Happy Sunday!

The market had a rocky week, shaken by news that cast doubt on the future of rate cuts.

On Wednesday, Fed officials expressed uncertainty about inflation, citing impacts from potential immigration and trade policy changes.

They signaled a more cautious approach to rate cuts moving forward.

Then, on Friday, a blowout jobs report added to the uncertainty.

U.S. payrolls surged by 256,000 in December, far exceeding the 155,000 forecast, while the unemployment rate dropped to 4.1%.

Treasury yields spiked on the report, signaling traders’ belief that the Fed is less likely to cut rates this year.

Markets were also closed Thursday in observance of the passing of former U.S. President Jimmy Carter, making it a shortened four-day trading week.

Some key data bites from this week that you should know:

Disney acquired 70% of Fubo, aims to merge it with Hulu+ Live TV.

Getty Images is buying Shutterstock to create a $3.7B stock-image company.

Constellation Energy is close to acquiring power producer Calpine for $30B.

Donald Trump has announced a $20B plan to build new data centers in the US.

AI startup Anthropic is raising $2B at a $60B valuation.

AI startups made up 46% of all US VC fundraising in 2024.

Squid Game Season 2 reached 126.2M views in 11 days on Netflix.

Jensen Huang said viable quantum computing was 20 years away.

Italy plans a $1.6B Starlink deal for secure government internet.

Damages from LA fires are estimated to reach up to $57B.

AI is expected to replace 200,000 jobs at global banks.

694 US companies filed for bankruptcy in 2024, a 14-year high.

Paychex will acquire Paycor HCM in a roughly $4.1B deal.

In today’s newsletter:

🎉 Potential IPOs In 2025

🏆 Best Investors In Congress

🏋️♀️ A Few Stocks Drive The Market

🐶 2025 Dogs Of The Dow

⛔️ Who Wins From A TikTok Ban?

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Presented By Wallstreet Prep

From Wall Street to Your Portfolio: Master Value Investing

The Applied Value Investing Certificate Program from Wharton Online and Wall Street Prep is an 8-week, online, self-paced program that teaches participants how to identify undervalued stocks with the process-driven approach used by the world’s top investors.

Program benefits also include:

Guest Speaker Series with top industry professionals

Exclusive access to networking and recruitment events

Invitation-Only LinkedIn Groups and Slack Channels

Certificate issued by Wharton Online and Wall Street Prep

2024 was a slow year for IPOs, but 2025 is shaping up to be different.

It’s all speculation for now, but some are making serious strides toward an IPO.

Stronger-than-expected economic conditions, as we’ve seen, could open the door for more companies to take the leap.

Some members of Congress absolutely destroyed the S&P 500 in 2024, based on research from Unusual Whales.

It’s important to note that these performances are estimates based on financial disclosures, and while Unusual Whales considers them conservative, they may not fully reflect precise results due to data limitations.

David Rouzer takes the top spot this year, despite not being an active trader.

His performance is driven by holdings he purchased a few years ago, such as Nvidia and MasterCard.

On the other hand, members like Pelosi achieved strong returns through more active trading.

Larry Bucshon’s nearly 100% portfolio return primarily reflects his position in Trump Media and Technology Group, though he’s only break-even on that stock after this year.

Many members have outperformed the S&P 500 thanks to their focus on tech and financials.

