- Carbon Finance

- Posts

- 📊 Tech Stocks Are Bleeding

📊 Tech Stocks Are Bleeding

1) Harvard’s Stock Portfolio 2) Nvidia Destroys Earnings 3) Google Launches Gemini 3 and more!

Happy Sunday!

Business deals continue to accelerate this year.

And this week brought another wave of major announcements:

On Monday, J&J said it would acquire Halda Therapeutics for $3.05B in cash to expand its portfolio of prostate cancer treatments.

On Wednesday, Adobe announced a $1.9B deal to acquire Semrush and strengthen its AI marketing tools.

On Thursday, Abbott agreed to buy Exact Sciences in a $21B deal, marking a major push into the fast-growing cancer diagnostics market.

M&A activity has been strong across the board.

Goldman Sachs, for example, is on track for its best merger advisory performance in 24 years.

Some key data bites from this week that you should know:

Morningstar shared their latest list of 12 undervalued tech stocks.

CEOs couldn’t put down these 82 books this year.

Trump’s tariff rollback on agricultural goods could benefit these 7 stocks.

Lessons from how the greatest trader turned $5K into $31B.

AI data center boom minted 16 new billionaires.

Anthropic is now valued around $350B following deal with Microsoft and Nvidia.

S&P 500 closed below its 50-day moving average for first time in 139 sessions.

Jeffrey Gundlach urged investors to keep 20% of their portfolios in cash.

Unemployment rate reached the highest level in 4 years.

College graduates make up 25% of unemployed workers.

Robinhood said over 1M customers have traded prediction markets.

China added 15 Tons of gold in September, well above the 1.24 Tons officially reported.

German arms manufacturer Rheinmetall expects sales to 5x by 2030.

Block unveiled a 3-year outlook and sees gross profit of $15.8B in 2028.

Elon Musk’s xAI in talks to raise $15B at a $230B valuation.

Japan approved $135B stimulus package to revive economy.

Earnings & Financial Results:

Temu owner PDD saw sales increase 9% and net profit jump 17%.

Home Depot cut its full-year profit forecast and missed estimates for the 3rd straight quarter.

Target saw comparable sales decline for the 3rd straight quarter.

Palo Alto Networks beat earnings and will acquire Chronosphere for $3.35B.

Walmart raised its full-year forecast for the 2nd quarter in a row.

TurboTax owner Intuit guided for 14.5% sales growth in the next quarter, ahead of estimates.

In today’s newsletter:

