- Carbon Finance

- Posts

- 📊 Nvidia Hits $5T

📊 Nvidia Hits $5T

1) Google’s Growth Engine 2) Meta One-Time Tax Hit 3) Apple’s Rich Valuation and more!

Happy Sunday!

I hope you all had a great Halloweekend.

This past week was one of the biggest of earnings season, packed with results, partnerships, layoffs, acquisitions, mergers, and plenty more.

And to top it off, I recently published my monthly investment ideas report featuring five companies worth adding to your watchlist.

If you missed it, it’s definitely worth checking out.

Some key data bites from this week that you should know:

OpenAI is laying the groundwork to IPO at a $1T valuation.

Big Tech plans to spend more than $380B in CapEx this year.

Netflix announced a 10-for-1 stock split.

U.S. Department of Commerce signed an $80B nuclear deal with Westinghouse.

U.S. Department of Energy formed $1B AI partnership with AMD.

Meta drew $125B in bond orders from investors seeking AI exposure.

Microsoft how holds a 27% stake in OpenAI’s for-profit arm.

UPS has cut 48,000 jobs so far this year.

Amazon announced cuts to 14,000 roles.

Chegg will cut 45% of its corporate workforce due to AI.

Tesla’s board chair said Elon Musk might leave if $1T pay package isn’t approved.

Anthropic is projected to use over 1M Amazon AI chips by year-end.

American Water Works and Essential Utilities combined to create $40B public water utility.

Novartis will buy biotech firm Avidity Biosciences for $12B in cash.

Huntington Bancshares to buy Cadence Bank in $7.4B deal.

Skyworks and Qorvo combine to create $22B radio-chip giant.

Novo Nordisk entered a bidding war with Pfizer after offering $9B for Metsera.

Earnings & Financial Results:

Amazon saw AWS sales accelerate 20%, fastest growth in 3 years.

PayPal raised its 2025 EPS forecast to $5.37 and announced a $0.14 dividend.

Starbucks posted same-store sales growth for first time in 7 quarters.

UnitedHealth Group beat estimates and raised 2025 EPS guidance to $16.25.

Coinbase posted consumer trading activity up 37% QoQ to $59B.

Chipotle cut its full-year same-store sales forecast for the 3rd straight quarter.

Eli Lilly bumped its share of the U.S. GLP-1 market by 1pp to 57.9%.

SoFi posted record adj. net revenue of $950M and added record 905K new members.

Mercedes-Benz confirmed annual outlook and plans $2B share buyback.

Fiserv plunged after full year adj. earnings forecast was reduced by 16%.

Visa saw net revenue increase 12% and payments volume jump 9%.

Reddit announced Daily Active Uniques increased 19% to 116M.

In today’s newsletter:

📈 Nvidia Hits $5T Market Cap

☁️ Google’s Growth Engine

💰 Microsoft Bets Big On AI

🧾 Meta One-Time Tax Hit

🍎 Apple’s Rich Valuation

Let’s jump right in.

Not subscribed yet? Sign up today!

📣 Together With Masterworks

Wall Street Isn’t Warning You, But This Chart Might

Vanguard just projected public markets may return only 5% annually over the next decade. In a 2024 report, Goldman Sachs forecasted the S&P 500 may return just 3% annually for the same time frame—stats that put current valuations in the 7th percentile of history.

Translation? The gains we’ve seen over the past few years might not continue for quite a while.

Meanwhile, another asset class—almost entirely uncorrelated to the S&P 500 historically—has overall outpaced it for decades (1995-2024), according to Masterworks data.

Masterworks lets everyday investors invest in shares of multimillion-dollar artworks by legends like Banksy, Basquiat, and Picasso.

And they’re not just buying. They’re exiting—with net annualized returns like 17.6%, 17.8%, and 21.5% among their 23 sales.*

Wall Street won’t talk about this. But the wealthy already are. Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

