- Carbon Finance

- Posts

- 📊 BlackRock Hits A New Record

📊 BlackRock Hits A New Record

1) Bitcoin Is The New King 2) JPMorgan Is Massive 3) The Rise Of A Monopoly and more!

Happy Sunday!

It was another big week for economic data.

On Tuesday, CPI rose 2.7% YoY and Core CPI came in at 2.9%, both in line with forecasts.

The report showed a mixed picture for tariffs, with categories like apparel and home furnishings, often exposed to import duties, seeing price increases, while vehicle prices declined.

Over the past 12 months, the biggest inflation drivers have been household energy, auto insurance, and housing.

The next day, wholesale inflation (PPI) came in flat for June, below the expected 0.2% increase, adding further uncertainty to the outlook for price pressures.

Then on Thursday, retail sales rose 0.6% in June, well above the 0.1% forecast and rebounding from May’s 0.9% decline.

While the American consumer remains cautious, the pickup in spending points to continued resilience.

On an unrelated note, if you’re interested in investment research with a long-term focus, I recently published a deep dive on Lululemon.

I’m focusing on companies facing short-term headwinds that could offer asymmetric returns once sentiment shifts.

All feedback would be appreciated!

Some key data bites from this week that you should know:

Economists lowered probability of recession in next 12 months to 33%.

Trump unveiled $90B in AI infrastructure investments in Pennsylvania.

Investors are rushing into US tech stocks at fastest pace in 16 years.

Anthropic eyes another funding round at a $100B+ valuation.

Google will invest $25B in data centers and AI infrastructure.

Amazon Prime Day drove over $24B in US e-commerce sales.

Perplexity has reached an $18B valuation with new funding.

Uber aims to deploy 20,000 Lucid vehicles for its robotaxi program.

Google will pay $2.4B to hire WindSurf CEO and license its technology.

SpaceX will invest $2B into xAI.

Apple will invest $500M into MP Materials.

Waymo has now driven more than 100M driverless miles.

Interactive Brokers saw new customer accounts jump 32% YoY to 3.87M.

Oracle will invest $2B in AI and Cloud Infrastructure in Germany.

Goldman Sachs posted a record $4.3B in revenue from stock trading.

In today’s newsletter:

₿ Bitcoin Is The New King

📈 BlackRock Hits A New Record

🏦 JPMorgan Is Massive

🍿 Netflix $10,000 Invested

⚙️ The Rise Of A Monopoly

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Together With Guidde

Create How-to Videos in Seconds with AI

Stop wasting time on repetitive explanations. Guidde’s AI creates stunning video guides in seconds—11x faster.

Turn boring docs into visual masterpieces

Save hours with AI-powered automation

Share or embed your guide anywhere

How it works: Click capture on the browser extension, and Guidde auto-generates step-by-step video guides with visuals, voiceover, and a call to action.

