- Carbon Finance

- Posts

- 📊 Tesla’s Growth Has Collapsed

📊 Tesla’s Growth Has Collapsed

1) Meta Can’t Stop Spending 2) Microsoft’s Backlog Risk 3) Apple’s Blowout iPhone Sales and more!

Happy Sunday!

The moment we’ve all been waiting for has arrived.

On Friday, President Trump announced Kevin Warsh as his nominee to succeed Jerome Powell as Fed chair.

Markets reacted cautiously, as Warsh is often viewed as more hawkish, favoring higher interest rates and a smaller Fed balance sheet.

Others, however, describe him as more pragmatic and flexible than his earlier reputation suggests.

Pending Senate confirmation, Warsh is set to take office in May 2026.

The announcement comes as the Fed held rates steady in a 3.5% to 3.75% range this week following a series of cuts.

Key Data Bites From This Week:

BofA shared 10 small-cap stocks that appear poised to beat the market.

Nvidia, Microsoft, & Amazon in talks to invest up to $60B in OpenAI.

SoftBank in talks to invest an additional $30B in OpenAI.

U.S. Army signed a $5.6B software deal with Salesforce.

Total Gold demand jumped 45% YoY to new all-time high of $555B.

Zoom reportedly has an investment in Anthropic worth up to $4B.

Nvidia announced a $2B investment in CoreWeave.

UPS plans to cut an additional 30,000 operational jobs.

Trump has delivered on ~27% of tariff threats he’s made.

U.S. government will invest $1.6B in mining company USA Rare Earth.

Micron will invest $24B in Singapore over the next decade.

Amazon laid off 16,000 corporate employees.

U.S. dollar sunk to a four-year low.

Earnings & Guidance:

GM beat earnings and announced $6B buyback and 20% dividend hike.

Texas Instruments posted 10% sales growth on data centers and industrial recovery.

ASML reported record orders of €13.16B in Q4.

Starbucks saw U.S. transactions climb for first time in 2 years.

ServiceNow posted 19.5% sales growth with 98% renewal rate in Q4.

IBM announced its GenAI book of business surpassed $12.5B.

Mastercard beat expectations and will lay off 4% of global workforce.

Visa recorded 15% revenue growth and 17% EPS growth.

Deckers saw HOKA sales jump 18.5%.

In today’s newsletter:

📉 UnitedHealth Sees Red

💵 Meta Can’t Stop Spending

🪫 Tesla’s Growth Has Collapsed

🚨 Microsoft’s Backlog Risk

📱 Apple’s Blowout iPhone Sales

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Together With Fiscal AI

There are thousands of investing platforms.

But my absolute favorite? Fiscal AI.

This single terminal will save you hundreds of hours. Here’s why:

Visualize fundamental data and KPIs

Screen for quality stocks

Track insider and institutional ownership

Browse earnings call transcripts and slides

And so much more.

You get a ton of access with a free account, and Pro is completely free to try for 14 days.