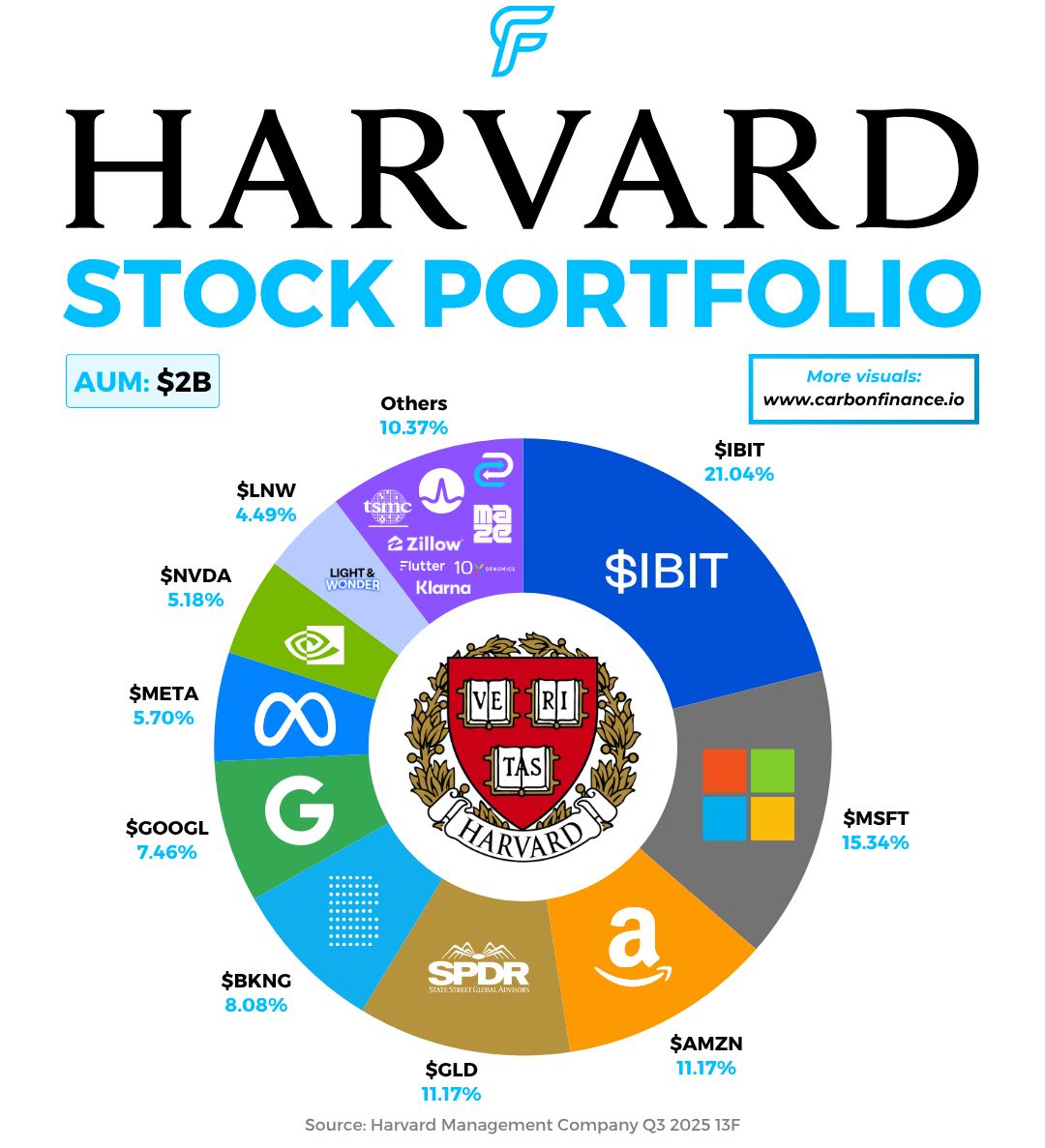

🏫 Harvard’s Stock Portfolio

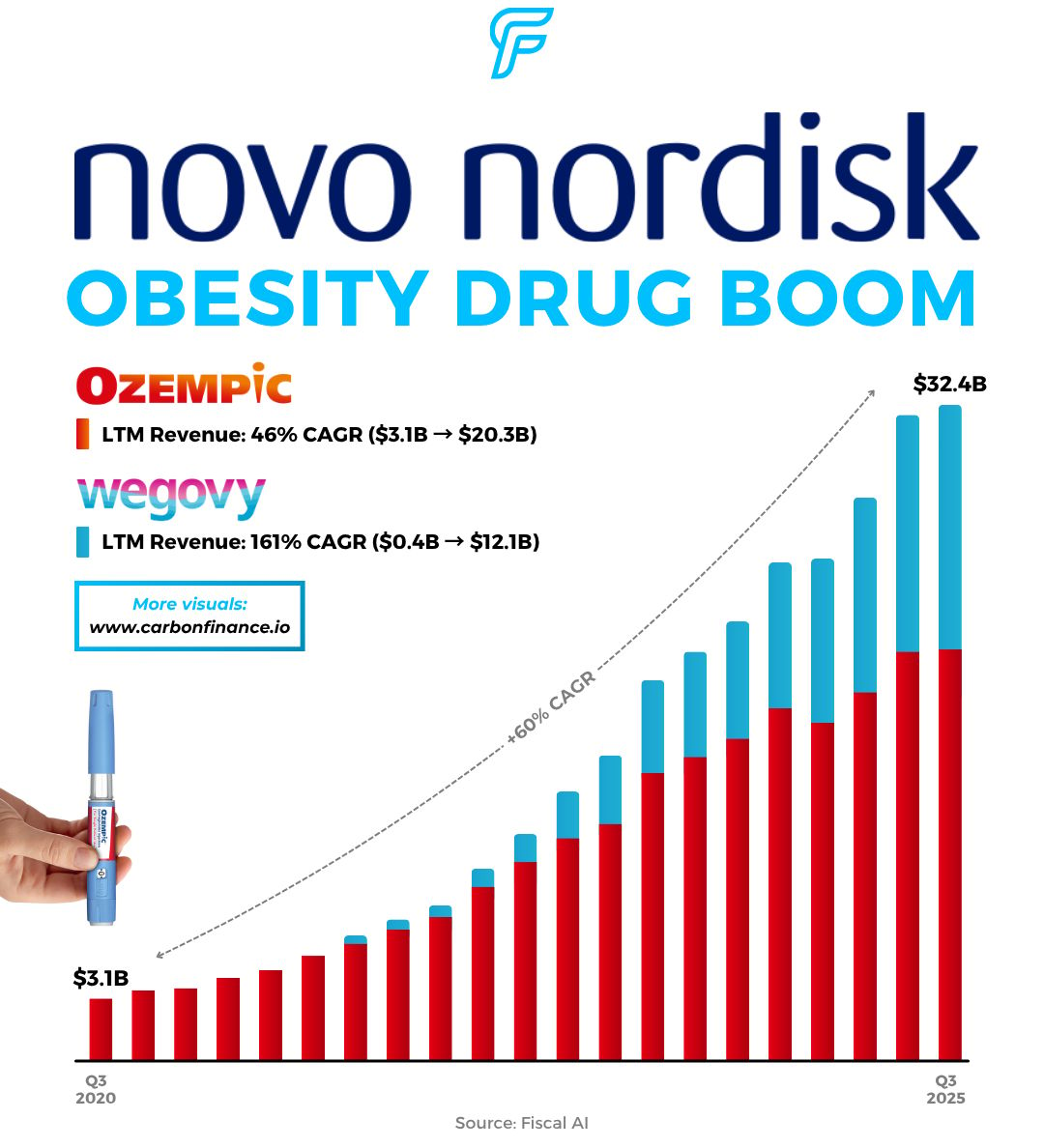

💉 Novo Nordisk’s Obesity Boom

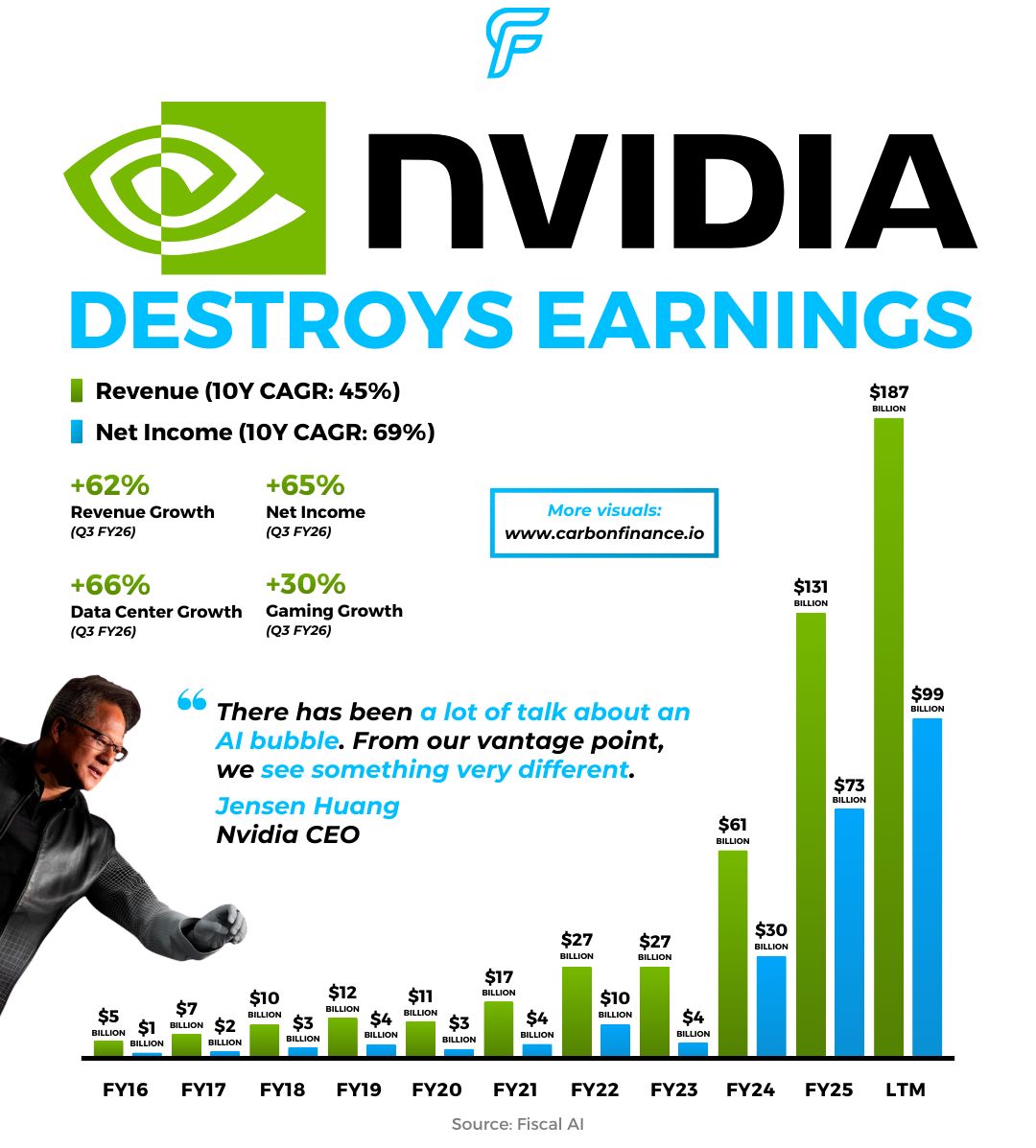

💪 Nvidia Destroys Earnings

🩸 Tech Stocks Are Bleeding

🚀 Google Launches Gemini 3

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Together With Fisher Investments

13 Investment Errors You Should Avoid

Successful investing is often less about making the right moves and more about avoiding the wrong ones. With our guide, 13 Retirement Investment Blunders to Avoid, you can learn ways to steer clear of common errors to help get the most from your $1M+ portfolio—and enjoy the retirement you deserve.

Harvard is betting big on Bitcoin.

Its latest 13F filing shows a 257% increase in the iShares Bitcoin Trust.

That position now makes up 21% of Harvard’s U.S. public equity portfolio.