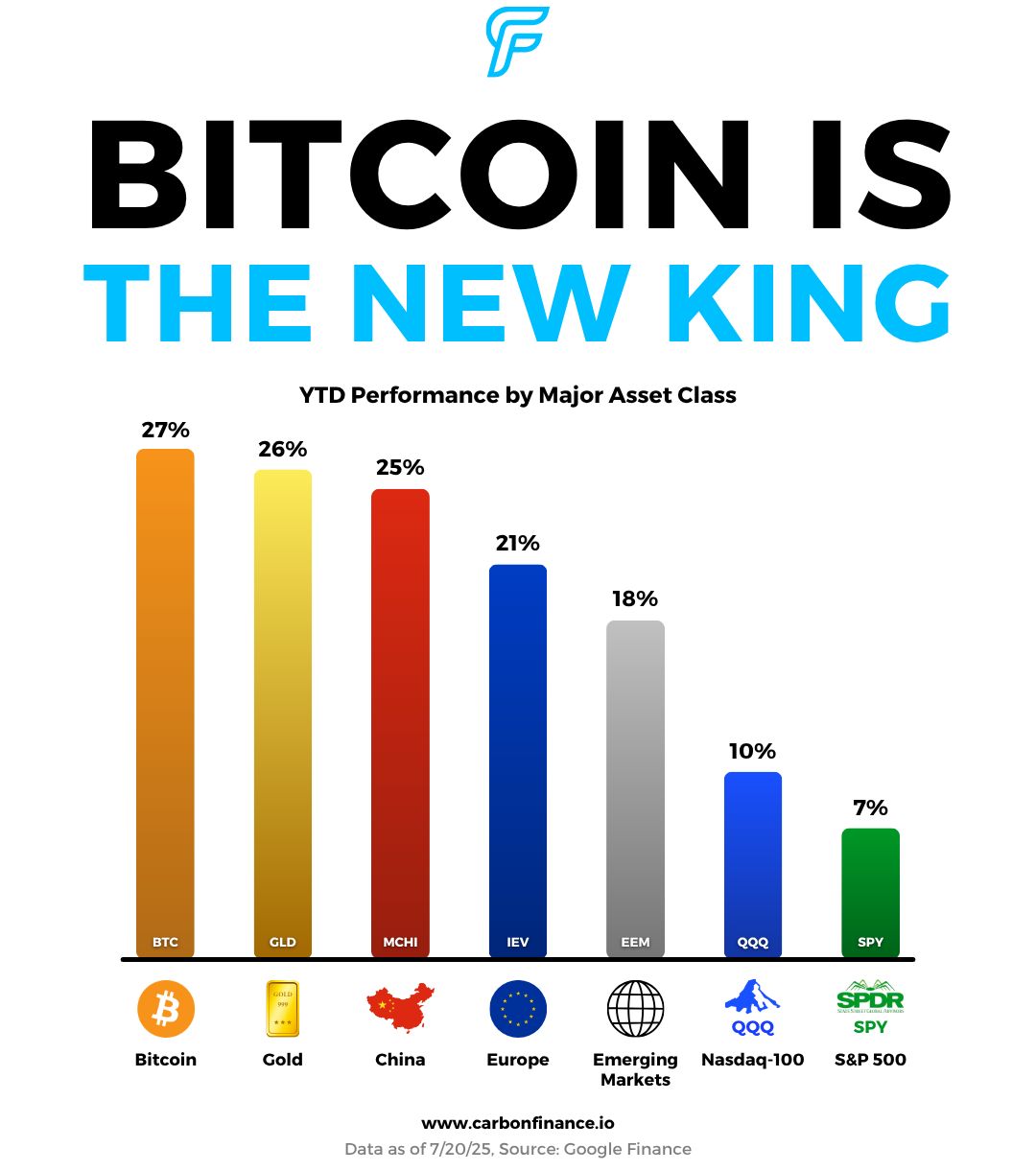

Bitcoin is the new king of the hill.

This past week, the world’s largest cryptocurrency hit an all-time high of $123K.

Its market cap has climbed to nearly $2.4T, making it more valuable than names like Alphabet, Meta, Saudi Aramco, and Berkshire Hathaway.

It now stands as the best-performing major asset class this year, with a 27% YTD gain.

Bitcoin has even edged past gold, which is up 26% this year after a strong 2024.

European and Chinese equities are also up over 20%, while U.S. stocks, tracked by the Nasdaq and S&P 500, pale in comparison.

The Crypto industry had a ton of other notable headlines this week:

Congress passed the first federal legislation to regulate stablecoins.

The total market value of cryptoassets jumped past $4T.

President Donald Trump’s unlocked memecoins will boost his net worth by almost $100M.

BlackRock went on a roller coaster ride this week.

Shares fell 7%, its worst earnings-day drop in over a decade, after a single Asian institutional client withdrew $52B from a low-fee index strategy.

Despite the headline shock, BlackRock still reported $68B in net inflows for the quarter, bringing year-to-date inflows to $152B.

Revenue grew 13% and adjusted operating income rose 12%, while assets under management hit a record $12.5T.

By week’s end, the stock had fully recovered, closing flat.

JPMorgan Chase is in a league of its own.

The world’s largest bank is now worth more than Bank of America, Wells Fargo, and Citigroup combined.

As Bloomberg reported, it generated $30B in profit during the first half of the year, more than double its closest rival.

It also extended its lead over Goldman Sachs and Morgan Stanley in investment banking revenue.

JPMorgan topped estimates for both earnings and revenue, with every business line posting growth in Q2, underscoring the strength of America’s biggest banks despite ongoing trade war uncertainty.

Netflix kicked off tech earnings season on a strong note.

The company reported EPS of $7.19, beating estimates of $7.08.

Revenue also topped expectations at $11.08B, up 16% YoY.

Growth was driven by new subscribers, price increases, and rising ad revenue.

Additionally, Netflix raised its full-year revenue outlook to $45B at the midpoint and now expects $8.25B in free cash flow, both ahead of previous forecasts.

The streaming giant remains one of the best-performing stocks of all time, with a $10,000 investment at its IPO now worth $11M.

When it comes to the AI revolution, names like Nvidia and Taiwan Semiconductor often lead the conversation.

But ASML is quietly one of the most critical players in the entire ecosystem.

It holds a monopoly as the sole producer of extreme ultraviolet (EUV) lithography machines, essential tools for manufacturing advanced AI chips.

Foundries such as TSMC, Intel, and Samsung rely entirely on ASML’s systems to build their leading-edge chips.

Even more staggering: ASML’s next-generation High-NA EUV tools cost nearly $400M each.

Fueled by AI demand, ASML has grown from $3B in revenue in 2005 to $38B over the last twelve months.

Yet despite strong earnings and revenue beats in Q2, shares dropped 8% this week.

The company warned of flat growth in 2026 due to macroeconomic and geopolitical uncertainty, and its near-term revenue guidance also came in below expectations.

