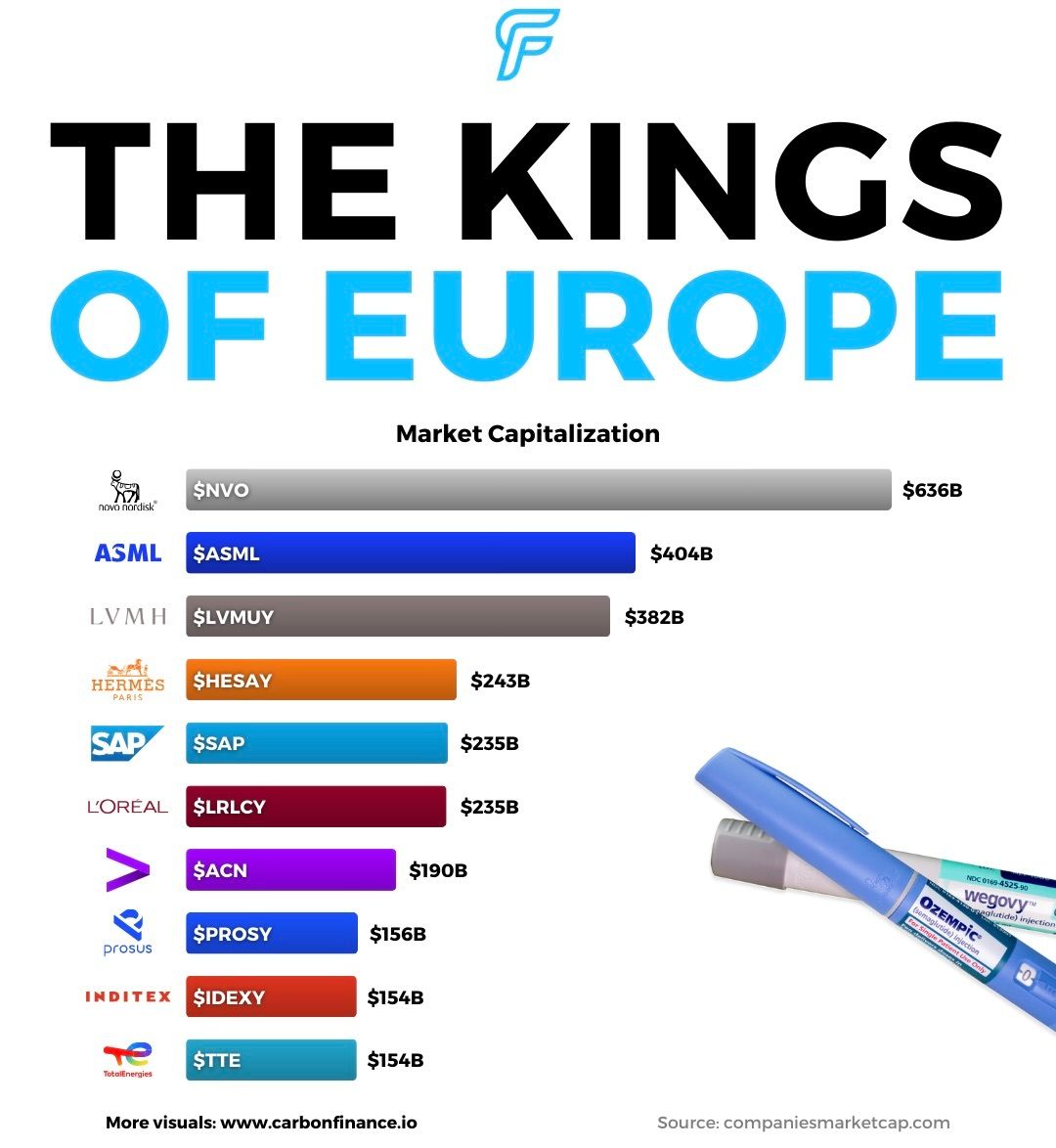

The weight loss drug boom has helped propel the Danish company Novo Nordisk all the way to the top.

Novo’s shares climbed this week following news of Wegovy’s approval for sale in China.

The company now sits comfortably in first place as the most valuable company in Europe, ahead of ASML by roughly $230B.

ASML, specializing in chip production machinery, recently climbed to second place, overtaking luxury giant Louis Vuitton, now third.

Rounding out the top ranks are diverse names like SAP, which develops enterprise software, Accenture, known for their IT consulting, and Inditex, renowned for Zara.

Speaking of European companies, German automobile manufacturer Volkswagen is easily one of the most well known.

The company made headlines this week following news of their investment of up to $5B in American EV company Rivian.

