Happy Sunday!

Meta is now the cheapest name in the Magnificent 7.

I published a 7,000+ word deep dive breaking down the business, the risks, and the valuation.

If you haven’t read it yet, set aside 15-20 minutes.

It’s among the most thoughtful pieces of work I’ve written, and I’d genuinely value your feedback.

At a minimum, you’ll come away with a deeper understanding of the company, the industry, and AI more broadly.

Key Data Bites From This Week:

Morningstar shared its latest list of 33 undervalued stocks as of Q1 2026.

Bank of America listed 25 stocks with AI exposure while avoiding bubble risk.

Trump imposed a 25% tariff on certain AI chips.

Trump imposed a 25% tariff on countries that do business with Iran.

Meta is looking to double AI smart-glasses production to 20M units annually.

Data center investments are expected to hit $3T over next five years.

Apple has captured a world-leading 20% of the global smartphone market.

OpenAI acquired health-care tech startup Torch for $60M.

Wall Street had highest job cuts in nine years in 2025, totaling 10,700 jobs.

China reached a record $1.2T trade surplus last year.

Porsche sales fell the most in 16 years on weak China demand.

Spotify increased its U.S. subscription prices for 3rd time in 3 years.

Core inflation increased at a 2.6% annual rate, less than expected.

Earnings & Guidance:

Delta Air Lines forecasted 20% earnings growth in 2026.

Goldman Sachs saw equities trading revenue surge 25%.

In today’s newsletter:

