Happy Friday!

On Tuesday, investment firms managing over $100M in assets were required to submit their 13F filings. These documents offer a glimpse into the firms' quarterly activities, revealing valuable insights for investors. I've visualized the portfolios of three prominent investors in this newsletter. I hope you enjoy it!

Some key data bites from this week that you should know:

U.S. consumer prices rose 3.2% year-over-year in October, below the expected 3.3% increase, driven by lower energy costs.

Donald Trump's Truth Social $DWAC has reported losses of over $31M since its launch.

U.S. wholesale prices fell 0.5% in October, the biggest drop since April 2020, while on a year-over-year basis, producer prices rose 1.3%, down from 2.2% in September.

United Parcel Service $UPS has opened a 20-acre warehouse in Kentucky with plans to deploy over 3,000 robots to handle tasks, allowing the facility to run with about 200 workers.

In today’s newsletter:

🐐 Warren Buffett’s Stock Portfolio

🧸 Michael Burry’s Stock Portfolio

💻 Bill Gates’ Stock Portfolio

Let’s dive right in!

Not subscribed yet? Sign up today!

🐐 Warren Buffett’s Stock Portfolio

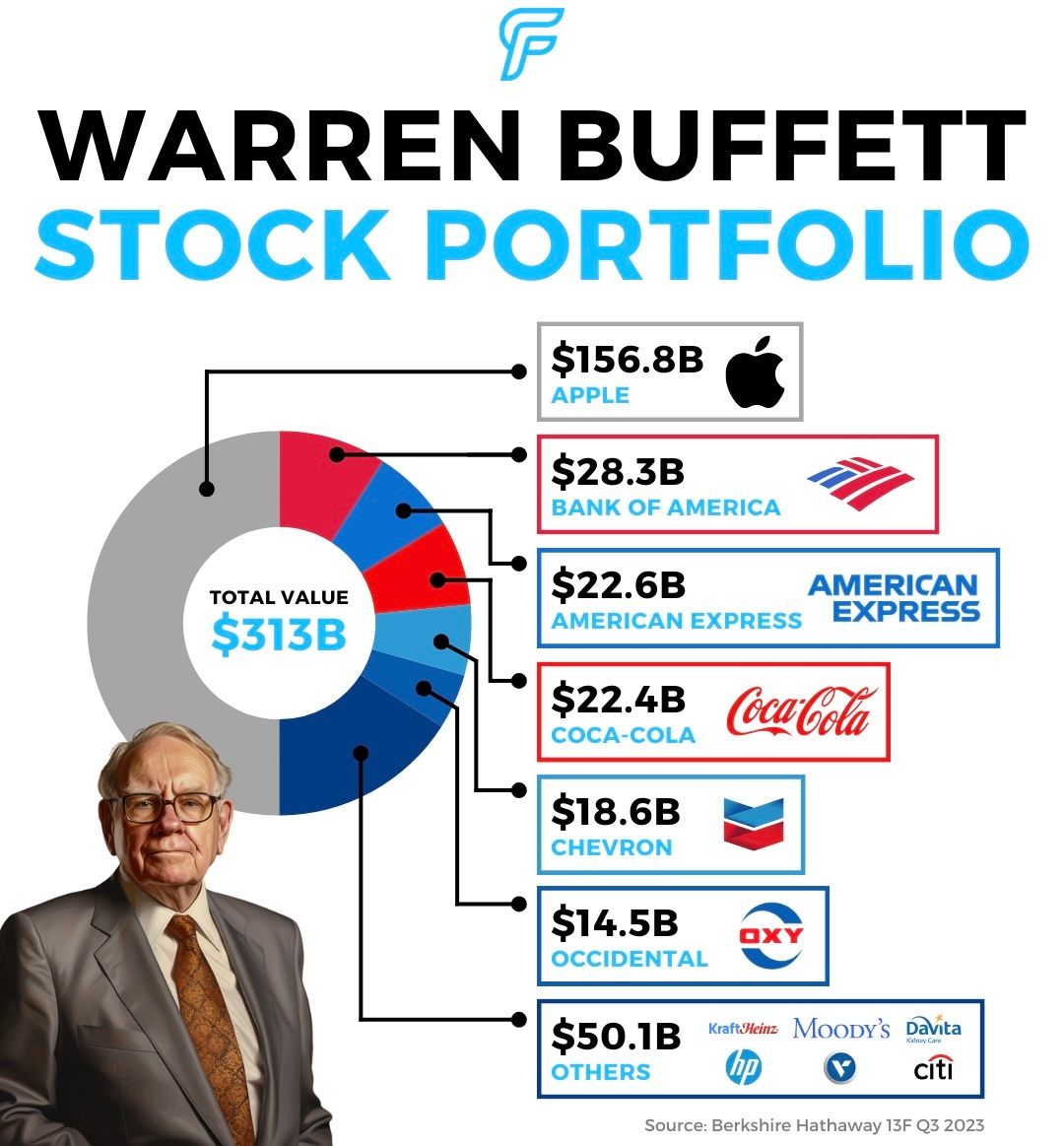

Warren Buffett’s Berkshire Hathaway made notable changes in its investment portfolio in Q3 2023, as revealed by the latest 13F report. Here’s the breakdown:

Purchased: Liberty Media $LLYVK, Sirius XM $SIRI, and the Atlanta Braves $BATRK

Reduced: Amazon $AMZN, AON $AON, Chevron $CVX, HP $HPQ, Markel Group $MKL, and Globe Life $GL

Entirely Sold: Activision Blizzard $ATVI, General Motors $GM, Celanese $CE, Johnson & Johnson $JNJ, Mondelez $MDLZ, Procter & Gamble $PG, and UPS $UPS.

As you can see from Buffett’s overall portfolio, he carries a concentrated portfolio of 45 stocks, with his top 5 positions making up 79.37% of his entire portfolio. Buffett has famously said that, “Diversification is protection against ignorance. It makes little sense if you know what you are doing.”

One final thing to note is that Berkshire chose to not disclose one or more recent investments, seeking confidentiality from the SEC, as revealing these stakes could inflate the stock prices of the companies they’re building a position in.