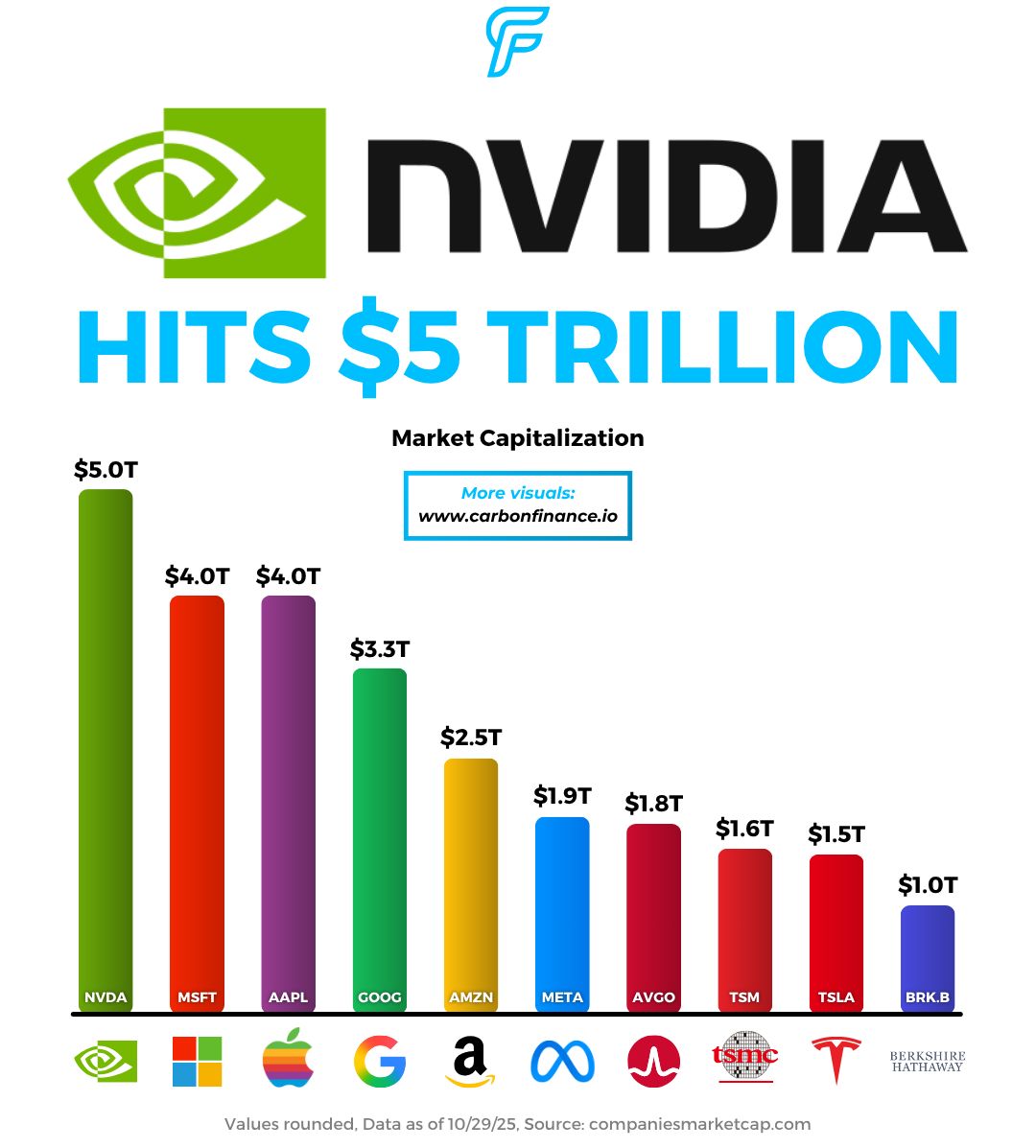

$5,000,000,000,000.

That’s how much Nvidia is worth, making it the first company in history to close above that mark.

Even more remarkable, Nvidia reached this milestone the same year it crossed $4T.

Shares rallied this past week after CEO Jensen Huang announced a wave of new partnerships at the company’s closely watched GTC event.

Nvidia revealed a $1B stake in Nokia to jointly develop next-generation 6G technology.

The company is partnering with Palantir to integrate its models into Palantir’s Ontology framework, expanding the reach of AI-powered applications and agents.

It’s also working with Eli Lilly to build pharma’s “most powerful” supercomputer, aimed at accelerating drug discovery and development.

Nvidia introduced NVQLink, a new open architecture that connects Quantum Processing Units with GPUs to enable hybrid quantum-classical systems.

From an autonomous standpoint, Nvidia and Uber joined together to build a fleet of 100,000 robotaxis and autonomous delivery vehicles.

The company also announced collaborations with Oracle and the U.S. Department of Energy to build the department’s largest AI supercomputer for scientific research.

And demand for its chips show no immediate signs of slowing.

Nvidia expects $500B in GPU sales between the current Blackwell generation and next year’s Rubin chips.

When asked if there’s a bubble in AI, Jensen Huang responded, “Today, we are really in the beginning of a ten-year buildout of a new computing platform, from the old approach to the new.”