With $443M in $IBIT, Harvard is now one of the top 20 holders of the spot Bitcoin ETF.

The university also doubled its stake in the SPDR Gold Trust, bringing gold to 11% of the portfolio.

At the same time, Harvard trimmed its Nvidia and Broadcom positions by 12% and 48%.

In total, the U.S. public equity portfolio was valued at $2.1B at the end of Q3.

Harvard’s total endowment stood at $56.9B for fiscal year 2025.

Ozempic is getting a slimmer price.

Novo Nordisk recently announced it will cut the direct-to-consumer price of Ozempic and Wegovy to make the blockbuster drugs more affordable.

The company plans to lower monthly costs by 30%, dropping the price from $499 to $349 for existing cash-paying patients.

Novo is also introducing a temporary starter offer.

New cash-paying patients can begin treatment with the lowest doses of Wegovy or Ozempic for $199 per month during their first two months.

After that period, pricing shifts to the newly reduced $349 per month.

The move follows a deal with the Trump administration that trades lower prices for new Medicare coverage of obesity drugs.

Lower pricing is expected to boost adoption and intensify competition with Eli Lilly, whose obesity drugs have been growing faster.

Over the past five years, Novo’s obesity drug portfolio has grown at a 66% CAGR, climbing from $3.1B in Q3 2020 to $32.4B in Q3 2025.

However, growth has slowed in recent quarters as Lilly’s Zepbound and Mounjaro gained momentum and compounding options from telehealth providers like Hims continued to snag market share.

Expectations could not be higher for Nvidia.

Yet Jensen delivered once again.

Nvidia reported Q3 earnings on Wednesday that comfortably topped estimates and beat forward guidance.

