- Carbon Finance

- Posts

- 📊 Analyzing The Mag 7

📊 Analyzing The Mag 7

1) Forward Valuation 2) Revenue Growth 3) YTD Performance and more!

Happy Sunday!

I hope you all had an incredible Thanksgiving weekend with friends and family.

A huge thank you to each and every one of you who continues to read, engage with, and share this newsletter. It means the world to me!

This was a shorter week, with markets closed on Thursday for the holiday and a shortened trading session on Friday.

If you missed it, I also published my November investment ideas report, highlighting five companies worth following closely.

Thank you for being a subscriber!

Some key data bites from this week that you should know:

Dan Ives shared his list of the 10 “must own” AI stocks.

New York Times shared 100 notable books of 2025.

Chinese couple made $9B after their company partnered with Nvidia.

Bloomberg says Trump’s $21T investment boom is actually closer to $7T.

OpenAI projects 220M paying ChatGPT users by 2030.

Amazon will invest up to $50B to expand AI infrastructure for U.S. government.

Apple will overtake Samsung as #1 smartphone maker for first time since 2011.

Wall Street’s macro traders are having their best run in 16 years.

Gas prices have fallen below $3/gallon in more than half of U.S. states.

Tesla sales in China dropped to a 3-year low in October.

U.S. posted a $284B budget deficit in October.

MIT study found AI can already replace 12% of U.S. workforce.

Big Tech is raising almost $100B through bond offerings to fund AI investments.

U.S. banks saw profits jump 13.5% to $79.3B in Q3.

Medicare negotiated a 71% discount on Novo Nordisk’s GLP-1 drugs.

Earnings & Financial Results:

Zoom raised FY26 outlook and increased share repurchase program by $1B.

Alibaba beat estimates and posted 34% growth in cloud business.

Dell topped earnings and raised AI server shipment guidance to $25B.

In today’s newsletter:

