- Carbon Finance

- Posts

- 📊 Oracle Is Bleeding Cash

📊 Oracle Is Bleeding Cash

1) SpaceX To IPO 2) Adobe Is Far From Dead 3) Lululemon’s Growth Hits A Wall and more!

Happy Sunday!

As the year comes to a close, I hope you’ve had an incredible one filled with progress, milestones, and meaningful growth.

Life is challenging, but every step forward matters, and how you keep moving makes all the difference.

Thank you for being apart of this journey. I’m excited for what 2026 has ahead.

I’ll be taking a two-week break, and the newsletter will return on January 4th. And with that, let’s cover the final issue of the year.

Key Data Bites From This Week:

Morningstar published the 160 best companies to own in 2026.

Wedbush shared 12 AI companies to avoid.

Fed cut interest rates by 25 bps and expects only 1 cut in 2026.

Trump will let Nvidia sell H200 chips to China if U.S. gets 25% cut.

IBM will acquire data streaming platform Confluent for $11B.

Mastercard announced a $14B share buyback program.

Trump announced $12B in aid to U.S. farmers.

JPMorgan sees $105B in 2026 expenses, above $101B analyst estimate.

Pepsi will lower prices and cut number of individual products by 20%.

China’s trade surplus crossed $1T for the first time.

Rising stocks created 287 new billionaires this year.

Microsoft and Amazon have pledged to invest over $52B in India.

Palantir announced a $448M deal with the U.S. Navy.

U.S. trade deficit reached a five-year low.

Tesla U.S. sales dropped to a near four-year low.

Disney will invest $1B in OpenAI and license characters.

Eli Lilly helped patients cut >23% of body weight with next-gen shot.

Earnings Results & Guidance:

GE Vernova ramped buybacks, doubled its dividend, and guided to a 20% adjusted EBITDA margin by 2028.

AutoZone posted its sixth-straight earnings miss.

GameStop posted declining sales but collectibles increased 50%.

Costco saw sales increase 8.2% and digital sales jump 20.5%.

Broadcom now has a $73B backlog in AI product orders.

In today’s newsletter:

🍿 Paramount Enters The Fight

🚀 SpaceX To IPO

🩸 Oracle Is Bleeding Cash

🎨 Adobe Is Far From Dead

🎽 Lululemon’s Growth Hits A Wall

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Together With AARE

A New way to Earn Income from Real Estate

Commercial property prices are down as much as 40%, and AARE is buying income-producing buildings at rare discounts. Their new REIT lets everyday investors in on the opportunity, paying out at least 90% of its income through dividends. You can even get up to 15% bonus stock in AARE.

This is a paid advertisement for AARE Regulation CF offering. Please read the offering circular at https://invest.aare.com/

Paramount is not backing down.

On Monday, the company launched an unsolicited, hostile all-cash tender offer of $30 per share directly to Warner Bros. Discovery shareholders.

The bid values the deal at roughly $108B.

Paramount had previously made the same offer to Warner Bros. Discovery’s board, who rejected it.

In total, the board turned down six proposals, prompting Paramount to bypass management and go straight to shareholders.

Just last week, Warner Bros. Discovery accepted a competing bid from Netflix to acquire its streaming and studio assets for $83B.

Paramount argues its offer delivers greater value to shareholders and a clearer path to regulatory approval.

Combined, Paramount and Warner Bros. Discovery would control nearly 14% of U.S. TV viewing time, based on Nielsen data from October.

What happens next remains uncertain.

The Warner Bros. Discovery board must formally respond, shareholders will need to vote, a bidding war could emerge, and regulators will review both proposals.

In other words, a final outcome is likely still months away.

Elon Musk is inching closer to a trillion-dollar fortune.

On Tuesday, Bloomberg reported that SpaceX is targeting a valuation of roughly $1.5T and is pursuing a public listing as early as mid-to-late 2026.

The company is looking to raise well over $30B, which would make it the largest IPO in history.

SpaceX is projected to generate $15B in revenue in 2025, with this figure expected to climb to $23B in 2026.

Musk later confirmed plans for SpaceX to go public in a post on X.

At a $1.5T valuation, SpaceX would more than double Musk’s net worth, pushing it to roughly $952B.

Oracle’s AI bet is growing fast, but so is the cash burn.

The company reported mixed earnings in its most recent quarter.

