Happy Sunday!

Hope you're all having an incredible 4th of July weekend.

This past week was packed with job data, here’s a quick breakdown of what mattered and why it does:

Job Openings (Good)

On Tuesday, job openings unexpectedly rose to 7.77M in May, up from 7.4M in April. This suggests continued strength in labor demand.

ADP Private Employment (Bad)

On Wednesday, private employers cut 33,000 jobs in June, well below the 100,000 gain expected. A surprising drop that points to softness in private-sector hiring.

Initial Jobless Claims (Good)

On Thursday, weekly jobless claims came in at 233,000, lower than the 240,000 expected. Fewer claims signal a stable labor market.

Nonfarm Payrolls & Unemployment Rate (Good)

And lastly, also on Thursday, the U.S. added 147,000 jobs in June, beating the 110,000 estimate.

The unemployment rate also dropped to 4.1%, better than the 4.3% forecast.

Both point to resilience in the broader jobs market.

Taken together, the data paints a mixed but slightly positive picture, solid job growth and demand, with a few signs of private-sector caution.

Some key data bites from this week that you should know:

Morningstar curated a list of 10 undervalued high-quality stocks.

Nvidia insiders have sold $1B in shares over the last year.

Jeff Bezos sold $737M worth of Amazon stock.

Microsoft will cut 9,000 employees, or roughly 4% of its workforce.

JPMorgan increased dividend and approved $50B buyback.

Oracle signed a cloud deal that will add $30B in annual revenue.

Tesla vehicle deliveries fell 14% to 384,000 in Q2.

Apple, Alphabet, and Tesla have been a 120 point drag on the S&P 500.

iPhone sales in China grew for the first time in 2 years.

Amazon deployed its one millionth robot in its operations.

Harvard’s endowment had a 39% exposure to private equity in 2024.

London IPOs hit a 28-year low.

In today’s newsletter:

🎨 Figma Files For IPO

💸 U.S. Debt Insane Growth

👨💼 Founders Beat The Market

🐶 Datadog Joins The S&P 500

❌ Big Companies Not In The S&P 500

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Together With Fiscal AI

There are thousands of investing platforms.

But my absolute favorite? Fiscal AI.

This single terminal will save you hundreds of hours. Here’s why:

Use AI to ask questions, summarize data, and visualize charts

Screen for quality stocks

Dive into fundamental data and KPIs

Track insider and institutional ownership

Browse earnings call transcripts and slides

And so much more.

You get a ton of access with a free account, and Pro is completely free to try for 14 days.

If you’re not using Fiscal AI yet, you’re falling behind.

The IPO market continues to heat up.

Design software company Figma has officially filed to go public.

This comes after its $20B acquisition deal with Adobe fell through, earning Figma a $1B breakup fee.

Now, its S-1 filing offers a deeper look into just how embedded Figma is in the enterprise world.

95% of Forbes 500 companies use its platform, it has 13M monthly active users, and revenue is growing 46% YoY.

Figma plans to raise $1.5B and list on the New York Stock Exchange, though pricing details and the exact date are still pending.

On July 4th, President Donald Trump signed the Big Beautiful Bill, his sweeping tax and spending package.

The bill makes the 2017 tax cuts permanent and expands deductions for state and local taxes.

It also includes new tax breaks for tip income, overtime pay, and Social Security benefits.

On the other side, the legislation reduces spending on Medicaid and food stamps, modifies federal student loan programs, and scales back clean energy tax credits.

Additionally, it allocates $350B toward his border and national security initiatives.

A more thorough breakdown of what’s included can be viewed here.

According to Yale research, the bill will result in a 2.9% income decline for the bottom quintile of earners, while boosting income for the top 1% by 1.9%.

The Congressional Budget Office estimates the legislation will add $3.3T to the federal deficit over the next decade.

In fiscal year 2025, the U.S. posted a $1.36T deficit and debt-to-GDP now stands at 121%.

Since 1993, U.S. federal debt has grown from $4.4T under Clinton to $37T today, just months into Trump’s second term.

The increase reflects decades of policy decisions across both parties, ranging from tax cuts and new spending to responses to the financial crisis, COVID-19, and rising interest costs.

While debt rose under every president, it's overly simplistic to assign full responsibility to any one administration.

Still, there’s no denying the U.S. faces serious long-term risks if deficits, debt levels, and slowing growth remain unaddressed.