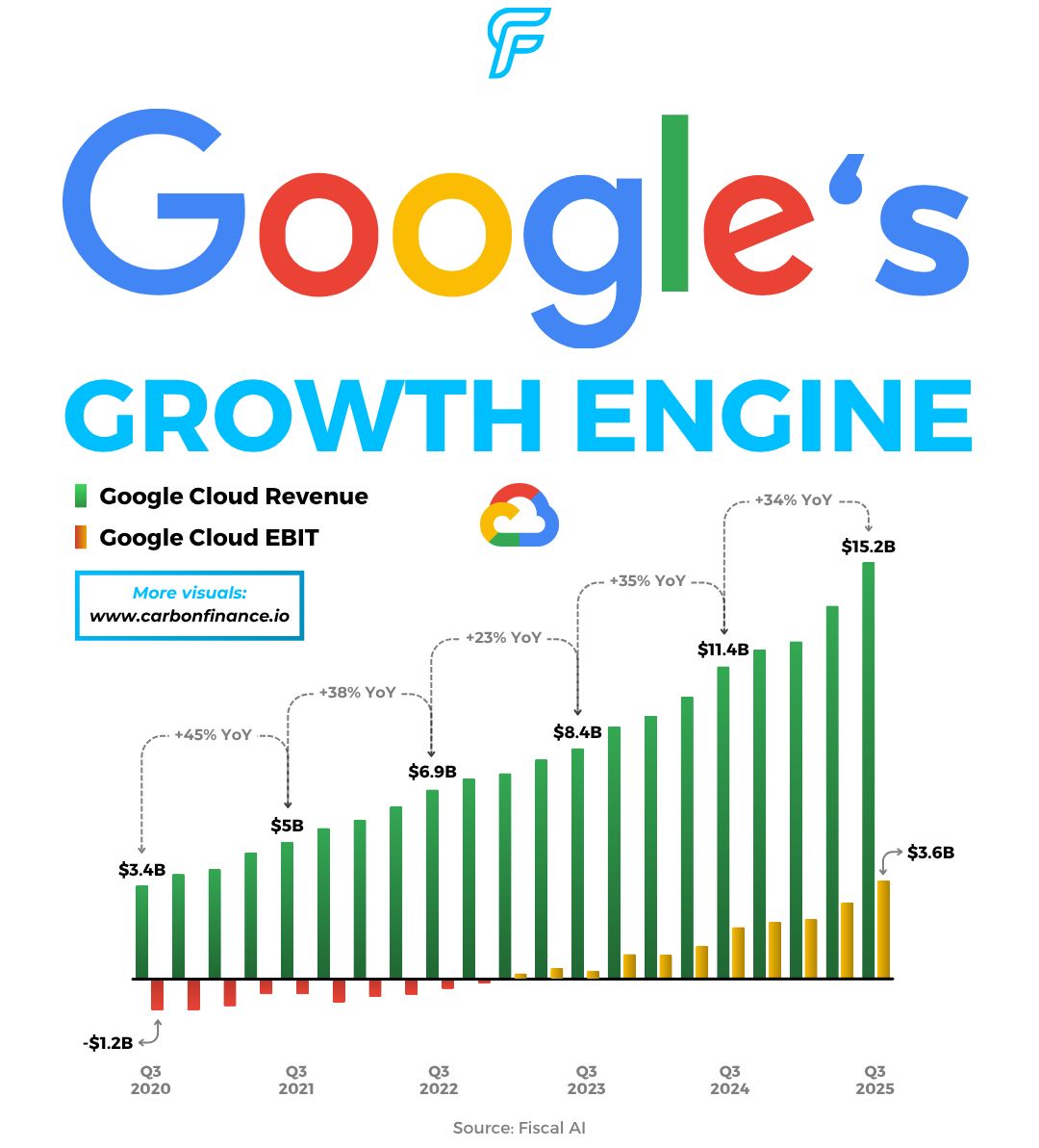

“Google is dead.”

That’s been the narrative hanging over the company for years.

But this year, that story finally started to break, and this quarter made that even clearer.

Google’s latest Q3 earnings easily topped analyst expectations.

Revenue reached $102.4B, beating estimates of $99.9B.

Adjusted EPS came in at $3.10, well ahead of the $2.33 estimate.

It also marked the first time the company crossed $100B in quarterly revenue.

Google’s biggest growth driver? It’s Cloud business.

Fueled by AI demand, Google Cloud ended the quarter with $155B in backlog and revenue up 34% to $15.15B.

Even more impressive, CEO Sundar Pichai said:

“We have signed more deals over one billion dollars through Q3 this year than we did in the previous two years combined.”

