Happy Sunday!

This upcoming week is going to be massive. The key event?

Nvidia’s earnings report on Wednesday.

Investors will be watching closely to gauge any recent changes in AI demand and to hear any insights on the broader tech sector’s outlook.

If you're on X, make sure to follow my page to get the earnings news the moment it drops and stay in the loop with every update!

Some key data bites from this week that you should know:

Only 1 in 5 members of GenZ contribute to a retirement account.

Nearly 1 in 10 homes are worth $1M or more.

56% of Fortune 500 companies listed AI as a risk factor in recent annual reports.

Carl Icahn has agreed to a $2M settlement with the SEC.

Alex Cooper signed a $120M multi-year deal with SiriusXM $SIRI.

Netflix $NFLX saw a +150% increase in upfront ad sales commitments over 2023.

AMD $AMD is set to buy server maker ZT Systems for $4.9B.

Toronto-Dominion $TD is allocating $2.6B to cover fines related to money-laundering.

Canadian National Railway $CN and Canadian Pacific Kansas City $CPKC have locked out 9,000 rail union workers due to a labor dispute.

U.S. jobs growth was overestimated by 30% in revised data.

A gold bar now worth more than $1M.

Kamala Harris has proposed raising the corporate tax rate to 28%.

Walmart $WMT raised $3.6B selling its stake in JD $JD.

Cava $CAVA saw net sales jump 35.4% in Q2 2024.

In today’s newsletter:

💰 Companies With The Most Cash

🔥 Is Inflation Finally Under Control?

☕️ Starbucks Is A Bank

🦾 Big Tech’s AI Spending War

🕵️ Who Really Owns Nvidia?

Not subscribed yet? Sign up today!

In the stock market, there’s always something to worry about.

Because of that, it doesn’t hurt when companies have a little bit of cash on hand.

Why? A solid cash reserve gives companies the flexibility to pay off debt, pursue acquisitions, distribute special dividends, buy back undervalued shares, and more.

Warren Buffett famously said, “Only when the tide goes out do you learn who has been swimming naked.”

Recently, Buffett has been practicing what he preaches.

Berkshire Hathaway tops this list of companies with the most cash and short-term investments, holding a staggering $277B.

Big Tech dominates the rest of the top 10, but it’s worth noting that Chinese e-commerce giants Alibaba and Pinduoduo (owner of Temu) also make the cut.

This list focuses on companies with their primary listings on the NYSE or Nasdaq and excludes banks, insurance companies, and other financial institutions, as their cash is often tied to operations or required by regulations.

It is fair to question why Berkshire Hathaway should be included on this list, given that it maintains a large cash pile primarily to cover potential insurance claims, a necessity due to its significant insurance operations.

However, unlike typical financial institutions, Berkshire's cash isn't just a reserve—it's a strategic asset used to invest in a wide range of other non-financial businesses, from railroads to energy.

This diversified approach allows Berkshire to leverage its cash pile for broader opportunities, setting it apart from other financials.

This common misconception trips up many people.

You might hear on the news that inflation is going down, but then notice prices still rising month after month.

This can definitely be confusing. The term for this phenomenon is disinflation.

It’s what’s happening now, where the CPI is increasing, but at a slower rate.

In July, Core CPI came in at +3.2%, its lowest level in 39 months and right in line with analyst estimates.

Core CPI excludes food and energy, which are often more volatile and unpredictable in the short term.

This measure is preferred by both economists and the Fed when assessing inflation trends.

There’s no denying that prices have surged overall compared to five years ago, but recent data is promising, and shows that inflation is now increasing at a much slower pace.

At the annual Economic Policy Symposium in Jackson Hole on Friday, Jerome Powell said, 'The time has come for policy to adjust,' hinting that the first rate hike could happen as early as September