🧸 Michael Burry’s Stock Portfolio

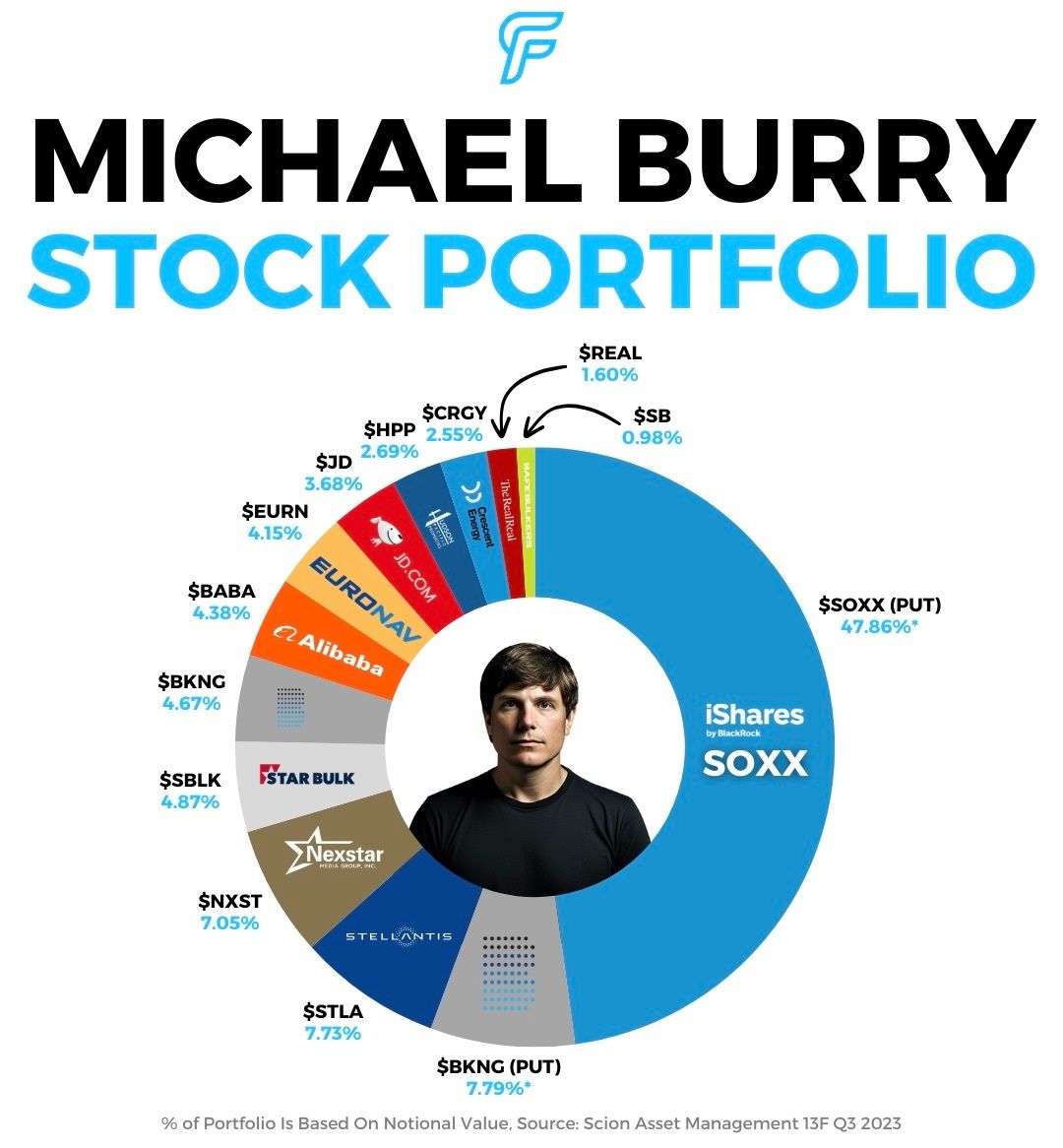

Michael Burry is a neurologist and hedge fund manager famous for predicting the subprime mortgage crisis that occurred between 2007 and 2010, earning a personal profit of $100M for himself and $700M for his investors.

Burry is an active trader and also made several changes to his investment portfolio in Q3 2023, as per the latest 13F report. Here’s the breakdown:

Purchased: iShares Semiconductor ETF (Put) $SOXX, Booking Holdings (Put) $BKNG, Booking Holdings $BKNG, Alibaba $BABA, JD.com $JD

Added: Stellantis $STLA, Star Bulk Carriers $SBLK, Nexstar Media Group $NXST, Hudson Pacific Properties $HPP, Euronav $EURN, Safe Bulkers $SB

Reduced: Crescent Energy $CRGY, RealReal $REAL

Entirely sold (Top 5): SPY (Put) $SPY, QQQ (Put) $QQQ, Expedia $EXPE, Charter Communications $CHTR, Generac $GNRC

To summarize, Michael Burry closed his short positions against the S&P 500 and Nasdaq 100, which previously had a notional value of $1.6B, shifting focus to a bearish bet on semiconductor stocks. The firm reduced its portfolio to 13 positions, and re-engaged in long positions with Alibaba and JD.com, while making automaker Stellantis his top long.

📣 An Exclusive Offer From My Friends at TrendSpider

This section features my affiliate link, meaning I'll earn a commission if you purchase through these links. Nonetheless, my opinion holds and you receive an exclusive offer. It’s a win for both of us!