To meet this explosive demand, Alphabet continues to invest heavily in AI infrastructure.

CapEx for the year is now expected to reach $92B, up from the prior $85B forecast.

Additionally, management expects spending to increase even further next year.

Google’s other segments like Search, YouTube Ads, and Subscriptions all posted double-digit sales growth, cementing a solid earnings print for the company.

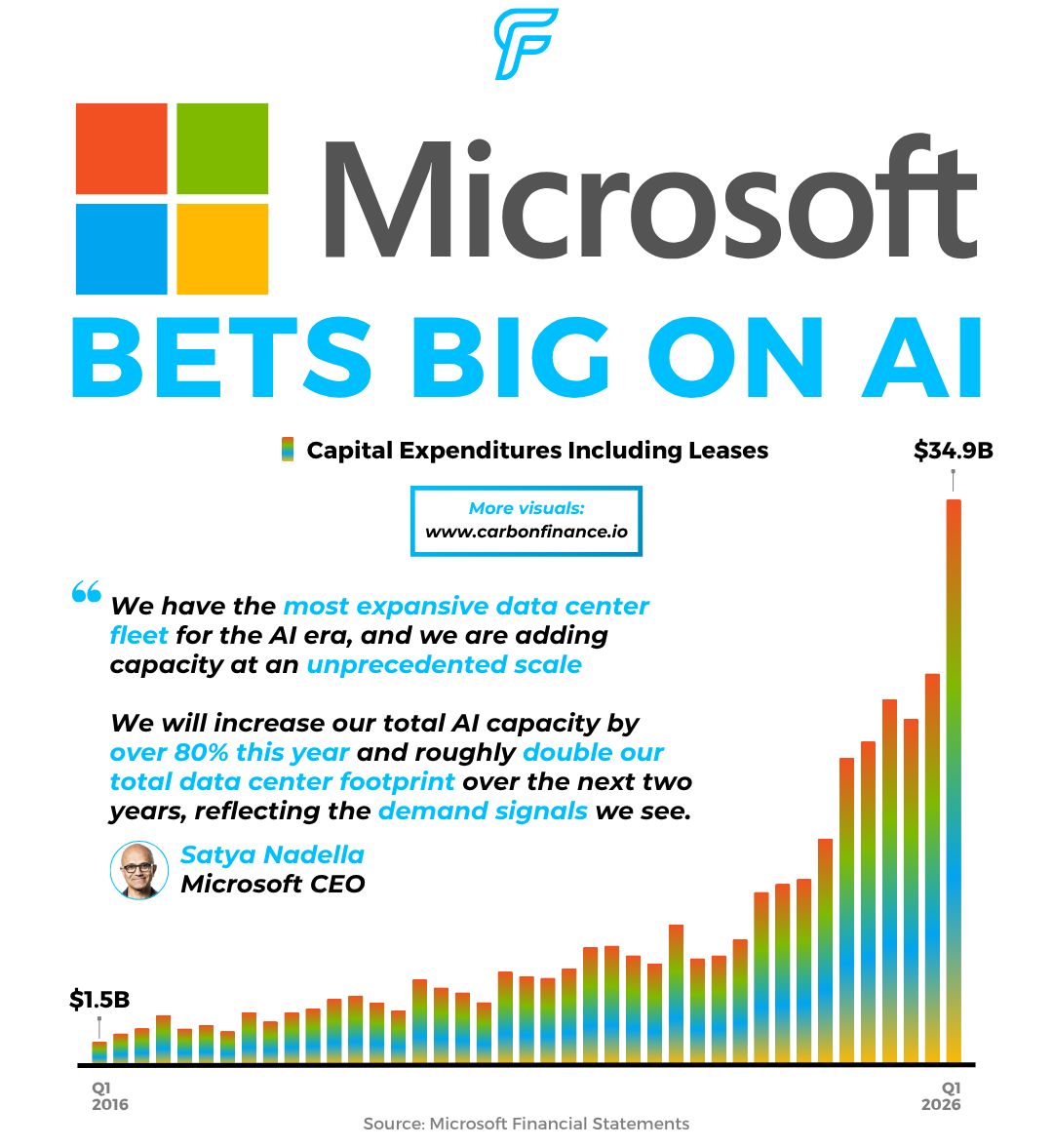

Microsoft has no plans to slow down its spending either.

Shares of the software giant fell this week after the company reported strong earnings but guided for higher capital expenditures ahead.

Revenue jumped 18% to $77.67B, beating estimates of $75.33B.

Earnings came in at $3.72 per share, slightly above the $3.67 consensus.