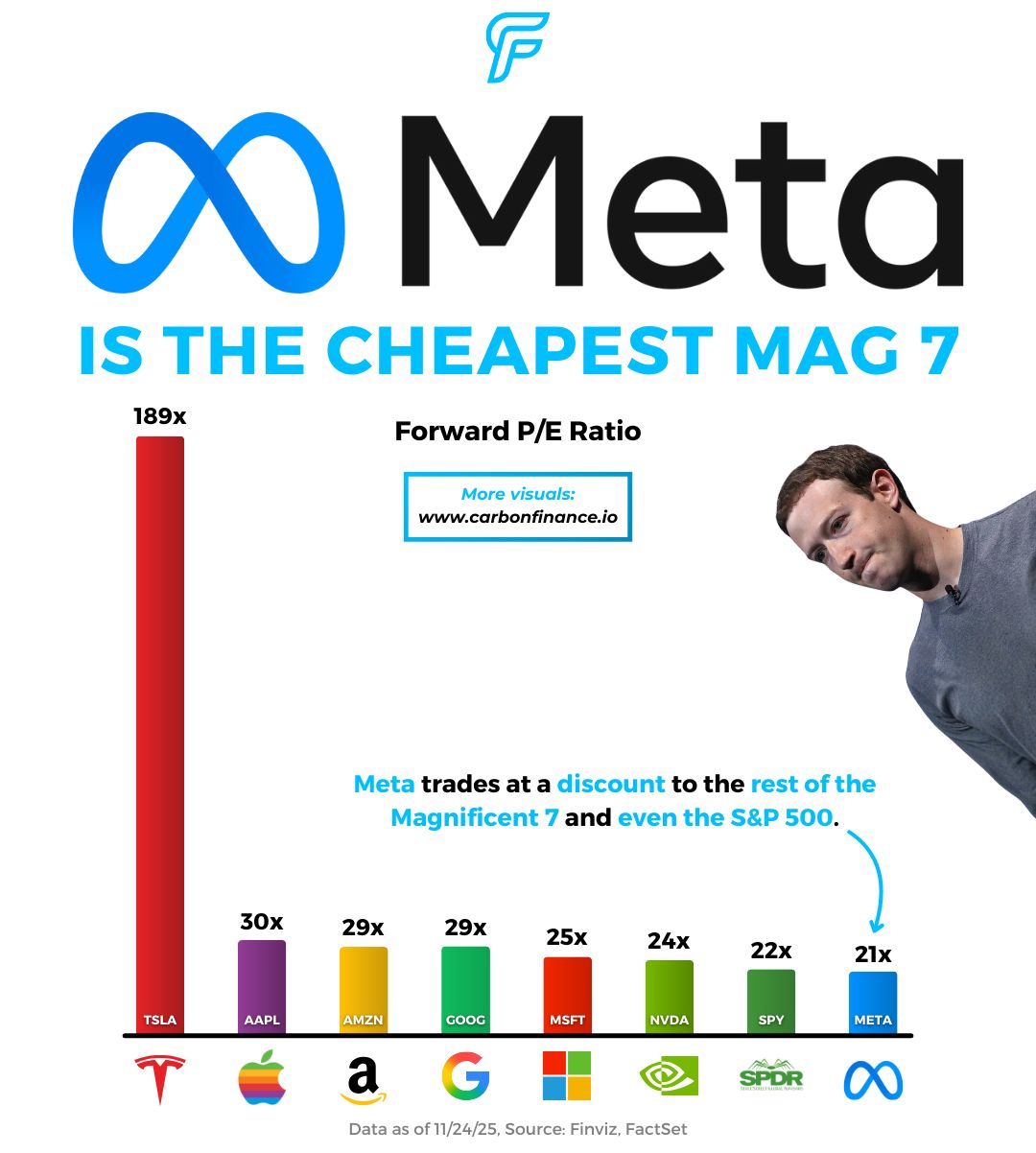

🏷️ Mag 7 Forward Valuation

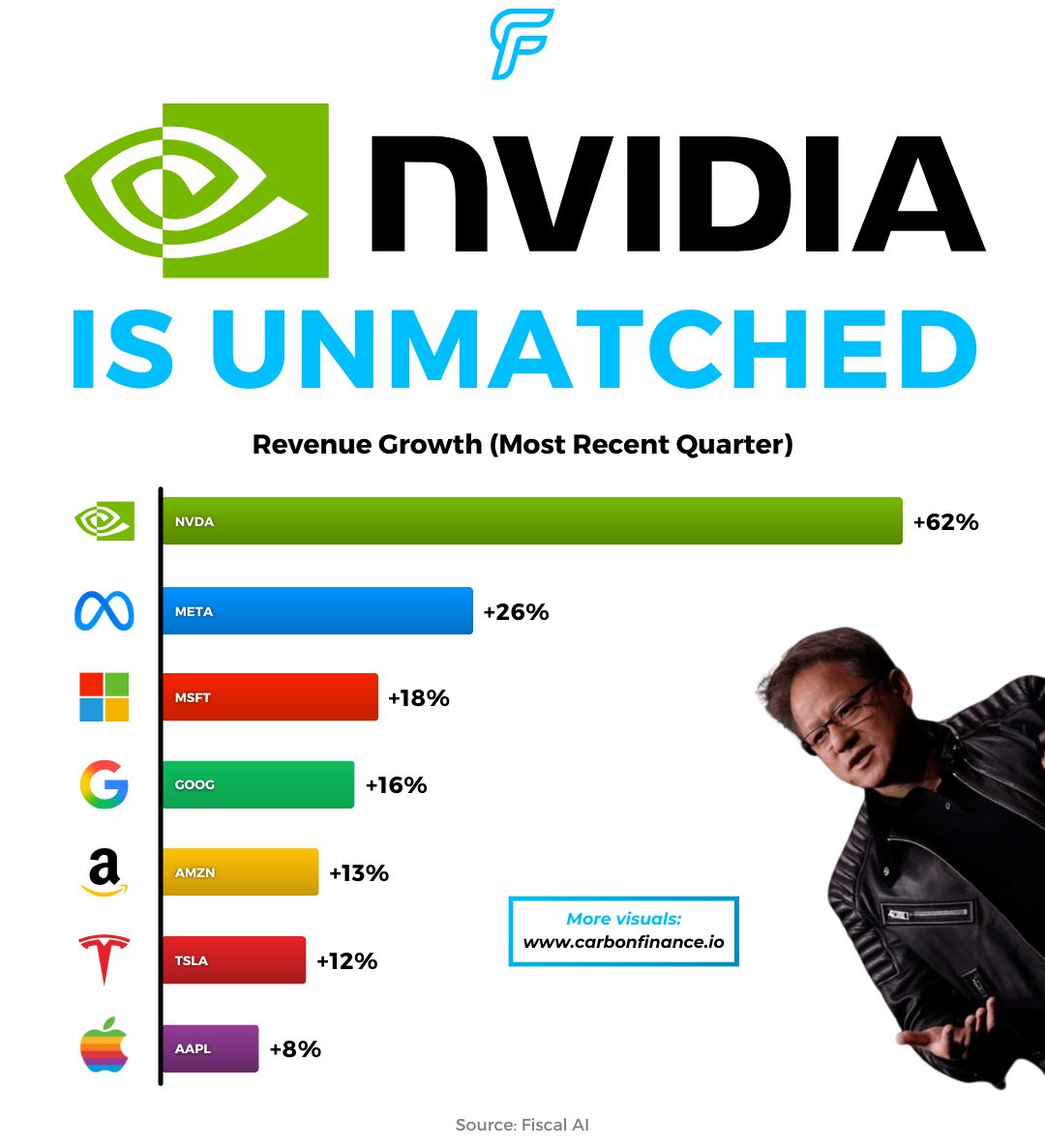

📈 Mag 7 Revenue Growth

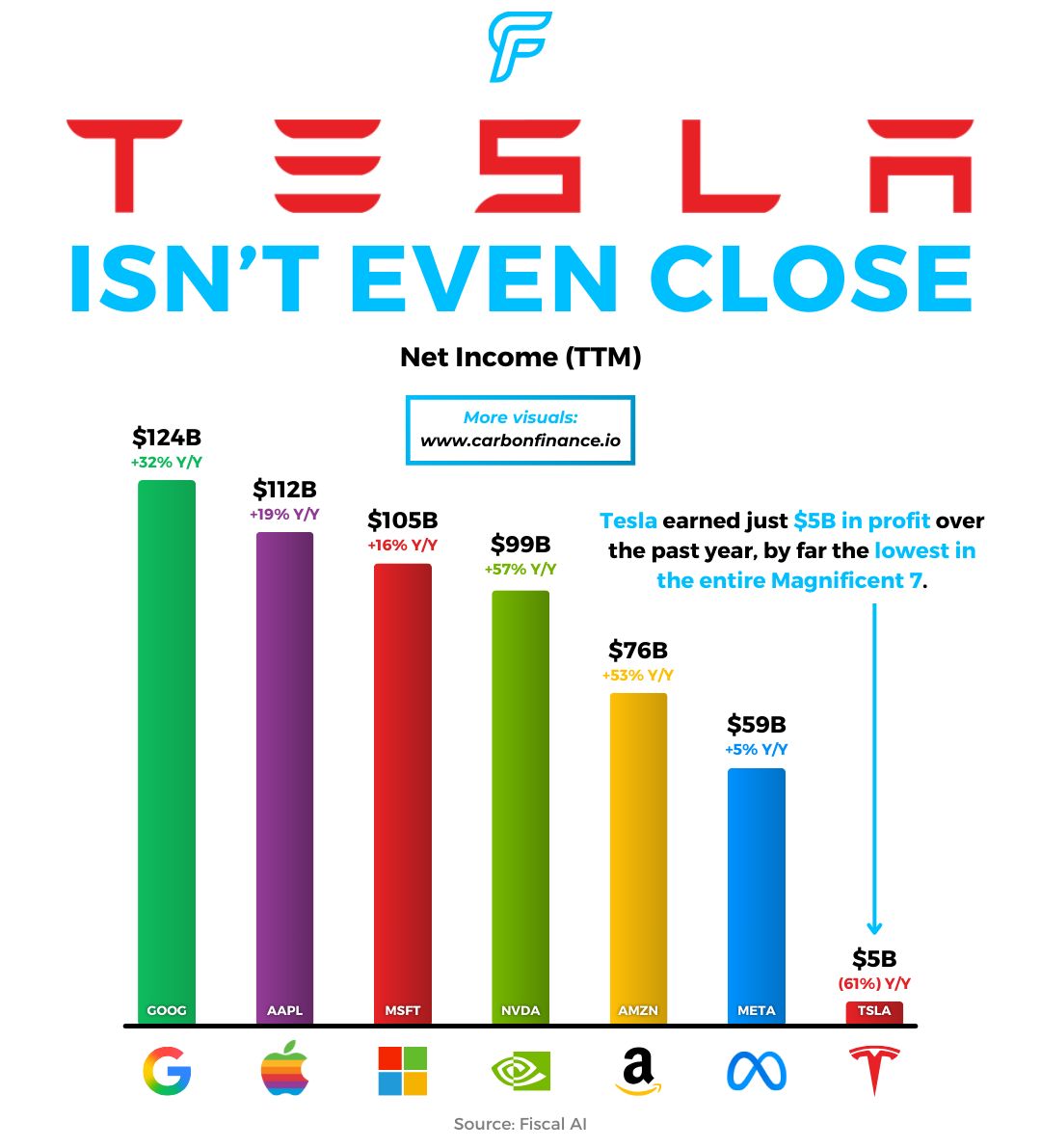

💰 Mag 7 Net Income

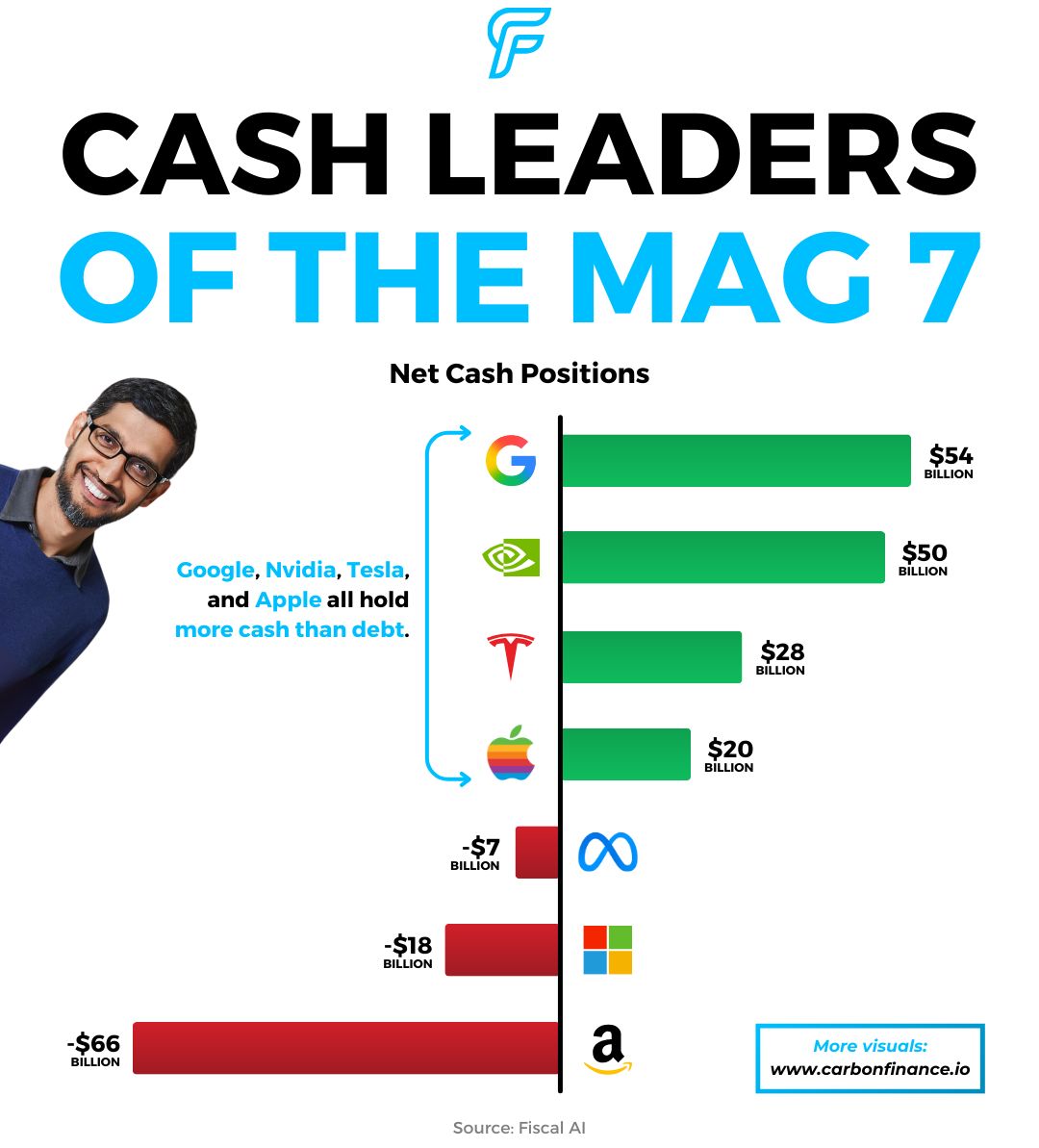

🏦 Mag 7 Net Cash Positions

🚀 Mag 7 YTD Performance

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Together With Masterworks

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Meta is spending big, but the market isn’t buying it.

The company now trades at a discount to the rest of the Magnificent 7, with a 21x forward earnings multiple.