Adjusted earnings came in at $1.30, above the $1.25 estimate.

Revenue reached $57B, ahead of the $55B consensus.

Data Center, its AI chips segment, reported $51B in revenue, beating expectations of $49B.

Year over year, these numbers translate to 62% revenue growth, 65% net income growth, and 66% data center growth.

Looking ahead, Nvidia expects next-quarter revenue to reach $65B, well above the $62B estimate.

CEO Jensen Huang pushed back against AI bubble fears, saying, “There’s been a lot of talk about an AI bubble. From our vantage point, we see something very different.”

Shares initially jumped 5% after the report, but the gains quickly reversed and Nvidia ended the week lower.

According to a leaked memo reported by Business Insider, Huang said the market did not appreciate the quarter.

He noted that Nvidia is in a lose-lose situation and said, “If we delivered a bad quarter, it is evidence there’s an AI bubble. If we delivered a great quarter, we are fueling the AI bubble.”

Fears of an AI bubble have led to remarkable volatility in the market.

The CNN Fear and Greed Index is now sitting in “extreme fear.”

The swings have been so sharp that on Thursday, both the Nasdaq and the Dow moved more than 1,000 points from their intraday highs to their lows.

This marked the biggest intraday swing since April 9th, during the tariff rollout.

Many AI winners have pulled back sharply as investors take profits, with several now in bear market territory from their 52-week highs.

Oracle’s move is especially notable.

The stock now trades below where it was before announcing a 359% surge in RPO tied largely to its cloud deal with OpenAI.

Concerns that OpenAI may struggle to meet its commitments, combined with Oracle taking on more debt to fund its infrastructure buildout, have weighed on sentiment.

The decline has also took a chunk out of Larry Ellison’s wealth.

Ellison, Oracle’s founder and CTO, briefly became the world’s richest man after Oracle’s RPO announcement, but has since seen his net worth fall by $135B in just two months.

While many tech stocks have been taking a hit, one name keeps pushing new 52-week highs.

And that’s Alphabet.

This week, the company surpassed Microsoft to become the world’s third-largest company.

It now sits behind only Apple and Nvidia.

Investor optimism grew after Google released Gemini 3, its most advanced AI model yet.

Google DeepMind’s CEO described the launch as “another big step toward AGI” and said it’s their best model for multimodal understanding and agentic capabilities.

Google’s Gemini app now has 650M monthly active users, just shy of the 700M figure OpenAI reported for ChatGPT in August.

And the results speak for themselves.

Gemini 3 Pro surpasses Gemini 2.5 Pro, Anthropic’s Claude, and OpenAI’s ChatGPT in nearly every benchmark.

On Thursday, Google also released Nano Banana Pro, its latest image editing and generation tool, which quickly went viral.

Google’s journey has been choppy, but the company has moved from being seen as an AI afterthought to an AI frontrunner.

Long-term holders have been rewarded.

A $10,000 investment in Google’s 2004 IPO is now worth more than $1.1M today.

📣 Presented by Masterworks

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 23 sales have delivered net annualized returns like 17.6%, 17.8%, and 21.5%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

⏎ Bezos Returns↗ - Jeff Bezos is backing a new AI startup called Project Prometheus and will serve as co-chief executive.

⬛️ Service Blackout↗ - Cloudflare suffered a major outage that disrupted major websites like X, ChatGPT, and DoorDash for several hours.

🏠 Housing Downturn↗ - More than half of U.S. homes lost value over the past year.

📲 Antitrust Victory↗ - Meta won its antitrust case against the FTC, which accused it of having a social-media monopoly.

🫧 Bubble Patience↗ - Ray Dalio said we are definitely in a bubble but investors shouldn’t sell yet.

🏷️ Nvidia Exit↗ - Peter Thiel’s hedge fund dumped its Nvidia stake and reduced its Tesla position.

