It’s Wednesday!

As earnings season picks up, I’ll be back to sending the newsletter out 2x per week to catch you up to speed on everything you need to know.

If there are any specific companies you’d like me to cover in future issues, feel free to let me know using the feedback poll at the bottom!

Some key data bites from this week that you should know:

Costco $COST hikes its dividend by roughly 14%.

Biden cancels an additional $7.4B in student loans.

China’s Q1 GDP grew by 5.3% YoY, ahead of expectations.

Cathie Wood has a 4% position in OpenAI in her Ark Venture Fund.

StubHub is looking to go public this summer with a $16.5B valuation.

Global $AAPL iPhone shipments fell 10% in Q1 2024.

Goldman Sachs $GS first quarter profit increased 28% to $4.13B.

Google $GOOG plans to spend more than $100B on AI.

In today’s newsletter:

🏦 JPMorgan Falls On Earnings

💰 BlackRock’s AUM Hits New Record

📉 Worst S&P 500 Stocks This Year

Let’s dive right in!

Not subscribed yet? Sign up today!

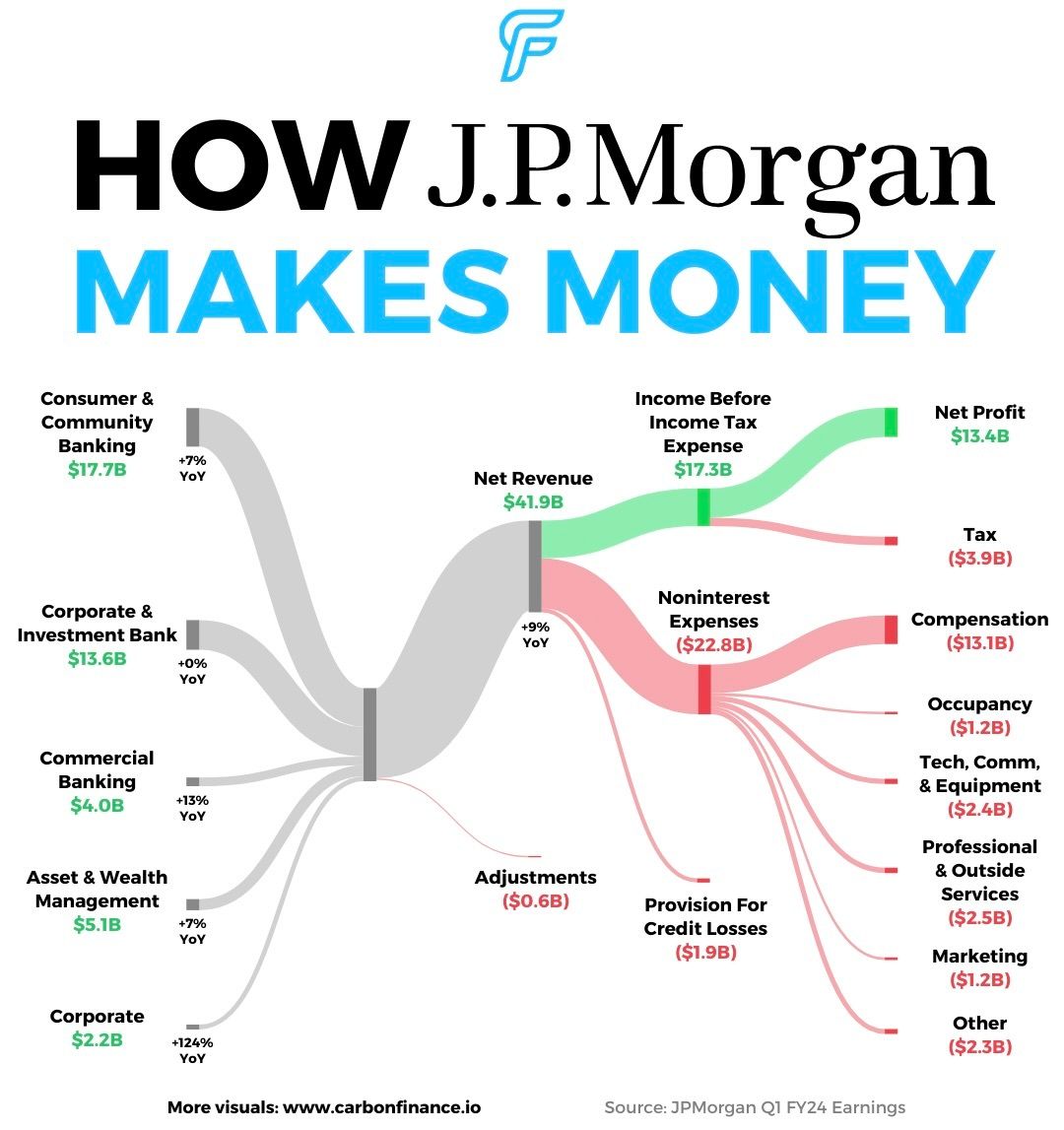

When JPMorgan reports earnings, everyone listens.