It is even cheaper than the S&P 500, which trades at 22x.

Investor concern is rising that Meta is overspending on AI, particularly compared to hyperscalers that can monetize their infrastructure faster through cloud customers.

Meta, by contrast, must build its own compute capacity to support its AI roadmap.

The situation reminds many investors of Meta’s heavy metaverse spending, which failed to generate meaningful ROI.

The company is also using off-balance-sheet funding through SPVs and spending billions to recruit top AI talent, adding to worries about long-term returns.

Who in the Magnificent 7 is growing the fastest?

Nvidia, and it’s not even close.

The company posted 62% revenue growth in the most recent quarter, more than double the next Mag 7 name, Meta.

Most of the group is still comfortably growing at double-digit rates.

Tesla, which previously posted –9% and –12% revenue declines, delivered a sharp rebound this quarter.

This was driven largely by a rush of EV purchases ahead of a federal tax credit expiring in September 2025.

The only name to post single-digit growth was Apple.

However, in the last earnings call, they guided for 10–12% total revenue growth in the next quarter.

Profit growth across the Mag 7 remains exceptionally strong.

Most are delivering high double-digit net income growth.

The two “exceptions” are Meta and Tesla.

Meta’s recent decline in net income was driven by a one-time non-cash tax charge that will actually reduce taxes in the future.

Tesla’s reason, on the other hand, was more operational.