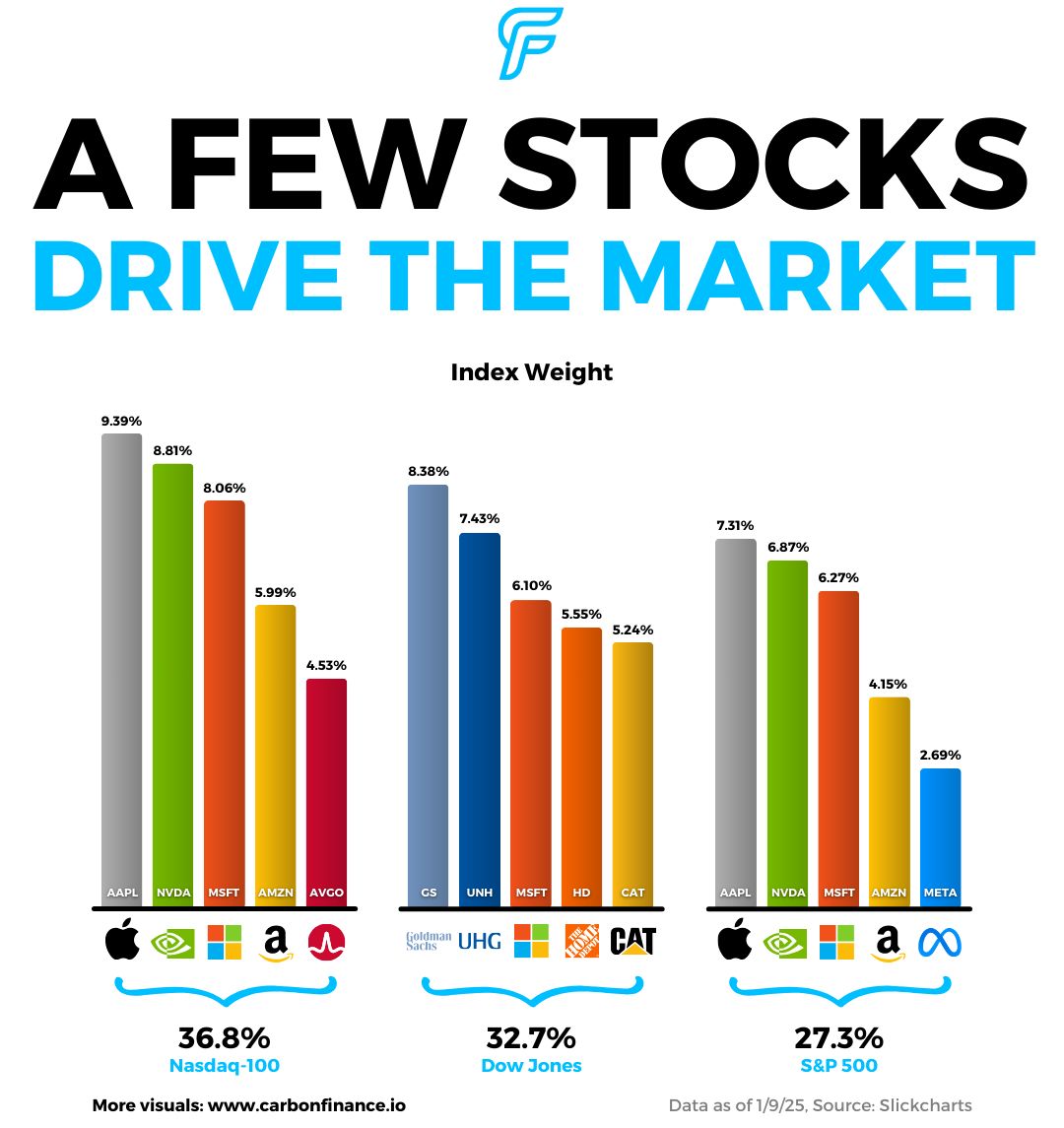

Index funds are often praised for their diversification, but there’s a catch—the U.S. stock market has never been more concentrated.

In the S&P 500, the top 5 stocks make up 27.3% of the index.

The top 10? A record-breaking 37.3%.

Even more striking, according to S&P Dow Jones analyst Howard Silverblatt, just 26 stocks now account for half the index’s total value.

And it’s not just the S&P 500.

The top 5 stocks in the Nasdaq-100 make up 36.8%, while in the Dow Jones, it’s 32.7%.

Diversified? Maybe not as much as most think.

Everyone loves puppies, right? Well, maybe not these dogs.

The Dogs of the Dow strategy involves buying the 10 highest dividend-yielding stocks in the Dow Jones Industrial Average at the start of each year.

It’s popular among some investors for its focus on established companies with relatively strong cash flows.

The idea is to buy companies facing short-term challenges, collect dividends, and hope for a turnaround.

But performance has been somewhat underwhelming.

According to Investopedia, from 2013 to 2023, the Dogs of the Dow delivered a trailing total return of 10.02%, lagging the Dow Jones at 11.48%.

The gap widened from 2018 to 2023, with returns of 5.29% for the Dogs compared to 8.39% for the broader index.

The end of TikTok in the U.S. may be near.

The app faces a potential shutdown on January 19th if the Supreme Court upholds a law requiring its sale by its parent company, with the Supreme Court inclined to do so, per the AP.

With 170M U.S. users, TikTok has become one of the most popular social media platforms in the country.

Does this mean it’ll vanish from your phone? Not exactly.