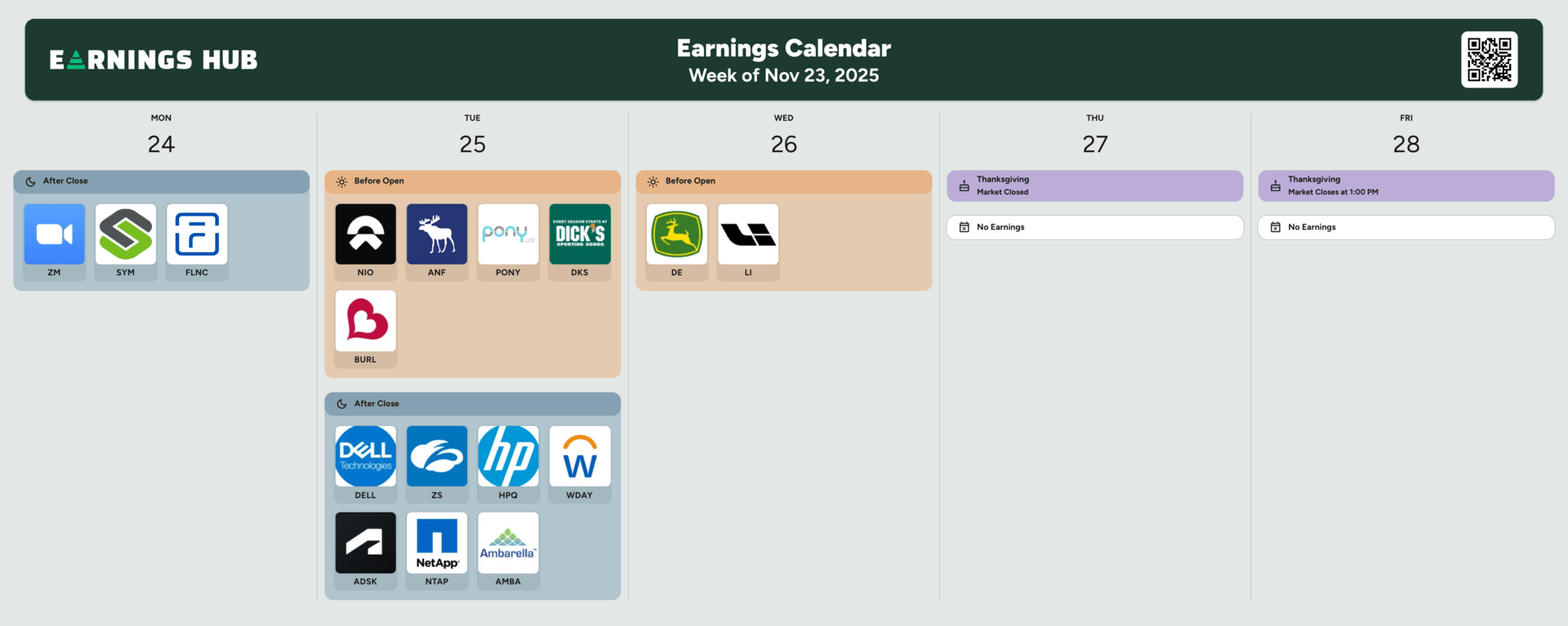

Courtesy of our affiliate partner, EarningsHub.

Notable Companies Reporting Earnings Week of November 23rd, 2025:

Major Trades Published 11/17 - 11/21. Trades may be those of family members. [Source: 2iQ]

Buys

Kevin Hern (R)

Company: Royal Bank of Canada ($RY)

Amount Purchased: $1.5M - $6M

Cleo Fields (D)

Company: Netflix ($NFLX)

Amount Purchased: $200K - $500K

Brandon Gill (R)

Company: Bitcoin ($BTC)

Amount Purchased: $100K - $250K

Sells

Kevin Hern (R)

Company: BNP Paribas ($BNPQY)

Amount Sold: $1.25M - $5.5M

Company: McDonald’s ($MCD)

Amount Sold: $101K - $265K

Company: Accenture ($ACN)

Amount Sold: $100K - $250K

Major Trades Published 11/17 - 11/21

Buys

Sells

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

This newsletter is sponsored by Fisher Investments and Masterworks. Sponsorship does not influence our editorial content. We do not endorse the sponsor’s products, services, or views, and we are not responsible or liable for any interaction or transaction between readers and the sponsor.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Reply