Initially, Volkswagen will invest $1B, with plans to potentially increase this to $5B over time.

This influx of cash is a crucial lifeline for Rivian, whose stock has plummeted nearly 90% since its late 2021 IPO.

Volkswagen aims to develop a next-generation software-defined vehicle platform using Rivian’s technology, which both companies will integrate into their future EVs.

Since they went public, Rivian has lost $17.9B.

Even more surprising, Rivian lost an average of $39,000 for each vehicle sold in the first quarter of the year.

Nonetheless, investors were bullish on the news, sending shares of Rivian up 30% this week.

SpaceX isn’t just sending rockets up; their valuation is soaring too.

The company’s valuation has now hit a new all-time high at $210B.

This spike follows a recent insider share sale at $112 per share in a tender offer, marking a 17% increase from its $180B valuation in December.

SpaceX now approaches the valuation of TikTok’s owner, Bytedance, at $268B.

So, just how big is SpaceX now? It has surpassed the entire mass media giant Disney in value.

In fact, it’s also now worth more than PayPal, Palantir, Supermicro, and Lululemon combined.

While these companies are not direct competitors to SpaceX, it’s always interesting to look at valuations in the context of other companies.

This surge in valuation is set to considerably boost Elon Musk’s net worth, given his 42% stake in the privately held company.

📣 A Message From Our Sponsor

Put your money to work in a high-yield cash account with up to $2M in FDIC† insurance through program banks.

Get started today, with as little as $10.