The app would be removed from app stores, preventing updates and gradually degrading performance over time.

The Supreme Court’s final decision is expected in the coming days.

If TikTok gets banned, advertisers will likely shift their dollars to other platforms, boosting competitors in the space.

🏷️ Valuation Gap. Stocks are nearing their most overvalued levels against corporate credit and Treasuries in about two decades - BB

🐷 Equity Entry. Private equity is hoping to lobby Trump to tap into peoples’ retirement accounts - FT

🆕 Board Change. Dana White has been elected to Meta’s board of directors - META

✏️ Policy Shift. Meta is ending its fact checking program, shifting to community notes, and lifting restrictions on several topics - META

📉 Flutter Fumbles. Flutter Entertainment, FanDuel’s parent company, lowered its outlook after an NFL season dominated by favorite wins - IV

💥 Chaos Bet. Ex-hedge fund manager who made billions in 2008 is raising $250M to bet on market volatility - BB

🍟 McValue Launch. McDonald’s unveiled its new McValue menu - MCD

🛩️ Rich Escapade. Wealth Managers are moving to this South American Beach Haven - BB

🍺 Label Shock. Alcohol stocks tanked after US surgeon general suggested adding a cancer warning label - YF

🇨🇦 Trudeau Resigns. Canadian Prime Minister Justin Trudeau announced his resignation - AP

Courtesy of our partner EarningsHub—I may earn a commission if you upgrade.

Notable Companies Reporting Earnings Week of January 13th, 2025:

Here’s what I will be watching this week:

Wednesday: JPMorgan Chase & Co $JPM, Goldman Sachs $GS, BlackRock $BLK, Citi $C, Wells Fargo $WFC, Bank of New York Mellon $BK

Thursday: Taiwan Semiconductor $TSM, UnitedHealth Group $UNH, Bank of America $BAC, Morgan Stanley $MS, US Bancorp $USB

Friday: Schlumberger $SLB, Fastenal $FAST, Truist Financial $TFC

📣 Presented By Short Squeez

Add A Little Zest To Your Mornings

Short Squeez (started by the Overheard on Wall Street team) provides a short squeez on the world of business news.

The Short Squeez team breaks down complex stories, stock updates, mind-blowing lessons, memes and daily book recommendations.

It’s completely free and guaranteed to make you laugh and feel smarter in 3 minutes.

Sponsored

Short Squeez

The daily squeeze on major news from Wall Street to Silicon Valley. Read by 200,000+ bankers & investment professionals.

Major Trades Published 1/6 - 1/10. Trades may be those of family members. [Source: 2iQ]

Buys

Shelley Moore Capito (R)

Company: Broadcom ($AVGO)

Amount Purchased: $1K - $15K

Guy Reschenthaler (R)

Company: Bitcoin ($BTC)

Amount Purchased: $1K - $15K

Company: Solana ($SOL)

Amount Purchased: $1K - $15K

Company: Ripple ($XRP)

Amount Purchased: $1K - $15K

Sells

Virginia Foxx (R)

Company: AT&T ($T)

Amount Sold: $50K - $100K

Company: Pembina Pipeline Corp ($PBA)

Amount Sold: $50K - $100K

Company: Via Renewables ($VIA)

Amount Sold: $50K - $100K

Sheldon Whitehouse (D)

Company: Nvidia ($NVDA)

Amount Sold: $15K - $50K

Company: Lam Research ($LRCX)

Amount Sold: $15K - $50K

Company: Apple ($AAPL)

Amount Sold: $15K - $50K

Major Trades Published 1/6 - 1/10

Buys

Fedex Corp ($FDX)

Insider: John Dietrich (EVP Chief Financial Officer)

# of Shares Purchased: 1,000

$ Amount: $273,980

SEC Forms: [1]

Sells

Tesla ($TSLA)

Insider: Kathleen Wilson-Thompson (Director)

# of Shares Sold: 100,000

$ Amount: $41,162,799

SEC Forms: [1]

Dick’s Sporting Goods ($DKS)

Insider: Edward Stack (Executive Chairman)

# of Shares Sold: 160,600

$ Amount: $36,817,230

SEC Forms: [1]

Palo Alto Networks ($PANW)

Insider: Nikesh Arora (CEO)

# of Shares Sold: 176,242

$ Amount: $31,730,749

SEC Forms: [1]

How was today's newsletter?

🤝 Review of the Week

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.