Adjusted earnings reached $2.26 per share, well ahead of estimates, helped in part by a one-time gain from the sale of its Ampere stake.

Revenue rose 14% to $16.06B, but missed analyst expectations.

For the current quarter, Oracle guided to $1.72 in adjusted earnings and projected 20% revenue growth, broadly in line with consensus.

Remaining performance obligations continued to swell, jumping to $523B and above the $502B estimate.

That backlog growth was driven in part by new commitments from customers like Nvidia and Meta.

But free cash flow was the real concern.

Oracle reported -$10B in free cash flow for the quarter.

Over the past twelve months, free cash flow has fallen to -$13B.

The burn reflects a sharp ramp in capital spending as Oracle builds data center capacity to support AI workloads.

Rising CapEx, growing debt needs, and fears of an AI bubble have weighed heavily on sentiment.

Concerns are amplified by Oracle’s concentrated customer exposure, with OpenAI representing its largest commitment.

Shares are now down more than 40% since spiking in September following the $300B OpenAI cloud deal.

Adobe keeps delivering while the market stays skeptical.

Despite ongoing concerns about its long-term positioning, the company continues to post solid results.

In Q4, adjusted earnings reached $5.50, while revenue grew 10% to $6.19B.

Analysts had expected $5.40 in earnings and $6.11B in revenue.

The company also beat guidance expectations for the current quarter.

Looking ahead to fiscal 2026, the company guided to 10.2% annual recurring revenue growth and projected both revenue and adjusted earnings above consensus.

In short, Adobe delivered a beat in the most recent quarter, a beat on the current quarter’s guidance, and a beat on 2026 expectations.

The company also recently announced plans to integrate its applications more deeply into ChatGPT, expanding distribution and usage across AI-driven workflows.

While demand for Adobe’s tools remains strong and AI monetization is increasing, fears about future competition from AI-native tools continue to weigh on sentiment.

As a result, shares are down 20% YTD and trade at just 15x forward earnings, a notable discount to the broader market.

Lululemon’s CEO is headed for the exit.

Shares jumped more than 10% after the company announced the news during its Q3 earnings report.

The decision marks the end of an era under CEO Calvin McDonald, who took the role in August 2018.

McDonald will leave the position in January 2026 after eight years at the helm, and will remain on as a senior advisor through March 2026.

The leadership change comes after a clear slowdown in growth.

Lululemon has now posted six consecutive quarters of low single-digit comparable sales growth.

In Q3, the company beat expectations on both earnings and revenue, but forward guidance disappointed.

Q4 revenue is expected to be about $3.55B, below the $3.60B estimate.

Earnings per share are guided to $4.71, well under the $5.03 estimate.

The company’s CFO and COO will serve as interim co-CEOs while a search for a new leader begins.