📈 15 Stocks With Fast Growing Dividends

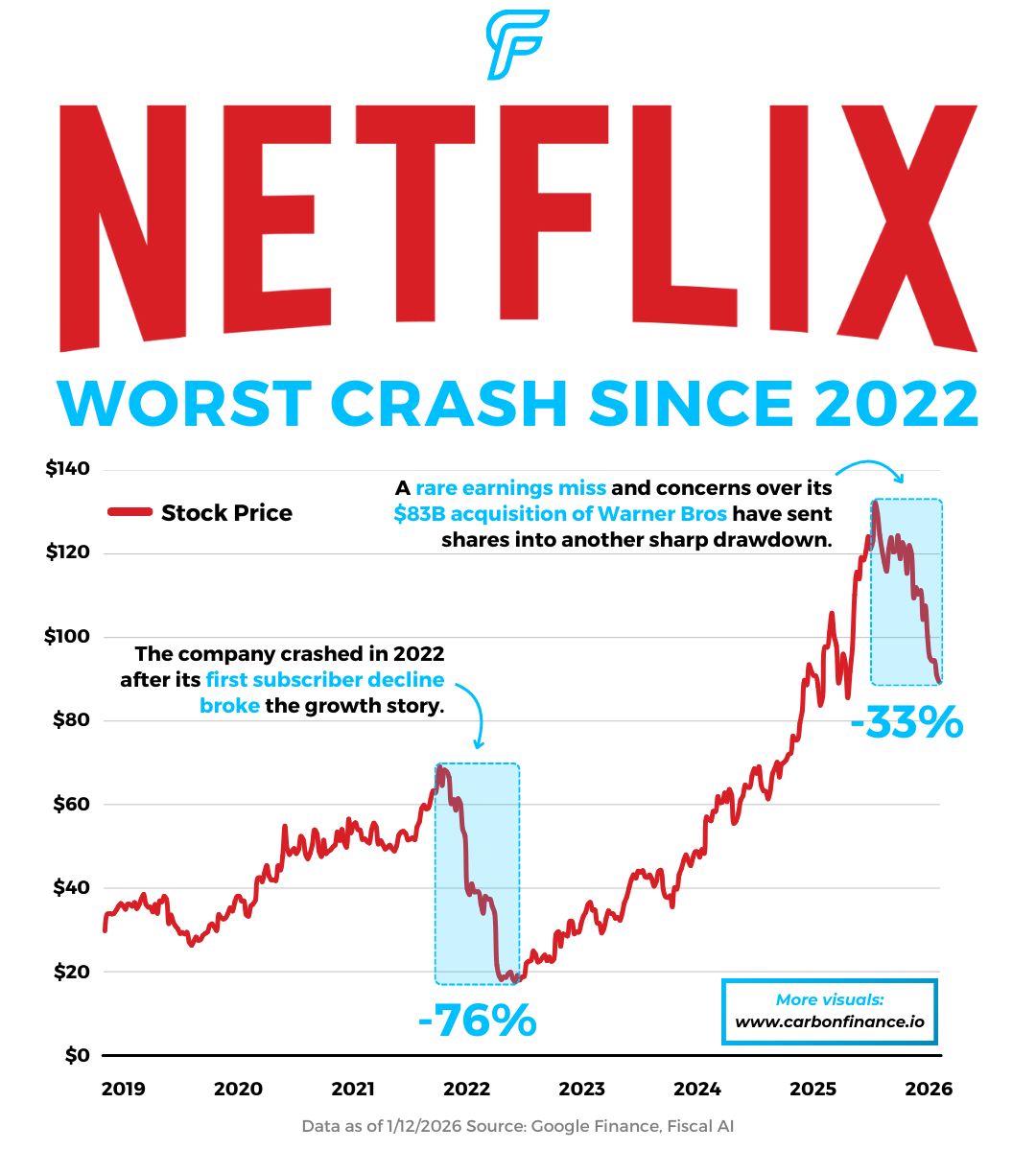

📉 Netflix’s Bear Market

🏛️ JPMorgan Is Massive

🏭 Taiwan Semi’s Blowout Profits

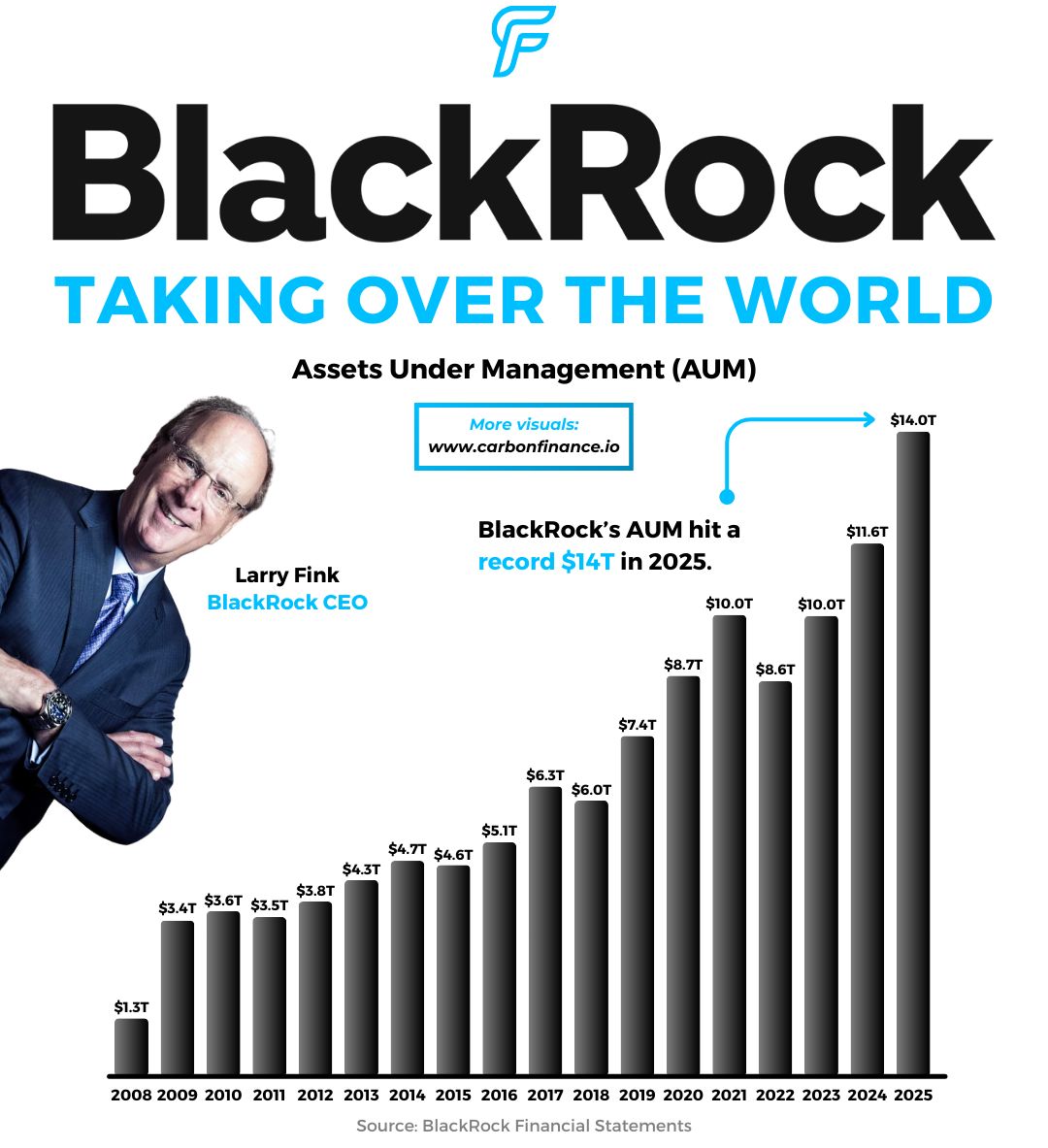

💰 BlackRock’s Record $14T AUM

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Together With The Investor’s Edge

Investing isn’t about reacting faster.

It’s about understanding what actually matters, and recognizing it before it becomes obvious.

The Stock Investor’s Edge helps you cut through the noise with deep research, clearly explained investment and options ideas, and ongoing market context.

If you want to make calmer, more confident decisions grounded in research and process, this community is built for you.

Dividend growth matters more than most investors realize.

Since 1957, dividend growth for the S&P 500 has averaged around 6% per year, and dividends have contributed roughly 31% of the index’s total return.

Consistent dividend growth helps preserve purchasing power and acts as a long-term inflation hedge.

While many investors who opt to invest in individual stocks chase high dividend yields, the real opportunity often lies elsewhere.

High yields can signal maturity and may not be sustainable.

Companies growing dividends rapidly are often earlier in their lifecycle, moving up the S-curve with strong revenue and earnings growth to support future payouts.

Among U.S. companies with market caps above $1B, many of the fastest dividend growers cluster in the $1B to $10B range.

These names are frequently overlooked by both retail investors and institutions

Netflix is facing its toughest episode in years.

Shares are experiencing their largest drawdown since 2022.

There are two main reasons.