🟢 Export Greenlight. Nvidia and AMD were given permission to resume sales of some AI chips in China - BB

📑 Deck Builder. OpenAI revealed agents that can make spreadsheets and PowerPoints - WSJ

🆕 Index Update. The Trade Desk and Square will join the S&P 500 and replace ANYSYS and Hess - CNBC

🤫 Silent Filing. Crypto Asset Manager Grayscale has filed confidentially for US IPO - YF

🏭 Meta Megawatts. Mark Zuckerberg announced Meta will build massive gigawatt-size data centers - BB

🏷️ Hidden Gains. UnitedHealth Group used stealth asset sales to help beat Wall Street targets - BB

👖 Lulu Pileup. Lululemon’s bestselling black leggings are piling up at outlet stores - BB

☁️ Cloud Alliance. OpenAI will use Google Cloud for ChatGPT - CNBC

🥤 Sugar Switch. President Trump announced Coca-Cola will now use real cane sugar in Coke in the US - X

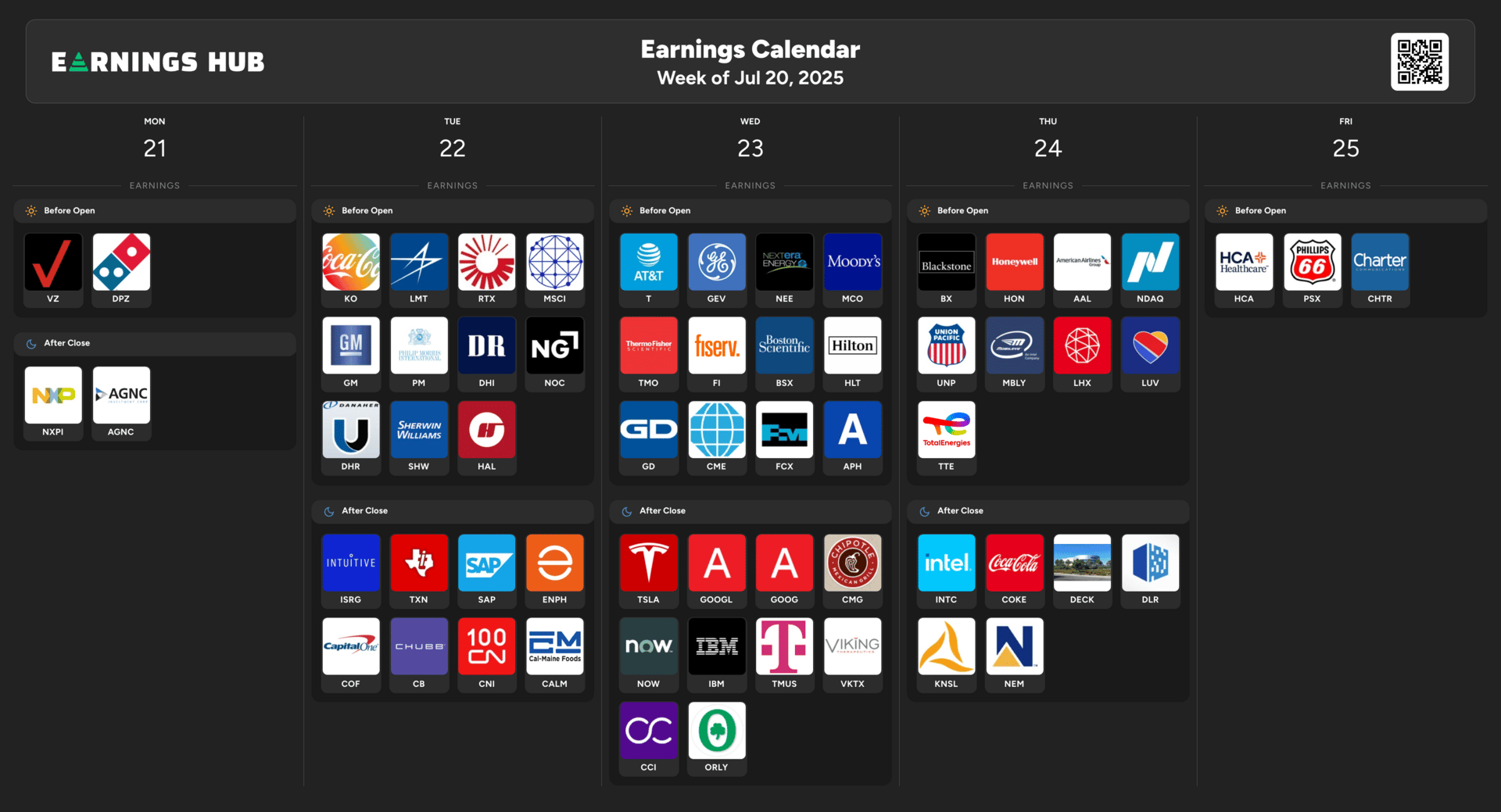

Courtesy of our paid partner, EarningsHub.

Notable Companies Reporting Earnings Week of July 21st, 2025:

Major Trades Published 7/14 - 7/18. Trades may be those of family members. [Source: 2iQ]

Buys

Jonathon Jackson (D)

Company: IBM ($IBM)

Amount Purchased: $15K - $50K

Sells

Mark Green (R)

Company: VanEck Merk Gold ETF ($OUNZ)

Amount Sold: $50K - $100K

Major Trades Published 7/14 - 7/18

Buys

Sells

How was today's newsletter?I value all of the feedback that I receive. Let me know how I did so I can continue to make this the best investing newsletter available! |

🤝 Review of the Week

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Reply