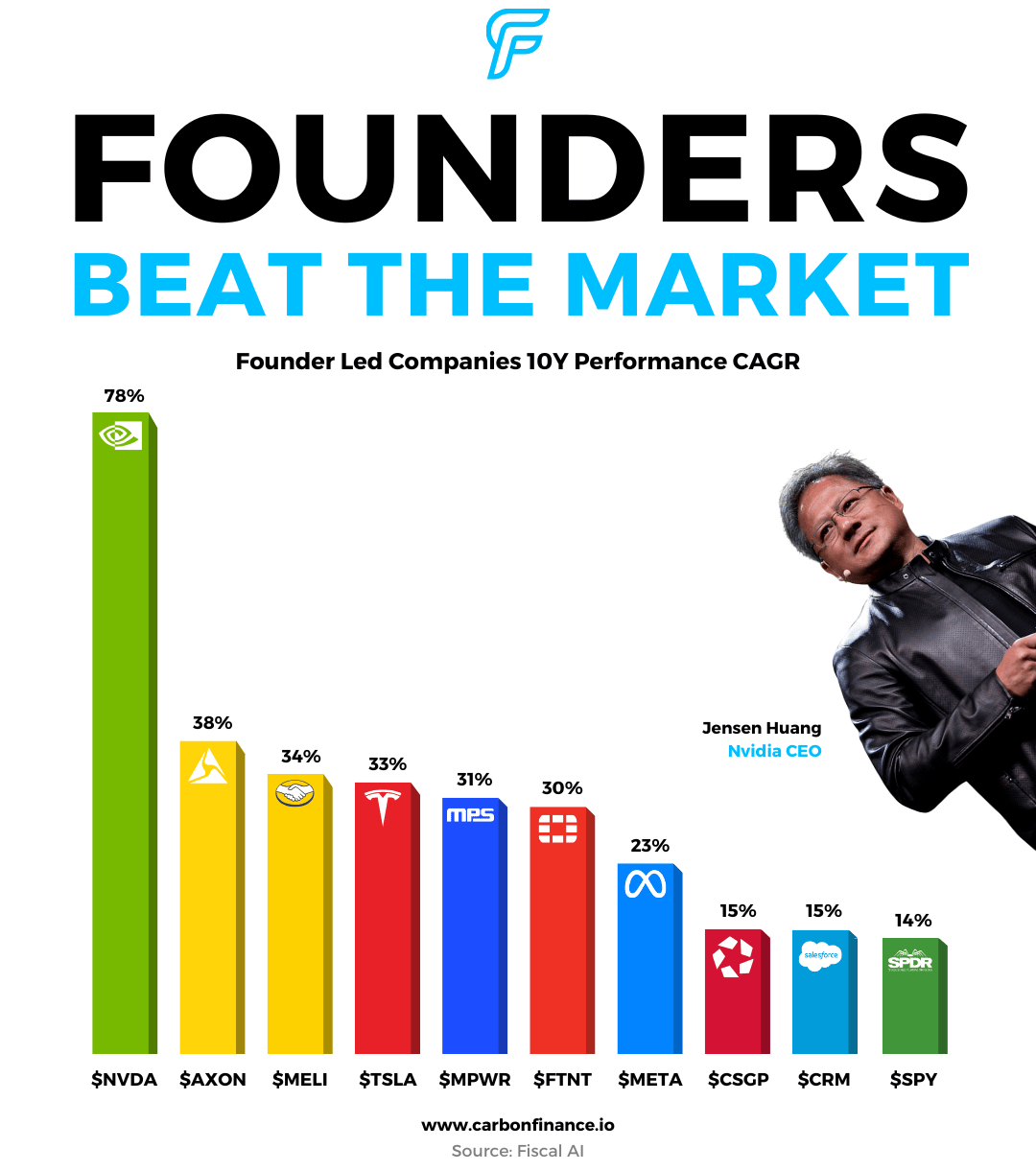

Founder-led companies tend to outperform, and the reason is simple.

When the person who built the company is still running it, decisions are made with long-term conviction, not short-term optics.

There's more skin in the game, more care in execution, and a deeper sense of purpose.

It’s no coincidence that companies like Nvidia, Axon, and MercadoLibre have left the S&P 500’s 10Y performance far behind.

The founder’s mindset isn’t just different, it’s often a competitive advantage.

Datadog let out a loud bark this week.

Shares jumped 15% on Thursday after news broke that the software company will be added to the S&P 500, replacing Juniper Networks.

To qualify for the index, companies must meet criteria like sustained profitability and a minimum market cap of $22.7B.

Datadog now joins the index with a $54B market cap, $2.7B in 2024 revenue, and a customer base of 30,000, marking a major milestone in its growth story.

Datadog’s surge highlights just how bullish investors get when a company is added to a major index.

Inclusion in the S&P 500 triggers automatic buying from index funds and ETFs, boosting demand, liquidity, and visibility.

Several companies are large enough to meet the S&P’s market cap threshold, and others meet all inclusion criteria but have yet to be added.

Notable names still waiting on the sidelines include AppLovin, MicroStrategy, and Robinhood.

📣 Presented By With SelectSoftware

Get a List of the Best HRIS Software for Your Company

Stop wasting time on endless research and confusing options.

Our HR Software experts provide you with tailored recommendations from our database of 1,000+ vendors across HRIS, ATS, Payroll, and HCM.

✅ 15 minutes vs. hours of demos

✅ 1:1 help from an HR Software expert

✅ No spam, no sales pressure

🇪🇺 Tokenized Trading. Robinhood is now offering tokenized US stocks and ETFs across Europe - CNBC

🦾 Federal Upgrade. Palantir and Accenture are partnering to implement AI across the federal government - IV

🎽 Athleisure Lawsuit. Lululemon has sued Costco for selling ‘dupes’ of its products - AP

🤝 Concert Collab. Netflix held talks with Spotify to collaborate on concerts, music awards, celebrity interviews, and rapid-fire documentaries - WSJ

Courtesy of our paid partner, EarningsHub.

Earning Calendar for the Month of July:

This upcoming month is going to be huge!

EarningsHub helps me stay on top of earnings, forecasts, and AI-powered call recaps.

It’s free, and perfect if you want to track every major company reporting.

Major Trades Published 6/30 - 7/4. Trades may be those of family members. [Source: 2iQ]

Buys

Cleo Fields (D)

Company: Nvidia ($NVDA)

Amount Purchased: $1.78M - $6.8M

Company: Amazon ($AMZN)

Amount Purchased: $650K - $1.6M

Company: Apple ($AAPL)

Amount Purchased: $469K - $1.16M

Company: Microsoft ($MSFT)

Amount Purchased: $301K - $615K

Company: Taiwan Semiconductor ($TSM)

Amount Purchased: $100K - $250K

Sells

Virginia Foxx (R)

Company: Energy Transfer ($ET)

Amount Sold: $15K - $50K

Major Trades Published 6/30 - 7/4

Buys

Sells

How was today's newsletter?

🤝 Review of the Week

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.