First, Netflix reported a surprise earnings miss in Q3 driven by a one-time $619M tax charge tied to a dispute in Brazil.

Excluding that item, the core business remained solid and revenue met expectations.

The bigger concern is Netflix’s proposed $83B acquisition of assets from Warner Bros. Discovery.

The deal would add roughly $50B in new debt and require issuing nearly $12B in new equity, diluting existing shareholders.

Netflix is also locked in a competitive bidding process with Paramount Skydance, raising the risk of losing the deal altogether.

Even if Netflix prevails, antitrust scrutiny could still block the transaction.

A failed deal could trigger a breakup fee of up to $5.8B.

On Tuesday, Bloomberg reported that Netflix is considering restructuring the bid as an all-cash offer.

Such a move would remove equity dilution risk and give Warner Bros. Discovery shareholders clearer price certainty.

Bank stocks pulled back this week as investors sold the news.

JPMorgan delivered a massive $13B profit, driven by record results in payments and trading.

Shares still fell after a $2.2B charge tied to the Apple Card portfolio and Jamie Dimon’s cautious commentary around sticky inflation.

Bank of America posted a 12% increase in profit, with record digital engagement and investment banking fees reaching five year highs.

The stock declined as investors weighed the impact of potential regulatory caps on credit card fees.

Wells Fargo beat earnings expectations thanks to the Fed removing an asset cap on the bank, enabling it to reach its 15% return target.

However, shares fell following a revenue miss and elevated severance costs from ongoing job cuts.

Citigroup surpassed profit forecasts, posted an 84% jump in financial advisory fees, and returned $18B to shareholders, its largest payout since the pandemic.

