Happy Sunday!

A warm welcome to the +200 subscribers that have joined us this week!

It has been a crazy last few days and earnings season is starting to heat up, so expect a ton of headlines and visuals over the next few weeks!

Some key data bites from this week that you should know:

June CPI increased 3% YoY, below the 3.1% projected.

Apple $AAPL plans to ship 10% more new iPhones this year.

AMD $AMD will acquire AI startup Silo AI for $665M.

Copying Nancy Pelosi’s trades would have returned 700% in the last decade.

MicroStrategy $MSTR announced a 10-for-1 stock split.

The IRS collected $1B in unpaid taxes from 1,600 people.

Lucid’s $LCID deliveries increased 70% in Q2.

Eli Lilly $LLY to acquire Morphic Holdings $MORF for $3.2B in cash.

JPMorgan $JPM saw its quarterly profit jump 25% to $18.15B.

Markets now expect a 90.3% chance of a rate cut in September.

UiPath $PATH plans to cut 10% of its staff.

Intuit $INTU also laid off 10% of its staff, comprised of low performers and executives.

46% of GenZ relies on their parents for financial assistance.

Apple $AAPL Vision Pro sales are projected to drop 75% this quarter.

In today’s newsletter:

❤️ Hedge Funds Love These Stocks

📉 Beaten Up Stocks Near 52-Week Lows

👩🏻 Cathie Wood’s Top Holdings

🛒 Costco Raises Its Membership Fee

Not subscribed yet? Sign up today!

Ever wondered what the big players in finance are investing in?

Hedge funds with over $100M in assets under management must disclose their holdings due to regulatory requirements.

This is great for everyday investors like us, giving us a glimpse into what the big money is doing.

Thanks to 13F data compiled by Whale Wisdom, we are able to see which stocks are the most popular among hedge funds.

Big tech giants dominate the top 10, with Microsoft, Amazon, and Alphabet leading the pack.

Other names like Visa, JPMorgan, Berkshire Hathaway, and Mastercard also made the cut.

Hedge funds update their holdings quarterly, so be on the look out for the Q2 2024 13F reports when they come out on 08/14!

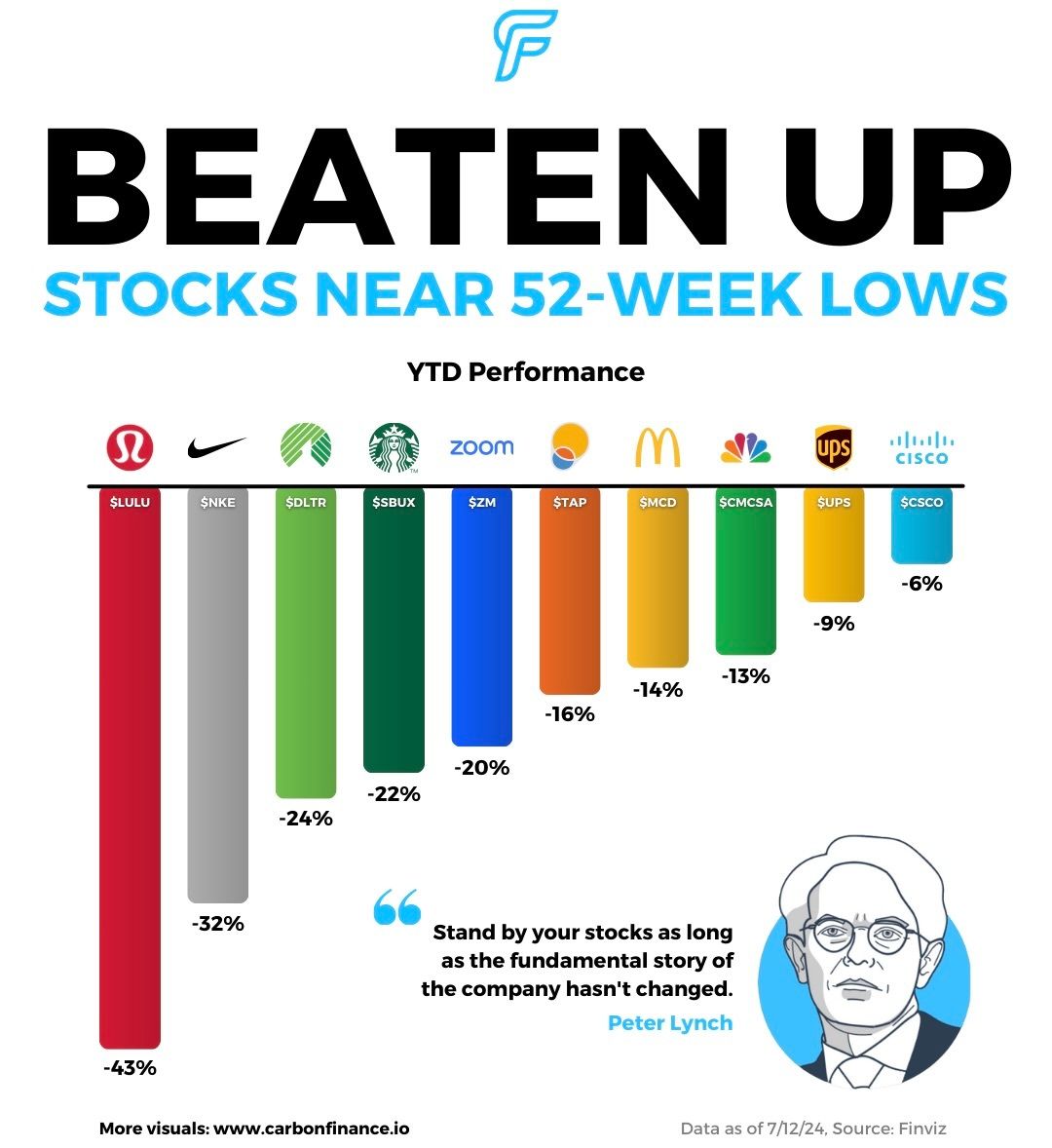

One of the best places to find investment ideas is by looking at stocks trading near 52-week lows.