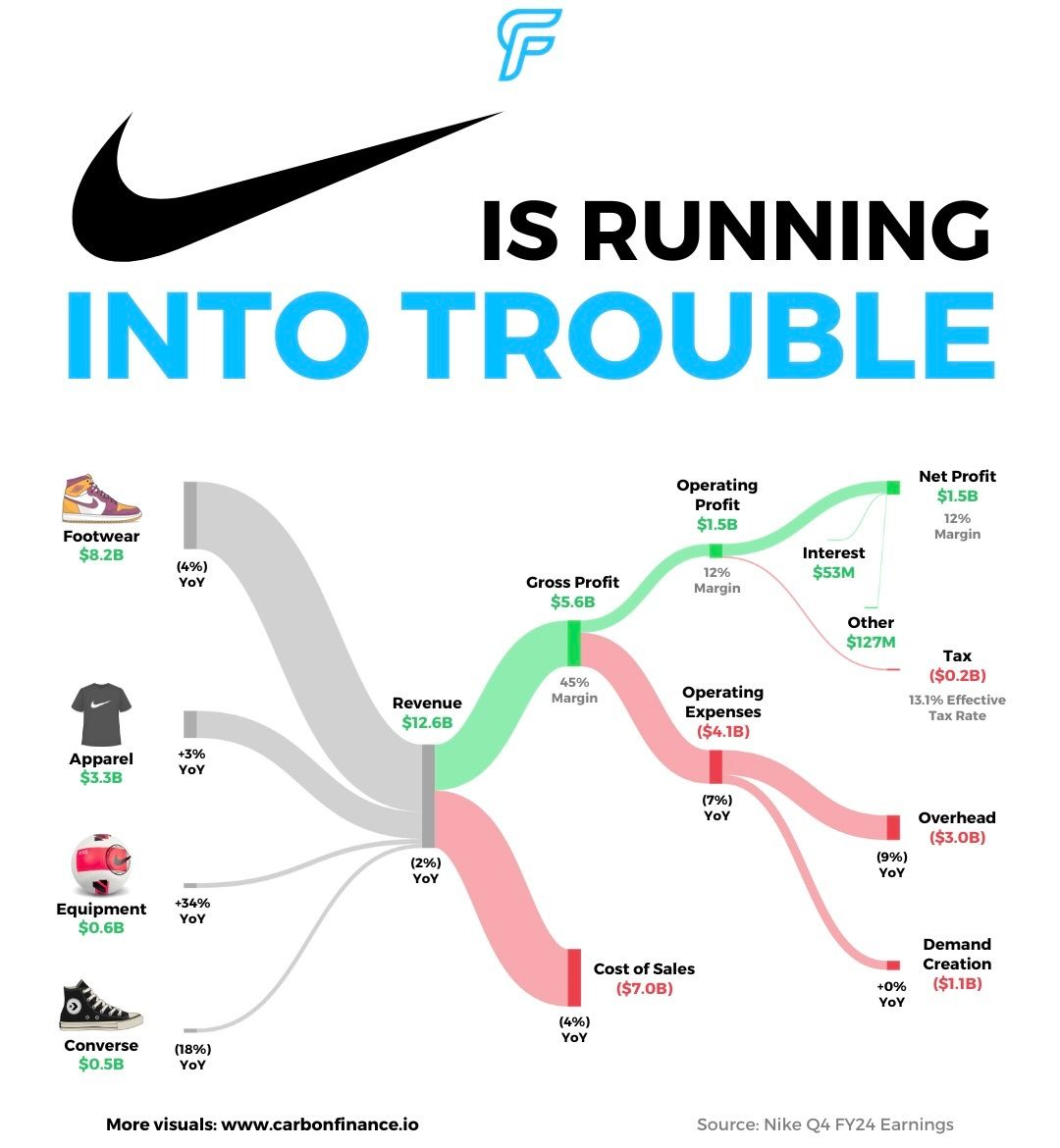

While SpaceX seems to be doing well, let’s talk about a company that isn’t doing too hot: Nike.

Shares of the athletic footwear giant plummeted nearly 20% following its Q4 Fiscal 2024 earnings report, marking its worst trading day since its 1980 IPO.

Despite exceeding earnings expectations for the quarter, Nike fell short on revenue.

Furthermore, sales growth for fiscal 2024 was the slowest since 2010, excluding the Covid pandemic.

The primary driver for Nike’s stock plunge though was the company’s forecast of a 10% sales decline in the current quarter, significantly below analysts' expectations of a 3.2% drop.

The grim outlook reflects weak sales in China, leading Nike to anticipate mid-single-digit declines for fiscal 2025, a sharp contrast to previous growth projections.