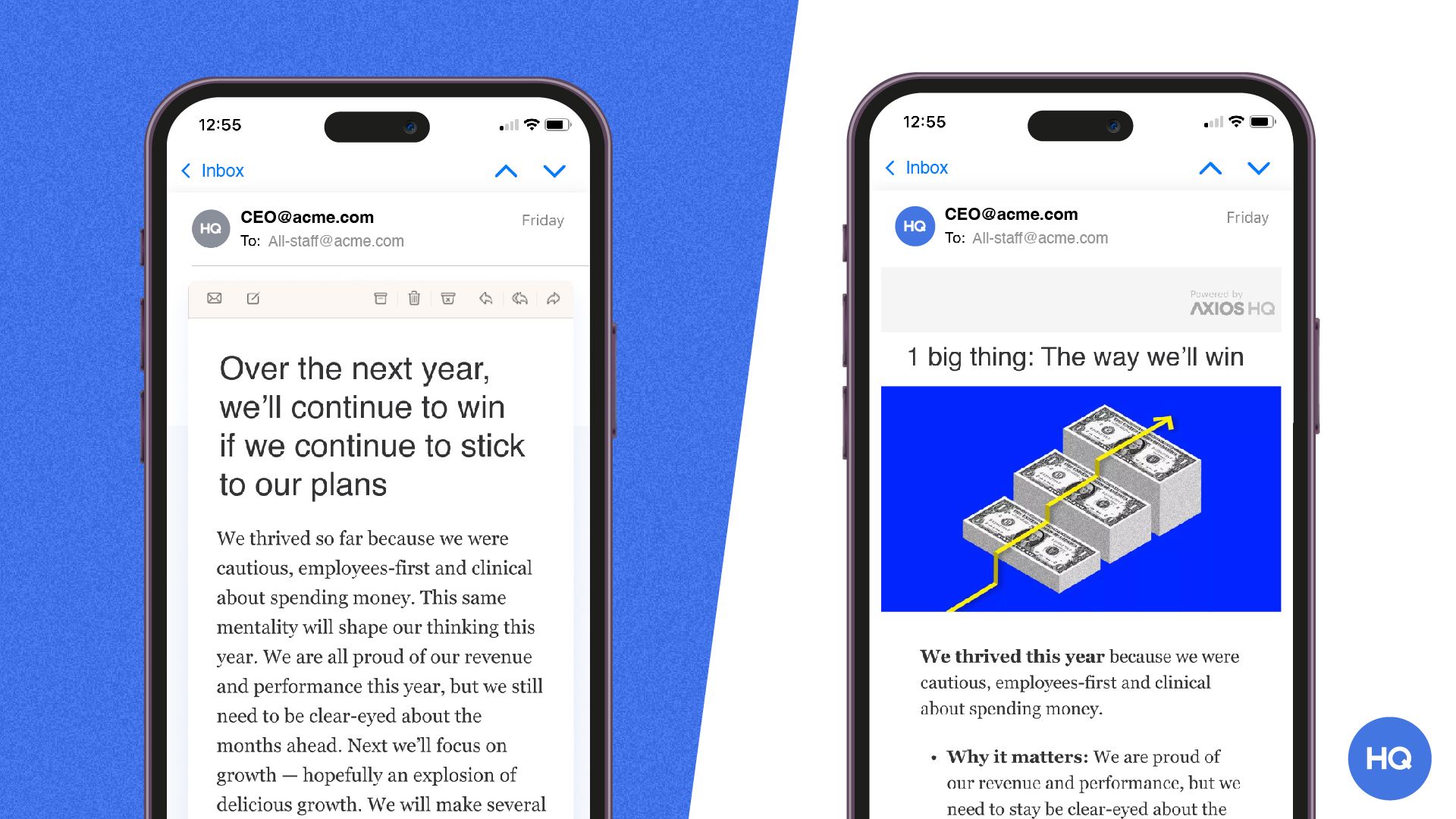

📣 Presented by Axios HQ

Six resources. One skill you'll use forever

Smart Brevity is the methodology behind Axios — designed to make every message memorable, clear, and impossible to ignore. Our free toolkit includes the checklist, workbooks, and frameworks to start using it today.

🔌 Power Deals↗ - NextEra Energy announced major deals to supply power for Meta and Google data centers.

🚪 Berkshire Exit↗ - Todd Combs, GEICO’s CEO and a Berkshire Hathaway investment manager, is leaving to join JPMorgan.

📐 National Standard↗ - President Trump signed an executive order that creates a single national rule for AI, limiting power of states.

₿ Savings Flip↗ - Young men are more likely to own cryptocurrency than have a 401(k), with 26% owning crypto versus 21% with a 401(k).

↪️ Model Shift↗ - Meta is moving away from open-source models and plans to launch a proprietary model early next year.

🪐 Orbital Armsrace↗ - Jeff Bezos and Elon Musk are racing to build AI data centers in space.

Courtesy of our affiliate partner, EarningsHub.

Notable Companies Reporting Earnings Week of December 14th, 2025:

Major Trades Published 12/8 - 12/12. Trades may be those of family members. [Source: 2iQ]

Buys

Cleo Fields (D)

Company: Netflix ($NFLX)

Amount Purchased: $200K - $500K

Michael McCaul (R)

Company: Genuine Parts Co ($GPC)

Amount Purchased: $100K - $250K

Sells

Michael McCaul (R)

Company: Las Vegas Sands Corp ($LVS)

Amount Sold: $100K - $250K

Company: Genpact ($G)

Amount Sold: $100K - $250K

Major Trades Published 12/8 - 12/12

Buys

Sells

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

This newsletter is sponsored by AARE and Masterworks. Sponsorship does not influence our editorial content. We do not endorse the sponsor’s products, services, or views, and we are not responsible or liable for any interaction or transaction between readers and the sponsor.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Reply