Happy Tuesday.

Welcome to the 128 new subscribers who joined this past week. Some key data bites you should know:

The MSG Sphere $SPHR in Las Vegas reported a $98.4M loss for its first financial quarter and saw its CFO resign.

AMC Entertainment's $AMC stock plunged after the company filed to sell up to $350M in common shares in an effort to improve liquidity and reduce debt.

A study shows that the weight loss drug Wegovy, owned by Novo Nordisk $NVO, can reduce the risk of cardiovascular issues in overweight or obese people with heart disease by 20%.

Google $GOOG pays Apple $AAPL 36% of the revenue it earns from search advertising on the Safari browser.

In today’s newsletter:

🏹 Investors Don’t Like Robinhood

🧱 Roblox Keeps Stacking

🦜 Duolingo Is Taking Off

Let’s dive right in!

Not subscribed yet? Sign up today!

🏹 Investors Don’t Like Robinhood

Robinhood has been taking a hit after the company recently reported lower trading volumes and active users, with its Q3 revenue of $467M missing analysts' expectations of $480M. The company's transaction revenue declined, particularly in crypto trading, which dropped 55% year-over-year. Despite these challenges, Robinhood is planning to expand into Europe, including launching its brokerage in the U.K. and opening crypto trading to EU customers, as it aims to broaden its product offerings and market presence.

Following the sharp decline, Cathie Wood’s ARK Invest purchased approximately 1.14M shares of Robinhood, valued at $9.55M, across their three ETFs. This continues to reinforce ARK’s position as the second largest institutional holder of Robinhood, according to FactSet.

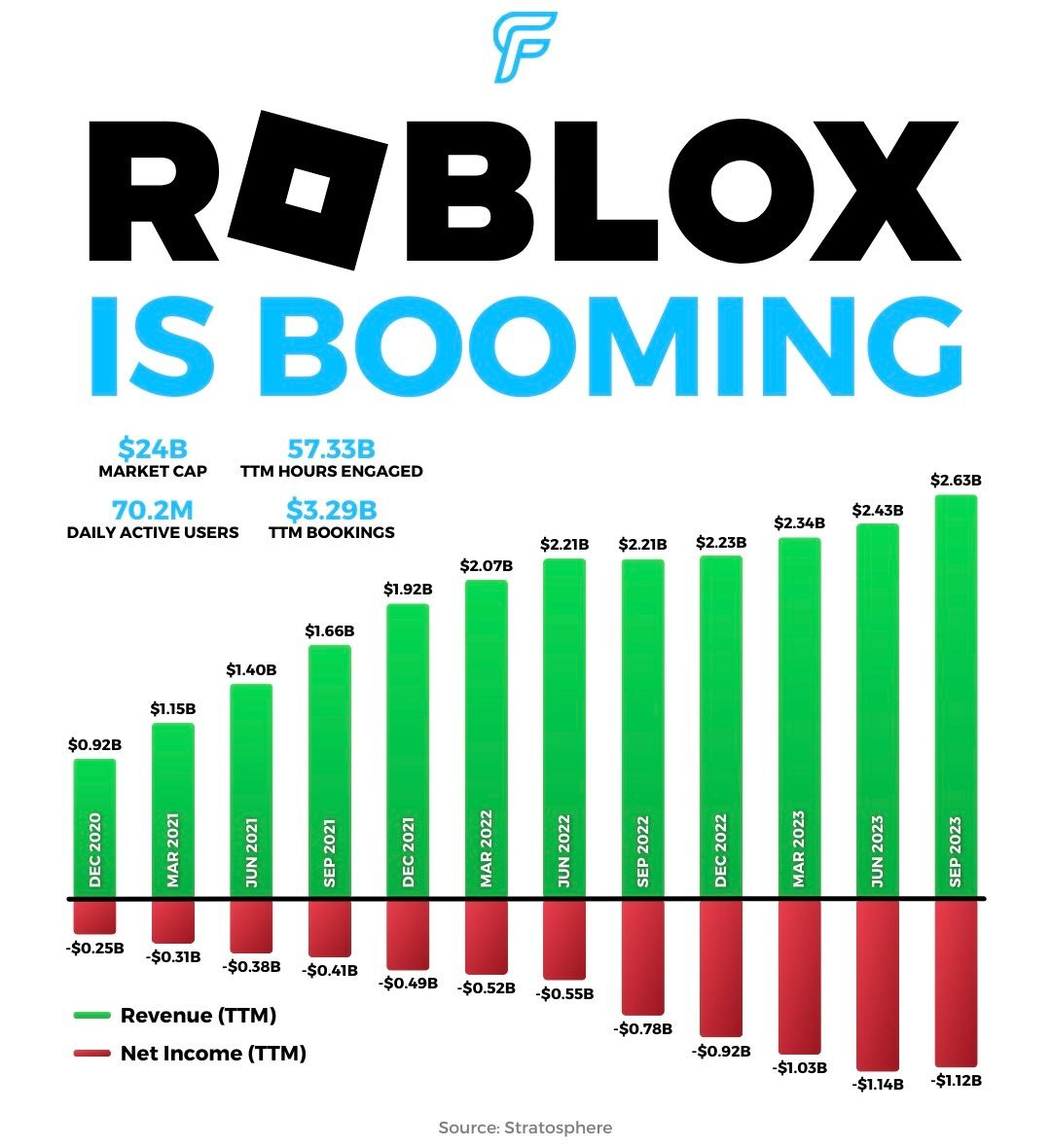

🧱 Roblox Keeps Stacking

While Robinhood has been getting beat up, Roblox, the popular video-game platform among teenagers, saw its shares surge by the most in nearly 9 months, buoyed by third-quarter bookings and revenue that exceeded analyst expectations. The company's bookings climbed 20% to $839.5M, surpassing the projected $822M, and their adjusted EBITDA reached $81.1M. Additionally, daily active users were reported at 70.2M and hours engaged for the quarter rose by 20% to 16B. These positive results are linked to robust growth in areas like advertising, music, shopping, and a strategic focus on AI for content creation.