All of Microsoft’s business segments posted growth.

Intelligent Cloud revenue rose 28% to $30.9B, driven by Azure growth of 40%, ahead of the 38.2% estimate.

Productivity and Business Processes, which includes Microsoft 365 and LinkedIn, increased 17% to $33B.

More Personal Computing, which covers Windows, Xbox, and Search, grew 4% to $13.8B.

However, investors were caught off guard by higher capital spending.

CFO Amy Hood said the company spent $34.9B in CapEx and leases during the quarter, considerably above the prior $30B forecast.

She also noted that CapEx growth for the next fiscal year will exceed 2025’s rate, marking a shift from earlier guidance that suggested a slowdown.

CEO Satya Nadella defended the ramp-up in spending, saying, “Our planet-scale cloud and AI factory, together with Copilots across high-value domains, is driving broad diffusion and real-world impact. It’s why we continue to increase our investments in AI across both capital and talent to meet the massive opportunity ahead.”

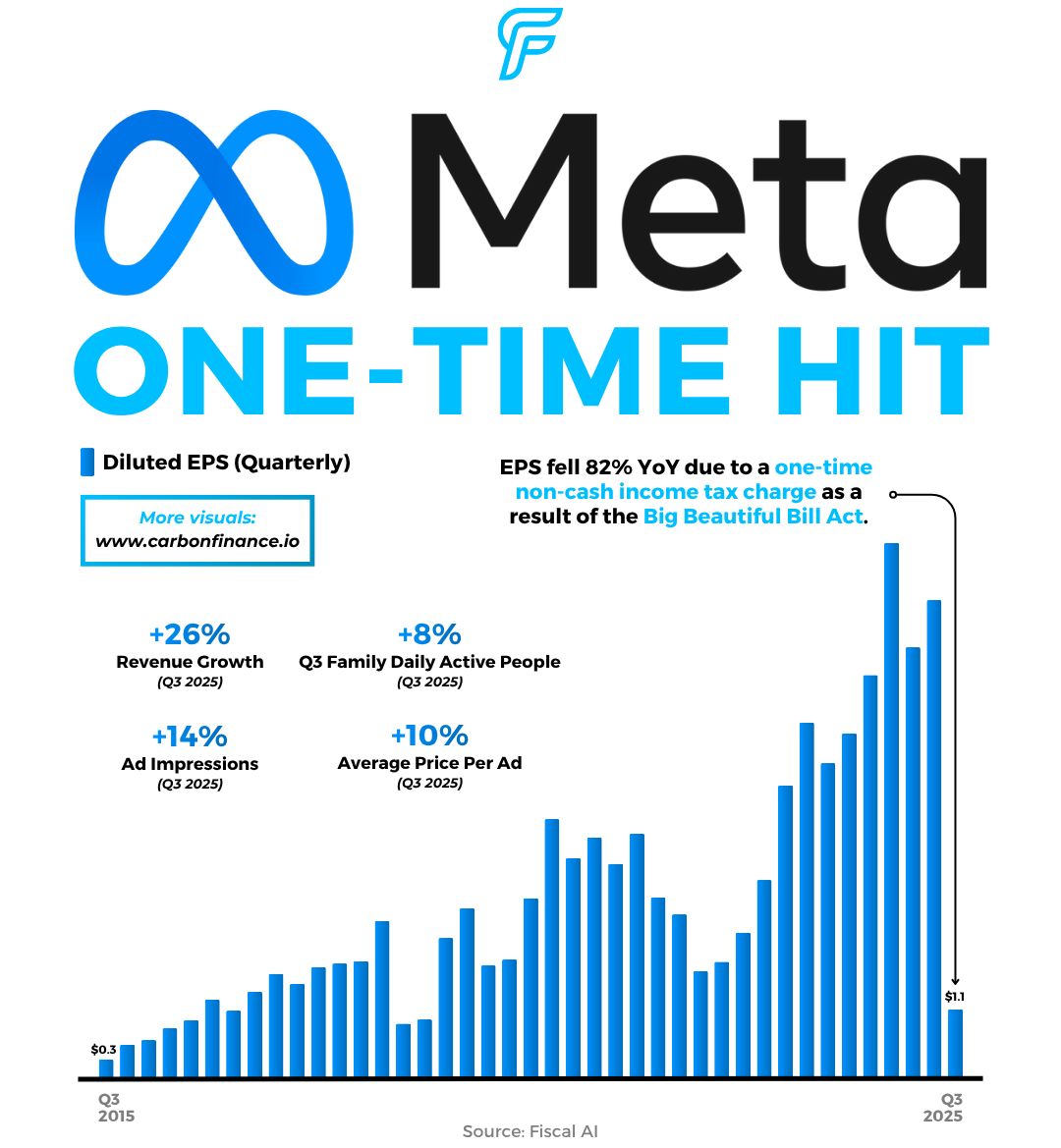

Meta posted its worst day in three years this past week.