These stocks often fall due to short-term issues or overreactions.

While some may continue to struggle, identifying those poised for a turnaround can offer attractive opportunities.

Often times too much pessimism is baked into these names, leaving room for upside on positive earnings surprises or favorable news.

Plus, since the stocks have already dropped, the risk of further decline is often lower, providing a margin of safety.

Retail giants like Lululemon and Nike, along with popular restaurant chains Starbucks and McDonald’s, are among those on trading near 52-week lows.

Cathie Wood Photographer: Reed Young

Can Tesla save Cathie Wood?

The EV giant has surged nearly 75% since its April 2024 low, now making up 15% of the ARK Innovation ETF as of July 11.

Cathie Wood has typically capped the top holding of the fund to 10%, and while she has been trimming the position recent weeks, she is continuing to let it run.

Despite this, ARKK continues to disappoint investors, with a YTD return of -7%, lagging behind the S&P 500’s 18%.

Over the past 5 years, the ETF has returned -3%, a stark contrast to the S&P 500’s 86% gain.

Considered by many at the time to be the next big thing, many investors jumped into Cathie Wood’s fund after its 150% jump in 2020.

The result?

According to Morningstar, the ARK Innovation ETF has wiped out $7.1B in wealth, contributing to Ark Invest's ETFs collectively losing $14B in wealth over the past decade.

For the first time in 7 years, Costco is raising its annual membership fees by $5 for Gold Star card members.

This decision comes on the heels of Costco's June sales results announcement.

Starting September 1, 2024, the annual fee will increase to $65, marking an 8% rise.

This adjustment will affect approximately 52M members across the U.S. and Canada.

Interestingly, while the fee has grown substantially since Costco's inception in 1983 (when it was $25), it’s still below today's adjusted-for-inflation equivalent of $80.

Despite the increase, Costco boasts impressive renewal rates of 93% in the U.S. and Canada, highlighting the strong loyalty of its customer base.

📚 Recommended Reading

Want to catch up on the markets daily for free in under 5 minutes?

Check out The One Read.

They provide market highlights, important news, and economic analysis in an easy to read, simplified format.

Don’t waste time filtering through all the stories in the financial world, sign up now and receive their update after market close!

🚖 Robotaxi Delay. Tesla $TSLA has delayed its robotaxi event by roughly two months - AX

📉 Capital Crumble. Bill Hwang was found guilty of fraud and market manipulation in Archegos Capital’s $36B collapse - BB

✈️ Crash Consequences. Boeing $BA has agreed to plead guilty and pay a fine of $243.6M due to the fatal 737 MAX crashes - R

🎶 Spotify Social. Spotify $SPOT is revamping its app to build a social network - TC

🏥 Rally Attack. Donald Trump was evacuated following a reported shooting at his Pennsylvania rally - X

Notable Companies Reporting Earnings This Week:

Monday (7/15):

Goldman Sachs $GS, BlackRock $BLK

Tuesday (7/16):

UnitedHealth Group $UNH, Bank of America $BAC, Morgan Stanley $MS

Wednesday (7/17):

ASML $ASML, Johnson & Johnson $JNJ, Prologis $PLD

Thursday (7/18):

Taiwan Semi $TSM, Netflix $NFLX, Novartis $NVS, Abbott $ABT, Intuitive Surgical $ISRG, Blackstone $BX

Friday (7/19):

American Express $AXP, Schlumberger $SLB

All of the companies that are reporting earnings next week can be viewed here.

Major Trades Published 07/08 - 07/12. Trades may be those of family members. [Source: 2iQ]

Buys

Ro Khanna (D)

Company: Chevron ($CVX)

Amount Purchased: $65K - $150K

Company: Exxon Mobil ($XOM)

Amount Purchased: $65K - $150K

Sells

Mark Green (R)

Company: NGL Energy Partners ($NGL)

Amount Sold: $50K - $100K

Rick Allen (R)

Company: Johnson & Johnson ($JNJ)

Amount Sold: $15K - $50K

Major Trades Published 07/08 - 07/12

Buys

GameStop ($GME)

Insider: Lawrence Cheng (Director)

# of Shares Purchased: 4,140

$ Amount: $102,879

SEC Forms: [1]

Sells

How was today's newsletter?

🤝 Review of the Week

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

The mention of The One Read in our newsletter is provided as a courtesy to our readers and should not be construed as an endorsement of any product, service, or information provided by the sponsor or partner. Carbon Finance makes no representations or warranties, express or implied, about the accuracy, completeness, reliability, or suitability of the information contained in the sponsor’s or partner’s materials or any related services. Any reliance you place on such information is strictly at your own risk. We are not liable for any loss or damage arising from your engagement with The One Read or their content.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.