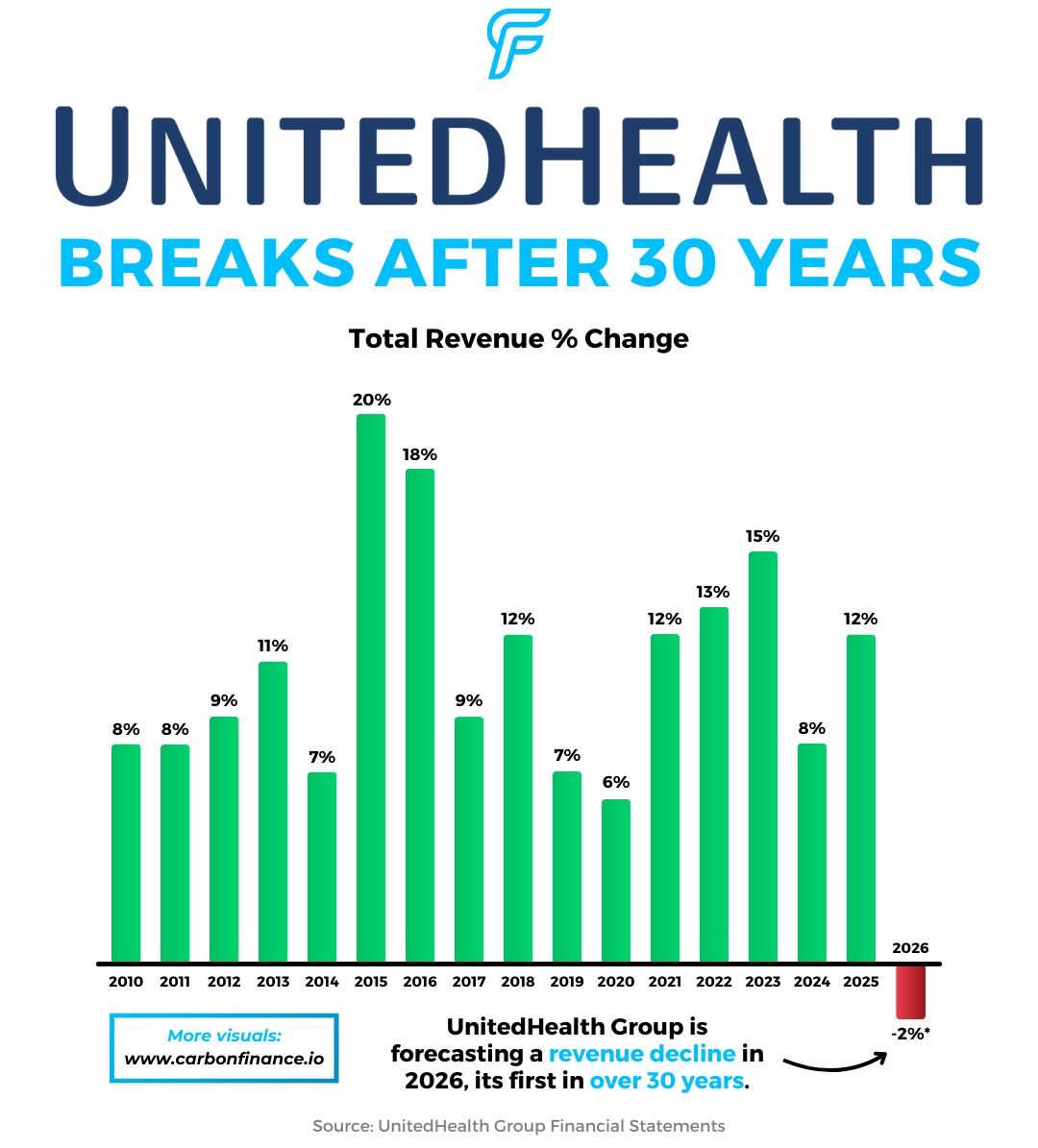

UnitedHealth Group is forecasting red.

For the first time in more than 30 years, the company expects revenue to decline.

UnitedHealth now projects 2026 revenue to fall 2% as it deliberately shrinks parts of the business to restore profitability.

Management is reducing insurance membership, exiting overseas markets, and scaling back Optum Health’s U.S. footprint.

The insurance unit alone could lose up to 2.8M members across commercial, Medicare, and Medicaid plans.

Another major headwind is Medicare’s new V28 coding system, which is expected to reduce revenue by $6B in 2026.

And just one day before earnings, pressure intensified after the U.S. government proposed flat Medicare Advantage payment rates, well below the 5% increase analysts expected.

Despite weaker revenue, UnitedHealth Group still expects adjusted profit of $17.75 in 2026, ahead of estimates.