And it came right after a relatively solid Q3 earnings report.

Revenue climbed 26% to $51.2B, beating estimates of $49.41B.

Adjusted EPS came in at $7.25, also above the $6.69 estimate.

Overall, the business continues to grow smoothly.

Family daily active people rose 8% to 3.54B.

Ad impressions increased 14%, and the average price per ad was up 10%.

So why were investors disappointed?

On a non-adjusted basis, diluted earnings plunged 82% to $1.10, which scared some investors.

This drop wasn’t operational, but the result of President Trump’s One Big Beautiful Bill Act, which created a one-time, non-cash income tax charge.

Meta explained that, going forward, the law should actually reduce its U.S. federal cash tax payments through 2025 and beyond.

So while the decline looks severe, it’s mostly an accounting adjustment, not real cash leaving the business.

The second reason for investor concern was spending guidance, similar to what we saw with Microsoft.

Meta raised its 2025 capital expenditures outlook to $71B, up from $69B.

Total expenses are now expected to reach $117B, slightly higher than the prior $116B estimate.

CEO Mark Zuckerberg reiterated that these investments are essential to build computing power for Meta’s AI initiatives.

But many investors remain skeptical about when, or if, this level of spending will translate into meaningful returns.

Demand for the iPhone 17 is running hot.

Apple reported earnings on Thursday and delivered a solid forecast for the December quarter.

The company expects sales to rise 10–12% YoY, with iPhone revenue growing by double digits, setting up what could be Apple’s best quarter ever.

Guidance came in ahead of expectations, driven by strong consumer demand for the new iPhone 17 lineup.

For the current quarter, Apple beat analyst estimates on both the top and bottom line.

Revenue reached $102.5B, above the $102.2B estimate.

EPS came in at $1.85, topping the $1.77 expected.

iPhone revenue, however, slightly missed expectations at $49.03B.

This was largely due to timing, as the new models were available for only one week within the reported quarter.