That strength was offset by a $1.2B loss from its Russia exit and weaker revenue due to the bank’s complex restructuring.

Zooming out, the gap is clear.

JPMorgan is now valued at nearly the same level as Bank of America, Wells Fargo, and Citigroup combined, while generating comparable net income.

AI demand isn’t slowing down.

Taiwan Semiconductor reported its highest quarterly profit ever, with net income jumping 35% to $16B, well above expectations.

Revenue climbed 26% YoY to $33.73B, reflecting continued strength in advanced AI chip demand.

Management expects momentum to persist, guiding to roughly 30% revenue growth for the year, in line with forecasts.

To meet that demand, the company signaled a major step up in spending.

Taiwan Semi now expects $54B in capital expenditures this year, far higher than prior expectations.

Leadership reiterated strong conviction in the AI megatrend, clearly visible with its accelerating investment across Taiwan and the U.S.

The results helped ease fears of an AI slowdown, lifting Taiwan Semi shares and the broader chip sector on the week.

Separately, the U.S. and Taiwan signed a new trade agreement reducing U.S. tariffs on Taiwanese goods to 15% from 20%, alongside $250B in planned Taiwanese investment into U.S. semiconductors and AI infrastructure.

BlackRock just got even bigger.

The world’s largest asset manager reported a standout quarter, with assets under management reaching a record $14T, up 22% YoY.

The milestone was driven by $342B in net inflows during Q4, the strongest quarter of client flows in five years and well ahead of expectations.

Financial results followed.

Adjusted earnings rose 10% to $13.16, while revenue jumped 23% to $7B, both beating analyst estimates.

With momentum accelerating, BlackRock increased its quarterly dividend by 10% and authorized the repurchase of 7M additional shares under its existing buyback program.

CEO Larry Fink summed it up simply.

BlackRock enters 2026 with the strongest inflows year and quarter in its history.

📣 Presented by Google AdSense

Easy setup, easy money

Making money from your content shouldn’t be complicated. With Google AdSense, it isn’t.

Automatic ad placement and optimization ensure the highest-paying, most relevant ads appear on your site. And it literally takes just seconds to set up.

That’s why WikiHow, the world’s most popular how-to site, keeps it simple with Google AdSense: “All you do is drop a little code on your website and Google AdSense immediately starts working.”

The TL;DR? You focus on creating. Google AdSense handles the rest.

Start earning the easy way with AdSense.

🔎 Powell Investigated↗ - Federal Prosecutors opened an investigation into Fed Chair Jerome Powell.

🔊 AI Outsourced↗ - Apple has selected Google’s Gemini to run AI-powered Siri.

🏭 Infrastructure Mode↗ - Meta is establishing a new initiative called Meta Compute to build AI infrastructure.

🧾 Payment Pressure↗ - Senate report found that UnitedHealth used aggressive tactics to boost medicare payments.

🏥 Cost Reset↗ - Trump administration presented a health care framework aimed at lowering costs.

⚡️ Energy Squeeze↗ - Trump administration is pushing tech companies to pay for rising power cuts.

🏠 Breaking Glass↗ - Trump’s housing plan would allow Americans to use money in their 401(k)s for a down payment.

🤝 Diplomatic Shift↗ - Canada and China struck an initial trade deal and forged new strategic ties.

Courtesy of our affiliate partner, EarningsHub.

Notable Companies Reporting Earnings Week of January 18th, 2025:

Major Trades Published 1/12 - 1/16. Trades may be those of family members. [Source: Capitol Trades]

Buys

Gil Cisneros (D)

Company: Campbell Soup Co ($CPB)

Amount Purchased: $50K - $100K

Sells

Tommy Tuberville (R)

Company: Apple ($AAPL)

Amount Sold: $50K - $100K

Steve Cohen (D)

Company: Morgan Stanley ($MS)

Amount Sold: $50K - $100K

Major Trades Published 1/12 - 1/16

Buys

Sells

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

This newsletter is sponsored by The Investor’s Edge and Google AdSense. Sponsorship does not influence our editorial content. We do not endorse the sponsor’s products, services, or views, and we are not responsible or liable for any interaction or transaction between readers and the sponsor.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.