Bookings is a key metric to analyze Roblox because it represents virtual currency sales from in-game purchases. The company is strategically attracting older gamers with better graphics and enhanced game fidelity, which has led to higher spending per user. This shift is part of Roblox's effort to move away from the "metaverse" label and diversify its offerings and revenue streams through partnerships in sports, music, and major brands.

📣 Together With Asymmetric Investing

Do you want investment research for stocks that have the potential for an asymmetric return over the next decade? Here’s where Asymmetric Investing comes in:

Explore High-Potential Stocks: Dive into a world of stocks with the potential for asymmetric returns of 10x or more over the next decade.

Exclusive Research Access: In-depth insights and analysis, unlocking a wealth of investment knowledge.

Real-Money Portfolio: Gain insight into a real-money portfolio, a reflection of confidence in the research.

Join a Community of Forward-Thinking Investors: Be part of a group that looks beyond the conventional, aiming to discover stock market gems.

Subscribe to Asymmetric Investing today completely for FREE:👇

Sponsored

Asymmetric Investing

Investment research covering stocks with asymmetric return potential of 10x (or more) over the next decade. Start here and find out what I'm buying each month on Asymmetric Investing.

🦜 Duolingo Is Taking Off

Duolingo shares have been on the rise following a quarterly earnings report that exceeded expectations, with a Q3 EPS of $0.06, surpassing analysts' estimate of ($0.08), and revenue reaching $153.6M, a 43% year-over-year increase. The company also reported significant growth in total bookings, paid subscribers, and user engagement, with paid subscribers up 60% year-over-year to 5.8M, and monthly active users increasing by 47% from last year. Duolingo's future outlook remains positive, with projected Q4 2023 revenue and FY2023 revenue both exceeding consensus estimates.

🛍 Meta/Amazon Partnership. Meta $META is partnering with Amazon $AMZN to allow users to link their Facebook and Instagram accounts to shop through Meta's apps, streamlining the buying process. [TC]

🇨🇳 China’s Attractive Sectors. Citadel founder Ken Griffin encouraged global investors to invest in China's innovative sectors, particularly in solar and electric vehicles. [BB]

🇺🇸 Negative Outlook. Moody's $MCO maintained the U.S. credit rating as AAA but changed the outlook to "negative" due to fiscal concerns and political polarization. [NYT]

💾 New Nvidia Chips. Nvidia $NVDA is developing new AI chips for China due to U.S. restrictions, aiming to maintain access to the market while complying with regulations. [WSJ]

🥈 Ether ETF. BlackRock $BLK applied to list an ETF that tracks the price of Ether. [F]

🏦 Financials Short. Global hedge funds have increased bearish positions to their highest level in nearly five years, particularly in the financial sector. [R]

Notable Companies Reporting Earnings This Week:

Monday:

Sun Life Financial $SLF, Tyson Foods $TSN, AECOM $ACM, Monday.com $MDAY

Tuesday:

Home Depot $HD, Sea Limited $SE

Wednesday:

Cisco Systems $CSCO, TJX Companies $TJX, Palo Alto Networks $PANW, Target $TGT, JD.com $JD, XPeng $XPEV

Thursday:

Walmart $WMT, Alibaba $BABA, Applied Materials $AMAT

Friday:

BJ’s Wholesale $BJ, Atkore $ATKR

All of the companies that are reporting earnings this week can be viewed here.

Major Trades Published Week of 11/6. Trades may be those of family members. [Source: 2iQ]

Buys:

Carol Miller (R)

Company: iShares MSCI Emerging Markets ex-China ETF ($EMXC)

Amount Purchased: $65K - $150K

Maria Elvira Salazar (R)

Company: New Fortress Energy ($NFE)

Amount Purchased: $15K - $50K

Greg Stanton (D)

Company: Microsoft ($MSFT)

Amount Purchased: $15K - $50K

Company: Apple ($AAPL)

Amount Purchased: $15K - $50K

Sells:

Pete Sessions (R)

Company: BlackRock Utility & Infrastructure Trust ($BUI)

Amount Sold: $250K - $500K

Company: Procter & Gamble ($PG)

Amount Sold: $100K - $250K

Company: McDonald’s ($MCD)

Amount Sold: $100K - $250K

Company: Lockheed Martin ($LMT)

Amount Sold: $100K - $250K

Company: Snowflake ($SNOW)

Amount Sold: $15K - $50K

Company: Microsoft ($MSFT)

Amount Sold: $15K - $50K

Greg Stanton (D)

Company: Microsoft ($MSFT)

Amount Sold: $15K - $50K

Company: Apple ($AAPL)

Amount Sold: $15K - $50K

Katherine Clark (D)

Company: Coca-Cola ($KO)

Amount Sold: $15K - $50K

How was today's newsletter?

🤝 Review of the Week

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

The views and opinions expressed in this newsletter are solely those of Carbon Finance and do not reflect the official policy or position of any other agency, organization, employer or company.

The mention of Asymmetric Investing in our newsletter is provided as a courtesy to our readers and should not be construed as an endorsement of any product, service, or information provided by the sponsor. Carbon Finance makes no representations or warranties, express or implied, about the accuracy, completeness, reliability, or suitability of the information contained in the sponsor's materials or any related services. Any reliance you place on such information is strictly at your own risk. We are not liable for any loss or damage arising from your engagement with Asymmetric Investing or their content.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.