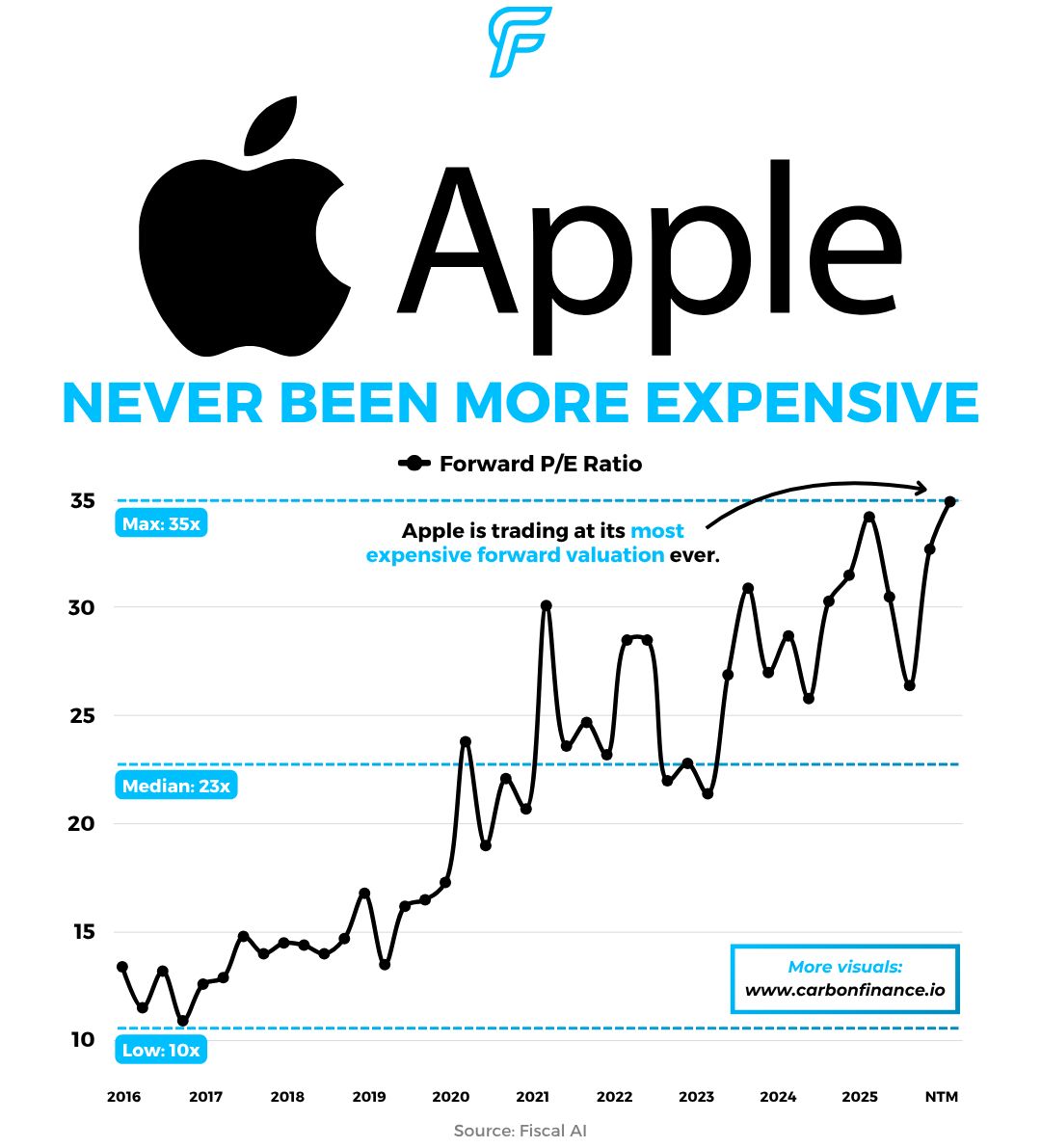

While growth remains strong, Apple’s valuation continues to stretch.

The company now trades at 35x forward earnings, its most expensive level ever.

📣 Together With Masterworks

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 23 sales have delivered net annualized returns like 17.6%, 17.8%, and 21.5%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

💸 Smart Payments↗ - PayPal signed a deal with OpenAI to power instant checkout and agentic commerce in ChatGPT.

💾 Chip Debut↗ - Qualcomm announced new AI accelerator chips to compete with AMD and Nvidia.

🏈 Athletic Expansion↗ - Lululemon has partnered with the NFL and Fanatics to sell apparel for all 32 teams.

✍️ Pacific Partnerships↗ - President Trump signed several deals on trade and critical minerals with Thailand, Malaysia, Cambodia, and Vietnam.

✂️ Cautious Cut↗ - The Fed cut interest rates by 25 bps, said additional cuts this year aren’t certain, and announced that quantitative tightening will end on 12/1.

🫧 Bubble Watch↗ - Ray Dalio said an AI market bubble is forming but may not pop until the Fed tightens.

😅 Snowflake Slip↗ - Snowflake filed an 8-K after an exec accidentally shared unauthorized guidance in an Instagram street interview.

🇨🇳 Trade Relief↗ - The U.S. will cut tariffs on China while China has agreed to allow the export of rare earth elements and start buying American soybeans.