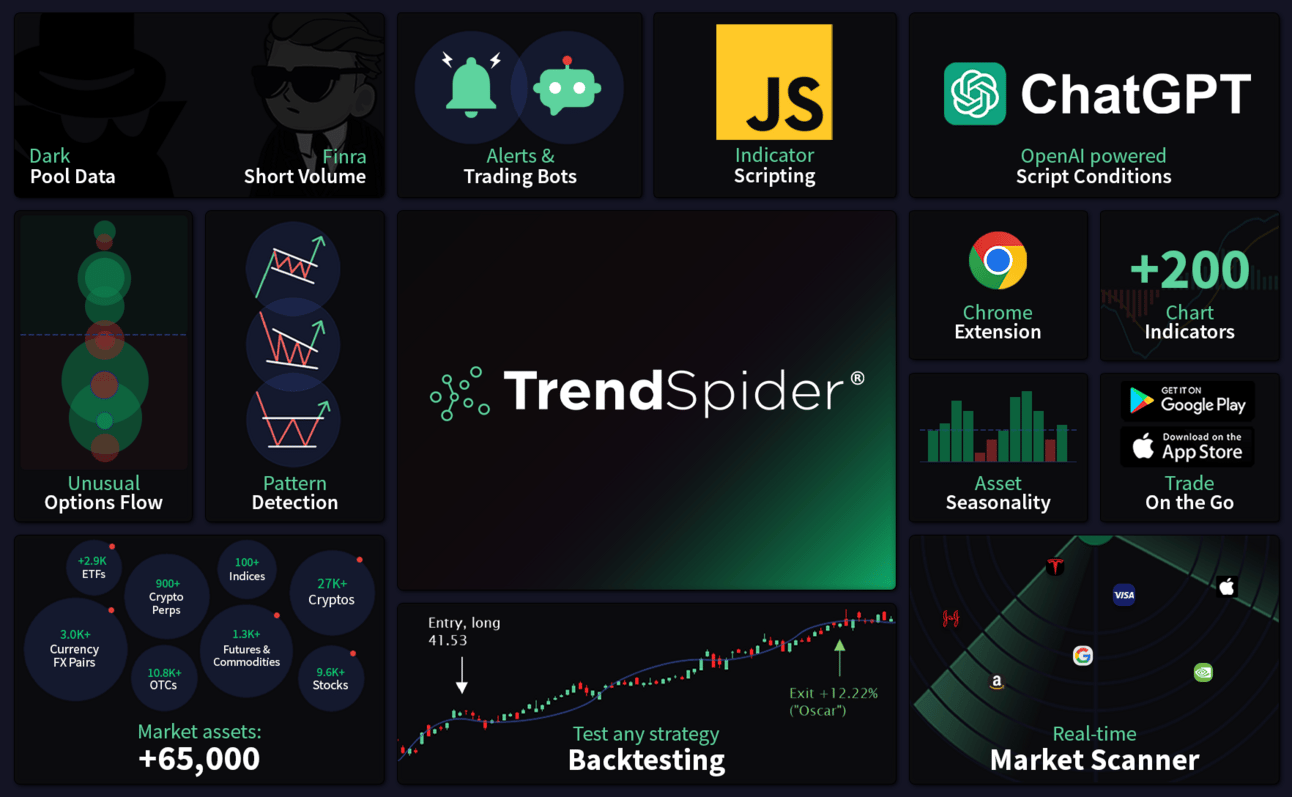

As you’ve probably seen, I love charts, and although I’m not a day trader, I do incorporate technical analysis before initiating long positions. I’m a long-term investor, but I recognize that sentiment, noise, and crowd psychology influence short-term price movements.

If the technical setup for a company I’m interested in buying becomes increasingly bearish, I prefer to wait in order to aim for the lowest possible cost basis. For several years, I’ve been using TrendSpider, and it’s definitely my favorite day-to-day tool.