The company has seen a steep plunge in net income, driven by heightened competition, price cuts, higher R&D spending, and tariffs.

Meanwhile, 3 names in the Magnificent 7 have generated over $100B in profits in the last twelve months: Google, Apple, and Microsoft.

Many of the Magnificent 7 are holding deep pockets.

Google, Nvidia, Tesla, and Apple all hold more cash than debt, giving them net cash positions.

Companies with net cash have far more flexibility to invest, scale, and withstand macro volatility.

That said, a net debt position isn’t a red flag by itself.

Many large companies operate efficiently with leverage, and those with reliable cash flow can comfortably manage a net debt position.

There’s been one big winner of the Magnificent 7 this year.

And that is Google.

The stock has surged nearly 70% this year as sentiment reversed, supported by a favorable FTC decision, strong growth across segments, and rising confidence in its AI leadership.

Rapid adoption of Gemini, robust Google Cloud performance, and continued momentum at Waymo have all helped propel the stock.

As a result, Google has outperformed the S&P 500’s return by 4x this year.

One fun fact?

The majority of the Magnificent 7 are actually underperforming the S&P 500 this year.

Amazon is the largest laggard, returning just 6% YTD.

📣 Presented by Masterworks

$57 Billion in NVDA Revenue, 62% YoY Growth. And stocks still fell… What now?

Nvidia just posted a record-breaking quarter… yet the markets dropped. Why?

Experts say that even the top AI earnings couldn’t calm the fear of a potential bubble.

After soaring at the open, the S&P reversed sharply, wiping out over $2T of value in hours.

The “Great Bitcoin Crash of 2025” only wiped out ~$1T by comparison.

Wall Street’s finally asking: What if AI isn’t enough?

So, where can investors diversify when public markets stop making sense?

Now, for members-only → blue-chip art.

It’s not just for billionaires to tie the room together. It’s poised to rebound.

With Masterworks, +70k are investing in shares of multimillion dollar artworks featuring legends like Basquiat and Banksy.

And they’re not just buying. They’re selling too. Masterworks has exited 25 investments so far, including two this month, yielding net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers skip the waitlist:

*Past performance is not indicative of future returns. Investing involves risk. Reg A disclosures: masterworks.com/cd

💾 Chip Shift↗ - Meta is in talks to use Google’s AI chips in a multibillion-dollar deal that would reduce its reliance on Nvidia.

🚀 Genesis Launch↗ - President Trump signed an Executive Order launching the Genesis Mission, aimed at accelerating AI R&D.

🇺🇸 No Slowdown↗ - Treasury Secretary Scott Bessent said there is no recession risk for U.S. economy after $11B government shutdown.

💊 Trial Failure↗ - Novo Nordisk said its GLP-1 trials failed to slow Alzheimer’s progression.

📨 Allegation Response↗ - Nvidia sent a private memo to Wall Street analysts pushing back on accounting allegations.

🎵 Price Hike↗ - Spotify is planning to increase U.S. subscription prices in the first quarter of 2026.

🇨🇳 Military Ties↗ - Pentagon concluded that Alibaba, Baidu, and BYD should be added to list of companies that aid Chinese military.