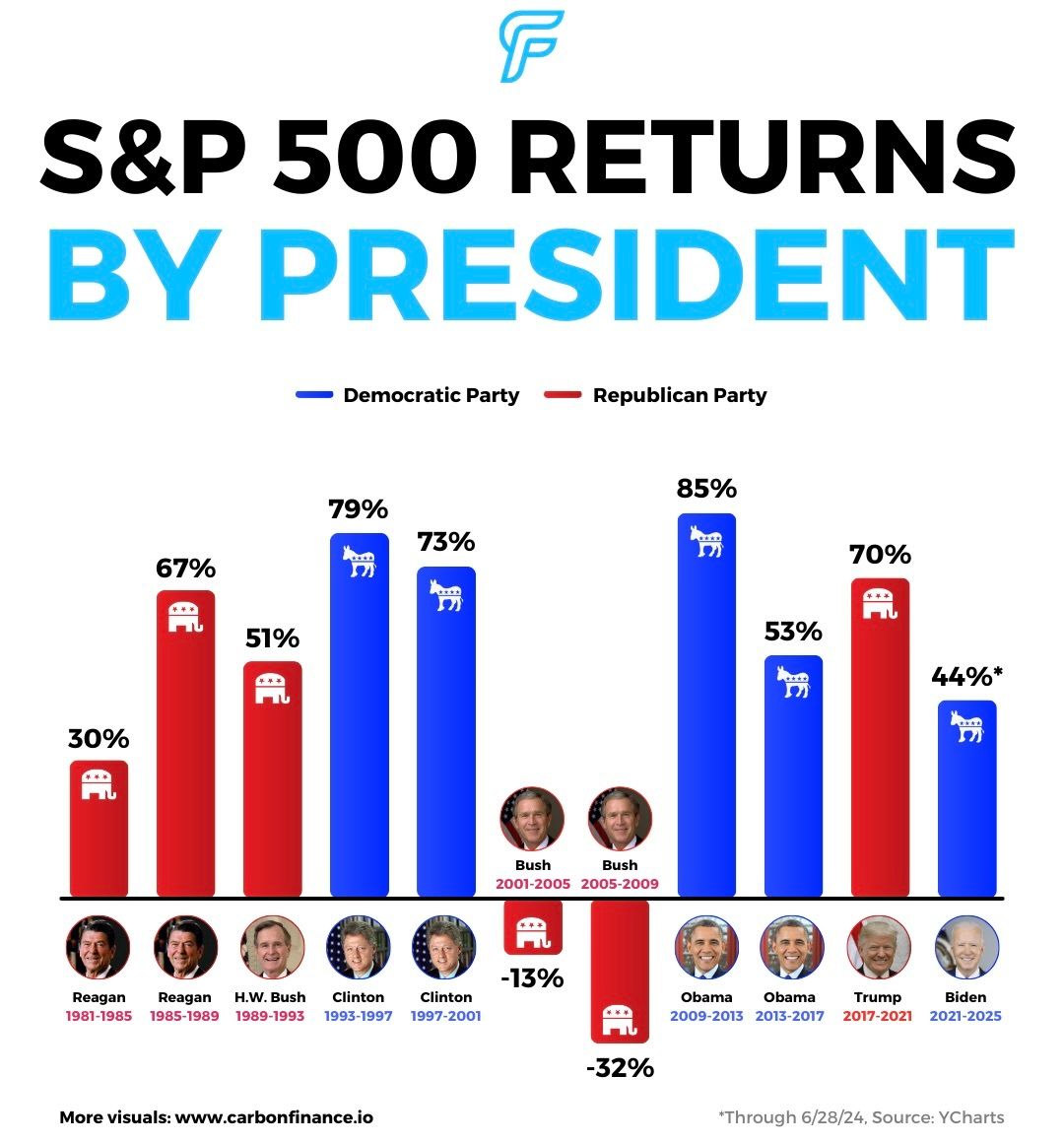

Does the stock market really care whose in office?

Based on historical data, the answer is not really.

Over the long term, the stock market has done well under both Democratic and Republican administrations, per data from The Motley Fool.

From a mean perspective, the S&P 500 has grown annually at 9.8% under Democratic presidents, outpacing the 6% under Republicans since 1957.

However, looking at median growth rates, the market has seen 10.2% growth under Republicans and 8.9% under Democrats.

While either party could make the case that the stock market performs better during their party, the direct impact of policy remains hard to quantify.

Furthermore, presidential terms are susceptible to unforeseen events like the dot-com bubble, the 2008 financial crisis, and Covid-19, to name a few.

As always, the name of the game is time in the market, not the president’s political party.

The S&P 500’s compounded annual growth rate of 10.26% is a clear testament to that.

🍟 $5 Value Meal. McDonald’s $MCD has started to roll out their $5 value meals - YF

🏦 Recession Proof Verified. All 31 U.S. banks passed the annual stress test, confirming their ability to withstand a severe recession - CNBC

😡 Crypto Controversy. Coinbase $COIN is suing the SEC and FDIC for concealing past crypto probes and obstruction of banking access - IV

🪫 EV Streak Loss. Tesla $TSLA is on the verge of losing its six-year streak of outselling every other automaker combined in U.S. EV sales - BB

💊 Drug Doubts. Hunterbrook Media released a short seller report on Hims & Hers $HIMS regarding concerns around its weight-loss drugs offering - WSJ

Notable Companies Reporting Earnings Next Week:

Wednesday (7/3):

Constellation Brands $STZ

All of the companies that are reporting earnings next week can be viewed here.

📚 Recommended Reading

Want to become a better long term investor?

My friend the Decade Investor sends out a free weekly newsletter with proven tactics that you can learn from as you build your long term investment portfolio.

Join 17,000+ readers who get a weekly recap of the stock market👇

Major Trades Published 06/24 - 06/28. Trades may be those of family members. [Source: 2iQ]

Buys

Michael McCaul (R)

Company: Apple ($AAPL)

Amount Purchased: $530K - $1.3M

Company: Intel ($INTC)

Amount Purchased: $265K - $550K

Company: Kraft Heinz ($KHC)

Amount Purchased: $200K - $500K

Sells

Michael McCaul (R)

Company: Wells Fargo ($WFC)

Amount Sold: $200K - $500K

Company: Philip Morris International ($PM)

Amount Sold: $200K - $500K

Debbie Dingell (D)

Company: Apple ($AAPL)

Amount Sold: $31K - $115K

Major Trades Published 06/24 - 06/28

Buys

RH ($RH)

Insider: Gary Friedman (Chairman & CEO)

# of Shares Purchased: 46,274

$ Amount: $9,999,978

SEC Forms: [1]

Sells

Aribnb ($ABNB)

Snowflake ($SNOW)

Insider: Grzegorz Czajkowski (EVP, Engineering and Support)

# of Shares Sold: 469,120

$ Amount: $57,742,876

SEC Forms: [1]

DraftKings ($DKNG)

Insider: Paul Liberman (Director)

# of Shares Sold: 668,890

$ Amount: $25,972,124

SEC Forms: [1]

Nvidia ($NVDA)

Insider: Colette Kress (EVP & Chief Financial Officer)

# of Shares Sold: 200,000

$ Amount: $24,430,514

SEC Forms: [1]

How was today's newsletter?

🤝 Review of the Week

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

The mention of The Decade Investor Weekly in our newsletter is provided as a courtesy to our readers and should not be construed as an endorsement of any product, service, or information provided by the sponsor or partner. Carbon Finance makes no representations or warranties, express or implied, about the accuracy, completeness, reliability, or suitability of the information contained in the sponsor’s or partner’s materials or any related services. Any reliance you place on such information is strictly at your own risk. We are not liable for any loss or damage arising from your engagement with The Decade Investor Weekly or their content.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.