I find great value in analyzing historical charts, and TrendSpider's seasonality feature is particularly useful for understanding how a company has historically performed each month.

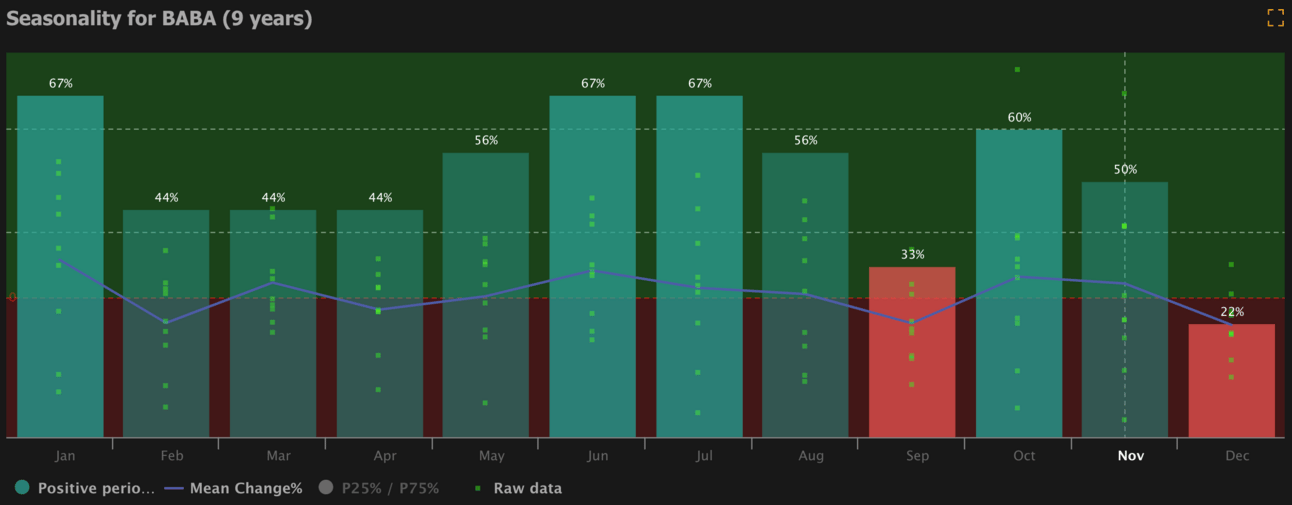

Take Alibaba $BABA as an example. Over the last few days, shares of the company plunged after announced it wouldn't spin off its cloud computing division, resulting in it further dropping below its IPO price.