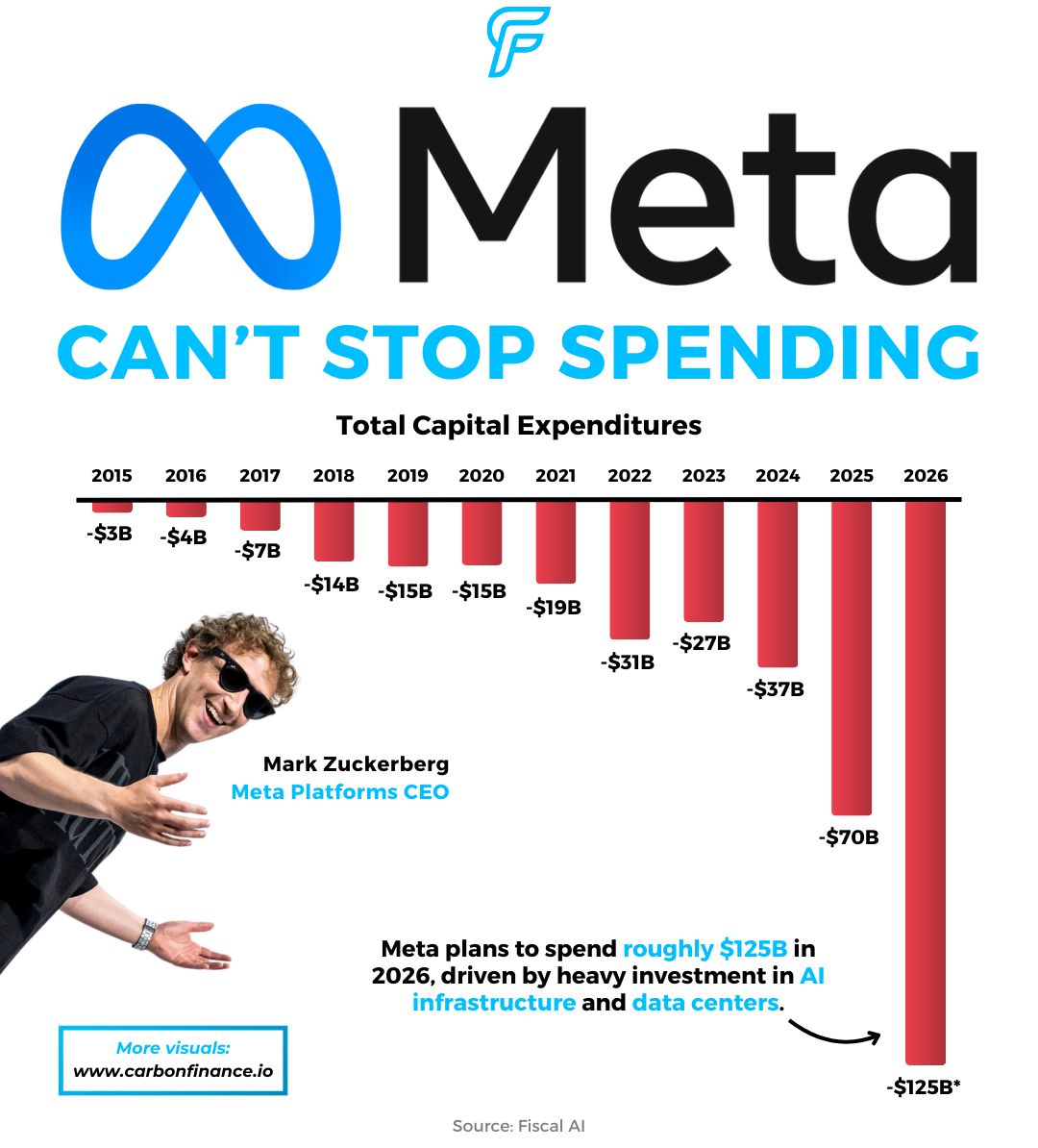

Meta is going all-in on AI.

The company expects 2026 capital expenditures to land between $115B and $135B, or $125B at the midpoint.

That figure is well above the $111B analysts were expecting and nearly double what Meta spent last year.

Management said the company remains compute-constrained as it pours capital into its core advertising business and Meta Superintelligence Labs to build next-generation AI models.

Despite the spending surge, the underlying business remains strong.

Revenue climbed 24%, family daily active people increased 7%, ad impressions rose 18%, and average price per ad increased 6%.