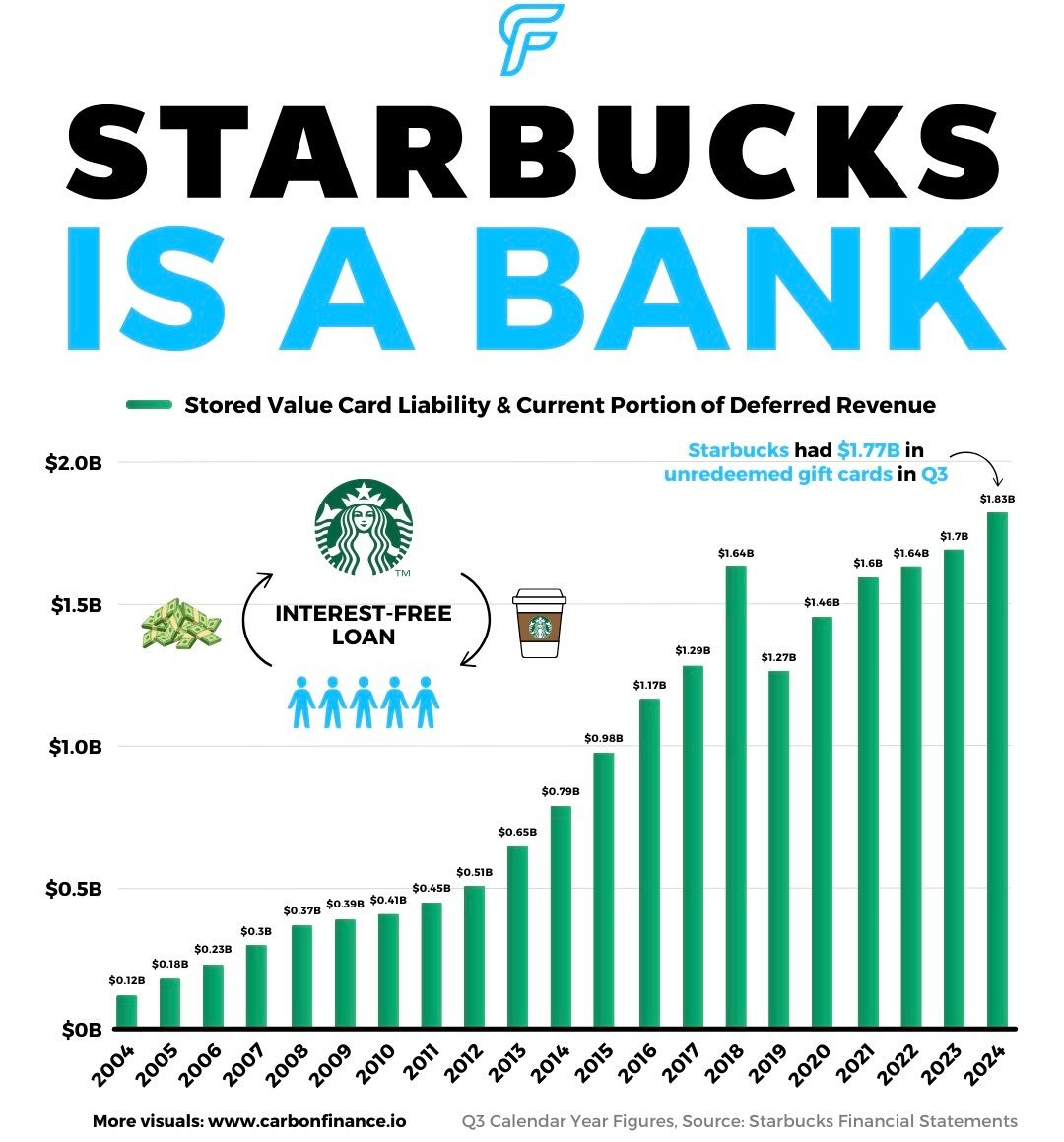

Starbucks has been all over the news after poaching Chipotle’s CEO Brian Niccol, offering him a $113M pay deal and a remote office in Newport Beach.

Following this announcement, Starbucks added over $20B to its market capitalization.

But here’s something more interesting aside from leadership changes.

For those of you that don’t know, Starbucks effectively operates like a bank by receiving interest-free loans from customers when they purchase gift cards or deposit money into their Starbucks accounts.

The funds loaded onto these cards are recorded as deferred revenue, recognized as income only when customers redeem their cards.

This deferred revenue primarily comes from unredeemed gift cards, along with up-front prepaid royalties from Nestlé.

Over time, a portion of these cards is never redeemed, allowing Starbucks to recognize the “breakage” as additional revenue.

Ultimately, this setup gives Starbucks access to interest-free cash flow while generating extra revenue thanks to its loyal customer base.

📣 Presented By Betterment

We put your money to work

Betterment’s financial experts and automated investing technology are working behind the scenes to make your money hustle while you do whatever you want.

There’s one thing you should know about AI.

It’s not cheap.

But don’t just take my word for it—listen to the CEOs of the biggest tech companies in the world.