If you were contemplating buying the $BABA dip, you should note that since its IPO, Alibaba has ended the month of December green just 22% of the time, with an average monthly return of -5.12%.

You can leverage the historical performance data to make more informed decisions around position sizing. If the company has historically underperformed in December, it would be strategic to start with a smaller or medium-sized position now and plan to buy more in December, rather than committing to a large position immediately. This approach allows for adjusting the investment size based on the company's historical performance trends and short-term price action.

Thanks to TrendSpider, I have a special Pre-Pay deal exclusively for my subscribers, accessible via the button below. This is a better deal than their current BlackFriday offer, but expires this Sunday at 11:59 pm. You won’t be able to get this offer through the traditional TrendSpider website.

Additionally, anyone who takes them up on this offer will receive free one-on-one training from a dedicated success manager.

And here’s some more awesome features and data that TrendSpider offers:

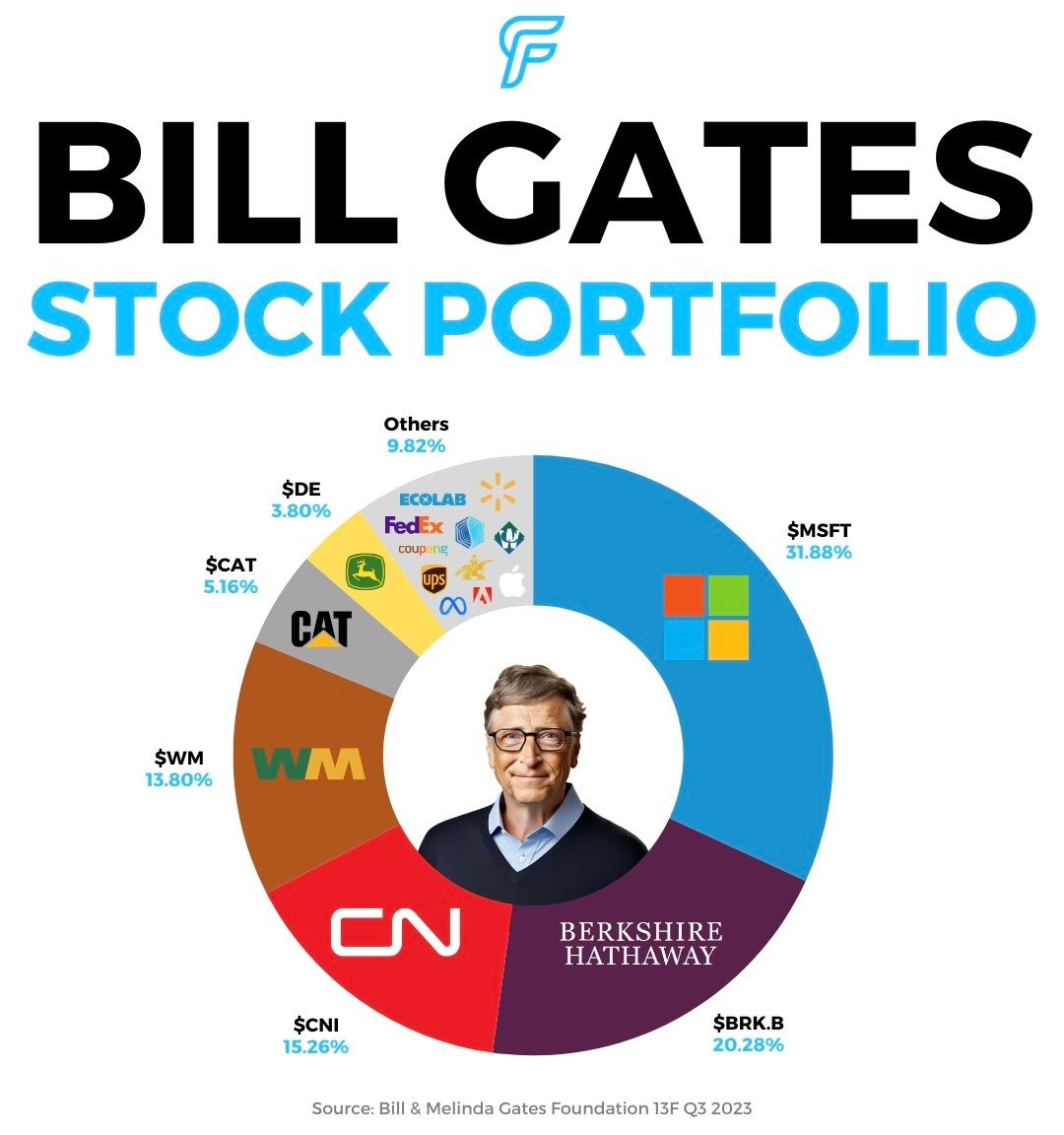

💻 Bill Gates’ Stock Portfolio

Bill Gates is not only an incredible business owner but also a reputable investor. Bill and Melinda Gates employ external managers under their guidance to manage the $39B in investments under the Bill & Melinda Gates Foundation Trust. Here are some of their moves based on their latest 13F report:

Purchased (Top 5): Apple $AAPL, iShares US Technology ETF $IYW, Meta Platforms $META, Adobe $ADBE, Applied Materials $AMT

Added: UPS $UPS, Walmart $WMT, Microsoft $MSFT

Reduced: Berkshire Hathaway $BRK.B

At a high level, not too many big changes. They trimmed 10.39% of their Berkshire Hathaway holdings and likely used those funds for the 51 new additions to the portfolio. One of the additions was Nvidia, which was also purchased by Ray Dalio.

💾 New AI Chips. Microsoft $MSFT introduced its first AI chip, Maia 100, aiming to bolster its presence in the AI computing market. [BB]

📉 Cathie Sees Deflation. Cathie Wood, CEO of Ark Invest $ARKK, believes a deflation trend has started in the U.S., potentially leading to significant Fed rate cuts in the future. [MW]