Meta delivered $8.88 in earnings per share on $59.9B in revenue, comfortably beating estimates for the fourth quarter.

Looking ahead, the company expects Q1 revenue of $55B, well above the $51B consensus forecast.

Tesla’s core business is running out of energy.

The company slightly beat Q4 estimates, but cracks continue to show up underneath the surface.

Automotive revenue growth has declined on a trailing twelve month basis for seven consecutive quarters.

Additionally, for the first time in company history, Tesla’s annual revenue fell.

Full year revenue declined to $94.8B in 2025, down from $97.7B in 2024.

Tesla also announced it will discontinue the Model S and Model X, two of its longest running vehicles.

Production lines for those models will be repurposed to manufacture Optimus humanoid robots.

Separately, Elon Musk is reportedly exploring a potential merger between SpaceX and either Tesla or xAI to form a larger AI focused entity.

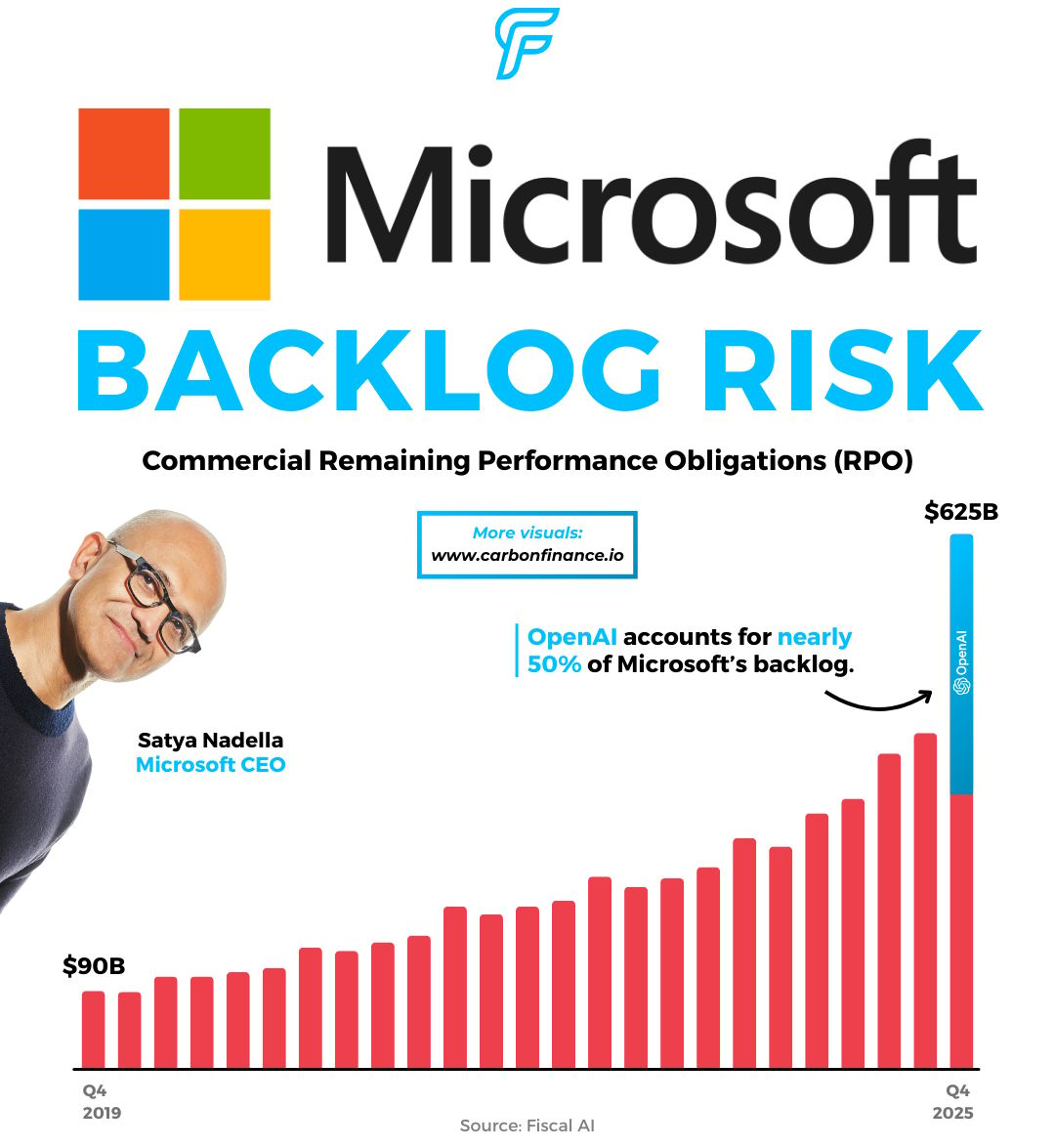

Microsoft’s backlog is growing fast, but so is its dependence on one customer.

The company reported that commercial remaining performance obligations jumped 110% to $625B, a measure of revenue that will be recognized in future periods.

However, for the first time, Microsoft disclosed that 45% of that backlog is tied to OpenAI.

That means nearly half of the company’s revenue visibility depends on a single customer whose ability to meet long term financial commitments remains uncertain.

This was a concern similar to what has recently weighed on Oracle, and was part of the reason shares of Microsoft slipped over 7% on the week.

Despite the reaction, the underlying quarter was relatively solid.

Adjusted earnings reached $4.14 per share on $81.27B in revenue, both ahead of expectations.

Guidance for the upcoming quarter came in line with analyst estimates.