In their most recent earnings calls:

Microsoft CEO Satya Nadella stated, “To meet the growing demand signal for our AI and cloud products, we will scale our infrastructure investments with FY25 CapEx expected to be higher than FY24.”

Similarly, Mark Zuckerberg of Meta remarked, “…we currently expect significant CapEx growth in 2025 as we invest to support our AI research and our product development efforts.”

But perhaps the most telling quote came from Sundar Pichai, Alphabet’s CEO, who said, “When we go through a curve like this, the risk of under-investing is dramatically greater than the risk of over-investing for us here, even in scenarios where it turns out that we are over-investing.”

The numbers back up these statements.

Big tech’s CapEx spending has skyrocketed from $18B in 2015 to $118B in 2024 as companies pour resources into data centers, cloud infrastructure, AI hardware, and more to fuel the AI revolution.

With these massive investments come concerns from investors.

There’s ongoing debate about whether the CapEx required for Generative AI will ultimately lead to substantial returns.

Only time will tell if this spending will pay off.

Who has benefited the most from Nvidia’s meteoric rise?

Unsurprisingly, none other than its CEO and cofounder Jensen Huang.

According to Fortune, just five years ago, Jensen was worth around $4B.

Now, thanks to Nvidia's stock surge, his net worth has skyrocketed to roughly $92B.

Recently, some investors have been growing concerned as they've noticed Jensen selling around $14M worth of shares nearly every day this summer.

In July alone, he offloaded $323M worth of stock.

Given that Nvidia has delivered a staggering 3,000% return over the past five years, it’s no surprise he’s cashing in on some gains.

To add on, Jensen’s sales are also under the Rule 10b5-1 agreement, which follows a predetermined schedule.

And lastly, despite these sales, he remains a top 5 owner of Nvidia, with a 3.5% stake in the company.

🏈 Launch Intercepted. A judge has blocked Fox $FOX, ESPN $DIS, and Warner Brothers $WBD from launching a new sports streaming service - AP

💸 Paper Tax. Kamala Harris is backing Biden’s tax proposals which include a tax on unrealized capital gains for the super wealthy - MW

🤖 Autonomous Partnership. GM’s $GM robotaxi firm Cruise will offer its autonomous vehicles on Uber’s $UBER platform - R

🔪 Bank Nightmare. Elon Musk’s Twitter acquisition has been the worst merger-finance deal for banks since 2008 - WSJ

Notable Companies Reporting Earnings This Week:

Monday (8/26):

PDD Holdings $PDD, Trip.com $TCOM

Tuesday (8/27):

Bank of Montreal $BMO, SentinelOne $S

Wednesday (8/28):

Nvidia $NVDA, Salesforce $CRM, CrowdStrike $CRWD

Thursday (8/29):

Dell Technologies $DELL, Marvell Technology $MRVL, Autodesk $ADSK, Lululemon $LULU, Dollar General $DG, Ulta Beauty $ULTA

Thursday (8/30):

Frontline $FRO

All of the companies that are reporting earnings next week can be viewed here.

📣 Presented By Advisor.com

Invest Confidently With A Trusted Advisor

Feeling uncertain about the stock market in 2024? Take our online quiz to find a trusted fiduciary financial advisor who can ease your nerves and guide you through market fluctuations. We compare 2024's Top Financial Advisors & CFPs based on rigorous criteria: credentials, client reviews, and experience. Whether you're new to investing or a seasoned investor, expert advice can make all the difference. Don't navigate market uncertainty alone. Start your journey to financial confidence today!

Major Trades Published 08/19 - 08/23. Trades may be those of family members. [Source: 2iQ]

Buys

Kathy Manning (D)

Company: Garmin ($GRMN)

Amount Purchased: $52K - $130K

Scott Franklin (R)

Company: Accenture ($ACN)

Amount Purchased: $51K - $115K

Company: Chubb ($CB)

Amount Purchased: $51K - $115K

Sells

Scott Franklin (R)

Company: Invesco QQQ ($QQQ)

Amount Sold: $115K - $300K

Company: Starbucks ($SBUX)

Amount Sold: $103K - $295K

Company: NextEra Energy ($NEE)

Amount Sold: $51K - $115K

Major Trades Published 08/19 - 08/23

Buys

Nerdy Inc ($NRDY)

Insider: Charles Cohn (CEO)

# of Shares Purchased: 2,170,291

$ Amount: $2,235,400

SEC Forms: [1]

Sells

How was today's newsletter?

🤝 Review of the Week

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.