Last Friday, the largest bank in the U.S., reported its fiscal first-quarter earnings for 2024, surpassing analyst expectations on both revenue and earnings.

Here’s a rundown of the numbers:

Earnings: $4.44 (vs. $4.17 Est. from FactSet)

Revenue: $41.9 billion (vs. $41.67B Est. from FactSet)

The bank saw growth across nearly all business segments, with quarterly profits rising 6% to $13.4B, and net interest income increasing 11.4% YoY to $23.1B.

However, there was a slight QoQ drop in net interest income of roughly 4%, ending a 10-quarter streak of increases.

Looking ahead, JPMorgan projects net interest income for 2024 to be around $90B, slightly below the $90.68B analysts anticipated.

CEO Jamie Dimon expressed caution, citing global conflicts, persistent inflation, and the yet-to-be-felt impacts of quantitative tightening as reasons for vigilance.

Despite the well-rounded results, the market reacted negatively, with the stock dropping about 8% since the earnings announcement.

BlackRock now has a whopping $10.5T in assets under management, a new record.

This marks a considerable 15% increase from $9.1T in the first quarter of 2023.

The company released its earnings for Q1 2024 last Friday and beat analyst estimates.

Here’s a rundown of the numbers:

Earnings: $9.81 (vs. $9.37 Est.)

Revenue: $4.7B (vs. $4.67B Est.)

Overall, the quarter was robust for BlackRock, with $76B in long-term net inflows.

The company also reported an 11% YoY increase in revenue and an 18% YoY increase in operating income.

A notable highlight from the earnings call was the BlackRock Bitcoin Spot ETF, IBIT, which attracted $14B in net inflows during the quarter.

Larry Fink, BlackRock’s CEO, said the Bitcoin fund was the fastest growing ETF in history and is approaching nearly $20B in AUM.

These stocks are having a tough time.

While the broader S&P 500 has had a choppy last few weeks due to geopolitical issues and greater than expected inflation, these companies face problems that extend beyond this.

Globe Life recently fell over 60% before slightly rebounding after Fuzzy Panda Research released a short seller report outlining allegations of insurance fraud.

Boeing is second on the list, and well, there’s no need to go into detail there.

CEO Dave Calhoun recently announced his resignation, but will continue to lead the company until the end of the year.

Meanwhile at Tesla, I previously reported on the company’s 8.5% YoY drop in Q1 deliveries.

This week, the company revealed plans to cut more than 10% of its global workforce.

Additionally, data released from Kelley Blue Book showed Tesla’s EV market share has declined from 62% in Q1 2023 to 51% in Q1 2024.

📚 Recommended Reading

Want to catch up on the markets daily for free in under 5 minutes?

Check out The One Read.

They provide market highlights, important news, and economic analysis in an easy to read, simplified format.

Don’t waste time filtering through all the stories in the financial world, sign up now and receive their update everyday after close!

✂️ No Cuts In Sight. Powell remains hawkish on rate cuts expectations - WSJ

🏥 Medical Device Sales Jump. Johnson & Johnson $JNJ beat earnings thanks to its medical devices business - CNBC

💳 Debt Burden. Credit card delinquencies have reached all time highs - M

😱 Recession Fears. 29% of economists surveyed by WSJ expect a recession within the next year - WSJ

☁️ Cloud M&A. Salesforce $CRM is in talks to acquire $10B Informatica $INFA - CNBC

📱India Expansion. Apple $AAPL is now generating $14B in devices from its India production line - YF

Notable Companies Reporting Earnings Next Week:

Monday (4/15):

Goldman Sachs $GS, M&T Bank $MTB

Tuesday (4/16):

UnitedHealth Group $UNH, Johnson & Johnson $JNJ, Bank of America $BAC, Morgan Stanley $MS, PNC Financial Services $PNC, The Bank of New York Mellon $BK

Wednesday (4/17):

ASML Holding $ASML, Abbott Laboratories $ABT, Prologis $PLD, U.S. Bancorp $USB, Crown Castle $CCI

Thursday (4/18):

Taiwan Semiconductor $TSM, Netflix $NFLX, Intuitive Surgical $ISRG, Blackstone $BX

Friday (4/19):

Procter & Gamble $PG, American Express $AXP, Schlumberger $SLB

All of the companies that are reporting earnings next week can be viewed here.

Major Trades Published 04/08 - 04/16

Buys

Sells

How was today's newsletter?

🤝 Review of the Week

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

The mention of The One Read in our newsletter is provided as a courtesy to our readers and should not be construed as an endorsement of any product, service, or information provided by the sponsor or partner. Carbon Finance makes no representations or warranties, express or implied, about the accuracy, completeness, reliability, or suitability of the information contained in the sponsor’s or partner’s materials or any related services. Any reliance you place on such information is strictly at your own risk. We are not liable for any loss or damage arising from your engagement with The One Read or their content.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.