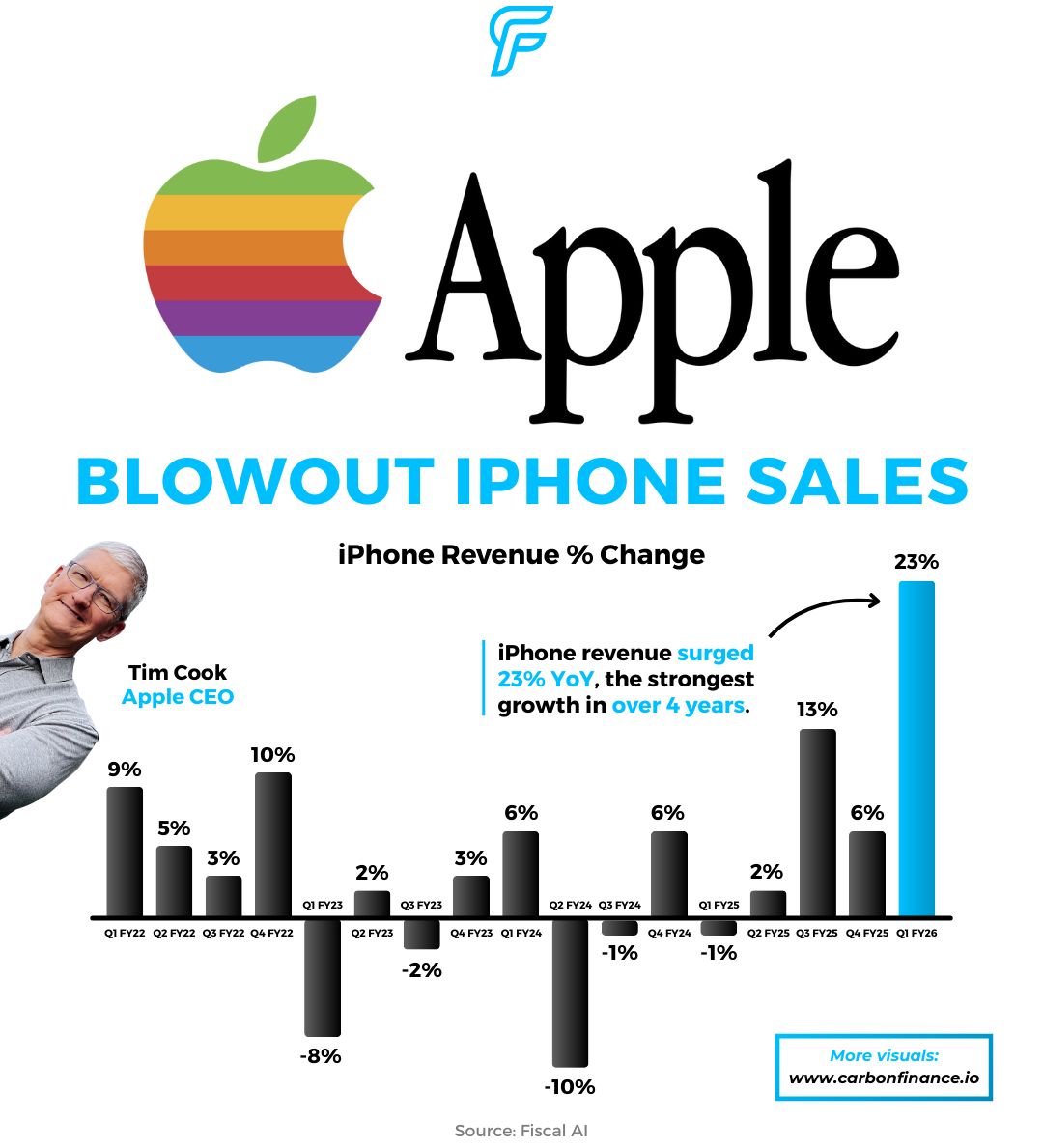

People can’t get enough of the iPhone.

Apple just delivered one of its strongest quarters in years as demand surged.

iPhone revenue jumped 23% to $85.3B, beating estimates by nearly $7B.

Total revenue climbed 16% YoY to $143.8B, far ahead of expectations.

Earnings per share came in at $2.84, well above the $2.67 estimate.

CEO Tim Cook called iPhone demand “staggering,” driven by the new iPhone 17 lineup.

Asia played a major role.

Sales across China, Taiwan, and Hong Kong jumped a whopping 38% to $25.5B, fueled by record upgrades and strong switcher growth.

📣 Presented by Gethookd

Stop guessing. Start scaling.

See the top-performing Facebook ads in your niche and replicate them using AI. Gethookd shows you what’s actually working so you can increase ROI and scale ad spend with confidence.

♠️ Burry’s Bet↗ – Michael Burry disclosed buying shares of GameStop.

💸 Consumer Power↗ – Consumption, not AI investments, was the most crucial driver of U.S. GDP growth last year.

🚕 Price Parity↗ – New data found that Uber rides in San Francisco were only marginally cheaper than Waymo rides.