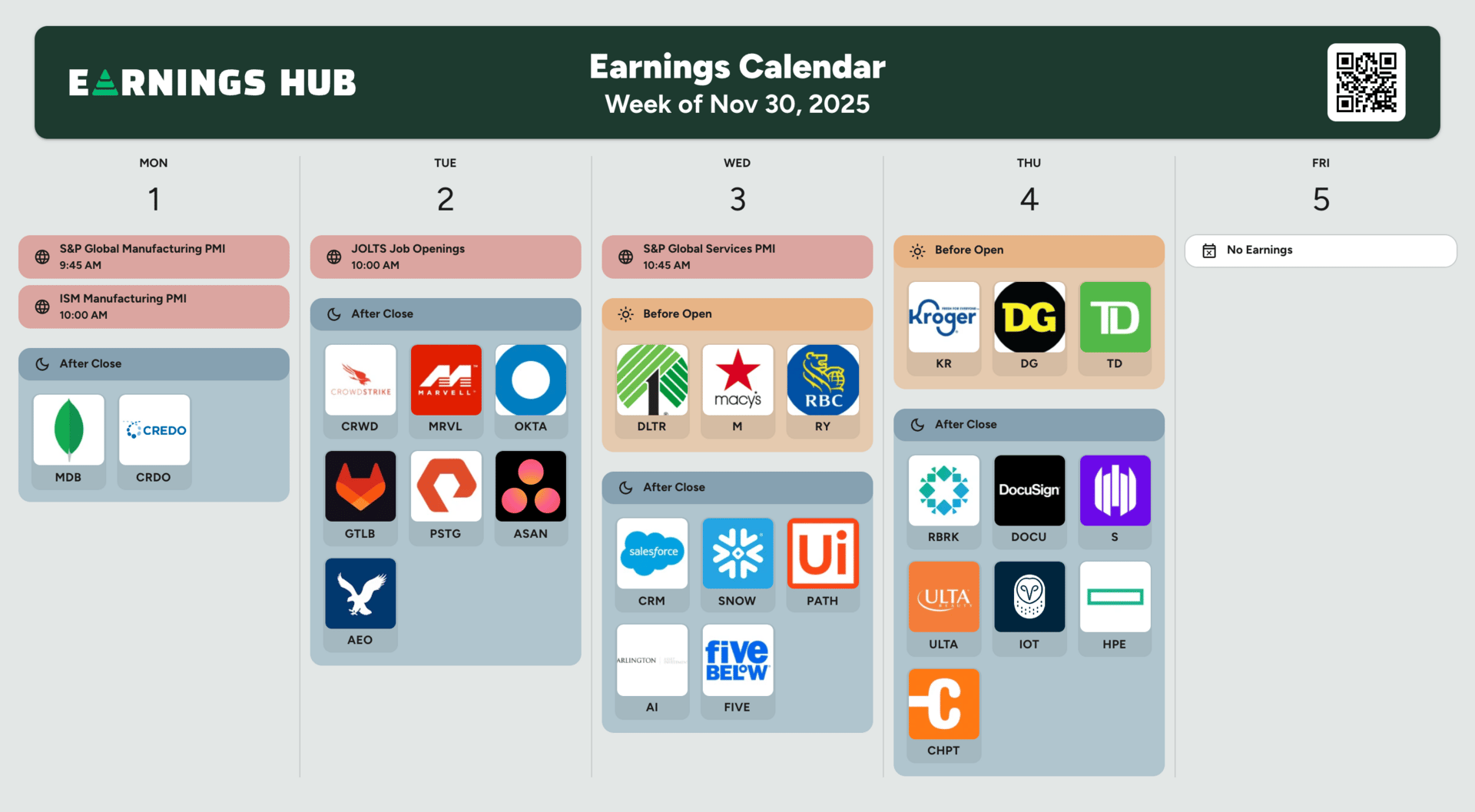

Courtesy of our affiliate partner, EarningsHub.

Notable Companies Reporting Earnings Week of November 30th, 2025:

Major Trades Published 11/24 - 11/28. Trades may be those of family members. [Source: 2iQ]

Buys

Dave McCormick (R)

Company: Bitwise Bitcoin ETF ($BITB)

Amount Purchased: $65K - $150K

Sells

Tina Smith (D)

Company: Huntington Bancshares ($HBAN)

Amount Sold: $100K - $250K

Major Trades Published 11/24 - 11/28

Buys

Sells

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

This newsletter is sponsored by Masterworks. Sponsorship does not influence our editorial content. We do not endorse the sponsor’s products, services, or views, and we are not responsible or liable for any interaction or transaction between readers and the sponsor.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Reply