🎯 Target Surges. Target's $TGT third-quarter earnings rose 36% to $971M, surpassing Wall Street forecasts, but sales slumped by 4.9% in nearly every category. [WSJ]

🛒 Walmart Plunges. Walmart $WMT dropped due to disappointing guidance for fiscal 2024, with adjusted earnings per share estimated between $6.40 and $6.48, below the expected $6.50. [B]

Notable Companies Reporting Earnings Next Week:

Notable Companies Reporting Earnings Next Week:

Monday:

Agilent $A, Keysight Technologies $KEYS, Trip.com $TCOM, Zoom $ZM

Tuesday:

Nvidia $NVDA, Lowe’s $LOW, Medtronic $MDT, Analog Devices $ADI, Autodesk $ADSK, HP $HPQ

Wednesday:

Deere & Co $DE

Thursday:

Futu Holdings $FUTU

Friday:

H World Group $HTHT

All of the companies that are reporting earnings next week can be viewed here.

Major Trades Published 11/13 - 11/16

Buys

Madrigal Pharmaceuticals ($MDGL)

Air Products & Chemicals ($APD)

Insider: Seifi Ghasemi (CEO)

# of Shares Purchased: 11,000

$ Amount: $2,908,620

SEC Forms: [1]

Block ($SQ)

Insider: Roelof Botha (Director)

# of Shares Purchased: 23,433

$ Amount: $1,194,485

SEC Forms: [1]

Bill.com ($BILL)

Insider: David Hornik (Director)

# of Shares Purchased: 17,710

$ Amount: $1,000,438

SEC Forms: [1]

Sells

TKO Group ($TKO)

Insider: Vincent McMahon (Director)

# of Shares Sold: 8,400,000

$ Amount: $641,844,000

SEC Forms: [1]

Airbnb ($ABNB)

Insider: Joseph Gebbia (Director)

# of Shares Sold: 499,999

$ Amount: $62,674,829

SEC Forms: [1]

Crowdstrike ($CRDW)

Insider: Godfrey Sullivan (Director)

# of Shares Sold: 150,000

$ Amount: $30,008,430

SEC Forms: [1]

M ($CRDW)

Insider: Parker Harris (CTO)

# of Shares Sold: 117,808

$ Amount: $25,934,746

SEC Forms: [1]

How was today's newsletter?

🤝 Review of the Week

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

The views and opinions expressed in this newsletter are solely those of Carbon Finance and do not reflect the official policy or position of any other agency, organization, employer or company.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, I will receive an affiliate commission at no extra cost to you. All opinions remain my own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.