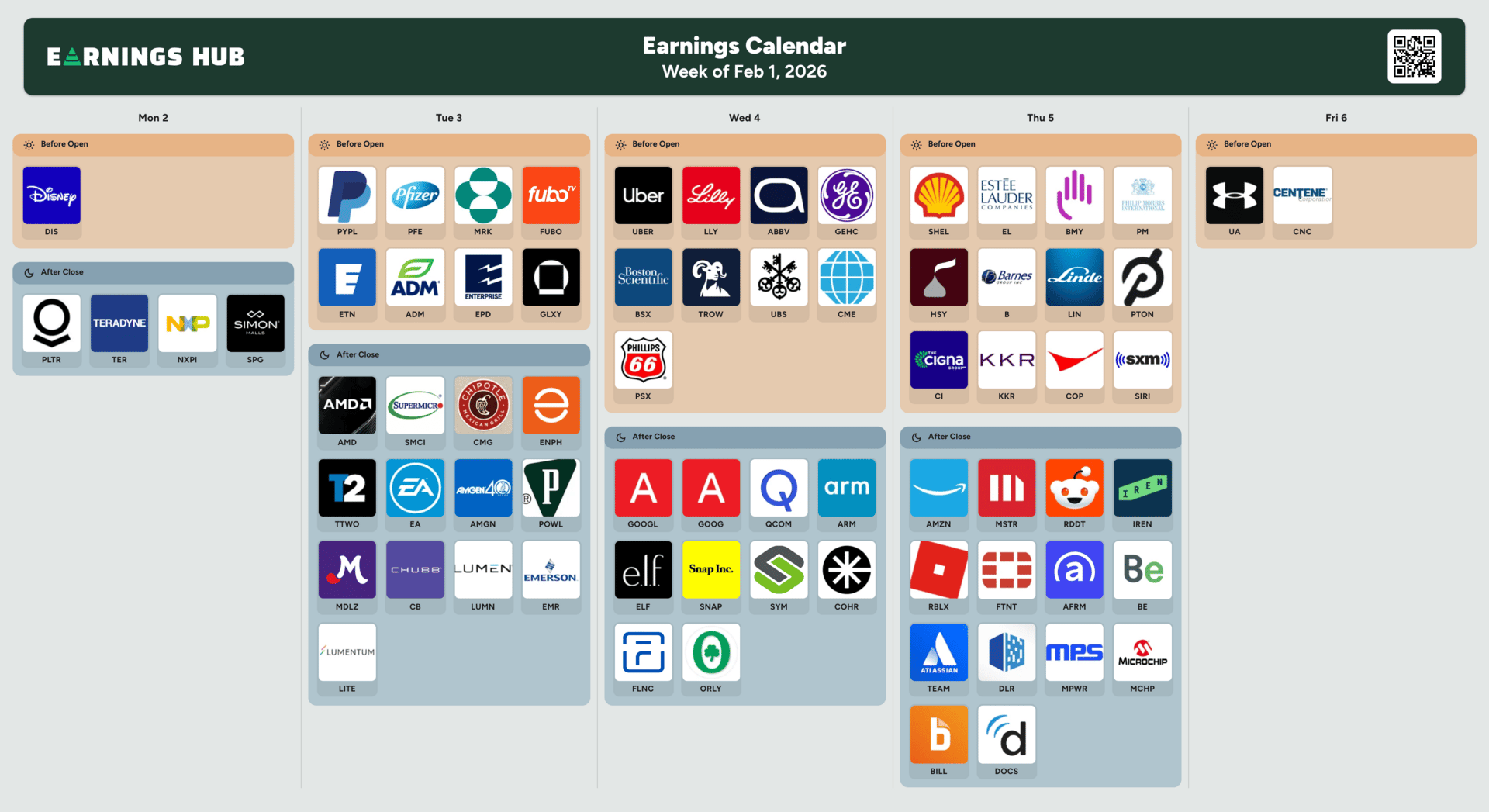

Notable Companies Reporting Earnings Week of February 1, 2026:

Major Trades Published 1/26 - 1/30. Trades may be those of family members. [Source: Capitol Trades]

Buys

Nancy Pelosi (D)

Company: AllianceBernstein ($AB)

Amount Purchased: $1M - $5M

Company: Alphabet ($GOOGL)

Amount Purchased: $500K - $1M

Description: Exercised 50 call options purchased 1/14/25 (5,000 shares) at a strike price of $150 with an expiration date of 1/16/26.

Company: Amazon ($AMZN)

Amount Purchased: $500K - $1M

Description: Exercised 50 call options purchased 1/14/25 (5,000 shares) at a strike price of $150 with an expiration date of 1/16/26.

Sells

Nancy Pelosi (D)

Company: Apple ($AAPL)

Amount Sold: $5M - $25M

Company: Nvidia ($NVDA)

Amount Sold: $1M - $5M

Company: Amazon ($AMZN)

Amount Sold: $1M - $5M

Company: Disney ($DIS)

Amount Sold: $1M - $5M

Major Trades Published 1/26 - 1/30

Buys

USA Rare Earth ($USAR)

Insider: Michael Blitzer (Director)

# of Shares Purchased: 100,000

$ Amount: $2,143,860

SEC Forms: [1]

Sells

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

This newsletter is sponsored by Gethookd. Sponsorship does not influence our editorial content. We do not endorse the sponsor’s products, services, or views, and we are not responsible or liable for any interaction or transaction between readers and the sponsor.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Reply