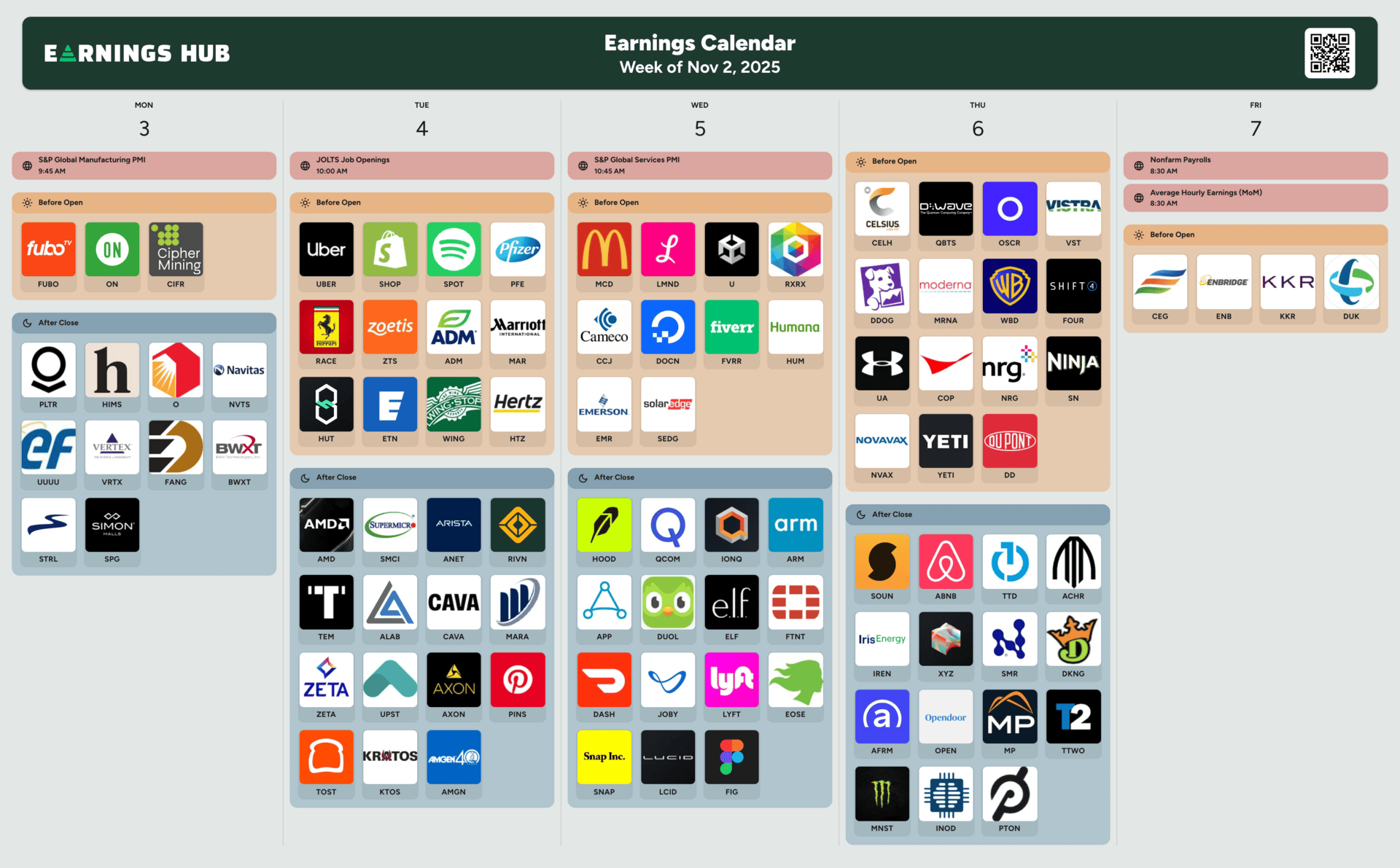

Courtesy of our affiliate partner, EarningsHub.

Notable Companies Reporting Earnings Week of November 2nd, 2025:

Major Trades Published 10/27 - 10/31. Trades may be those of family members. [Source: 2iQ]

Buys

Cleo Fields (D)

Company: Alphabet ($GOOGL)

Amount Purchased: $30K - $100K

Company: Palantir Technologies ($PLTR)

Amount Purchased: $15K - $50K

Lisa McClain (R)

Company: Rigetti Computing (RGTI)

Amount Purchased: $15K - $50K

Sells

Lisa McClain (R)

Company: Palantir Technologies ($PLTR)

Amount Sold: $200K - $450K

Company: Nvidia ($NVDA)

Amount Sold: $50K - $100K

Nancy Pelosi (D)

Company: Apple ($AAPL)

Amount Sold: $100K - $250K

Description: Contribution of 382 shares held personally to Trinity University in Washington, DC

Major Trades Published 10/27 - 10/31

Buys

Sells

How was today's newsletter?I value all of the feedback that I receive. Let me know how I did so I can continue to make this the best investing newsletter available! |

🤝 Review of the Week

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author, paid advertiser, or partner and do not reflect the official policy or position of any other agency, organization, employer or company.

Carbon Finance is a publisher of financial information, not an investment or financial advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website/newsletter has been crafted with the assistance of an AI language model to enhance the content of this newsletter. We have made efforts to ensure the quality and reliability of the information presented, but we cannot guarantee its absolute accuracy. Therefore, readers are advised to exercise their own judgment and seek additional sources if necessary.

THE INFORMATION CONTAINED ON THIS WEBSITE/NEWSLETTER IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the publisher undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

The publisher, its affiliates, and clients of the publisher or its affiliates may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

This newsletter is sponsored by Masterworks. Sponsorship does not influence our editorial content. We do not endorse the sponsor’s products, services, or views, and we are not responsible or liable for any interaction or transaction between readers and the sponsor.

Some of the links in this newsletter are affiliate links. This means that if you click on the link and purchase the item, we will receive an affiliate commission at no extra cost to you. All opinions remain our own.

By using the Site or any affiliated social media account, you are indicating your consent and agreement to this disclaimer. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Reply